Uncovering Opportunities: Ercros Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a mixed landscape, with U.S. stocks closing out a strong year despite recent slumps and economic indicators presenting varied signals, investors are increasingly looking for opportunities beyond the traditional blue-chip stocks. Penny stocks, though an older term, still capture the essence of smaller or emerging companies that can offer significant potential when backed by solid financials and growth prospects. In this article, we explore three penny stocks that stand out for their financial robustness and potential to provide both stability and growth in today’s evolving market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.64 | HK$40.08B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.968 | £152.69M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,820 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Ercros (BME:ECR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ercros, S.A. is a Spanish company that manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals with a market cap of €327.34 million.

Operations: The company's revenue is generated from three main segments: Chlorine Derivatives (€375.76 million), Intermediate Chemicals (€193.57 million), and Pharmaceuticals (€63.57 million).

Market Cap: €327.34M

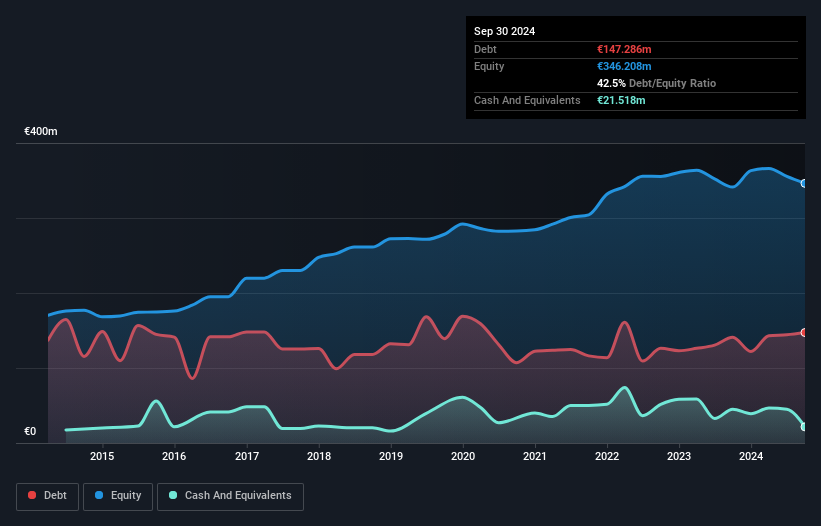

Ercros, S.A. has faced challenges with a net loss of €7.8 million for the nine months ending September 30, 2024, compared to a net income of €5.68 million the previous year. Despite this setback, Ercros maintains satisfactory debt levels with a net debt to equity ratio of 36.3% and its short-term assets exceed both short and long-term liabilities, indicating financial stability in covering obligations. The company’s earnings are forecasted to grow significantly at 48.52% annually despite recent negative growth trends and lower profit margins compared to last year’s performance.

- Take a closer look at Ercros' potential here in our financial health report.

- Gain insights into Ercros' future direction by reviewing our growth report.

Oiltek International (Catalist:HQU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oiltek International Limited is an investment holding company involved in supplying and providing engineering design and commissioning services for oil extraction equipment and plants across Asia, America, and Africa, with a market cap of SGD154.44 million.

Operations: The company generates revenue from three main segments: Edible & Non-Edible Oil Refinery (MYR188.17 million), Product Sales and Trading (MYR19.68 million), and Renewable Energy (MYR16.99 million).

Market Cap: SGD154.44M

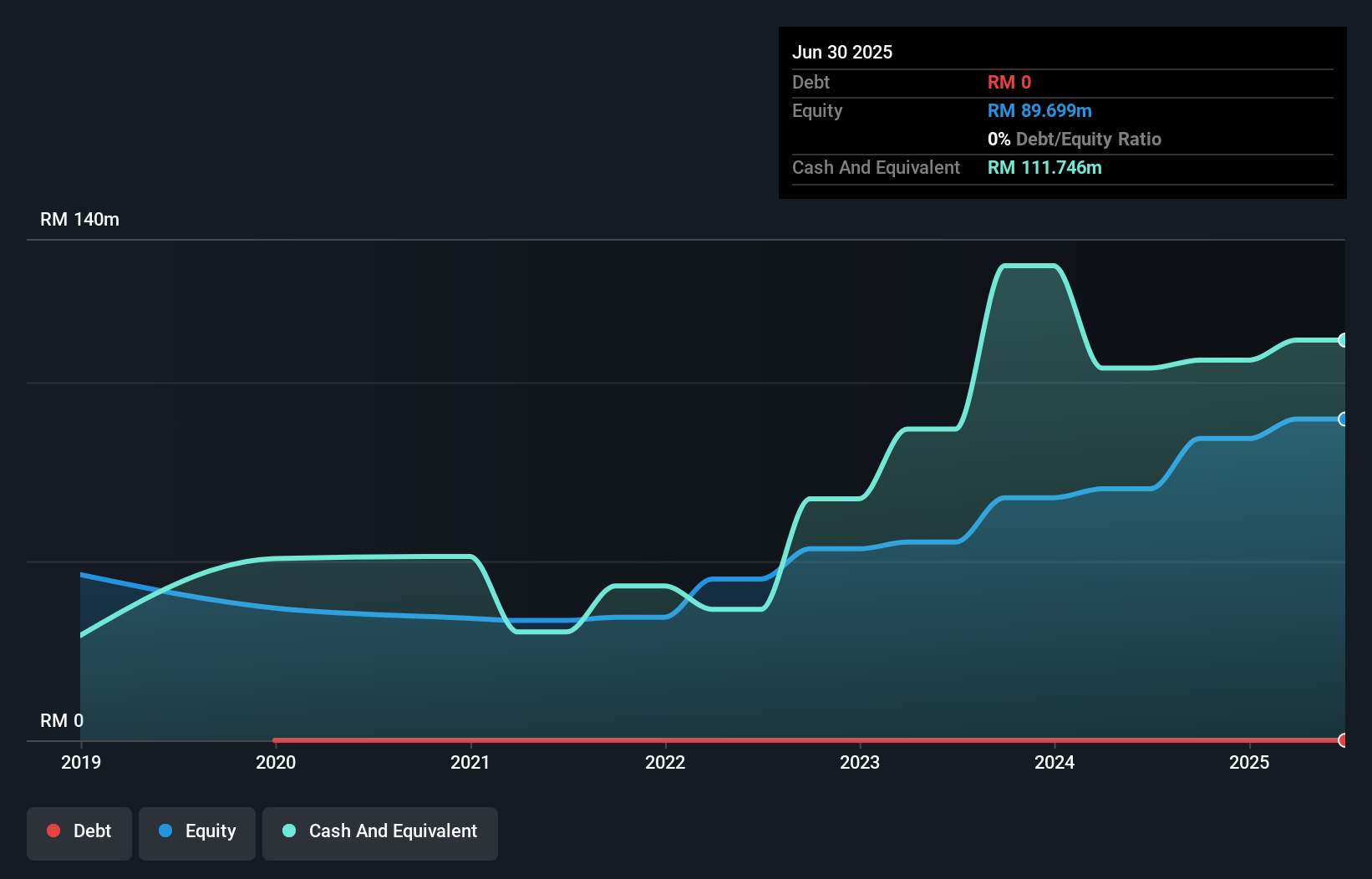

Oiltek International Limited, with a market cap of SGD154.44 million, shows promising financial health as its short-term assets (MYR159.2M) exceed both short-term liabilities (MYR92.5M) and long-term liabilities (MYR160K), indicating robust liquidity management. The company is debt-free, enhancing its financial flexibility and reducing risk exposure associated with leverage. Oiltek's earnings have grown significantly by 52.5% over the past year, surpassing its five-year average growth rate of 20.6% annually, and are forecasted to grow at 17.04% per year moving forward, suggesting strong future potential despite recent share price volatility.

- Get an in-depth perspective on Oiltek International's performance by reading our balance sheet health report here.

- Evaluate Oiltek International's prospects by accessing our earnings growth report.

Shenzhen Success Electronics (SZSE:002289)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Success Electronics Co., Ltd focuses on the R&D, production, and sale of LCD screens and modules, touch screens and modules, and touch display integrated modules in China with a market cap of CN¥1.06 billion.

Operations: The company's revenue primarily comes from the Computer, Communications and Other Electronic Equipment Manufacturing segment, generating CN¥163.76 million.

Market Cap: CN¥1.06B

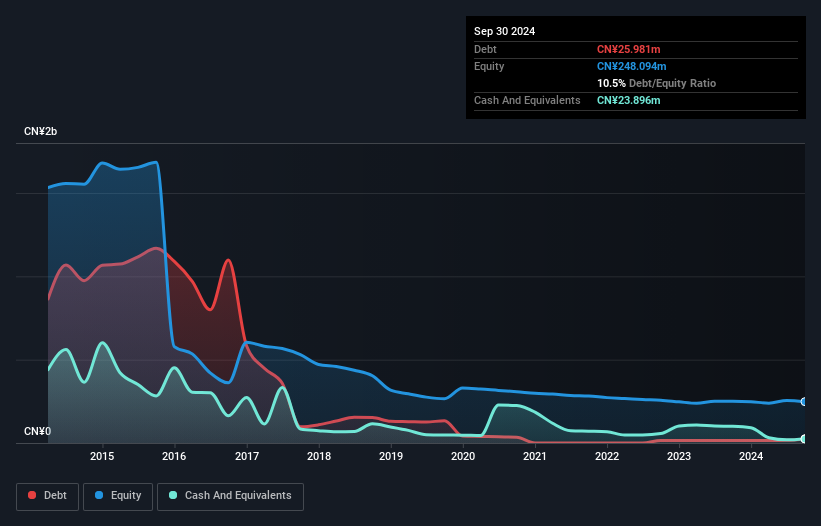

Shenzhen Success Electronics Co., Ltd, with a market cap of CN¥1.06 billion, faces challenges as it remains unprofitable despite generating CN¥163.76 million in revenue from its electronics manufacturing segment. The company's short-term assets (CN¥114.1M) comfortably cover both short-term (CN¥46.6M) and long-term liabilities (CN¥27M), indicating solid liquidity management, though it has less than a year of cash runway based on current free cash flow trends. Recent earnings reports show sales growth but an increased net loss of CN¥15.55 million for the nine months ended September 2024, highlighting ongoing profitability struggles amidst strategic business expansion considerations discussed in recent shareholder meetings.

- Click here to discover the nuances of Shenzhen Success Electronics with our detailed analytical financial health report.

- Assess Shenzhen Success Electronics' previous results with our detailed historical performance reports.

Taking Advantage

- Dive into all 5,820 of the Penny Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ercros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ECR

Ercros

Manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals in Spain.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives