- China

- /

- Electronic Equipment and Components

- /

- SZSE:002402

High Growth Tech Stocks to Watch in December 2025

Reviewed by Simply Wall St

As global markets navigate a landscape shaped by the Federal Reserve's interest rate cuts and mixed signals from economic indicators, Asian tech stocks are drawing attention amid concerns over technology valuations and AI infrastructure spending. In this environment, identifying promising high-growth tech stocks involves looking for companies that demonstrate resilience to market fluctuations and have strong fundamentals to support sustained growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.48% | 32.83% | ★★★★★★ |

| Suzhou TFC Optical Communication | 36.73% | 38.14% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩23.05 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩202.18 billion.

ALTEOGEN, a standout in the biotech sector, has recently transitioned to profitability, distinguishing itself with a projected annual revenue growth rate of 56.6% and earnings growth of 68.7%. These figures notably outpace the broader South Korean market's averages of 10.7% and 30.5%, respectively. The company's robust R&D investment is crucial for sustaining innovation and competitive edge in this high-stakes industry. With a forward-looking Return on Equity forecasted at an impressive 56.5%, ALTEOGEN is poised for significant advancements, underscored by its strategic shareholder meetings aimed at steering future growth trajectories effectively.

- Dive into the specifics of ALTEOGEN here with our thorough health report.

Explore historical data to track ALTEOGEN's performance over time in our Past section.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

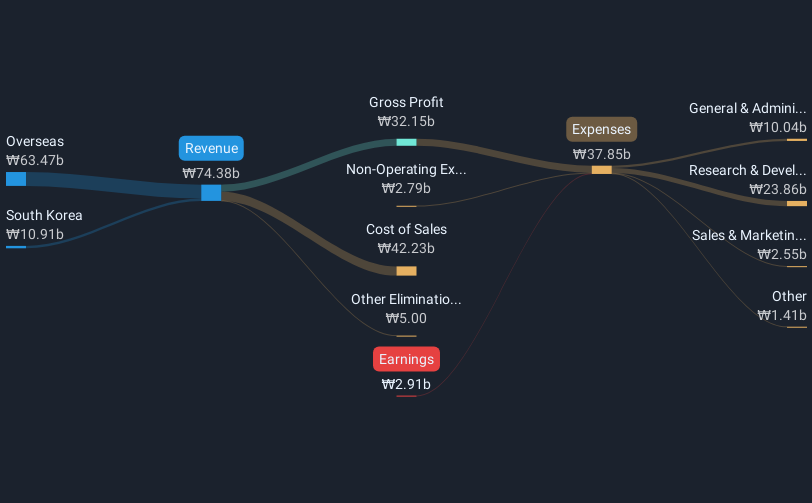

Overview: Shenzhen H&T Intelligent Control Co. Ltd, with a market cap of CN¥35.78 billion, engages in the research, development, manufacturing, sales, and marketing of intelligent controller products both in China and internationally.

Operations: Shenzhen H&T Intelligent Control Co. Ltd focuses on the development and production of intelligent controller products, catering to both domestic and international markets. The company operates through various revenue streams, primarily driven by its core product offerings in intelligent control technology.

Shenzhen H&T Intelligent Control Co. Ltd., a key player in the electronic control sector, has shown impressive growth with a 22.8% increase in annual revenue and an even more robust 73.6% surge in earnings over the past year, outpacing its industry's average growth of 9%. These financial advancements are supported by significant R&D investments, aligning with recent strategic moves including board expansions and amendments to company bylaws aimed at enhancing governance and operational flexibility. The firm's recent decision to explore new business avenues like the bill pool business underscores its proactive approach to capitalizing on emerging market opportunities, positioning it well for sustained growth amidst volatile market conditions.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen H&T Intelligent ControlLtd.

Learn about Shenzhen H&T Intelligent ControlLtd's historical performance.

Co-Tech Development (TPEX:8358)

Simply Wall St Growth Rating: ★★★★★★

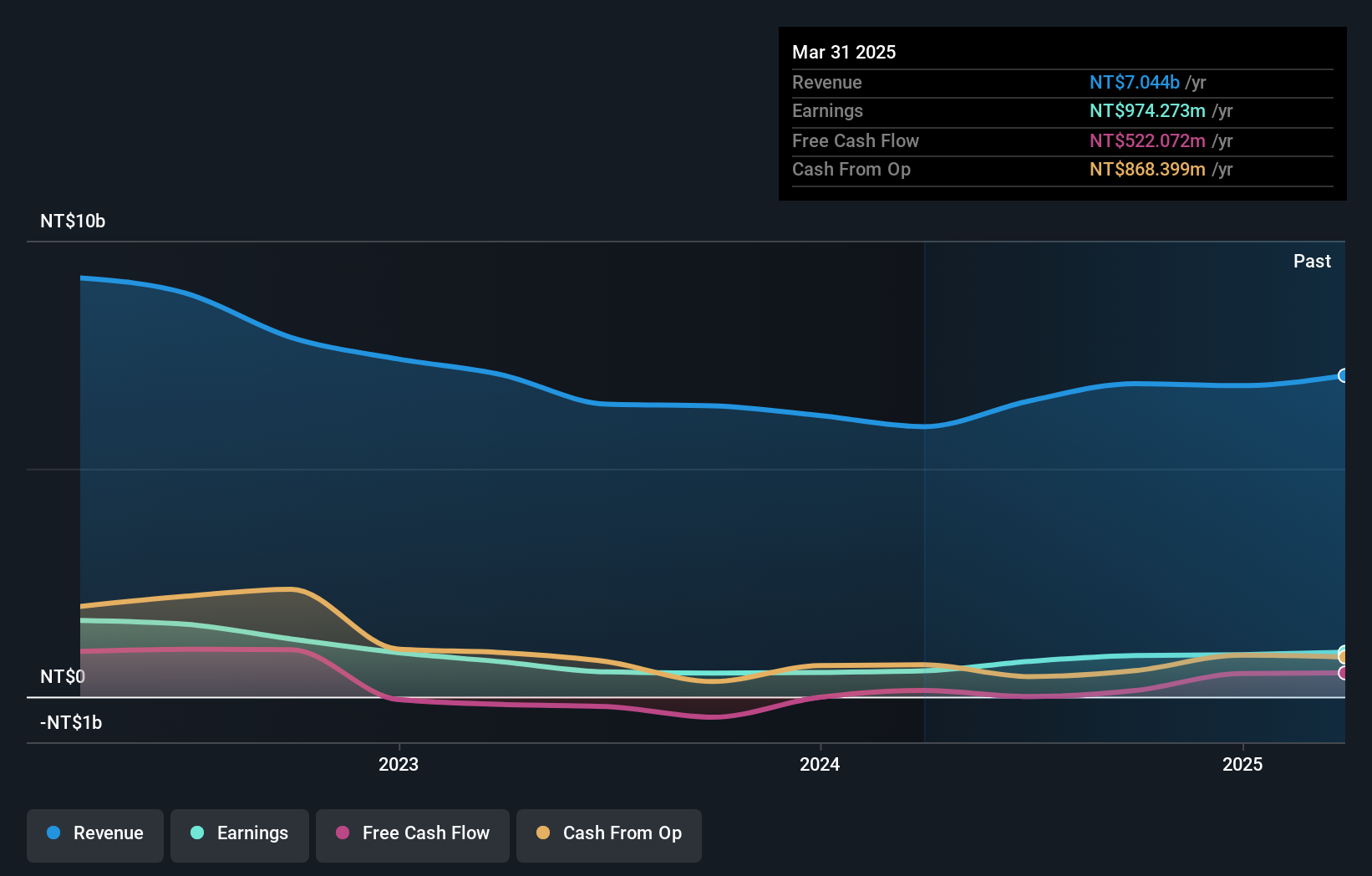

Overview: Co-Tech Development Corporation, along with its subsidiaries, specializes in the production and sale of copper foil for the printed circuit board industry in Taiwan and China, with a market capitalization of NT$61.34 billion.

Operations: The company focuses on producing copper foil for the printed circuit board industry, generating revenue primarily from this segment, which amounts to NT$7.42 billion.

Co-Tech Development has demonstrated robust financial performance, with a 10.7% increase in sales to TWD 5.72 billion over the last nine months, though net income slightly dipped by 5.7% to TWD 685.23 million compared to the previous year. This contrasts with an impressive forecast of annual earnings growth at 75.8%, significantly outpacing the TW market's average of 20.3%. The company's strategic focus on R&D is evident as it aligns with these ambitious growth projections, positioning Co-Tech well within Asia’s high-tech landscape despite recent share price volatility and a competitive electronic industry where it has experienced some challenges in maintaining earnings momentum against an industry average growth of 6.6%.

- Click to explore a detailed breakdown of our findings in Co-Tech Development's health report.

Evaluate Co-Tech Development's historical performance by accessing our past performance report.

Key Takeaways

- Dive into all 189 of the Asian High Growth Tech and AI Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002402

Shenzhen H&T Intelligent ControlLtd

Researches and develops, manufactures, sells, and markets intelligent controller products in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion