Stock Analysis

Exploring Top Dividend Stocks On The Shanghai Stock Exchange In July 2024

Reviewed by Simply Wall St

As the Shanghai Composite Index navigates a challenging period marked by recent rate cuts and subdued economic indicators, investors are closely monitoring opportunities within China's equity markets. In this context, dividend stocks on the Shanghai Stock Exchange could offer a compelling avenue for those seeking potential income in an uncertain economic landscape. A good dividend stock typically combines stable earnings with a consistent payout history, qualities that might be particularly appealing given the current market dynamics and economic headwinds in China.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Anhui Anke Biotechnology (Group) (SZSE:300009) | 3.05% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.77% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.99% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.70% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.17% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.98% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.64% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.88% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.83% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.66% | ★★★★★★ |

Click here to see the full list of 265 stocks from our Top Chinese Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CNSIG Inner Mongolia Chemical IndustryLtd (SHSE:600328)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNSIG Inner Mongolia Chemical Industry Co., Ltd. is a company engaged in the chemical industry with a market capitalization of CN¥10.89 billion.

Operations: CNSIG Inner Mongolia Chemical Industry Co., Ltd. does not have detailed revenue segment information available.

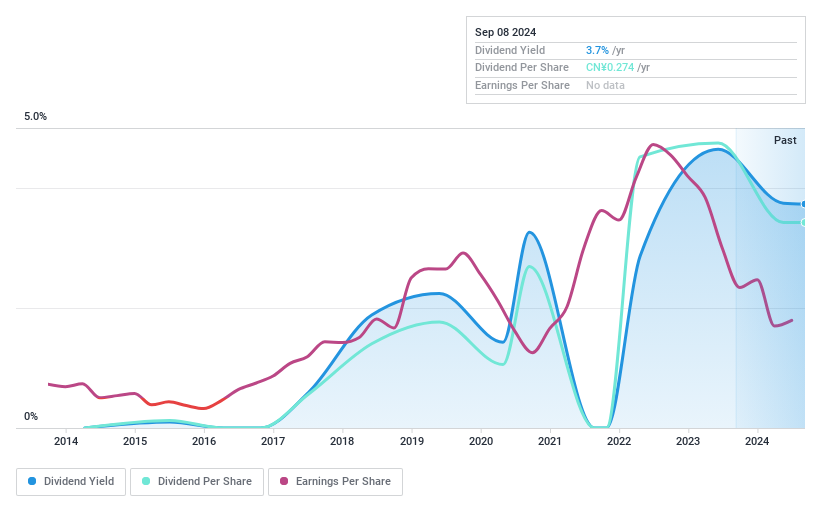

Dividend Yield: 3.7%

CNSIG Inner Mongolia Chemical Industry Ltd. has a dividend yield of 3.7%, ranking in the top 25% of Chinese dividend payers. Despite this, the company's dividend history is marked by instability, with significant fluctuations over its nine-year payout period. Recent financials show a downturn, with half-year sales dropping from CNY 8.66 billion to CNY 6.36 billion and net income falling to CNY 440.78 million from CNY 763.09 million year-over-year, reflecting potential challenges in sustaining dividends amidst declining earnings.

- Unlock comprehensive insights into our analysis of CNSIG Inner Mongolia Chemical IndustryLtd stock in this dividend report.

- According our valuation report, there's an indication that CNSIG Inner Mongolia Chemical IndustryLtd's share price might be on the cheaper side.

Changhong Huayi Compressor (SZSE:000404)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Changhong Huayi Compressor Co., Ltd. is a company that develops, manufactures, and sells a range of compressors both in China and globally, with a market capitalization of approximately CN¥3.93 billion.

Operations: Changhong Huayi Compressor Co., Ltd. generates its revenue primarily through the development, manufacturing, and sale of various compressors across domestic and international markets.

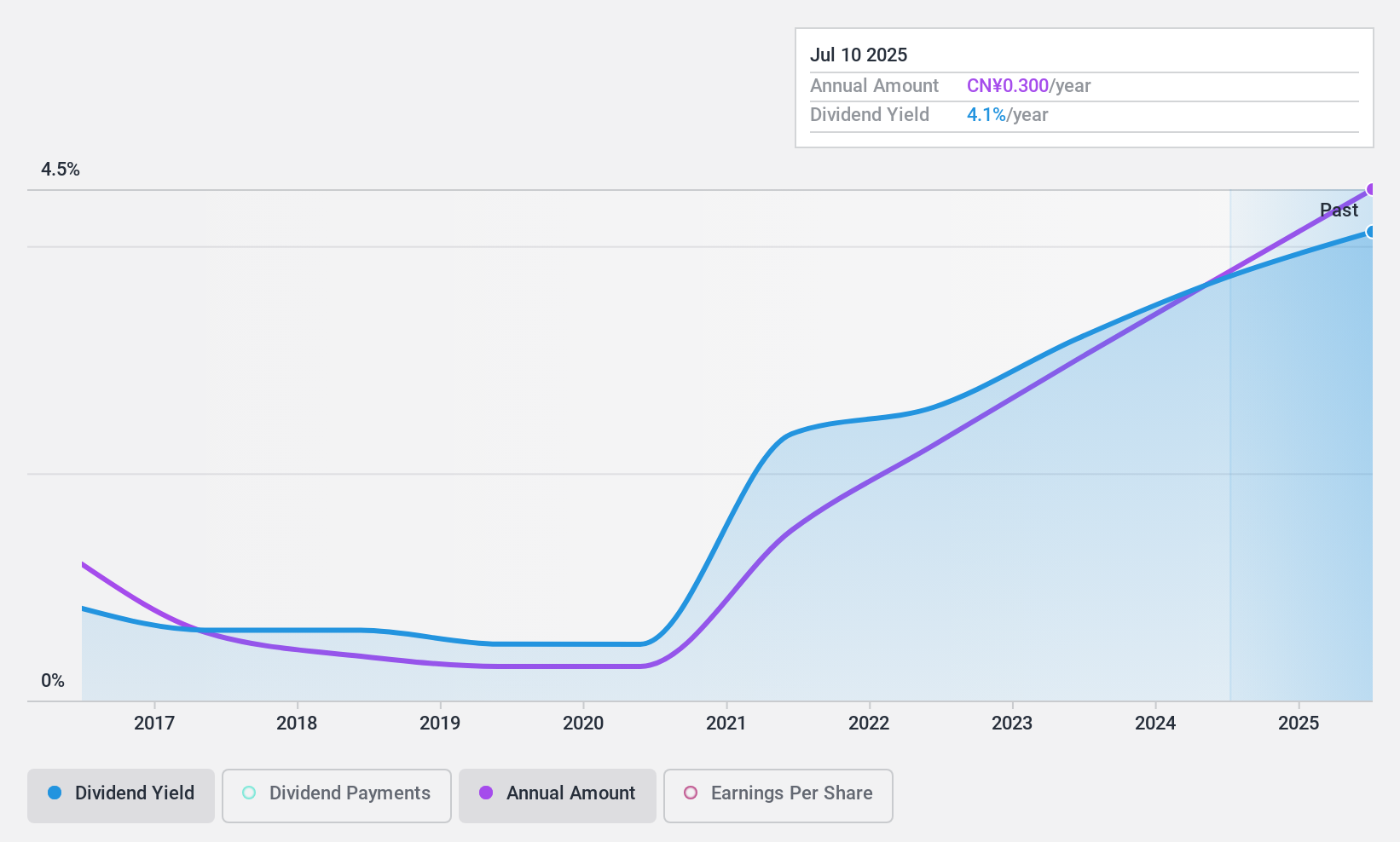

Dividend Yield: 4.4%

Changhong Huayi Compressor recently declared a cash dividend of CNY 2.50 per 10 shares for 2023, reflecting a commitment to shareholder returns despite its historical dividend volatility. The company's dividends are well-supported by earnings and cash flows, with payout ratios of 45.9% and 34% respectively, indicating sustainability. However, its dividend history has been marked by inconsistency over the past decade. Trading at a P/E ratio of 10.4x, Changhong offers value relative to its peers in the Chinese market.

- Click to explore a detailed breakdown of our findings in Changhong Huayi Compressor's dividend report.

- Our comprehensive valuation report raises the possibility that Changhong Huayi Compressor is priced lower than what may be justified by its financials.

Canny Elevator (SZSE:002367)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canny Elevator Co., Ltd. is a company based in China that focuses on the research, development, production, sale, installation, and maintenance of elevators, with a market capitalization of approximately CN¥4.61 billion.

Operations: Canny Elevator Co., Ltd. generates revenue primarily from its elevator operations, totaling CN¥4.82 billion.

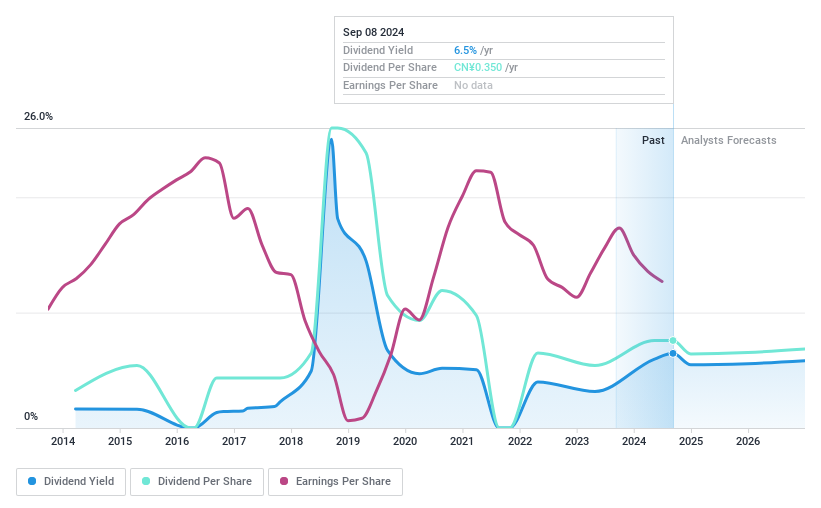

Dividend Yield: 6%

Canny Elevator, with a dividend yield of 6.01%, ranks in the top 25% of Chinese dividend payers. Despite this attractive yield, the company's dividend history has been marked by volatility over the past decade. Currently trading at 36.4% below its estimated fair value, it presents potential upside for investors. Earnings have grown annually by 12% over five years and are expected to grow by 5.1% per year moving forward. Both earnings (83.8%) and cash flows (51.8%) adequately cover the dividends, supporting sustainability despite past inconsistencies.

- Delve into the full analysis dividend report here for a deeper understanding of Canny Elevator.

- Our expertly prepared valuation report Canny Elevator implies its share price may be lower than expected.

Key Takeaways

- Dive into all 265 of the Top Chinese Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600328

CNSIG Inner Mongolia Chemical IndustryLtd

CNSIG Inner Mongolia Chemical Industry Co.,Ltd.

Excellent balance sheet average dividend payer.