- China

- /

- Electronic Equipment and Components

- /

- SZSE:002414

Global Market's 3 Stocks That Investors May Be Undervaluing

Reviewed by Simply Wall St

As global markets navigate through a maze of geopolitical tensions, fluctuating inflation rates, and evolving economic policies, investors are keenly observing the indices' performance. Amid these conditions, identifying undervalued stocks becomes crucial as they can offer potential opportunities for growth when market valuations may not fully reflect a company's intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ülker Bisküvi Sanayi (IBSE:ULKER) | TRY106.80 | TRY212.38 | 49.7% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥37.42 | CN¥74.74 | 49.9% |

| Teikoku Sen-i (TSE:3302) | ¥3400.00 | ¥6727.09 | 49.5% |

| NexTone (TSE:7094) | ¥2271.00 | ¥4509.37 | 49.6% |

| Hanza (OM:HANZA) | SEK129.60 | SEK258.05 | 49.8% |

| doValue (BIT:DOV) | €2.828 | €5.64 | 49.9% |

| COVER (TSE:5253) | ¥1865.00 | ¥3693.13 | 49.5% |

| Cicor Technologies (SWX:CICN) | CHF194.00 | CHF385.33 | 49.7% |

| Aquafil (BIT:ECNL) | €1.93 | €3.85 | 49.8% |

| Andes Technology (TWSE:6533) | NT$268.50 | NT$531.55 | 49.5% |

Let's explore several standout options from the results in the screener.

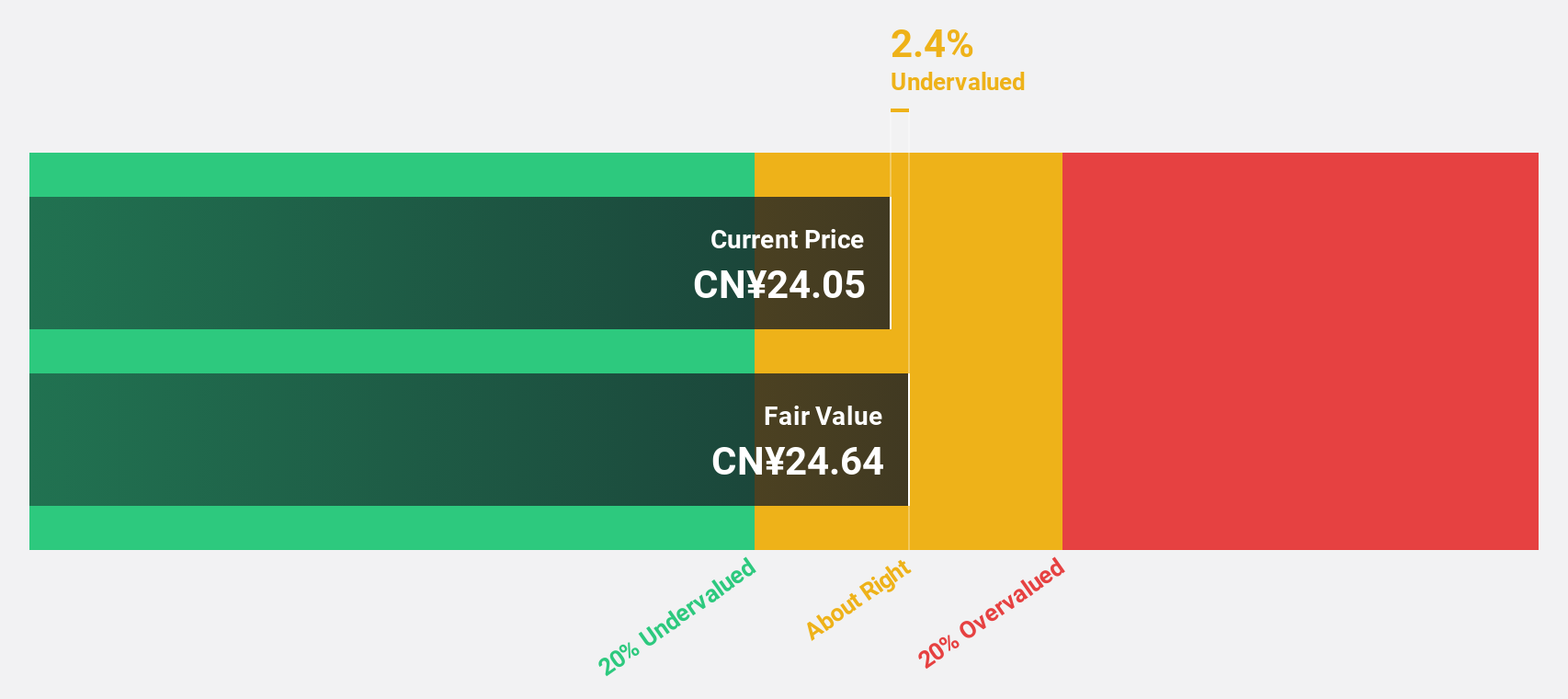

Shanghai Putailai New Energy TechnologyLtd (SHSE:603659)

Overview: Shanghai Putailai New Energy Technology Co., Ltd. develops and sells lithium-ion battery materials and automation equipment in China, with a market cap of CN¥57.81 billion.

Operations: The company generates revenue through the development and sale of lithium-ion battery materials and automation equipment.

Estimated Discount To Fair Value: 31.3%

Shanghai Putailai New Energy Technology Co., Ltd. is trading at a significant discount to its estimated fair value of CNY 40.28, with current prices around CNY 27.69. The company reported strong earnings growth, with net income rising to CNY 1,699.86 million for the nine months ended September 2025 from CNY 1,238.51 million a year ago. Despite volatile share prices and an unstable dividend track record, its forecasted annual profit growth of 32.2% suggests potential for future cash flow improvements relative to peers and industry standards.

- Our growth report here indicates Shanghai Putailai New Energy TechnologyLtd may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Shanghai Putailai New Energy TechnologyLtd.

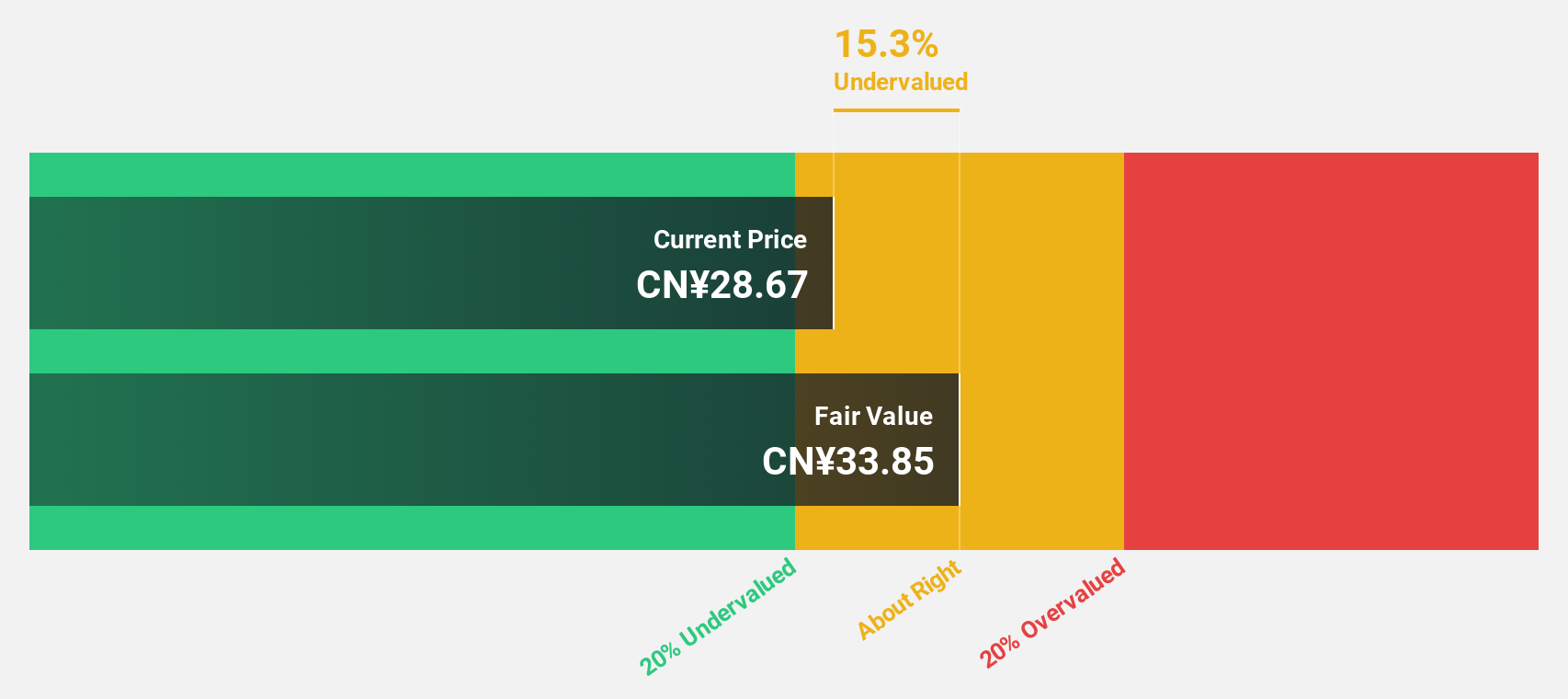

Xinjiang Daqo New EnergyLtd (SHSE:688303)

Overview: Xinjiang Daqo New Energy Co., Ltd. focuses on the research, development, production, and sale of polysilicon and silicon-based materials for the photovoltaic and semiconductor industries, with a market cap of CN¥58.92 billion.

Operations: The company generates revenue through the production and sale of polysilicon and silicon-based materials, catering primarily to the photovoltaic and semiconductor sectors.

Estimated Discount To Fair Value: 40%

Xinjiang Daqo New Energy Ltd. is trading at a 40% discount to its fair value, with a current price of CN¥28.44 compared to an estimated fair value of CN¥47.37. Despite recent financial challenges, including a net loss of CN¥1,073.19 million for the nine months ended September 2025 and volatile share prices, the company is expected to achieve above-average market growth in profitability and revenue over the next three years.

- The analysis detailed in our Xinjiang Daqo New EnergyLtd growth report hints at robust future financial performance.

- Click here to discover the nuances of Xinjiang Daqo New EnergyLtd with our detailed financial health report.

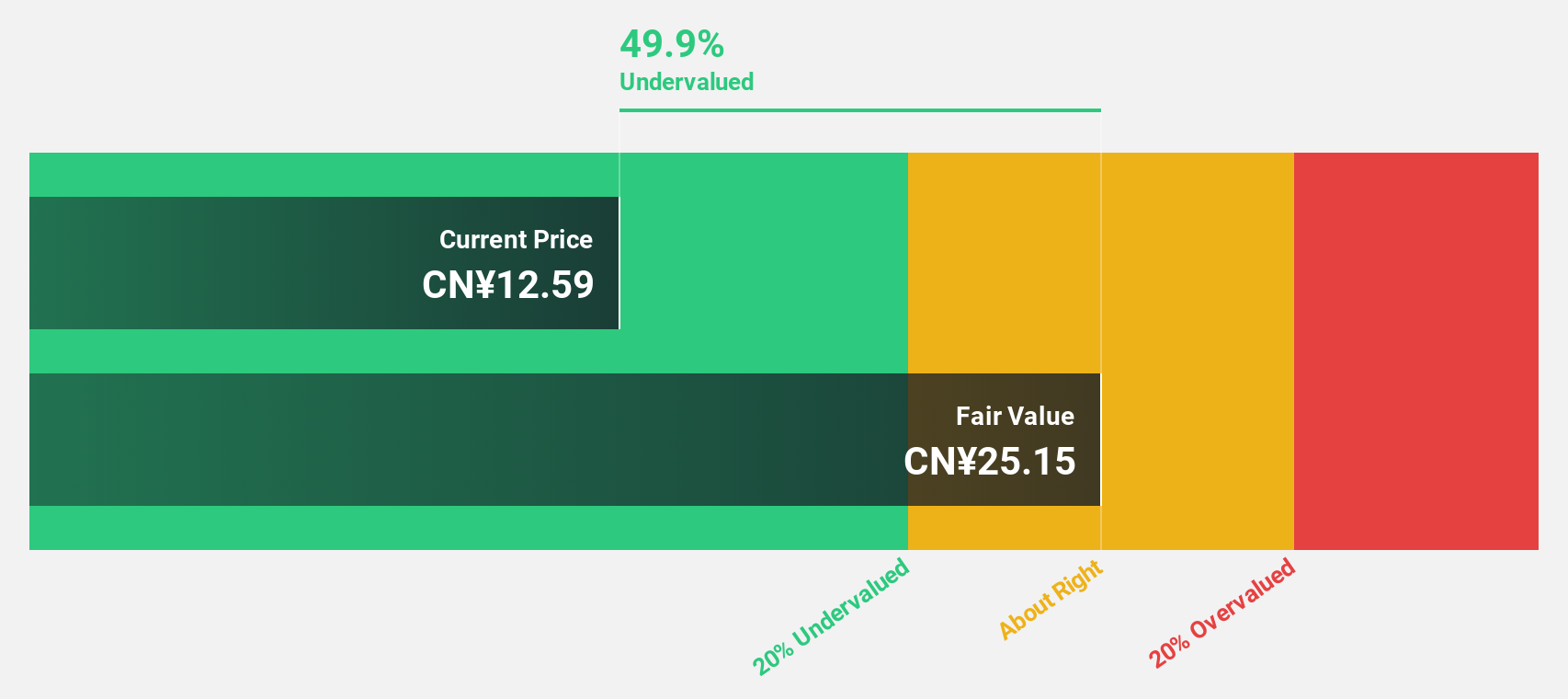

Wuhan Guide Infrared (SZSE:002414)

Overview: Wuhan Guide Infrared Co., Ltd. specializes in the research, development, production, and sale of infrared thermal imaging technology in Asia and has a market capitalization of CN¥57.23 billion.

Operations: The company's revenue primarily stems from its involvement in infrared thermal imaging technology across Asia.

Estimated Discount To Fair Value: 45.7%

Wuhan Guide Infrared is trading at CN¥13.55, significantly below its estimated fair value of CN¥24.97, highlighting potential undervaluation based on cash flows. Recent earnings show a substantial increase in sales and net income for the nine months ending September 2025, with sales reaching CN¥3.07 billion and net income at CN¥581.94 million. The company's revenue growth forecast of 23.7% annually surpasses the Chinese market average, although its future Return on Equity remains modest at 9.7%.

- The growth report we've compiled suggests that Wuhan Guide Infrared's future prospects could be on the up.

- Navigate through the intricacies of Wuhan Guide Infrared with our comprehensive financial health report here.

Key Takeaways

- Get an in-depth perspective on all 506 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuhan Guide Infrared might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002414

Wuhan Guide Infrared

Engages in the design, manufacture, marketing, and sale of infrared thermal imaging detectors and modules, and electro-optical systems in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion