Stock Analysis

- China

- /

- Communications

- /

- SZSE:300590

Guangdong Shenglu Telecommunication Tech Leads Three Stocks Estimated As Undervalued On Chinese Exchange

Reviewed by Simply Wall St

Amidst a backdrop of rate cuts and economic challenges, the Chinese stock market has shown signs of strain with key indices like the Shanghai Composite and CSI 300 experiencing notable declines. In such an environment, identifying stocks that may be undervalued becomes particularly crucial as investors look for potential resilience and growth opportunities within the market turbulence.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥161.99 | CN¥322.09 | 49.7% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥14.73 | CN¥28.31 | 48% |

| Shanghai Baolong Automotive (SHSE:603197) | CN¥30.11 | CN¥56.64 | 46.8% |

| Naipu Mining Machinery (SZSE:300818) | CN¥21.46 | CN¥41.92 | 48.8% |

| Thunder Software TechnologyLtd (SZSE:300496) | CN¥43.50 | CN¥84.02 | 48.2% |

| Guangdong Shenling Environmental Systems (SZSE:301018) | CN¥19.84 | CN¥38.08 | 47.9% |

| Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥15.78 | CN¥29.89 | 47.2% |

| China Film (SHSE:600977) | CN¥10.37 | CN¥20.32 | 49% |

| Seres GroupLtd (SHSE:601127) | CN¥77.96 | CN¥150.52 | 48.2% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥14.24 | CN¥27.68 | 48.6% |

We're going to check out a few of the best picks from our screener tool.

Guangdong Shenglu Telecommunication Tech (SZSE:002446)

Overview: Guangdong Shenglu Telecommunication Tech Co., Ltd. specializes in the manufacturing of telecommunication equipment, with a market capitalization of approximately CN¥5.05 billion.

Operations: The company generates revenue primarily through the manufacturing of telecommunication equipment.

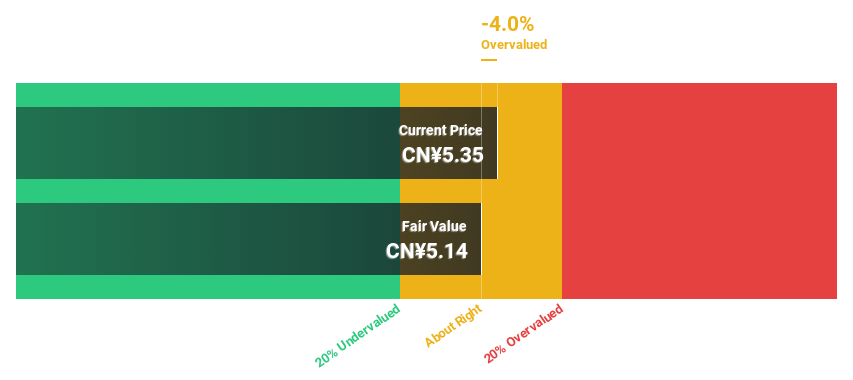

Estimated Discount To Fair Value: 13.7%

Guangdong Shenglu Telecommunication Tech Co., Ltd., priced at CN¥5.52, is currently undervalued by 13.7%, with a fair value estimated at CN¥6.40. The company's earnings are expected to grow significantly, at 59.9% annually over the next three years, outpacing the broader Chinese market's growth rate of 22.1%. However, its profit margins have declined from last year's 18.4% to just 1.2%. Revenue growth also looks promising at an annual rate of 30.6%, well above the market average of 13.6%.

- In light of our recent growth report, it seems possible that Guangdong Shenglu Telecommunication Tech's financial performance will exceed current levels.

- Take a closer look at Guangdong Shenglu Telecommunication Tech's balance sheet health here in our report.

Cetc Potevio Science&TechnologyLtd (SZSE:002544)

Overview: Cetc Potevio Science&Technology Co., Ltd. specializes in network communication solutions in China, with a market capitalization of approximately CN¥12.49 billion.

Operations: The company generates revenue primarily from its Software and IT Services segment, totaling approximately CN¥5.32 billion.

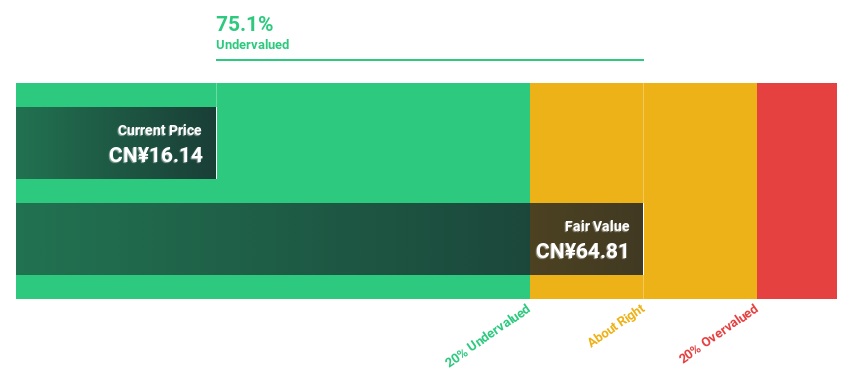

Estimated Discount To Fair Value: 23.2%

Cetc Potevio Science&TechnologyLtd, valued at CN¥18.29, is trading below its estimated fair value of CN¥23.81, indicating a potential undervaluation by over 20%. The company's earnings are projected to increase significantly, with an annual growth rate of 51.1% over the next three years—surpassing the Chinese market forecast of 22.1% growth. However, it faces challenges such as low profit margins at 0.6%, down from last year’s 3%, and recent dividend cuts in July may concern investors seeking steady income streams.

- The analysis detailed in our Cetc Potevio Science&TechnologyLtd growth report hints at robust future financial performance.

- Navigate through the intricacies of Cetc Potevio Science&TechnologyLtd with our comprehensive financial health report here.

Queclink Wireless Solutions (SZSE:300590)

Overview: Queclink Wireless Solutions Co., Ltd. provides Internet of Things (IoT) solutions globally, with a market capitalization of approximately CN¥5.44 billion.

Operations: The company generates its revenue from providing Internet of Things (IoT) solutions globally.

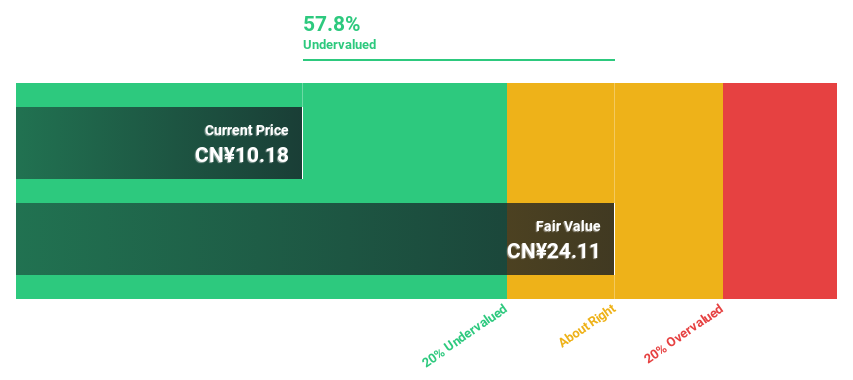

Estimated Discount To Fair Value: 43.5%

Queclink Wireless Solutions, priced at CN¥11.93, is significantly undervalued with a fair value estimate of CN¥21.12, reflecting a potential undervaluation of over 20%. The company's recent earnings report showed substantial growth with sales increasing to CN¥477.55 million and net income rising to CN¥98.69 million from the previous year. Despite an unstable dividend track record, Queclink's revenue and earnings are expected to grow at 24.1% and 27.45% per year respectively, outpacing the broader Chinese market forecasts.

- Insights from our recent growth report point to a promising forecast for Queclink Wireless Solutions' business outlook.

- Click to explore a detailed breakdown of our findings in Queclink Wireless Solutions' balance sheet health report.

Taking Advantage

- Dive into all 99 of the Undervalued Chinese Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Queclink Wireless Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300590

Queclink Wireless Solutions

Queclink Wireless Solutions Co., Ltd. IoT solutions worldwide.

Flawless balance sheet and undervalued.