- China

- /

- Tech Hardware

- /

- SHSE:688489

High Growth Tech Stocks To Watch This December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets have experienced a mixed bag of economic indicators and stock performances, with U.S. consumer confidence taking a dip and major indices like the Nasdaq Composite showing both gains and losses in recent weeks. In this environment, identifying high-growth tech stocks requires careful consideration of their resilience to economic fluctuations and their potential to capitalize on technological advancements despite broader market uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Sansec Technology (SHSE:688489)

Simply Wall St Growth Rating: ★★★★★☆

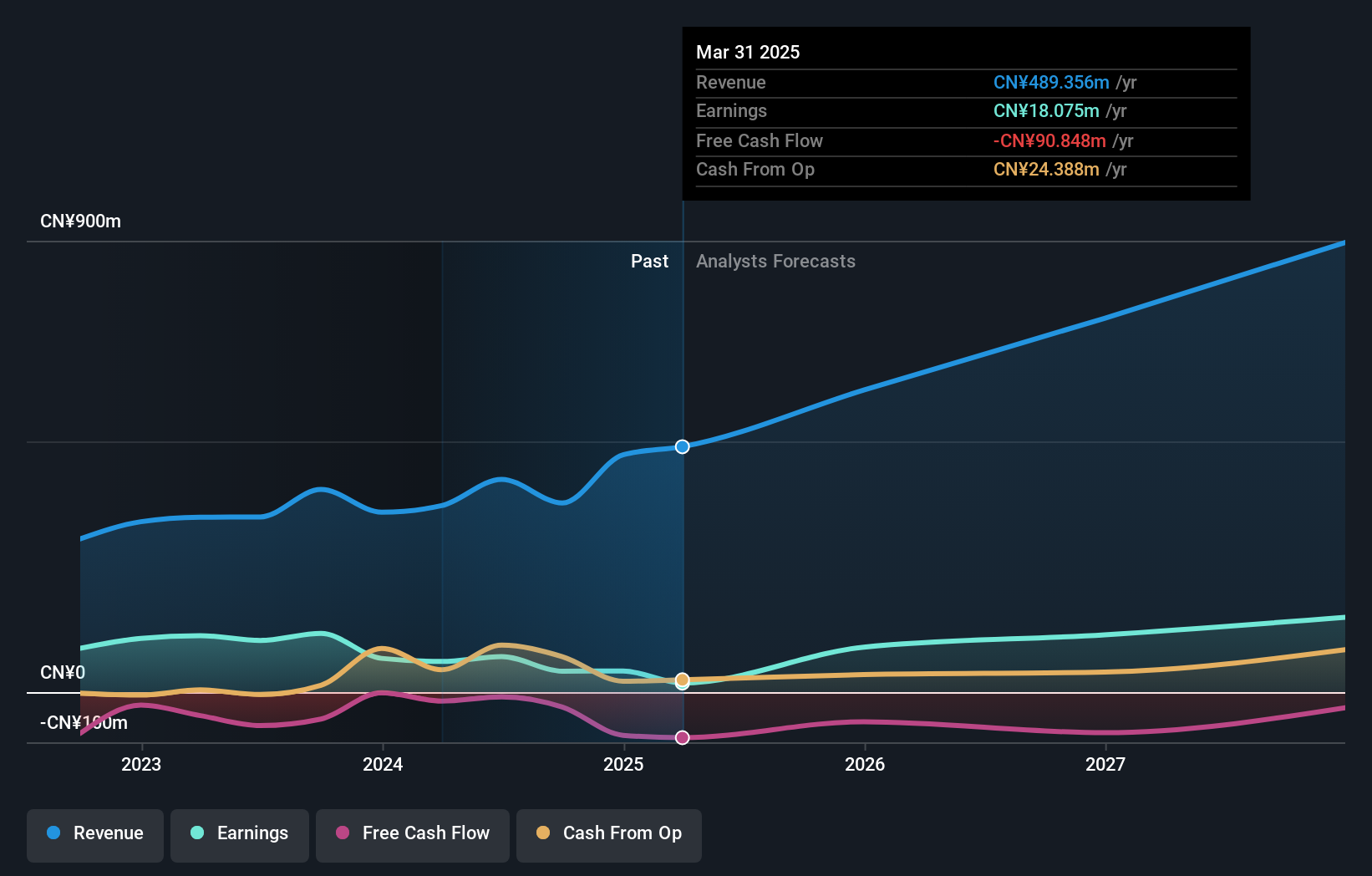

Overview: Sansec Technology Co., Ltd. focuses on the research, development, and production of commercial cryptographic products and solutions for internet information security in China, with a market cap of CN¥4.03 billion.

Operations: Sansec Technology specializes in developing cryptographic products and solutions for internet information security, primarily targeting the Chinese market. The company generates revenue through its focus on commercial cryptographic offerings.

Sansec Technology, despite its recent exclusion from the S&P Global BMI Index, demonstrates robust potential with a forecasted annual revenue growth of 25.3% and earnings growth of 44.1%. The firm has actively managed its capital through a share repurchase program, buying back 2.53% of its shares for CNY 79.96 million, underscoring confidence in its financial health amid volatile market conditions. However, it's crucial to note the impact of one-off gains on past earnings and a significant drop in net income this year to CNY 14.16 million from CNY 39.7 million previously, reflecting challenges that might affect future profitability despite high growth projections.

- Take a closer look at Sansec Technology's potential here in our health report.

Gain insights into Sansec Technology's past trends and performance with our Past report.

Hanwang TechnologyLtd (SZSE:002362)

Simply Wall St Growth Rating: ★★★★★☆

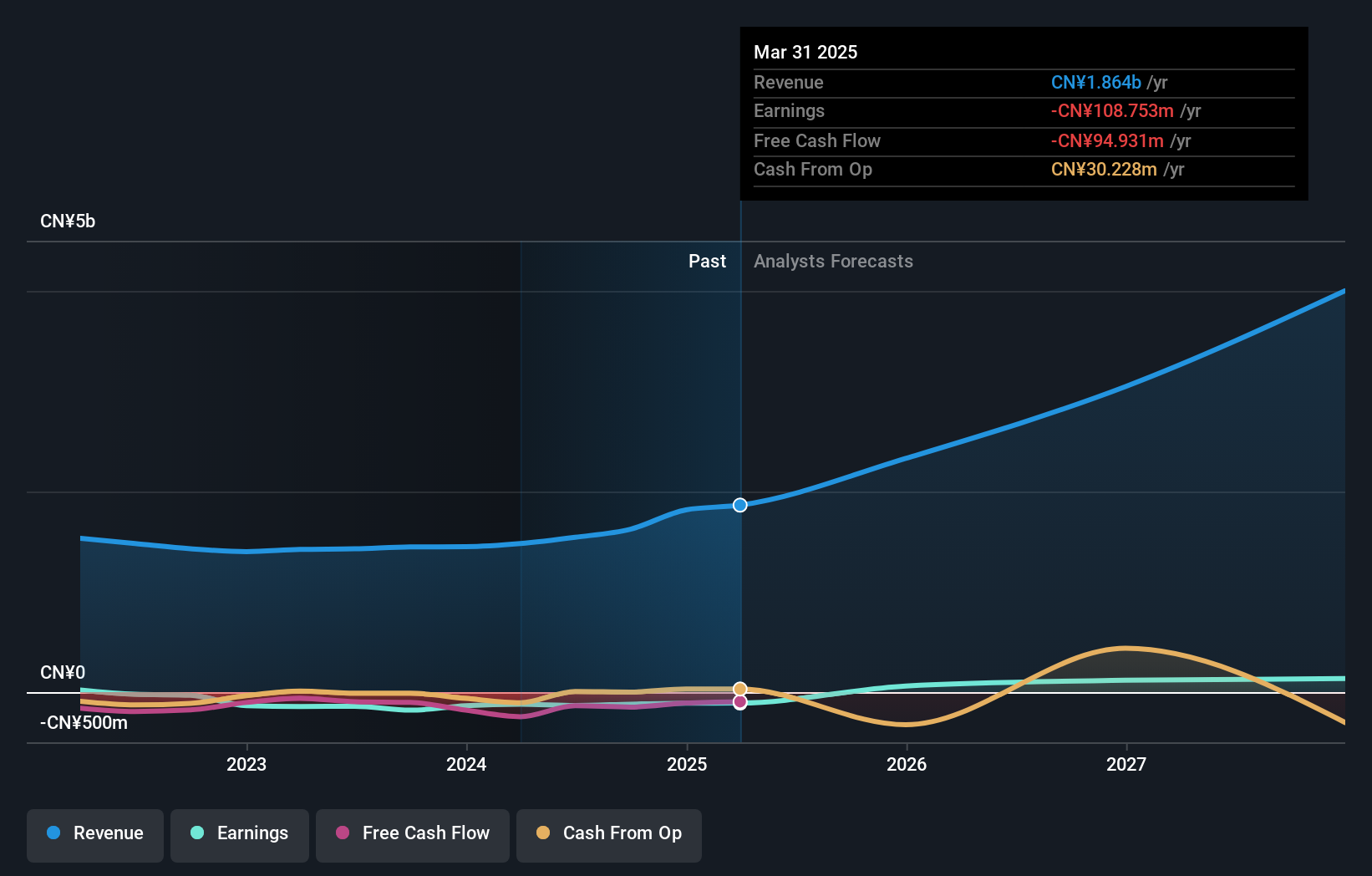

Overview: Hanwang Technology Co., Ltd. specializes in handwriting recognition, optical character recognition, and handwriting input products both in China and internationally, with a market cap of CN¥5.81 billion.

Operations: Hanwang Technology Co., Ltd. generates revenue primarily from its handwriting recognition, optical character recognition, and handwriting input products. The company operates both domestically in China and in international markets.

Hanwang TechnologyLtd, amidst a challenging financial landscape marked by a net loss reduction to CNY 75.01 million from CNY 89.85 million year-over-year, still showcases promising growth dynamics with revenue climbing to CNY 1.15 billion from CNY 972.71 million previously. This uptick aligns with an anticipated annual revenue growth of 25.3%, outpacing the Chinese market's average of 13.7%. Despite current unprofitability and a volatile share price, the company is poised for profitability within three years, supported by significant R&D investments aimed at fostering innovation and capturing market share in the competitive tech sector.

- Delve into the full analysis health report here for a deeper understanding of Hanwang TechnologyLtd.

Assess Hanwang TechnologyLtd's past performance with our detailed historical performance reports.

DTS (TSE:9682)

Simply Wall St Growth Rating: ★★★★☆☆

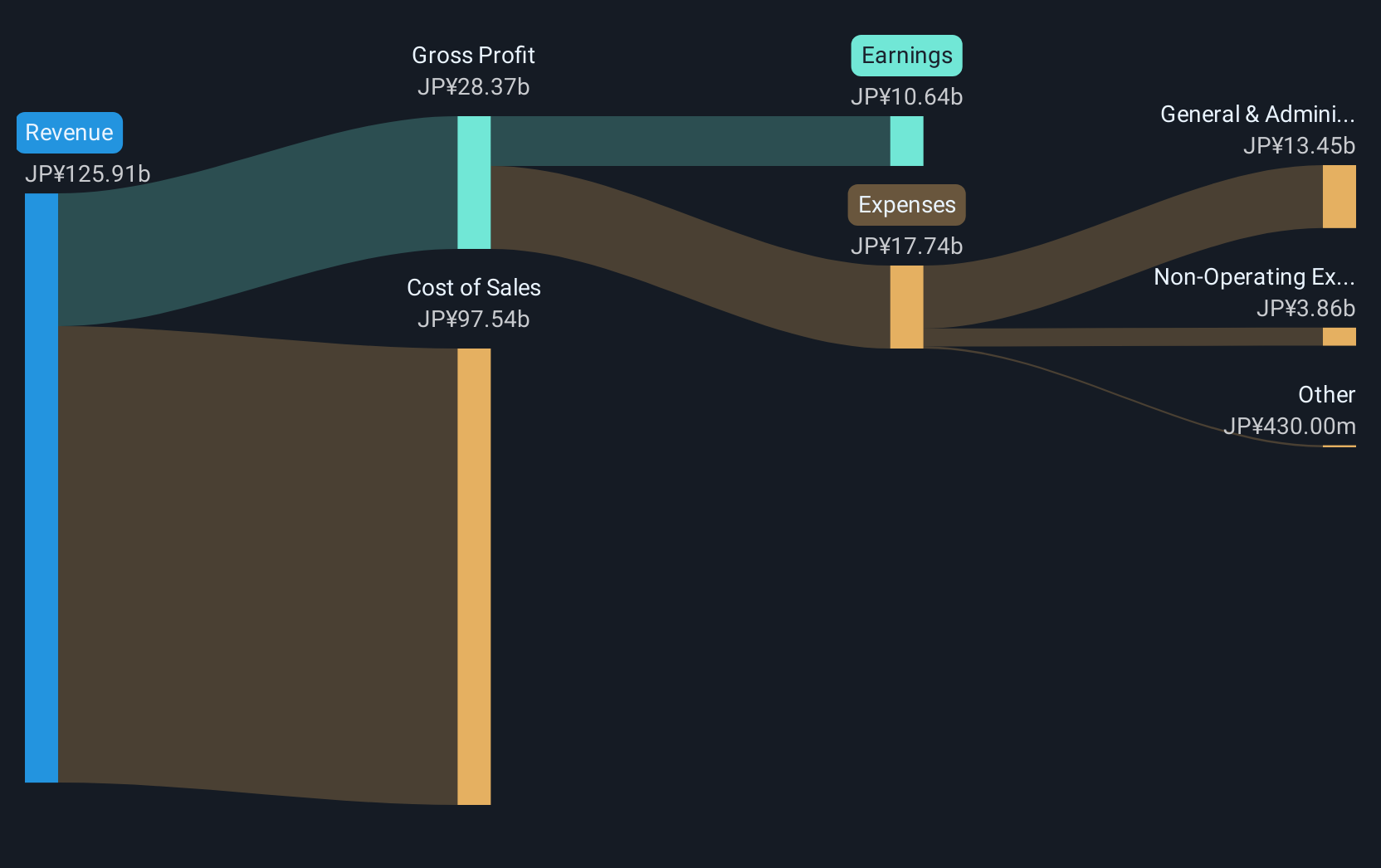

Overview: DTS Corporation is a Japanese company specializing in systems integration services with a market capitalization of ¥179.05 billion.

Operations: The company generates revenue primarily through its Business & Solutions segment, which contributes ¥49.81 billion, followed by Technology & Solutions at ¥42.66 billion and Platform & Services at ¥29.38 billion.

DTS Corporation, with its robust commitment to innovation, has significantly increased its R&D spending to ¥5.1 billion, representing a notable 15.3% of revenue, up from 12.7% last year. This strategic investment underscores DTS's focus on enhancing technological capabilities in a competitive landscape where software companies are swiftly transitioning to SaaS models for more predictable revenue streams. Additionally, the company's recent share repurchase program highlights a proactive approach in boosting shareholder value—repurchasing 621,200 shares for ¥2.503 billion within the last quarter alone—reflecting confidence in their financial health and future prospects despite facing industry-wide challenges such as fluctuating market demands and rapid technological evolution.

Make It Happen

- Reveal the 1267 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688489

Sansec Technology

Engages in the research, development, and production of commercial cryptographic products and solutions for internet information security in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives