Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:002389

AVIC Industry-Finance Holdings And Two Other Value Stocks On The Chinese Exchange That Could Be Priced Below Their Estimated Worth To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets exhibit mixed signals, with recent unexpected rate cuts in China hinting at concerns over economic growth, investors are closely monitoring opportunities that might be undervalued. In this context, identifying stocks such as AVIC Industry-Finance Holdings that are potentially priced below their intrinsic value could provide a strategic advantage for enhancing investment portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥166.00 | CN¥322.08 | 48.5% |

| Queclink Wireless Solutions (SZSE:300590) | CN¥11.08 | CN¥21.11 | 47.5% |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥23.64 | CN¥46.17 | 48.8% |

| Naipu Mining Machinery (SZSE:300818) | CN¥21.54 | CN¥41.93 | 48.6% |

| Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥15.22 | CN¥29.89 | 49.1% |

| Thunder Software TechnologyLtd (SZSE:300496) | CN¥43.14 | CN¥84.02 | 48.7% |

| Guangdong Shenling Environmental Systems (SZSE:301018) | CN¥20.26 | CN¥38.14 | 46.9% |

| INKON Life Technology (SZSE:300143) | CN¥7.37 | CN¥14.64 | 49.7% |

| China Film (SHSE:600977) | CN¥10.43 | CN¥20.32 | 48.7% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.53 | CN¥18.84 | 49.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

AVIC Industry-Finance Holdings (SHSE:600705)

Overview: AVIC Industry-Finance Holdings Co., Ltd. operates in China, focusing on industrial investment, equity investment, and investment consulting with a market capitalization of approximately CN¥20.12 billion.

Operations: The company's operations focus on industrial investment, equity investment, and investment consulting in China.

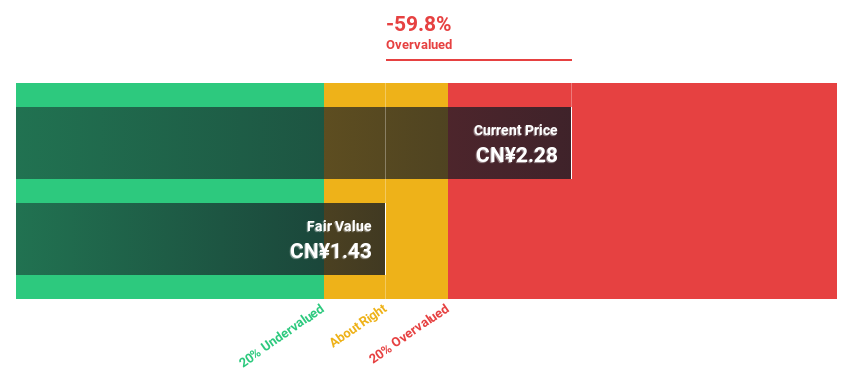

Estimated Discount To Fair Value: 34.1%

AVIC Industry-Finance Holdings is trading at CN¥2.28, significantly below the estimated fair value of CN¥3.46, suggesting a strong undervaluation based on discounted cash flow analysis. Despite a recent downturn in quarterly earnings with a shift from profit to a loss of CN¥352.71 million, the company is forecasted to become profitable within three years and expected to outpace market growth with revenue increasing by 15.4% annually. However, its debt levels are concerning as they are poorly covered by operating cash flows.

- Our comprehensive growth report raises the possibility that AVIC Industry-Finance Holdings is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of AVIC Industry-Finance Holdings.

SICC (SHSE:688234)

Overview: SICC Co., Ltd. specializes in the research, development, production, and sale of silicon carbide semiconductor materials both in China and globally, with a market capitalization of approximately CN¥22.41 billion.

Operations: The company generates CN¥1.48 billion in revenue from its semiconductor material segment.

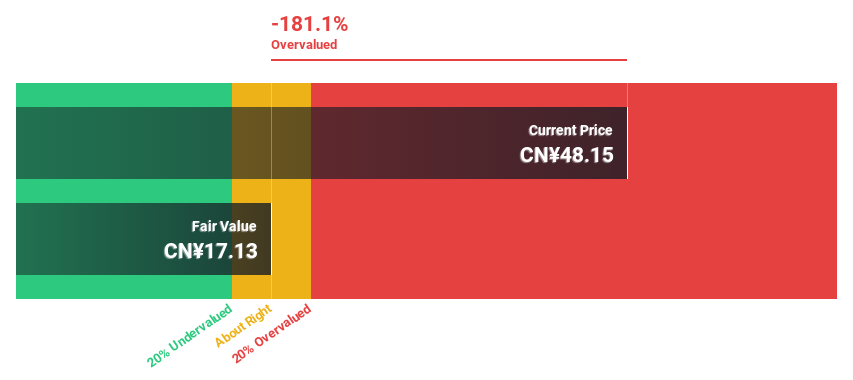

Estimated Discount To Fair Value: 18.8%

SICC, currently priced at CN¥52.26, is valued below the estimated fair value of CN¥64.35, reflecting potential undervaluation based on cash flows. The company's recent transition to profitability and a robust earnings growth forecast of 37.81% annually highlight its recovery trajectory. However, its return on equity is expected to remain modest at 11.6%. Recent buyback activities underscore management's confidence in the stock's value, with significant share repurchases completed for CNY 100.22 million.

- According our earnings growth report, there's an indication that SICC might be ready to expand.

- Navigate through the intricacies of SICC with our comprehensive financial health report here.

Aerospace CH UAVLtd (SZSE:002389)

Overview: Aerospace CH UAV Co., Ltd specializes in the research, development, production, maintenance, and sale of capacitor films within China, with a market capitalization of approximately CN¥13.02 billion.

Operations: The company's revenue is primarily derived from various activities related to capacitor films, including their research, development, production, and maintenance.

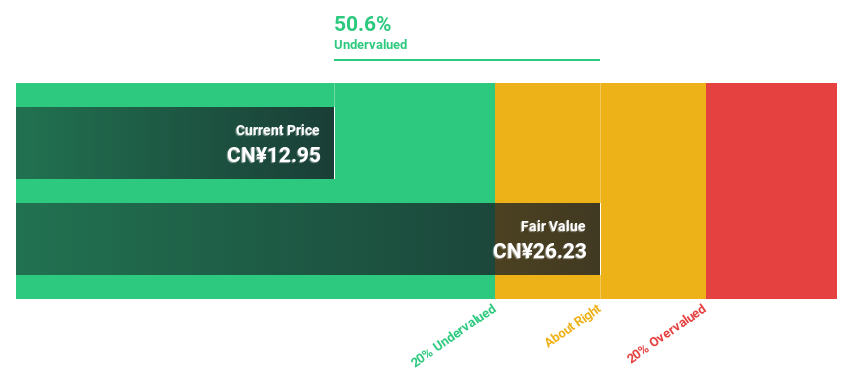

Estimated Discount To Fair Value: 20.2%

Aerospace CH UAV Co.,Ltd, with a current price of CN¥13.15, trades below the estimated fair value of CN¥16.48, suggesting undervaluation based on cash flow analyses. Despite recent challenges indicated by a decline in quarterly sales and net income, the company maintains a strong future outlook with significant expected revenue growth (26.8% per year) and earnings growth (41.07% per year). However, its return on equity remains low at 6.1%, reflecting potential concerns about profitability efficiency.

- In light of our recent growth report, it seems possible that Aerospace CH UAVLtd's financial performance will exceed current levels.

- Click here to discover the nuances of Aerospace CH UAVLtd with our detailed financial health report.

Next Steps

- Gain an insight into the universe of 99 Undervalued Chinese Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002389

Aerospace CH UAVLtd

Engages in the research, development, production, maintenance, and sale of capacitor films in China.

Flawless balance sheet with high growth potential.