In recent weeks, global markets have experienced volatility, with U.S. stocks declining amid cautious Federal Reserve commentary and political uncertainty surrounding a potential government shutdown. Smaller-cap indexes have been particularly affected, highlighting the challenges these companies face in navigating economic shifts and investor sentiment. In such an environment, identifying high-growth tech stocks involves assessing their resilience to market fluctuations and their ability to capitalize on technological advancements despite broader economic pressures.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Megacable Holdings S. A. B. de C. V (BMV:MEGA CPO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Megacable Holdings S. A. B. de C. V., along with its subsidiaries, provides cable television, internet, and telephone services through the installation, operation, and maintenance of distribution systems, with a market cap of MX$28.91 billion.

Operations: Megacable generates revenue primarily from its cable television, internet, and telephone services. The company focuses on the installation and maintenance of distribution systems to deliver these services.

Megacable Holdings, despite a challenging year with a 9.1% drop in earnings, shows promising signs with an expected annual earnings growth of 21.9%, significantly outpacing the Mexican market's average of 12.6%. This growth is supported by a strategic emphasis on R&D, crucial for staying competitive in the dynamic tech landscape. Recent financials reveal resilience; Q3 sales rose to MXN 8.22 billion from MXN 7.49 billion year-on-year, although net income slightly dipped to MXN 500.26 million from MXN 531.32 million in the same period last year—a reflection of ongoing investments and market adaptations.

Neusoft (SHSE:600718)

Simply Wall St Growth Rating: ★★★★☆☆

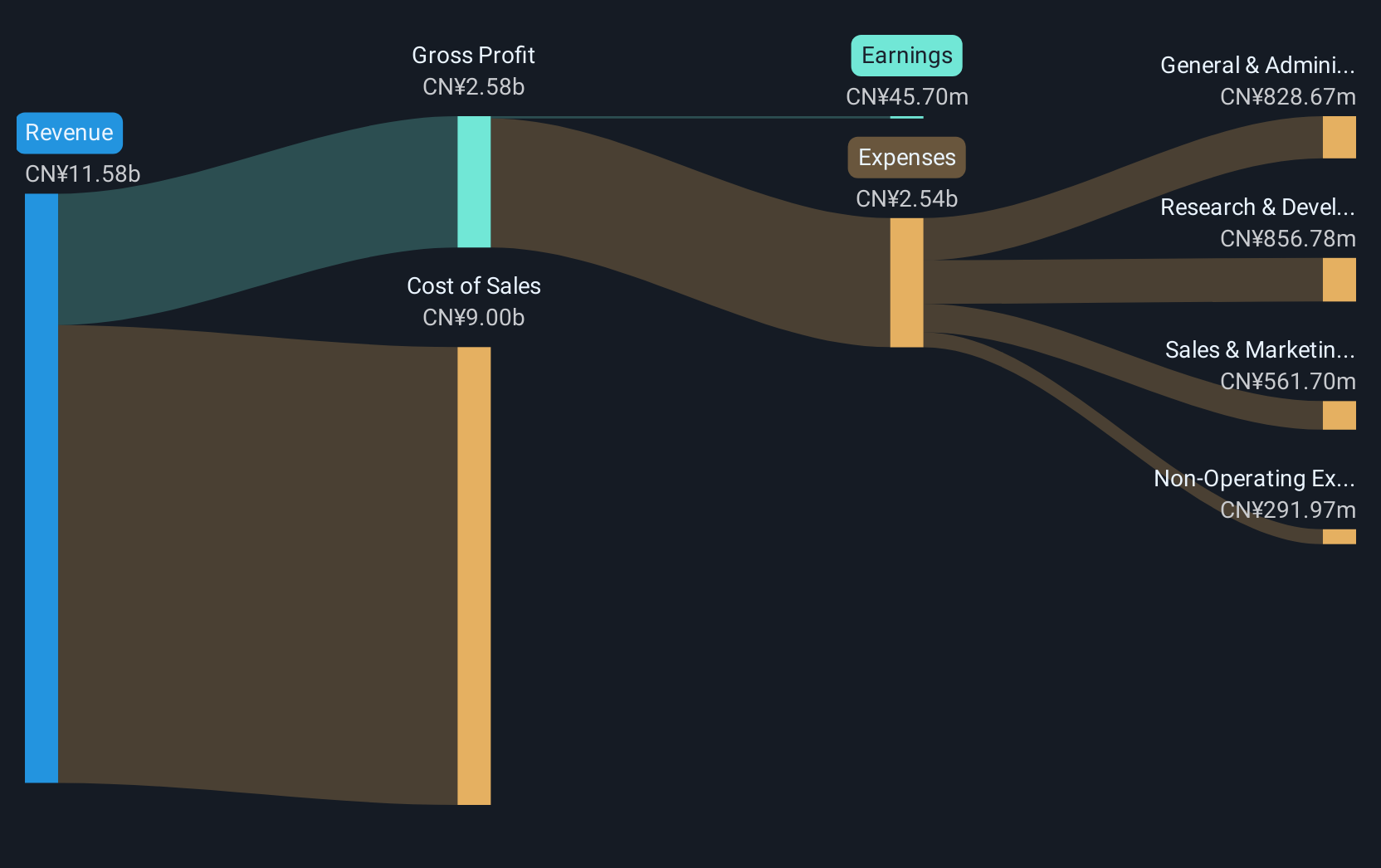

Overview: Neusoft Corporation offers software and IT solutions globally, with a market cap of CN¥12.44 billion.

Operations: The company generates revenue primarily through its software and IT solutions offerings. The gross profit margin has shown variability, reflecting changes in cost structures and pricing strategies over time.

Neusoft Corporation, with a notable 17.9% annual revenue growth, outstrips the Chinese market's average of 13.7%, reflecting robust sector dynamics. This growth is complemented by an impressive forecasted earnings increase of 57.8% annually, positioning it well above the national benchmark of 25.4%. The company's commitment to innovation is evident from its R&D spending which notably constitutes a significant portion of its revenue, underscoring its strategic focus on staying ahead in technological advancements. Recent developments include the renewal of key lease agreements ensuring stable operational footing and hinting at sustainable future growth prospects within its business ecosystem.

- Take a closer look at Neusoft's potential here in our health report.

Gain insights into Neusoft's historical performance by reviewing our past performance report.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. manufactures and sells printed circuit boards (PCBs) in China and internationally, with a market capitalization of CN¥20.01 billion.

Operations: Fastprint Circuit Tech specializes in the production and distribution of printed circuit boards (PCBs) across domestic and international markets. The company generates revenue primarily from its PCB manufacturing operations, leveraging its technological capabilities to serve a diverse client base.

Shenzhen Fastprint Circuit Tech Co., Ltd. faces challenges with a net loss of CNY 31.6 million this year, contrasting sharply with last year's net profit of CNY 190.46 million, yet it maintains a competitive edge with revenue growth at 17.5% annually, outpacing the Chinese market average of 13.7%. Despite current unprofitability, the company is expected to swing to profit within three years, supported by substantial R&D investments that underscore its commitment to innovation and sector leadership in the rapidly evolving tech landscape.

Seize The Opportunity

- Embark on your investment journey to our 1273 High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:MEGA CPO

Megacable Holdings S. A. B. de C. V

Engages in the installation, operation, and maintenance of cable television, internet, and telephone signal distribution systems.

Good value with reasonable growth potential.