Stock Analysis

High Growth Tech Stocks To Watch This November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration, key indices like the S&P 500 and Nasdaq have experienced notable declines, reflecting investor caution amid potential policy shifts and inflationary pressures. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability to evolving regulatory landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.59% | 31.50% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Travere Therapeutics | 31.75% | 72.43% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1303 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Swedish Orphan Biovitrum (OM:SOBI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedish Orphan Biovitrum AB (publ) is an integrated biotechnology company that focuses on researching, developing, manufacturing, and selling pharmaceuticals in haematology, immunology, and specialty care across Europe, North America, the Middle East, Asia, and Australia with a market capitalization of approximately SEK102.41 billion.

Operations: The company's revenue is primarily driven by its haematology segment, generating SEK15.58 billion, followed by immunology at SEK8.67 billion, and specialty care at SEK1.18 billion.

Swedish Orphan Biovitrum (SOBI) has demonstrated robust growth in the biotech sector, outpacing industry averages with a 26.9% earnings increase over the past year, significantly ahead of the biotech industry's -20.8% decline. This performance is underpinned by a strategic focus on rare diseases, as evidenced by promising phase 3 results from their VALIANT study showing a 68% reduction in proteinuria for kidney disease patients treated with pegcetacoplan. With R&D expenses aligning closely with innovative outcomes—evident from recent clinical successes—SOBI's commitment to research is likely to sustain its growth trajectory, further supported by an upwardly revised revenue forecast expecting mid-teens percentage growth for 2024 at CER. This positions SOBI favorably within a niche yet critical segment of healthcare, addressing unmet medical needs that could drive future expansion and market penetration.

- Navigate through the intricacies of Swedish Orphan Biovitrum with our comprehensive health report here.

Understand Swedish Orphan Biovitrum's track record by examining our Past report.

Aerospace CH UAVLtd (SZSE:002389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aerospace CH UAV Co., Ltd specializes in the research, development, production, maintenance, and sale of capacitor films in China with a market capitalization of CN¥19.72 billion.

Operations: Aerospace CH UAV Co., Ltd focuses on the research, development, production, and sale of capacitor films in China. The company operates within a market capitalization of CN¥19.72 billion.

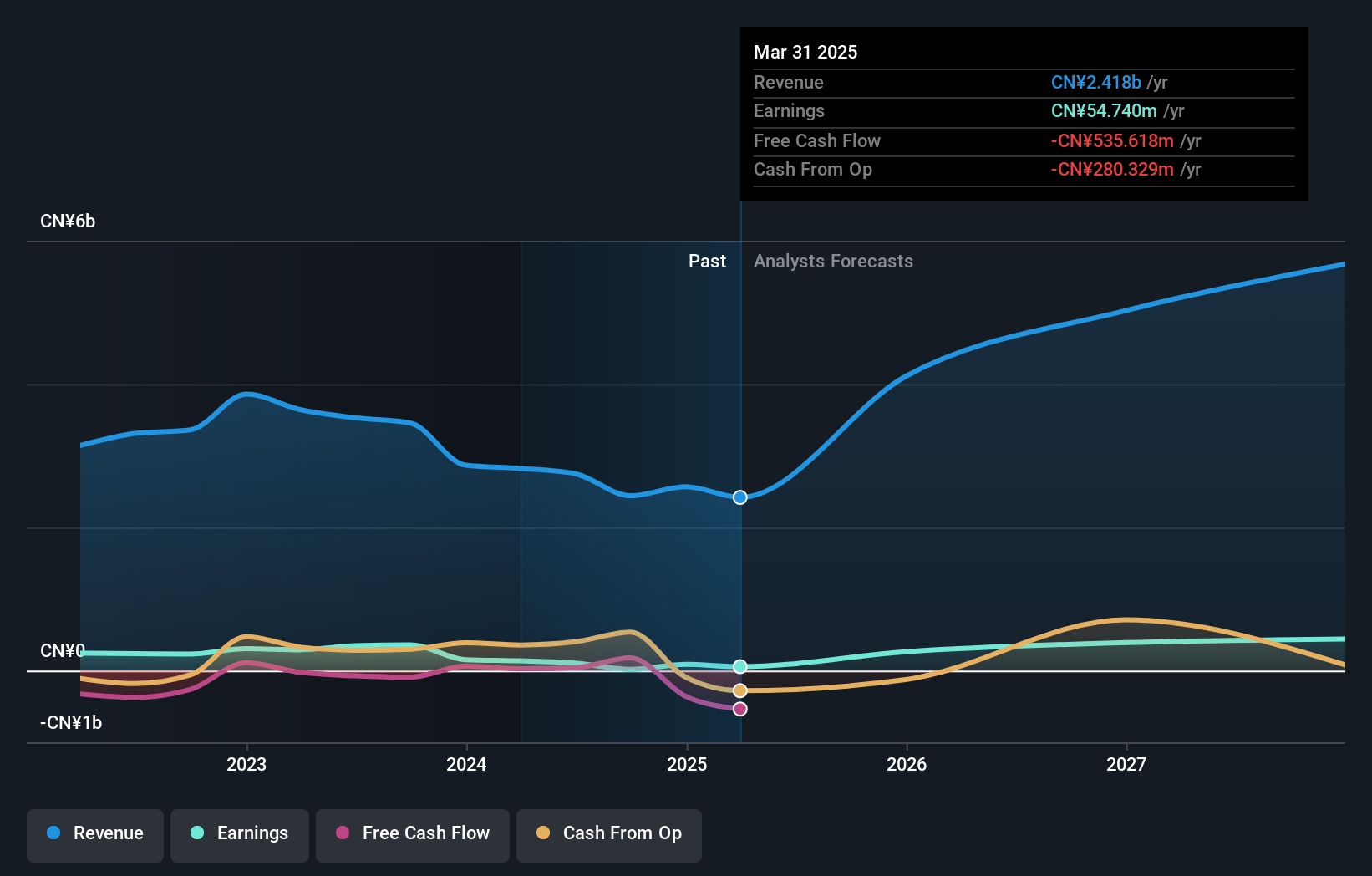

Aerospace CH UAVLtd, amidst a challenging market, reported a significant downturn in revenue from CNY 1.72 billion to CNY 1.29 billion year-over-year as of September 2024, with net income also plummeting to CNY 6.17 million from CNY 141.87 million previously. Despite these setbacks, the firm is poised for recovery with expected revenue growth at an impressive rate of 29.1% annually and earnings forecasted to surge by 59.6% per year over the next three years, signaling robust potential ahead. This optimism is further supported by their consistent investment in R&D, crucial for maintaining competitive edge and innovation in the high-stakes aerospace sector where technological advancements are paramount.

- Get an in-depth perspective on Aerospace CH UAVLtd's performance by reading our health report here.

Explore historical data to track Aerospace CH UAVLtd's performance over time in our Past section.

Oracle Corporation Japan (TSE:4716)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oracle Corporation Japan focuses on developing and selling software and hardware products and solutions within Japan, with a market capitalization of ¥1.91 trillion.

Operations: Oracle Corporation Japan generates revenue primarily through the sale of software and hardware products and solutions in the Japanese market. The company operates with a market capitalization of approximately ¥1.91 trillion, focusing on delivering comprehensive technology offerings to its clients.

Oracle Corporation Japan, reflecting a nuanced trajectory in the tech landscape, anticipates a revenue growth of 7.1% annually. This projection aligns closely with broader market trends yet remains robust given the firm's strategic emphasis on R&D, which constitutes a significant portion of its expenditure. In its latest fiscal projections, Oracle Japan expects to enhance net sales by up to 9% year-over-year and aims for an earnings per share between ¥445.00 and ¥460.00 by May 2025. The company's commitment is evident in its sustained investment in innovation, crucial for staying competitive in a rapidly evolving sector where technological advancements drive market dynamics. Despite not outpacing the software industry’s growth rate last year—where it posted an 8% increase compared to the industry’s 14.6%—Oracle Japan's focus on high-quality earnings and efficient capital allocation (evidenced by an impressive forecasted Return on Equity of 30%) positions it well for future scalability. These financial maneuvers are complemented by strategic corporate guidance that not only underscores resilience but also adaptability in adjusting to market demands and opportunities within the tech sphere.

- Click to explore a detailed breakdown of our findings in Oracle Corporation Japan's health report.

Assess Oracle Corporation Japan's past performance with our detailed historical performance reports.

Summing It All Up

- Delve into our full catalog of 1303 High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4716

Oracle Corporation Japan

Engages in the development and sale of software and hardware products and solutions in Japan.