- China

- /

- Auto Components

- /

- SHSE:600178

Giant Biogene Holding Among 3 Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate the implications of rising U.S. Treasury yields and tepid economic growth, investors are increasingly focused on identifying stocks that may be undervalued relative to their intrinsic value. In this environment, where large-cap and growth stocks have shown resilience despite broader market pressures, finding companies trading below their true worth can present compelling opportunities for long-term investment strategies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| J.K. Cement (BSE:532644) | ₹4348.90 | ₹8670.14 | 49.8% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥96.08 | CN¥192.33 | 50% |

| Lindab International (OM:LIAB) | SEK227.40 | SEK453.69 | 49.9% |

| California Resources (NYSE:CRC) | US$52.09 | US$104.09 | 50% |

| Super Group (JSE:SPG) | ZAR23.21 | ZAR46.16 | 49.7% |

| WEX (NYSE:WEX) | US$173.16 | US$346.09 | 50% |

| Foxtons Group (LSE:FOXT) | £0.594 | £1.19 | 49.9% |

| Energy One (ASX:EOL) | A$5.60 | A$11.03 | 49.2% |

| Mercari (TSE:4385) | ¥2131.50 | ¥4173.82 | 48.9% |

| Sinch (OM:SINCH) | SEK31.33 | SEK62.49 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

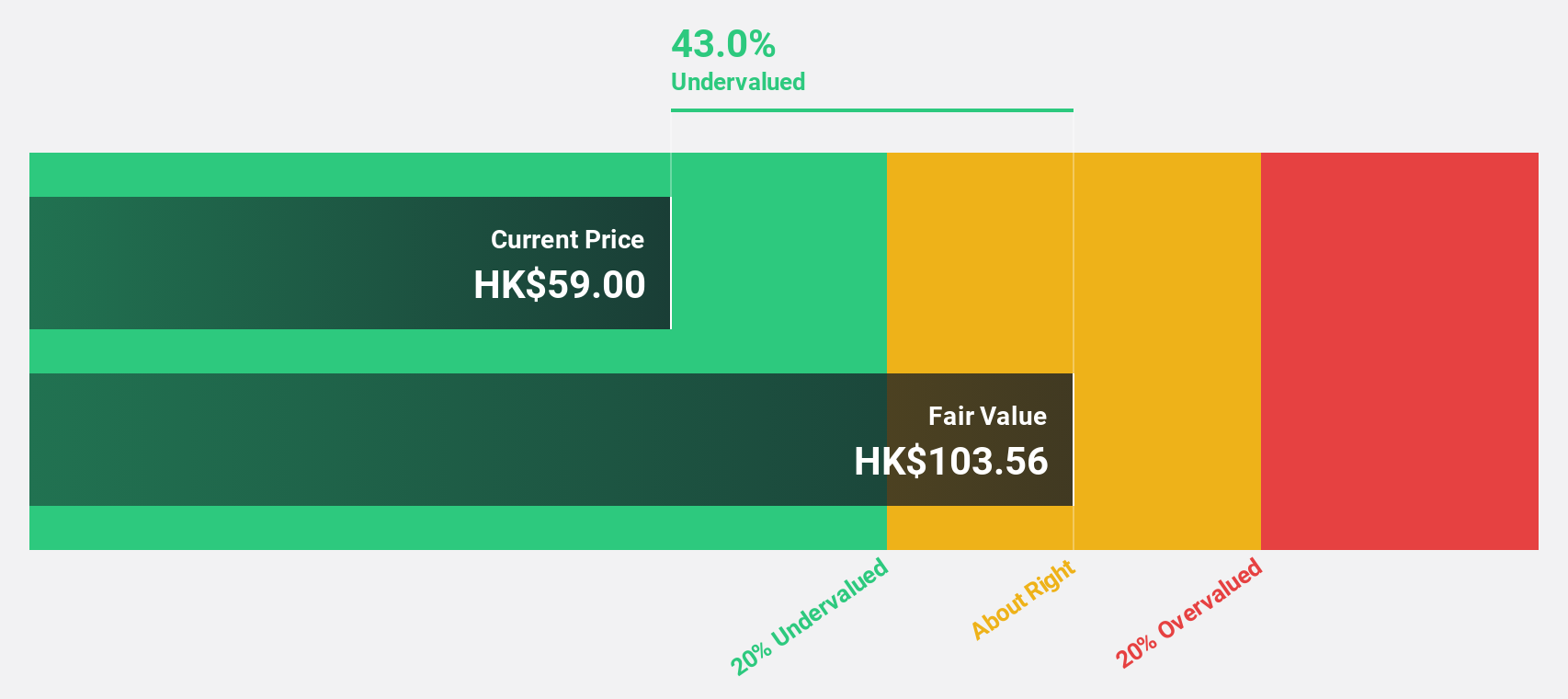

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company involved in the research, development, manufacture, and sale of bioactive material-based beauty and health products in China, with a market cap of HK$54.75 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥4.46 billion.

Estimated Discount To Fair Value: 44.9%

Giant Biogene Holding is trading at HK$54.25, significantly below its estimated fair value of HK$98.46, making it highly undervalued based on discounted cash flow analysis. The company reported strong half-year earnings with sales of CNY 2.54 billion and net income of CNY 983.16 million, reflecting substantial growth from the previous year. Despite past shareholder dilution, future prospects are promising with expected annual earnings growth of 23.3%, outpacing the Hong Kong market's average growth rate.

- In light of our recent growth report, it seems possible that Giant Biogene Holding's financial performance will exceed current levels.

- Get an in-depth perspective on Giant Biogene Holding's balance sheet by reading our health report here.

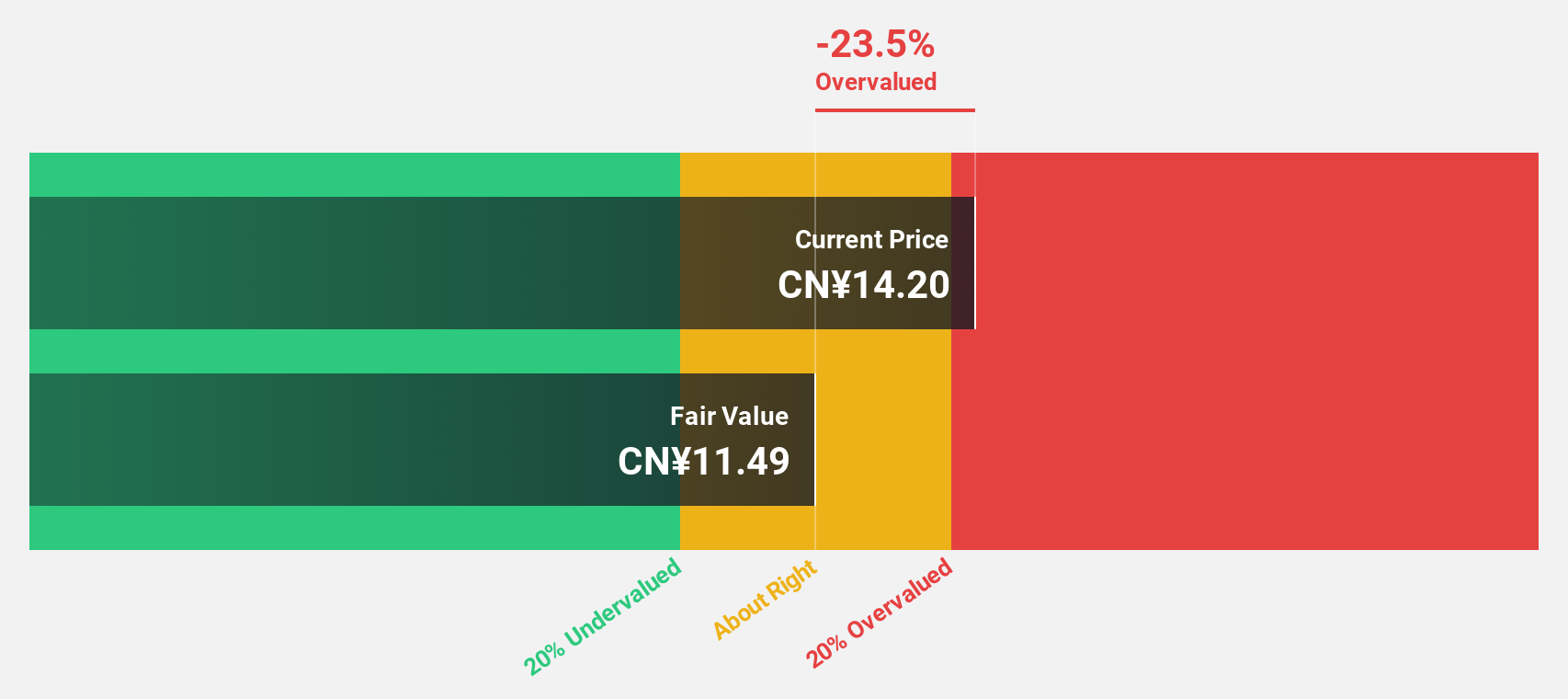

Harbin Dongan Auto EngineLtd (SHSE:600178)

Overview: Harbin Dongan Auto Engine Co., Ltd. produces and markets automobile products and has a market cap of CN¥6.03 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment data for Harbin Dongan Auto Engine Co., Ltd. If you can provide the missing details, I can help summarize them into one sentence.

Estimated Discount To Fair Value: 15.4%

Harbin Dongan Auto Engine Ltd. is trading at CN¥13.95, below its estimated fair value of CN¥16.49, indicating it is undervalued based on cash flows. Despite reporting a net loss of CNY 1.6 million for the nine months ending September 2024, the company is forecasted to achieve profitability within three years and has an expected revenue growth rate of 23.8% annually, surpassing the Chinese market's average growth rate.

- The analysis detailed in our Harbin Dongan Auto EngineLtd growth report hints at robust future financial performance.

- Click here to discover the nuances of Harbin Dongan Auto EngineLtd with our detailed financial health report.

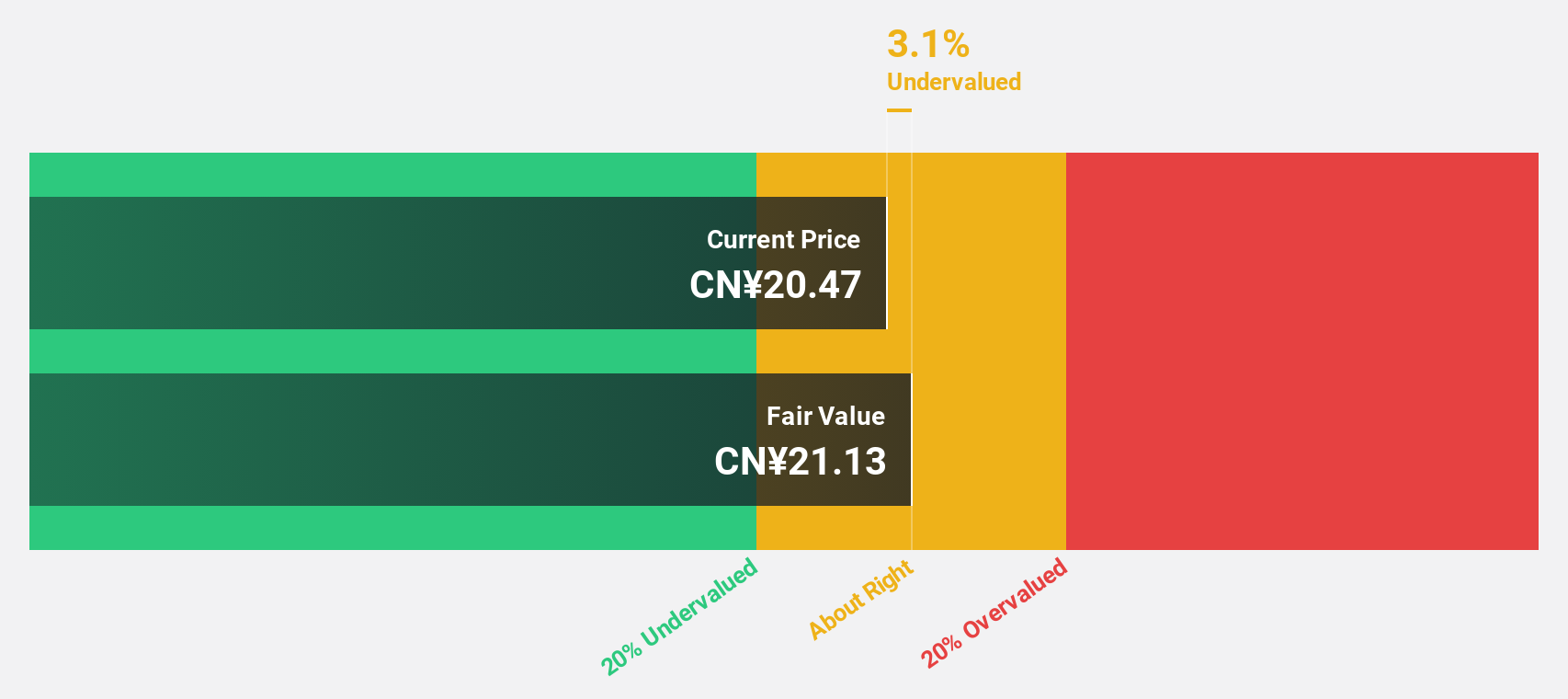

Shenzhen Everwin Precision Technology (SZSE:300115)

Overview: Shenzhen Everwin Precision Technology Co., Ltd. operates in the precision manufacturing sector and has a market cap of CN¥21.49 billion.

Operations: Shenzhen Everwin Precision Technology Co., Ltd. generates its revenue from various segments, contributing to its operations in the precision manufacturing sector.

Estimated Discount To Fair Value: 6.3%

Shenzhen Everwin Precision Technology's stock is trading at CN¥17.92, slightly below its estimated fair value of CN¥19.13, suggesting it could be undervalued based on cash flows. The company reported significant earnings growth for the nine months ending September 2024, with net income rising to CNY 594.2 million from CNY 1.55 million a year ago. However, high debt levels and recent shareholder dilution may pose concerns despite expected revenue growth outpacing the Chinese market average.

- The growth report we've compiled suggests that Shenzhen Everwin Precision Technology's future prospects could be on the up.

- Dive into the specifics of Shenzhen Everwin Precision Technology here with our thorough financial health report.

Summing It All Up

- Reveal the 951 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harbin Dongan Auto EngineLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600178

High growth potential with adequate balance sheet.

Market Insights

Community Narratives