- China

- /

- Electronic Equipment and Components

- /

- SZSE:300115

Exploring High Growth Tech Stocks Including Accelink Technologies CoLtd And 2 Others

Reviewed by Simply Wall St

In recent weeks, global markets have faced a mix of geopolitical tensions and economic uncertainties, with U.S. stocks experiencing fluctuations amid concerns over consumer spending and tariff implications. Despite these challenges, the technology sector remains a focal point for investors seeking high-growth opportunities, as companies like Accelink Technologies CoLtd continue to innovate and adapt in an evolving market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1191 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★★☆

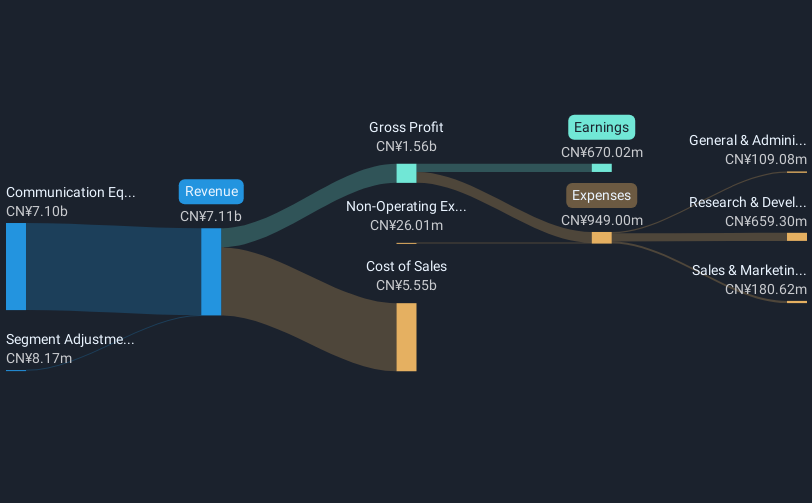

Overview: Accelink Technologies Co., Ltd. focuses on the research, development, manufacturing, sales, and technical services of optoelectronic components and systems, primarily in China, with a market cap of CN¥45.65 billion.

Operations: Accelink Technologies Co., Ltd. generates revenue primarily from the communication equipment manufacturing segment, which accounts for CN¥7.10 billion. The company specializes in optoelectronic chips, devices, modules, and subsystem products within China.

Accelink Technologies CoLtd stands out in the high-growth tech sector, with its earnings and revenue projected to expand significantly. The company's revenue is expected to increase by 25.1% annually, outpacing the CN market's 13.4%, while its earnings growth of 29.7% per year also surpasses the market average of 25.3%. This robust financial performance is supported by substantial R&D investments, ensuring continual innovation and competitive edge in optical communication products. Despite a highly volatile share price recently, Accelink's focus on enhancing non-cash earnings and a forecasted annual profit growth rate that exceeds industry standards underscore its potential in a rapidly evolving tech landscape.

- Click here to discover the nuances of Accelink Technologies CoLtd with our detailed analytical health report.

Understand Accelink Technologies CoLtd's track record by examining our Past report.

Shenzhen Everwin Precision Technology (SZSE:300115)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Everwin Precision Technology Co., Ltd. specializes in precision manufacturing and technology solutions, with a market capitalization of CN¥37.53 billion.

Operations: The company generates revenue through precision manufacturing and technology solutions. It focuses on delivering specialized products and services, contributing to its financial performance.

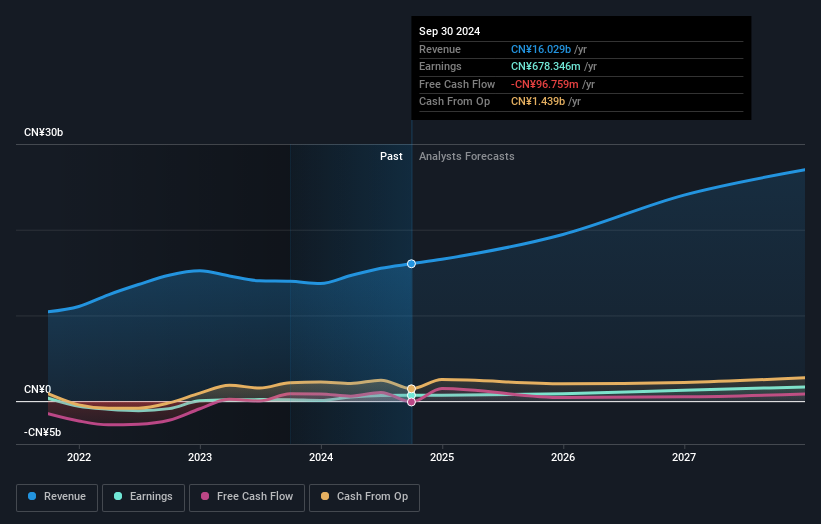

Shenzhen Everwin Precision Technology demonstrates robust potential in the high-growth tech landscape, with earnings expected to climb by 26.1% annually, surpassing the broader Chinese market's growth of 25.3%. This performance is bolstered by a significant surge in past year earnings, which rocketed by 334.4%, outpacing the electronic industry's modest 1.6% increase. Despite grappling with high debt levels and a volatile share price recently, the company's strategic R&D investments and upcoming special shareholders meeting suggest proactive governance adjustments that may further secure its competitive stance in technology innovation.

Xiamen Hongxin Electronics Technology Group (SZSE:300657)

Simply Wall St Growth Rating: ★★★★★★

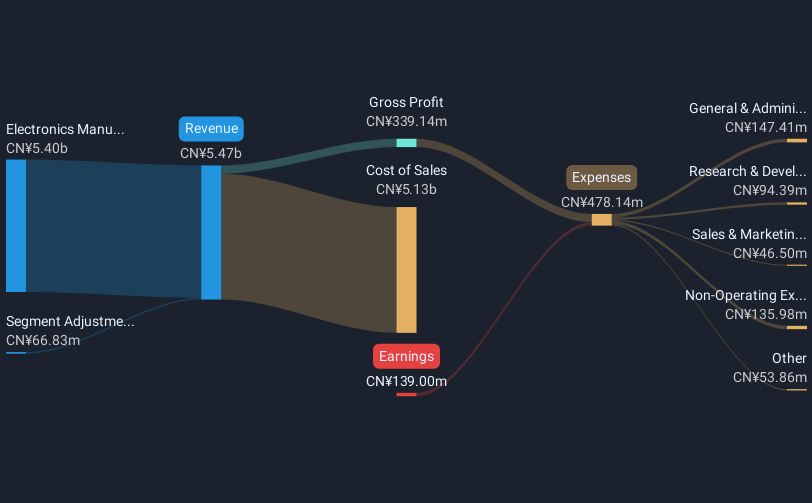

Overview: Xiamen Hongxin Electronics Technology Group Inc. operates in the electronics manufacturing industry, focusing on producing various electronic components and products, with a market cap of approximately CN¥19.48 billion.

Operations: The company generates revenue primarily from its electronics manufacturing segment, amounting to approximately CN¥5.40 billion.

Xiamen Hongxin Electronics Technology Group is navigating the high-growth tech sector with a projected annual revenue increase of 31.1%, significantly outpacing the Chinese market's average growth rate of 13.4%. Despite current unprofitability, the company is expected to achieve profitability within three years, showcasing a potential annual profit surge of 99.43%. Recent strategic changes, including amendments to its bylaws and capital adjustments approved in late 2024, underscore its proactive approach to governance and market adaptation. These developments could enhance Xiamen Hongxin's competitive edge in technology innovation while addressing past challenges like its highly volatile share price and negative free cash flow.

Summing It All Up

- Click here to access our complete index of 1191 High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shenzhen Everwin Precision Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300115

Shenzhen Everwin Precision Technology

Shenzhen Everwin Precision Technology Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives