- China

- /

- Entertainment

- /

- SZSE:002602

Accelink Technologies CoLtd Leads These 3 High Growth Tech Stocks

Reviewed by Simply Wall St

In a week dominated by tariff news and mixed economic signals, the tech-heavy Nasdaq Composite Index managed to hold its ground better than other major U.S. indexes, reflecting a modest preference for growth stocks over value. As investors navigate these turbulent times marked by geopolitical tensions and monetary policy uncertainties, identifying high-growth tech stocks like Accelink Technologies CoLtd can be appealing due to their potential to innovate and adapt in rapidly changing environments.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Intellego Technologies | 30.26% | 44.76% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★☆☆

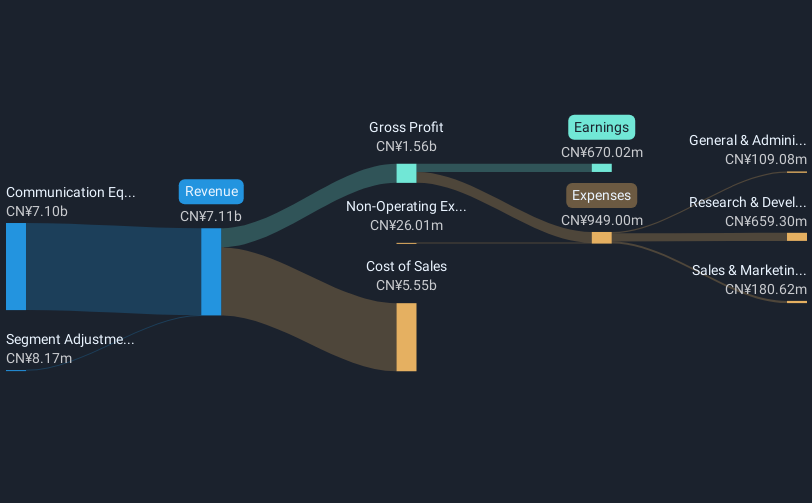

Overview: Accelink Technologies Co., Ltd. focuses on the research, development, manufacturing, sales, and technical services of optoelectronic chips, devices, modules, and subsystem products primarily in China with a market cap of CN¥37.67 billion.

Operations: Accelink Technologies Co., Ltd. generates revenue primarily from the communication equipment manufacturing segment, which accounts for CN¥9.16 billion.

Accelink Technologies CoLtd, a player in the high-tech sector, has demonstrated robust financial performance with significant year-on-year revenue growth of 18.6% and an earnings increase of 23.7%, outpacing the Electronic industry's average of 2.9%. This growth trajectory is supported by strategic R&D investments that align with industry demands for innovative tech solutions. Recent events such as dividend increases and positive earnings calls underscore its financial health and commitment to shareholder value. The company's focus on expanding its technological capabilities while maintaining strong market adaptability positions it well for sustained growth, despite a forecasted lower Return on Equity (12.9%) in three years compared to current levels.

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Growth Rating: ★★★★★☆

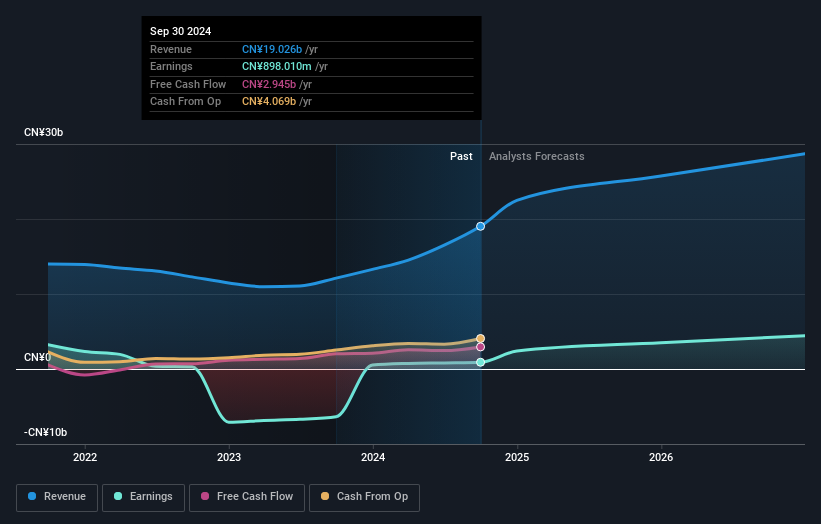

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and cloud data sectors both in China and internationally, with a market capitalization of CN¥93.91 billion.

Operations: Zhejiang Century Huatong Group Co., Ltd generates revenue through its diverse operations in auto parts, Internet games, and cloud data services. The company serves both domestic and international markets.

Zhejiang Century Huatong Group, amidst a dynamic tech landscape, has recently announced a significant share repurchase program, signaling strong confidence in its financial stability and future prospects. This move follows a robust performance with first-quarter sales doubling to CNY 8.14 billion from CNY 4.26 billion year-over-year and net income soaring to CNY 1.35 billion from CNY 651.51 million. The firm's commitment to innovation is evident in its R&D investments which are pivotal in maintaining its competitive edge in the entertainment industry where it has outpaced average industry earnings growth by an impressive margin of over 150%.

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

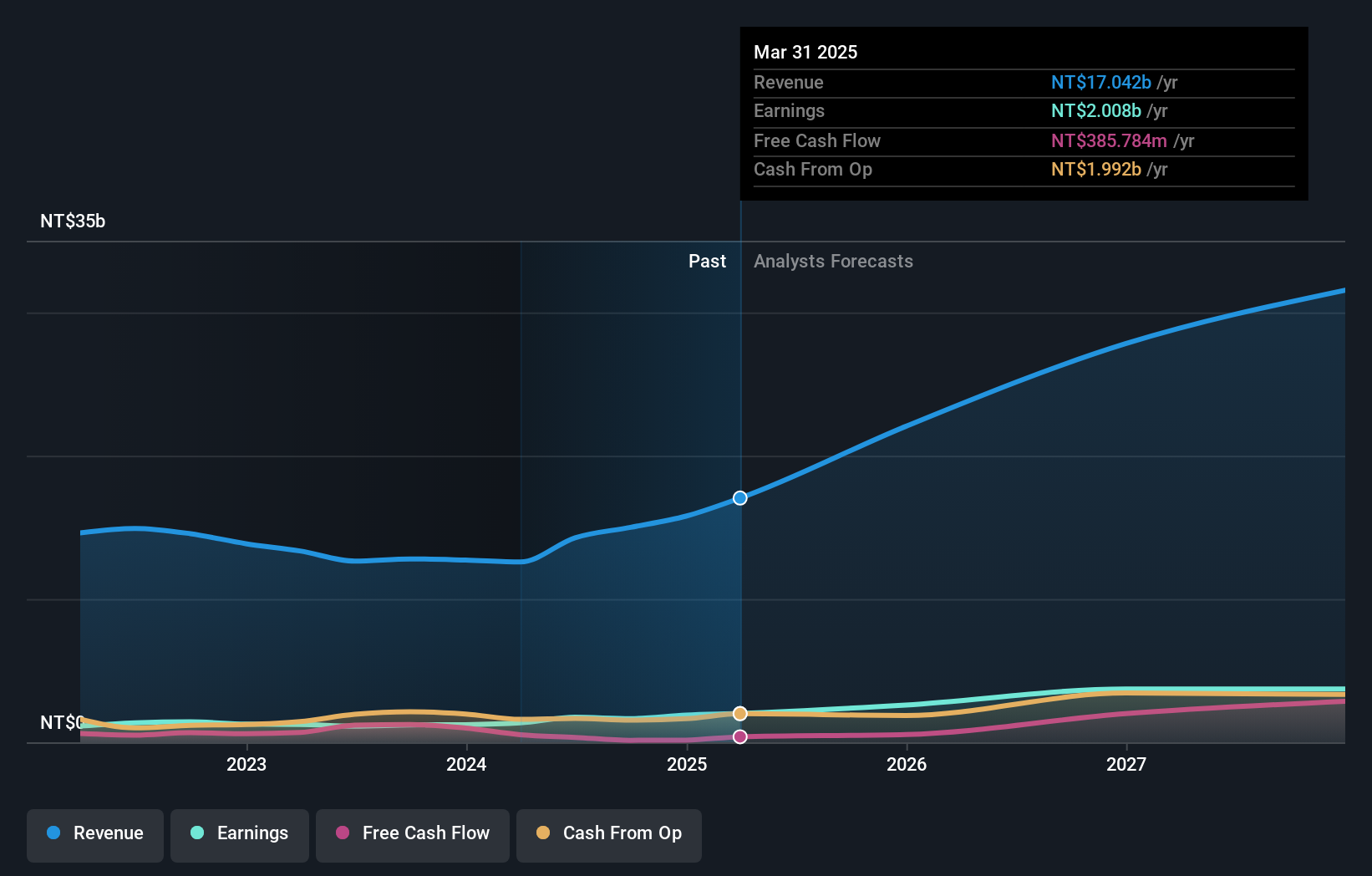

Overview: Auras Technology Co., Ltd. is involved in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across various international markets, with a market cap of NT$57.78 billion.

Operations: Auras Technology focuses on producing and selling electronic components and computer cooling modules across multiple international markets, with a significant revenue contribution from its Electronic Components & Parts segment, amounting to NT$17.04 billion.

Auras Technology's recent performance underscores its robust position in the high-growth tech sector, with a notable 22.2% annual revenue growth and an impressive 24.9% forecast in earnings growth per year. The company's commitment to innovation is reflected in its R&D spending which has consistently outpaced many of its peers, positioning it well for future technological advancements. Recent events, including significant conference presentations and amendments to company bylaws, highlight Auras’s proactive approach in shaping its strategic direction amidst evolving industry dynamics. This adaptability, combined with strong financial health as evidenced by a first-quarter net income rise to TWD 511.13 million from TWD 395.61 million year-over-year, suggests Auras is well-equipped to maintain its upward trajectory in a competitive landscape.

- Dive into the specifics of Auras Technology here with our thorough health report.

Understand Auras Technology's track record by examining our Past report.

Summing It All Up

- Gain an insight into the universe of 743 Global High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Century Huatong GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002602

Zhejiang Century Huatong GroupLtd

Engages in the auto parts, Internet games, and cloud data businesses in China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives