As rising U.S. Treasury yields exert pressure on stocks and the S&P 500 Index sees a dip after weeks of gains, the tech-heavy Nasdaq Composite manages to edge slightly higher, reflecting growth stocks' resilience in the current market landscape. In this environment, identifying high-growth tech stocks requires attention to companies that can leverage innovation and maintain competitive advantages despite broader economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Pharma Mar | 20.17% | 55.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Accelink Technologies Co., Ltd. is involved in the research, development, manufacturing, sales, and provision of technical services for optoelectronic chips, devices, modules, and subsystem products primarily in China with a market capitalization of CN¥29.89 billion.

Operations: Accelink Technologies Co., Ltd. focuses on the optoelectronics sector, offering a range of products including chips, devices, modules, and subsystems along with technical services. The company primarily operates within China and has a market capitalization of approximately CN¥29.89 billion.

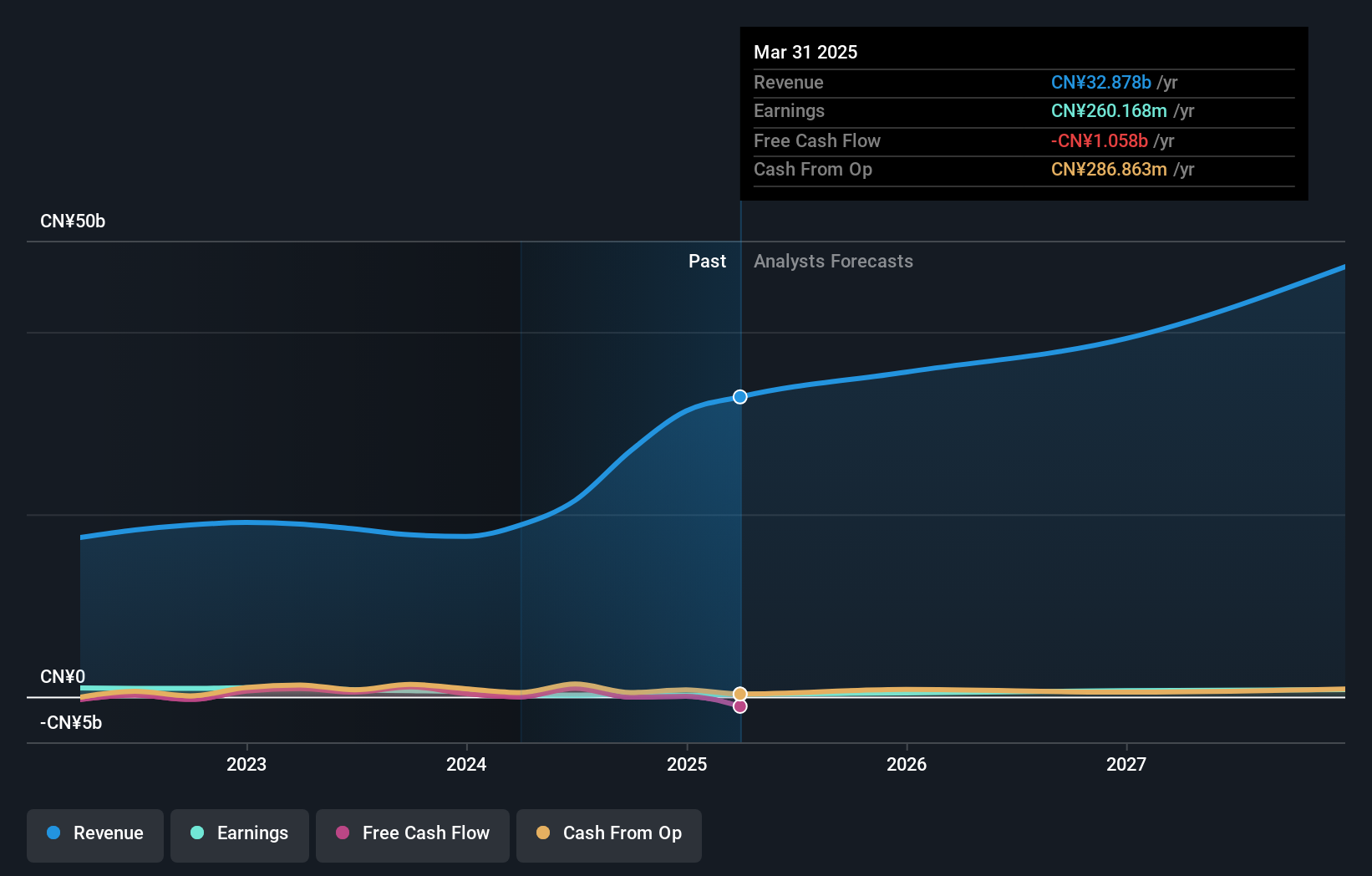

Accelink Technologies CoLtd has demonstrated a robust growth trajectory, with revenue surging by 23.7% annually, outpacing the broader Chinese market's growth rate of 13.7%. This performance is complemented by an impressive forecast of earnings growth at 27.5% per year, which not only exceeds the market average of 24.6% but also highlights the company's potential in leveraging industry advancements for financial gains. Despite challenges in maintaining high non-cash earnings levels and a modest return on equity projected at 11%, Accelink's strategic movements—including recent inclusion in the FTSE All-World Index and proactive shareholder engagements—signal a forward-looking approach that could sustain its upward trajectory amidst dynamic market conditions.

- Get an in-depth perspective on Accelink Technologies CoLtd's performance by reading our health report here.

Gain insights into Accelink Technologies CoLtd's past trends and performance with our Past report.

Shenzhen Everwin Precision Technology (SZSE:300115)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Everwin Precision Technology Co., Ltd. operates in the precision manufacturing industry, focusing on the production of electronic components and equipment, with a market cap of CN¥21.49 billion.

Operations: Shenzhen Everwin Precision Technology generates revenue primarily through the manufacturing of electronic components and equipment. The company operates within the precision manufacturing sector, focusing on delivering high-quality products to meet industry standards.

Shenzhen Everwin Precision Technology has shown remarkable growth, with its revenue increasing by 15.8% per year, outstripping the broader Chinese market's expansion of 13.7%. This surge is bolstered by an earnings forecast poised for a 25% annual increase, surpassing the market's expectation of 24.6%. Notably, R&D investments have been pivotal; the company reported significant R&D expenses aimed at fostering innovation and maintaining competitive edge in the precision technology sector. Recent financials reveal a transformative rebound with net income soaring to CNY 594.2 million from just CNY 1.55 million a year prior, underscoring operational efficiency and strategic foresight in navigating market dynamics.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. operates as a leading IT services provider, specializing in digital transformation solutions, with a market cap of CN¥61.79 billion.

Operations: iSoftStone Information Technology (Group) Co., Ltd. focuses on providing comprehensive IT services, emphasizing digital transformation solutions.

iSoftStone Information Technology (Group) Co., Ltd. has demonstrated a robust expansion in sales, nearly doubling from CNY 12.83 billion to CNY 22.21 billion year-over-year, reflecting a dynamic revenue growth of 73%. However, this growth contrasts starkly with its net income trajectory, which plummeted from CNY 352.31 million to just CNY 75.94 million in the same period, signaling challenges in profitability despite rising sales volumes. The company's commitment to innovation is evident from its R&D spending trends; however, specific figures were not disclosed in the recent earnings report which could provide deeper insights into their strategic focus areas and potential for future technological advancements or market competitiveness.

- Navigate through the intricacies of iSoftStone Information Technology (Group) with our comprehensive health report here.

Learn about iSoftStone Information Technology (Group)'s historical performance.

Where To Now?

- Discover the full array of 1280 High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iSoftStone Information Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301236

iSoftStone Information Technology (Group)

iSoftStone Information Technology (Group) Co., Ltd.

Excellent balance sheet with reasonable growth potential.