- China

- /

- Real Estate

- /

- SZSE:000620

Unveiling Undiscovered Gems In October 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, small-cap stocks have faced particular challenges, with indices like the Russell 2000 showing notable declines. In this environment, identifying undiscovered gems becomes crucial for investors seeking opportunities that might not be immediately apparent in a landscape dominated by large-cap resilience and tech-driven gains. A good stock in today's market is one that demonstrates resilience amidst macroeconomic pressures and possesses strong fundamentals that can weather shifts in interest rates and economic sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 21.55% | 10.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 9.68% | 28.34% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Can-One Berhad | 88.80% | 9.35% | 23.83% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sanjiang Shopping ClubLtd (SHSE:601116)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sanjiang Shopping Club Co., Ltd operates a chain of food supermarkets in Zhejiang province, China, with a market cap of CN¥5.80 billion.

Operations: Sanjiang Shopping Club Co., Ltd generates revenue primarily through its chain of food supermarkets in Zhejiang, China. The company's financial performance is influenced by its cost structure, which impacts the net profit margin.

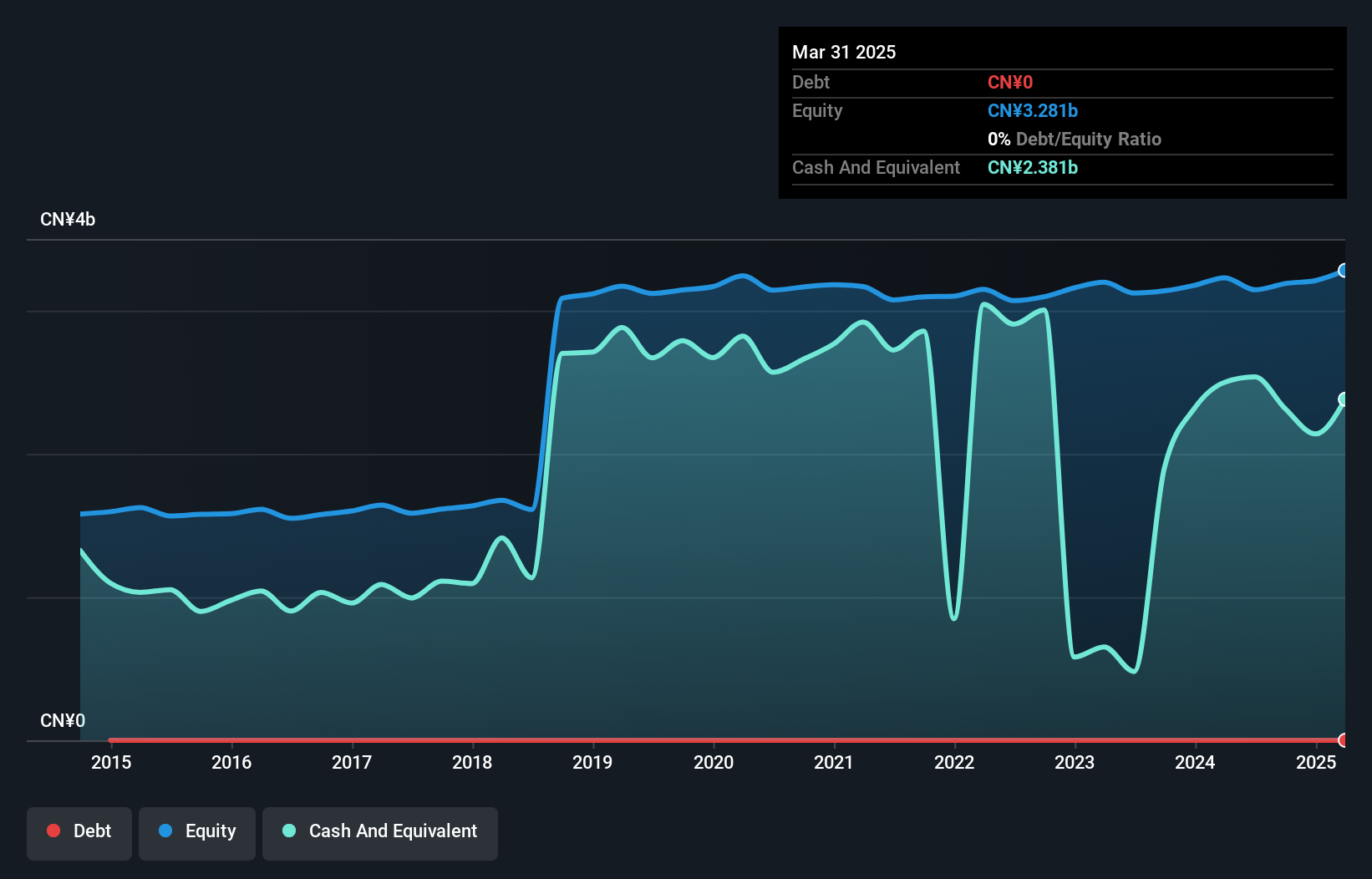

Sanjiang Shopping Club, with its modest market size, has shown stable financial performance. Over the past five years, earnings have grown 1.2% annually, indicating a steady upward trajectory. The company's net income for the nine months ending September 2024 was CNY 121.06 million, up from CNY 104.52 million the previous year, reflecting its profitability despite industry challenges. Earnings per share increased to CNY 0.221 from CNY 0.1908 a year ago, showcasing improved shareholder returns. Although debt levels have risen slightly to a debt-to-equity ratio of 2.3%, interest coverage remains strong due to high-quality earnings and positive free cash flow.

Henan Thinker Automatic EquipmentLtd (SHSE:603508)

Simply Wall St Value Rating: ★★★★★☆

Overview: Henan Thinker Automatic Equipment Co., Ltd. specializes in the development and manufacturing of automated machinery and equipment, with a market capitalization of CN¥8.99 billion.

Operations: Henan Thinker Automatic Equipment Co., Ltd. generates revenue primarily from the sale of automated machinery and equipment. The company's financial performance includes a focus on managing costs effectively to support its operations.

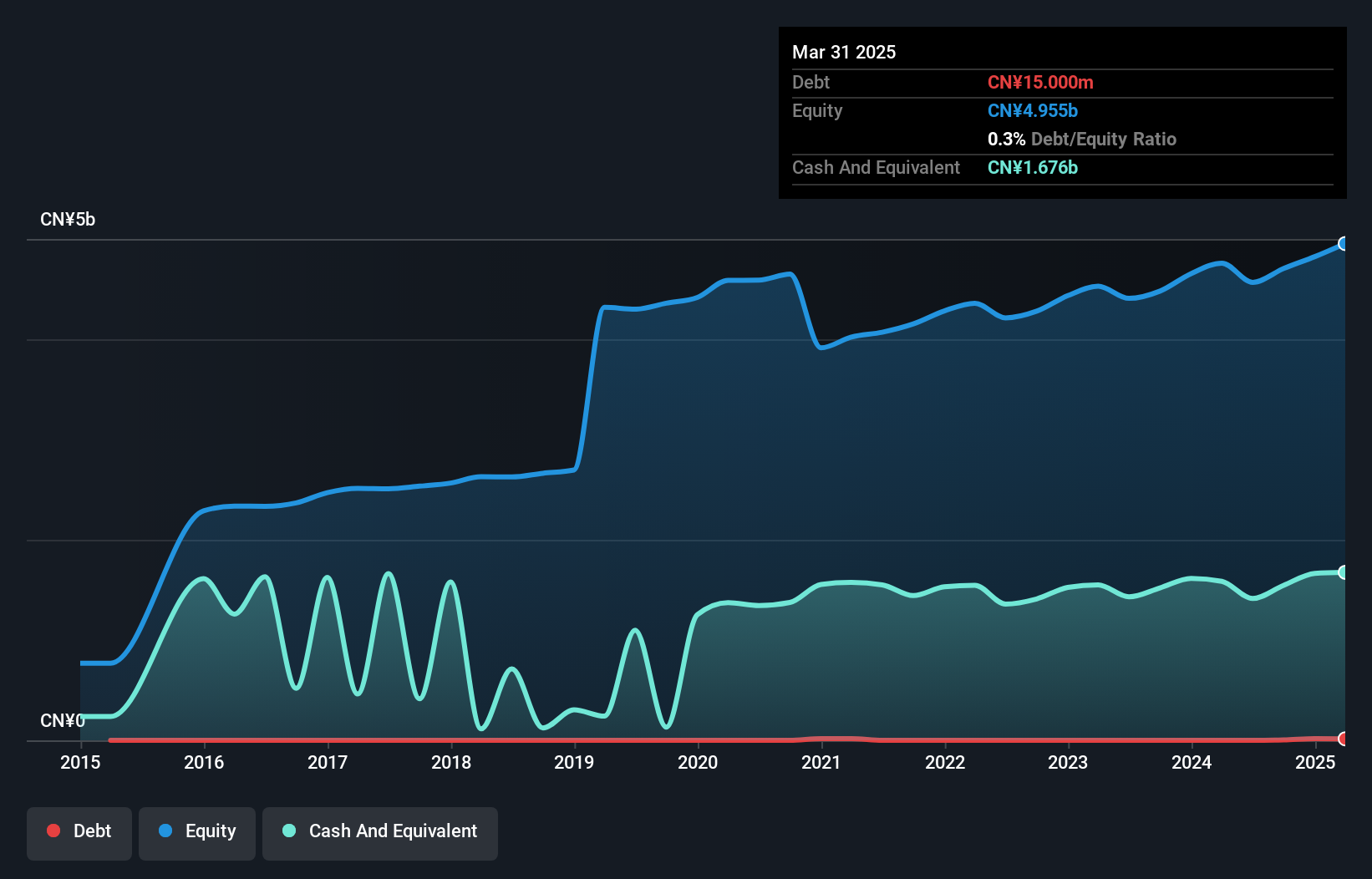

Henan Thinker Automatic Equipment Ltd. showcases a promising profile with its earnings growth of 24.8% over the past year, outpacing the Machinery industry's -3.9%. The company reported sales of CNY 905.78 million for the nine months ending September 2024, up from CNY 731.47 million in the previous year, while net income rose to CNY 327.69 million from CNY 244.59 million a year ago, indicating solid financial performance and high-quality earnings. With a debt-to-equity ratio now at just 0.07%, it suggests prudent financial management alongside a price-to-earnings ratio of 19x, below the CN market average of around 34x, hinting at potential undervaluation in this niche player within its sector.

Macrolink Culturaltainment Development (SZSE:000620)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Macrolink Culturaltainment Development Co., Ltd. operates in the cultural and entertainment sectors, with a market capitalization of CN¥9.98 billion.

Operations: Macrolink Culturaltainment Development generates revenue primarily from its activities in the cultural and entertainment sectors. The company's financial performance is influenced by its ability to manage costs effectively, impacting its net profit margin.

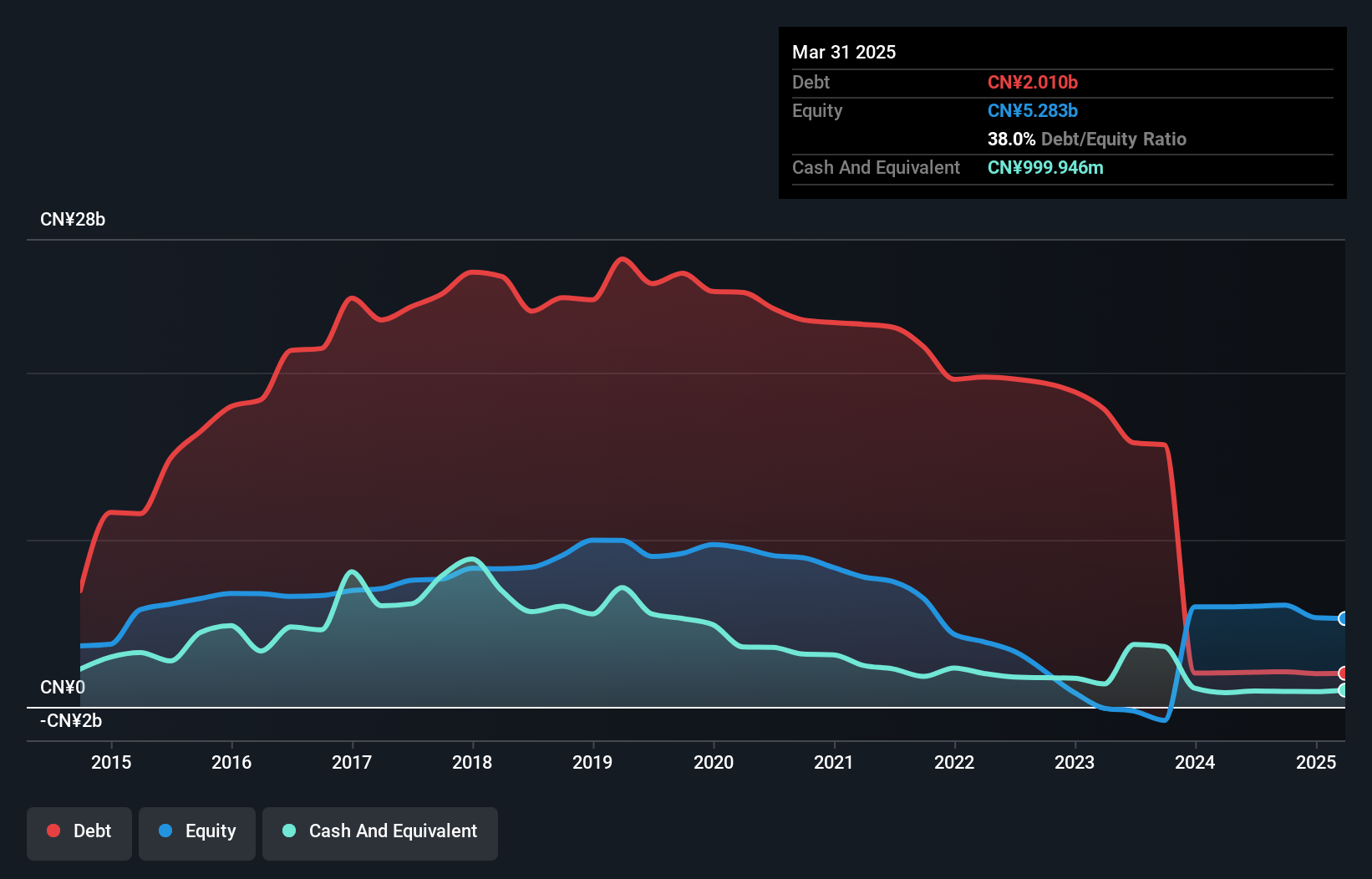

Macrolink Culturaltainment Development, with its recent inclusion in the S&P Global BMI Index, showcases a promising yet challenging profile. The company's net debt to equity ratio stands at a satisfactory 18.6%, having significantly improved from 281.2% over five years, indicating prudent financial management. Despite becoming profitable this year and boasting high-quality past earnings, shareholders faced substantial dilution recently. Its price-to-earnings ratio of 6.6x suggests potential undervaluation compared to the broader CN market's 34.3x average, offering an intriguing opportunity for investors seeking value amidst industry challenges like the Real Estate sector's -37.5% growth rate last year.

Summing It All Up

- Investigate our full lineup of 4732 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winnovation Culturaltainment Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000620

Winnovation Culturaltainment Development

Engages in the development and sale of real estate properties in China.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives