- China

- /

- Electrical

- /

- SZSE:301031

3 High Insider Ownership Growth Companies On Chinese Exchange With Earnings Growing Up To 59%

Reviewed by Simply Wall St

As global markets navigate mixed signals, China's recent unexpected rate cuts reflect a proactive approach to stimulate economic growth amidst underwhelming GDP figures and retail slowdowns. In this context, exploring growth companies with high insider ownership on Chinese exchanges could offer insights into firms potentially poised for resilience and informed leadership in uncertain times.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 26.5% |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 28.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Here we highlight a subset of our preferred stocks from the screener.

Sichuan Haite High-techLtd (SZSE:002023)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Haite High-tech Co., Ltd specializes in providing aircraft airborne equipment maintenance services in China, with a market capitalization of approximately CN¥6.88 billion.

Operations: The company generates its revenue primarily from aircraft airborne equipment maintenance services.

Insider Ownership: 15.3%

Earnings Growth Forecast: 28.9% p.a.

Sichuan Haite High-tech Co., Ltd., a company with high insider ownership, has shown remarkable earnings growth, increasing by a very large percentage over the past year. Future projections remain robust with earnings expected to grow by 28.92% annually, outpacing the Chinese market's average. However, its forecasted return on equity in three years is relatively low at 2.5%. Recently, the company affirmed dividends and amended its bylaws, indicating stable governance and commitment to shareholder returns.

- Dive into the specifics of Sichuan Haite High-techLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Sichuan Haite High-techLtd implies its share price may be too high.

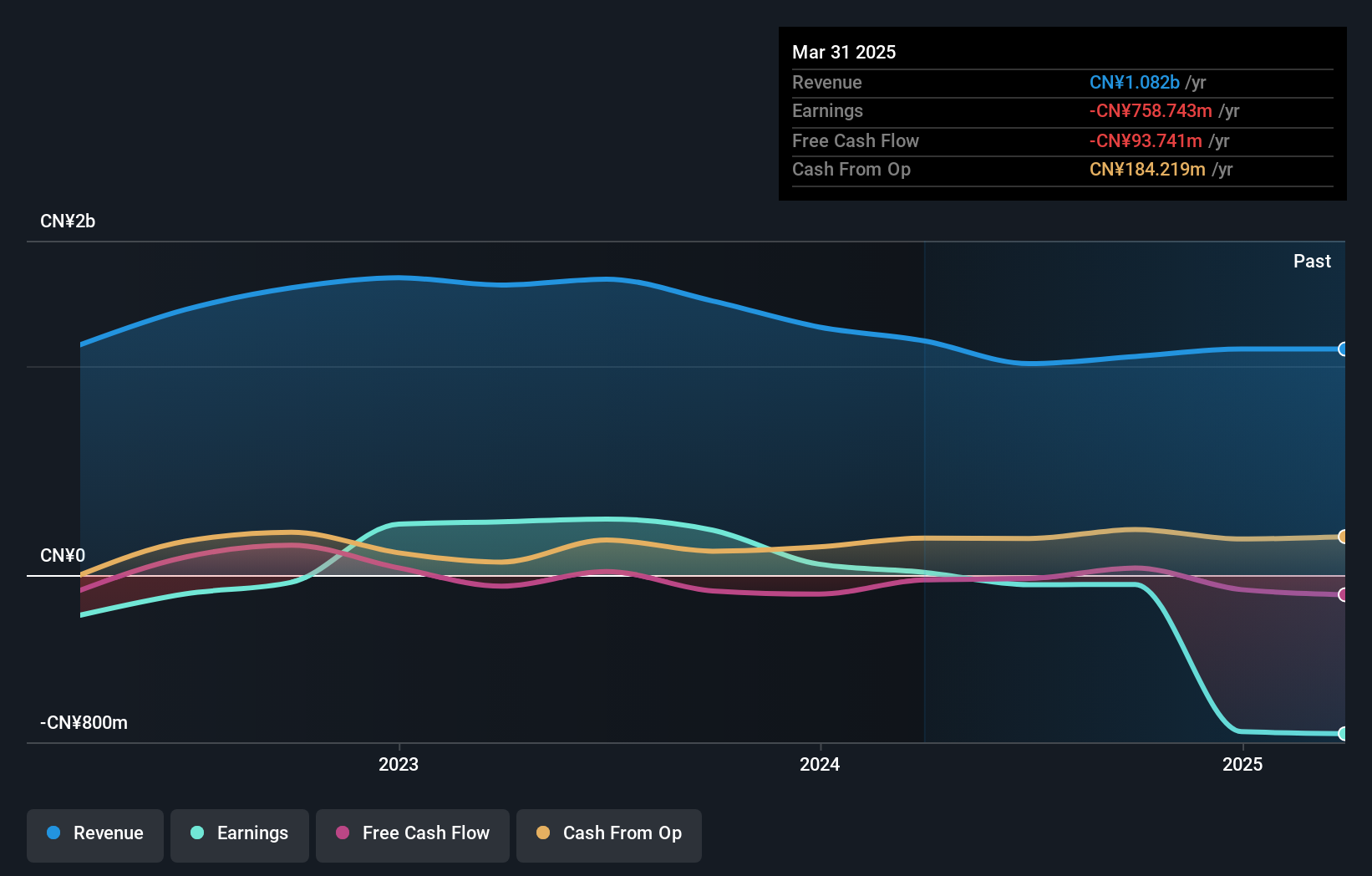

Guangdong Shenglu Telecommunication Tech (SZSE:002446)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenglu Telecommunication Tech Co., Ltd. is a company that specializes in the research, development, and manufacturing of antenna products for telecommunication applications, with a market capitalization of approximately CN¥5.05 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 16.3%

Earnings Growth Forecast: 59.9% p.a.

Guangdong Shenglu Telecommunication Tech Co., Ltd. is positioned below its fair value by 13.7% and shows promising growth prospects with revenue expected to increase by 30.6% annually, outstripping the Chinese market's average of 13.6%. However, its profit margins have declined significantly from last year, dropping to 1.2%. Despite this, earnings are anticipated to surge by nearly 60% per year over the next three years, although return on equity is projected at a modest 9.5%. At a recent Annual General Meeting, amendments were made to the company's articles of association.

- Click here and access our complete growth analysis report to understand the dynamics of Guangdong Shenglu Telecommunication Tech.

- Our valuation report here indicates Guangdong Shenglu Telecommunication Tech may be overvalued.

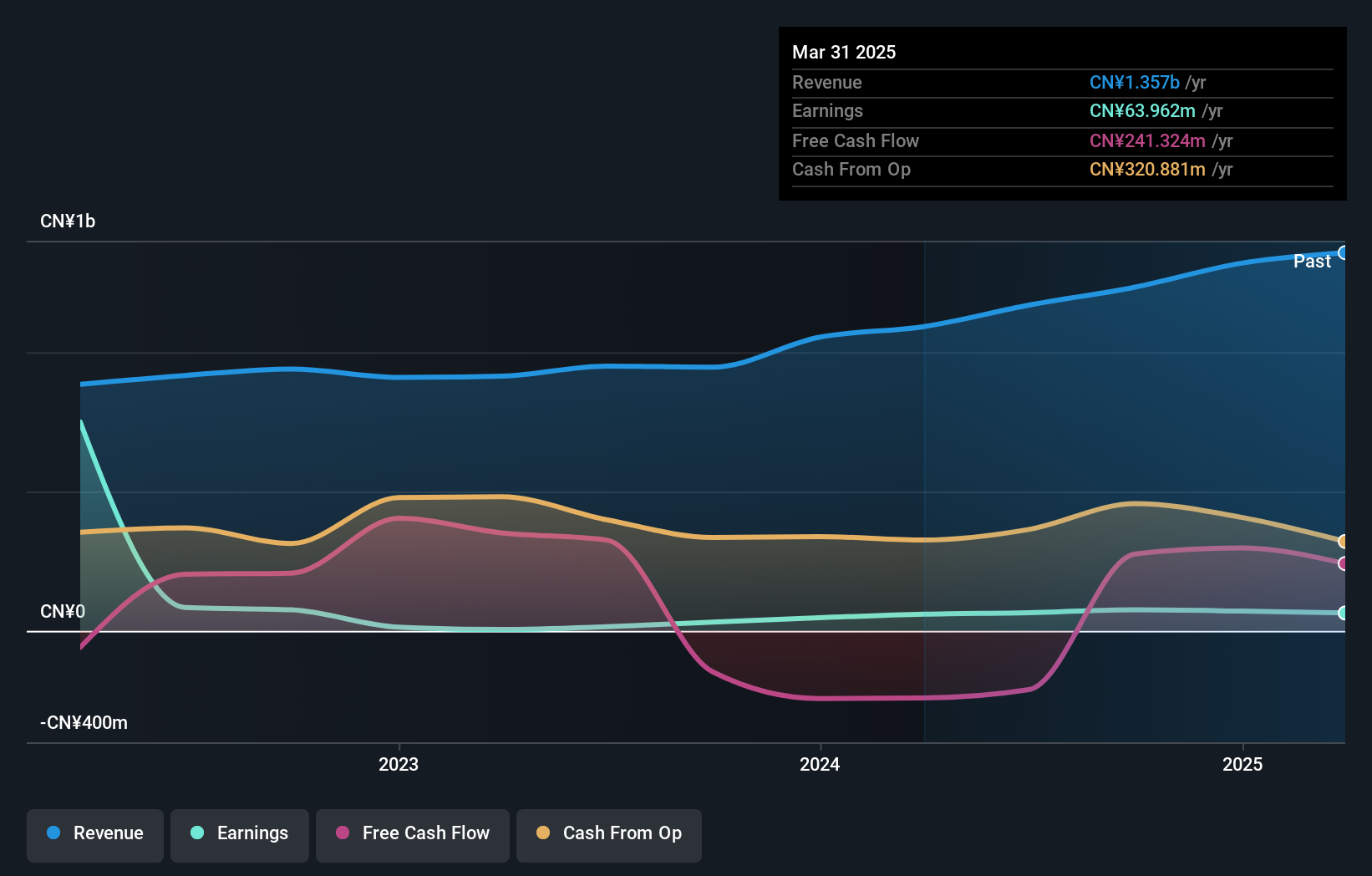

Xi'an Sinofuse Electric (SZSE:301031)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an Sinofuse Electric Co., Ltd. specializes in the research, development, production, and sale of circuit protection devices and fuses, with a market capitalization of approximately CN¥5.31 billion.

Operations: The company generates revenue primarily through the sale of circuit protection devices and fuses.

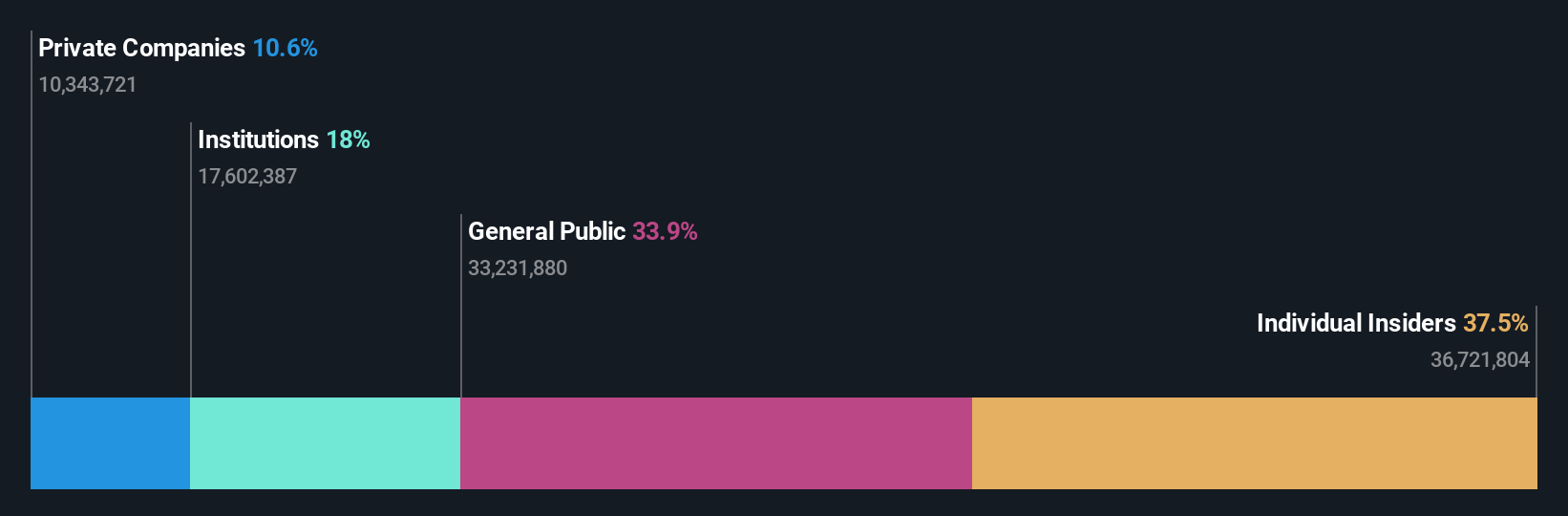

Insider Ownership: 36.8%

Earnings Growth Forecast: 43.1% p.a.

Xi'an Sinofuse Electric Co., Ltd. recently affirmed a dividend and announced a share buyback, signaling confidence in its financial health. The company is expected to see robust growth with earnings forecasted to increase by 43.1% annually and revenue growth projected at 28.8% per year, both well above market averages. However, its share price has been highly volatile recently, and last year's profit margins were lower than the previous year's, indicating potential challenges ahead despite strong insider ownership initiatives like equity incentives for employees.

- Click to explore a detailed breakdown of our findings in Xi'an Sinofuse Electric's earnings growth report.

- Our valuation report unveils the possibility Xi'an Sinofuse Electric's shares may be trading at a premium.

Where To Now?

- Discover the full array of 364 Fast Growing Chinese Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301031

Xi'an Sinofuse Electric

Engages in the research, development, production, and sale of circuit protection devices, fuses, and related accessories.

Exceptional growth potential with excellent balance sheet.