High Growth Tech Stocks In Asia Inspur Digital Enterprise Technology And Two Others

Reviewed by Simply Wall St

As the Asian markets continue to navigate a complex economic landscape with China's GDP growth showing resilience and Japan's political uncertainties impacting investor sentiment, high-growth tech stocks have emerged as a focal point for investors seeking opportunities in this dynamic region. In such an environment, identifying promising tech stocks often involves looking at companies that are well-positioned to leverage technological advancements and consumer trends, making them potentially attractive even amid broader market fluctuations.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.23% | 29.66% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 27.20% | 30.47% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Inspur Digital Enterprise Technology (SEHK:596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inspur Digital Enterprise Technology Limited is an investment holding company that focuses on management software development, cloud services, and IoT solutions in China, with a market cap of HK$10.09 billion.

Operations: The company derives its revenue from three primary segments: cloud services (CN¥2.76 billion), management software (CN¥2.56 billion), and IoT solutions (CN¥2.88 billion).

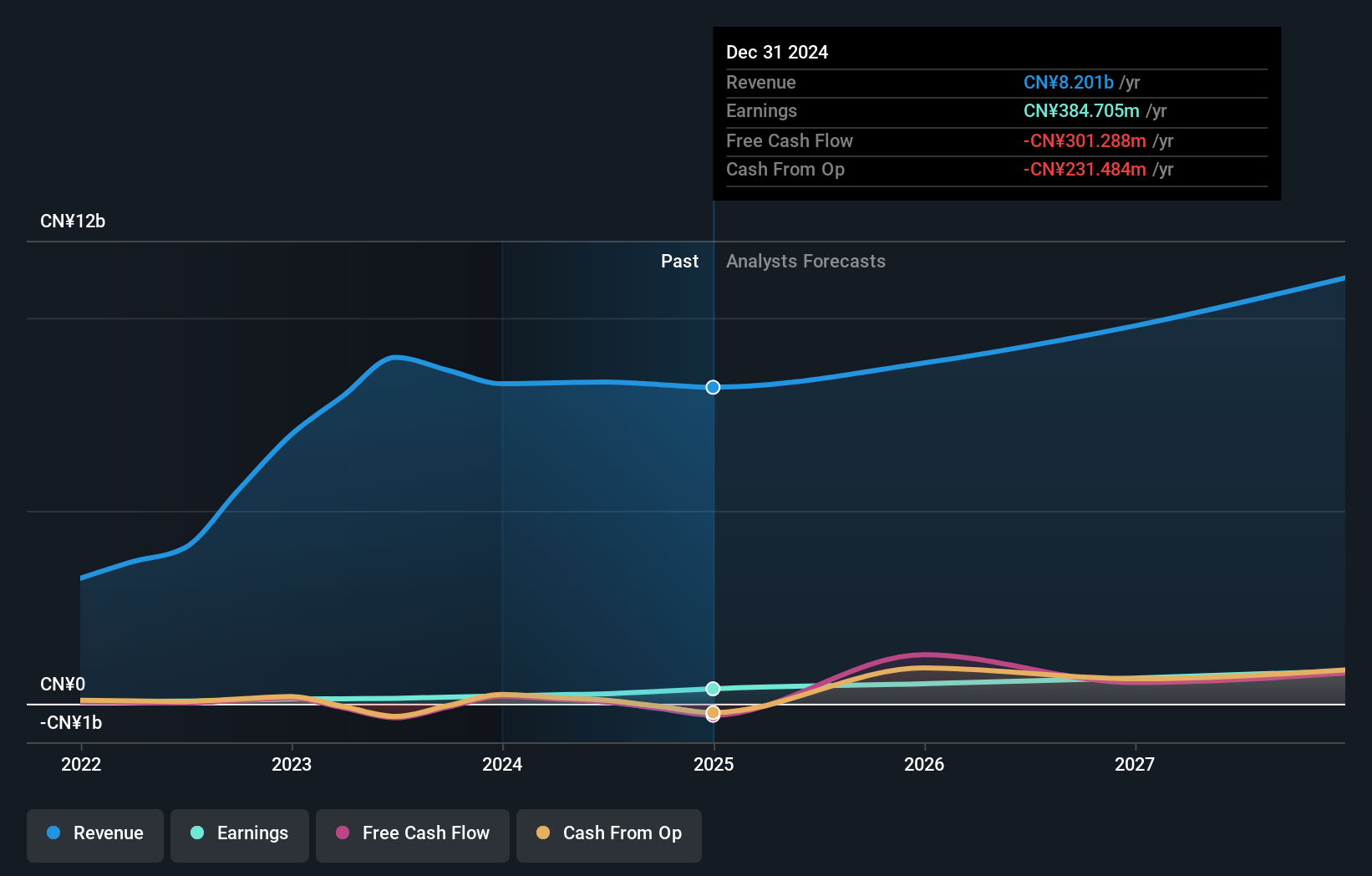

Inspur Digital Enterprise Technology, a key player in Asia's tech sector, is navigating a dynamic market landscape with impressive financial metrics. With an annual revenue growth of 10%, the company outpaces the Hong Kong market average of 8%. This growth is complemented by a robust earnings increase of 25.4% per year, significantly higher than the local market's 10.5%. Furthermore, Inspur has demonstrated exceptional performance with a past year earnings surge of 90.8%, starkly contrasting the software industry's decline of -3.3%. The company also maintains strong R&D commitments which are crucial for sustaining innovation and competitiveness in technology development. Recent corporate activities include an extraordinary shareholders meeting to discuss strategic financial agreements aimed at bolstering its service offerings—a move that could further enhance its market position. Additionally, Inspur announced a dividend increase to HKD 0.08 per share, reflecting confidence in its financial health and ongoing profitability. These factors collectively underscore Inspur’s potential to maintain its trajectory in the high-growth tech arena while adapting effectively to evolving industry demands.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen H&T Intelligent Control Co. Ltd, with a market cap of CN¥21.65 billion, is engaged in the research, development, manufacturing, sales, and marketing of intelligent controller products both in China and internationally.

Operations: H&T Intelligent Control Co. Ltd focuses on the development and production of intelligent controller products, serving both domestic and international markets.

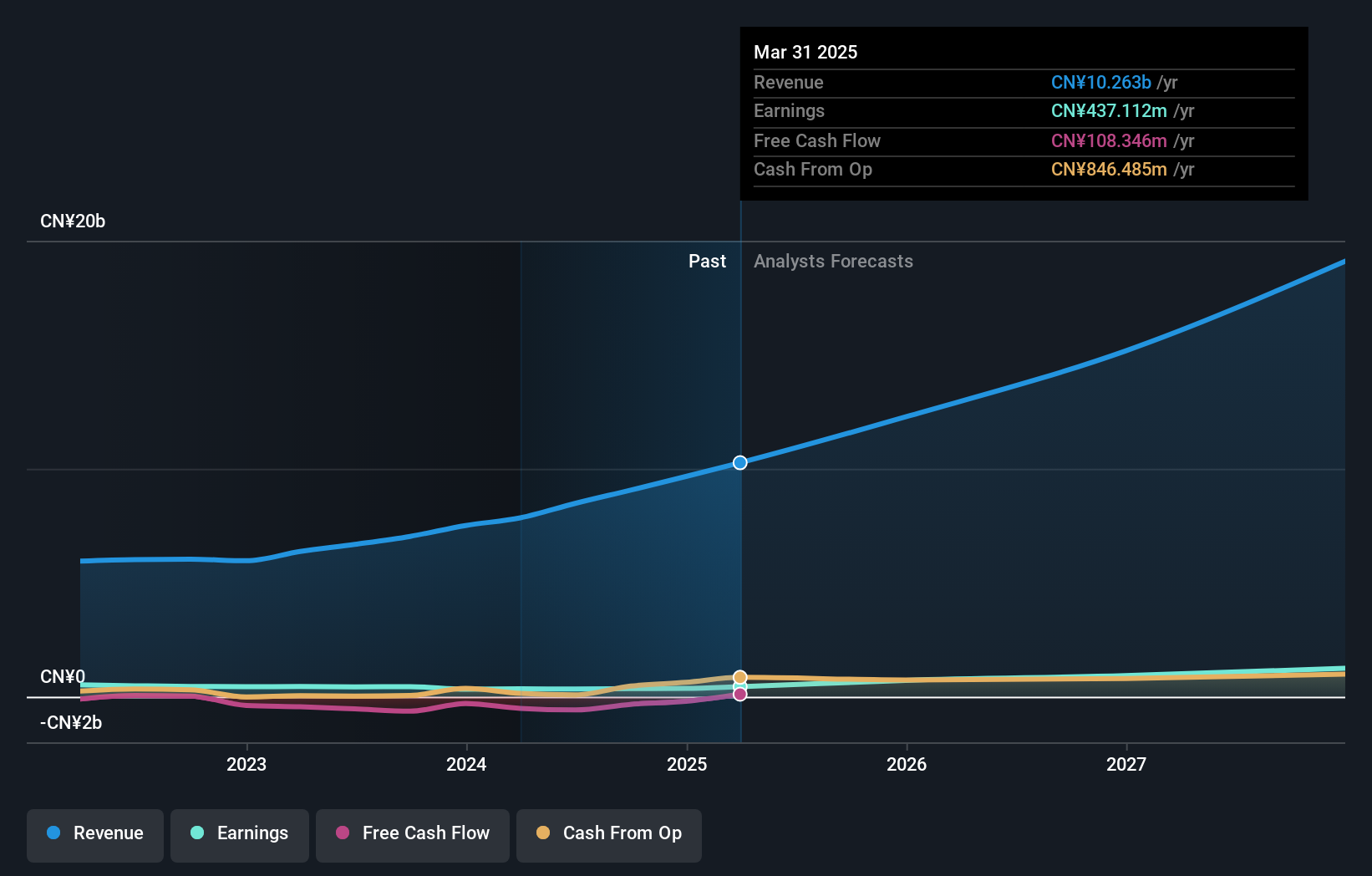

Shenzhen H&T Intelligent Control Co. Ltd, a player in the high-growth tech sector in Asia, is demonstrating robust financial health with an annual revenue growth of 21.6% and earnings growth of 33.9%. This performance is significantly ahead of the broader Chinese market averages of 12.4% and 23.4%, respectively. The company's commitment to innovation is evident from its substantial R&D investments, which have been strategically aligned with its expansion goals in intelligent control solutions. Recent amendments to its bylaws and a proactive approach towards shareholder engagement during the AGM highlight its adaptive corporate governance practices, poised to further drive growth amidst evolving industry dynamics.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing SuperMap Software Co., Ltd. offers geographic information system and spatial intelligence software products and services both in China and internationally, with a market cap of CN¥8.41 billion.

Operations: SuperMap generates revenue primarily from its geographic information system and spatial intelligence software products and services. The company operates in both domestic and international markets, leveraging its expertise in these specialized fields.

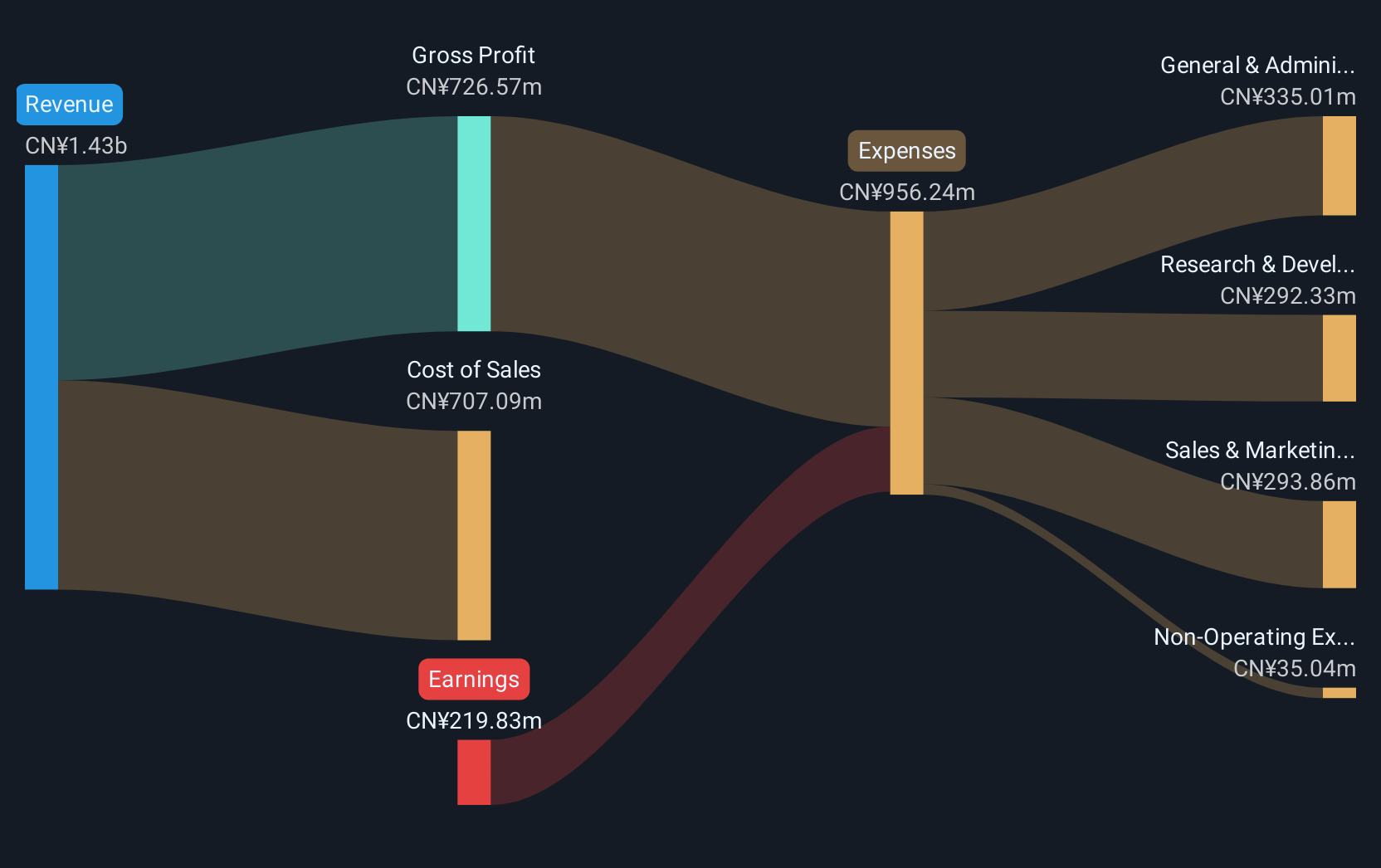

Beijing SuperMap Software, amidst a challenging quarter with revenue dropping to CNY 234.02 million from CNY 298.23 million year-over-year and flipping to a net loss of CNY 43.54 million, still showcases potential through its strategic R&D commitments. With an impressive projected earnings growth of 90.7% annually, the company is poised for recovery and profitability within three years. This focus on innovation could enhance its competitive edge in the geospatial software segment, crucial as industries increasingly rely on advanced mapping technologies for decision-making processes.

Key Takeaways

- Unlock our comprehensive list of 479 Asian High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing SuperMap Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300036

Beijing SuperMap Software

Provides geographic information system and spatial intelligence software products and services in China and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives