- China

- /

- Metals and Mining

- /

- SZSE:000795

Undiscovered Gems And 2 More Small Caps With Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, rising U.S. Treasury yields have put pressure on stocks, with small-cap equities feeling the brunt more than their large-cap counterparts. This environment has created unique opportunities for investors to explore lesser-known small-cap stocks that may offer strong potential due to their ability to adapt and thrive despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.07% | 32.89% | -17.68% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Zhewen Interactive Group (SHSE:600986)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhewen Interactive Group Co., Ltd. offers intelligent marketing solutions in China and has a market cap of CN¥7.71 billion.

Operations: The group generates revenue primarily through its intelligent marketing solutions in China. Key financial data such as gross profit margin or net profit margin trends are not provided, limiting insights into profitability dynamics.

Zhewen Interactive Group, a smaller player in the media industry, has shown impressive earnings growth of 233.5% over the past year, outpacing the industry's 0.3%. Its price-to-earnings ratio stands at 35.1x, which is attractive compared to the industry average of 46x. The company's net income for the nine months ended September 2024 was CN¥157.64 million, up from CN¥114.51 million a year earlier, despite sales dropping to CN¥5.60 billion from CN¥8.24 billion last year due to large one-off gains impacting results by CN¥175 million and debt levels rising over five years from 12.5% to 23.4%.

- Click here to discover the nuances of Zhewen Interactive Group with our detailed analytical health report.

Assess Zhewen Interactive Group's past performance with our detailed historical performance reports.

Innuovo Technology (SZSE:000795)

Simply Wall St Value Rating: ★★★★★☆

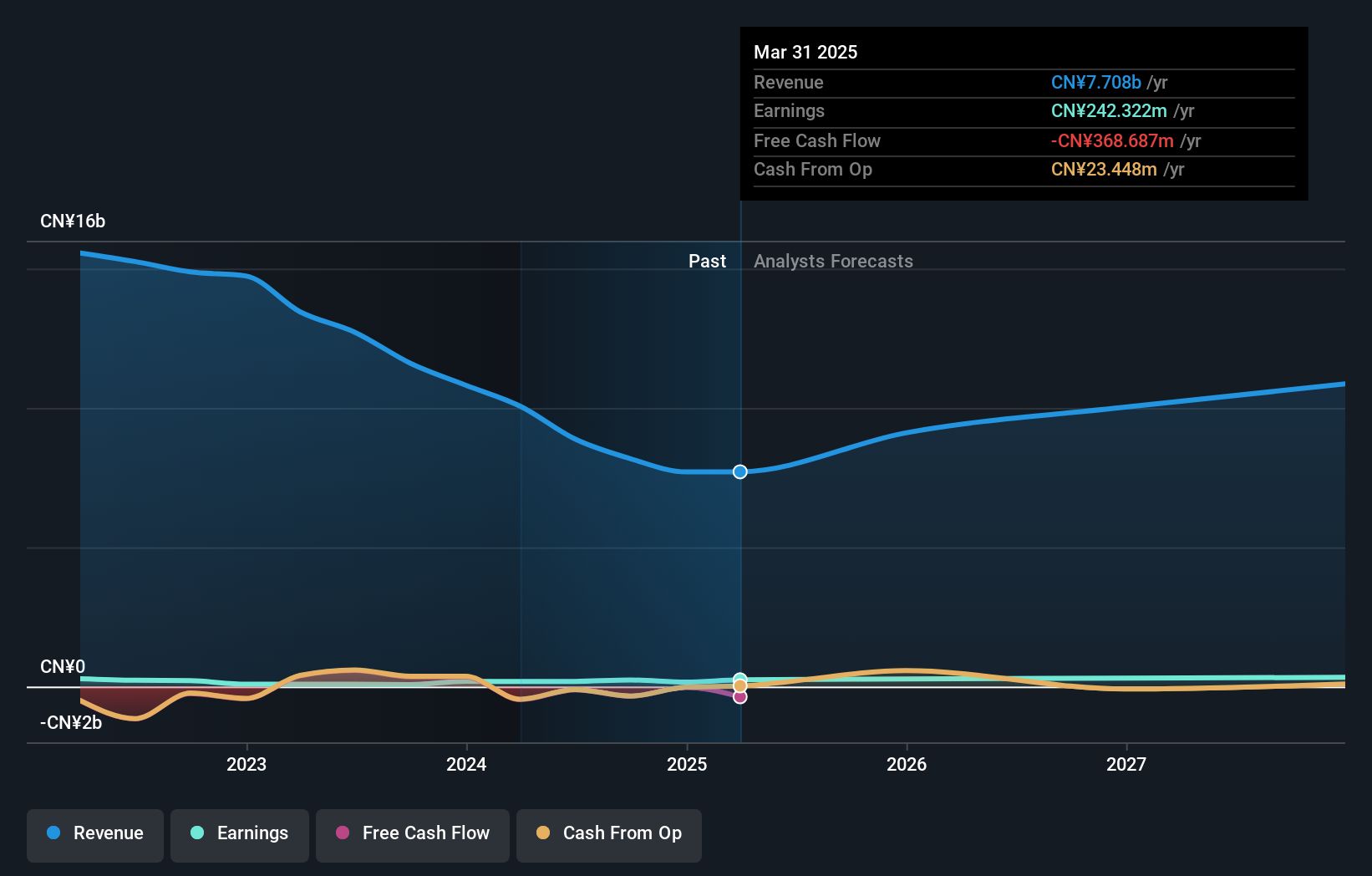

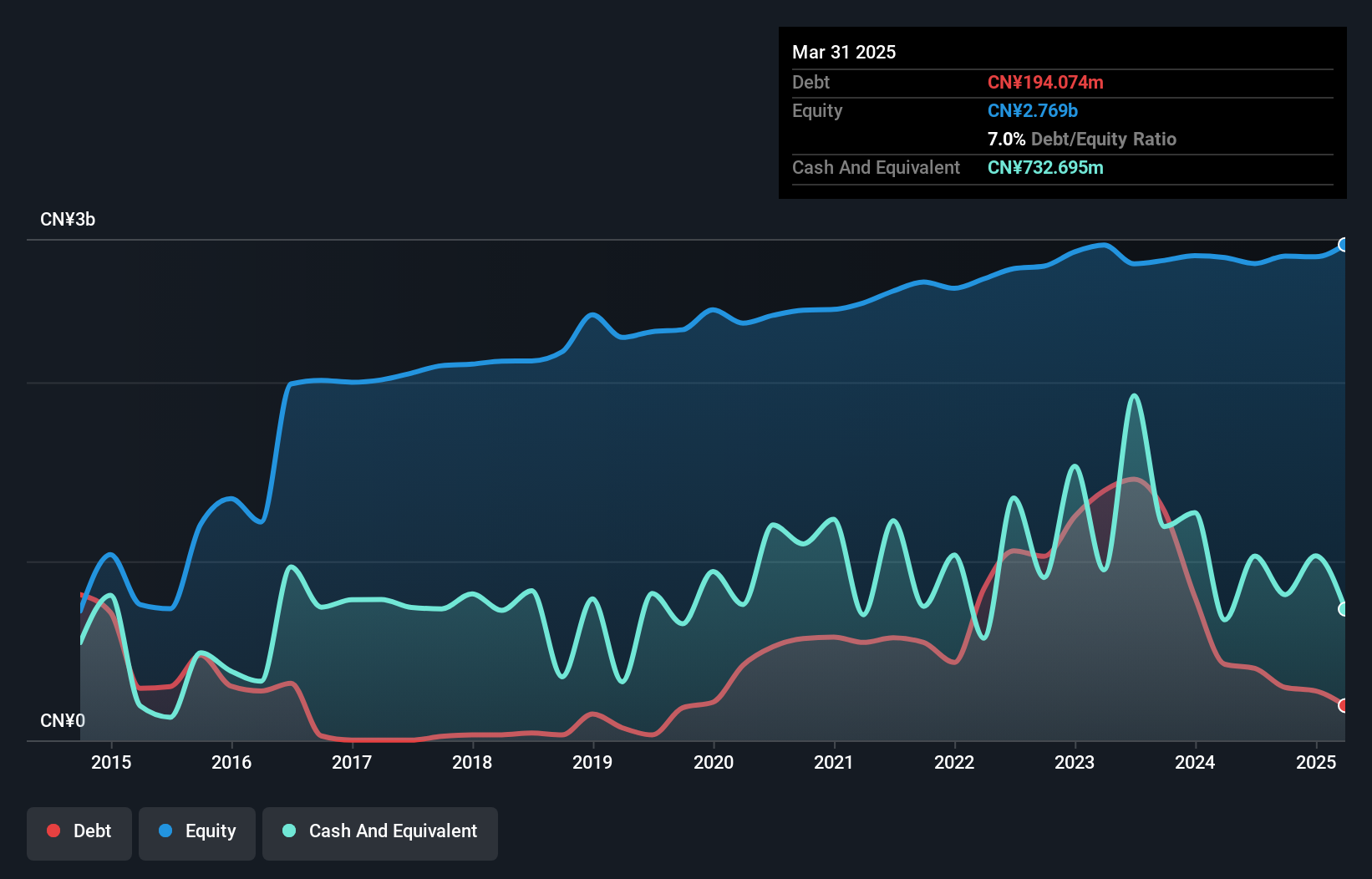

Overview: Innuovo Technology Co., Ltd. and its subsidiaries focus on the R&D, production, and sale of rare earth permanent magnet materials both in China and internationally, with a market cap of CN¥7.59 billion.

Operations: The company generates revenue primarily from the sale of rare earth permanent magnet materials. Its net profit margin shows variability, reflecting changes in cost structures and market conditions.

Innuovo Technology, a promising player in its sector, has seen significant earnings growth of 62.5% over the past year, outpacing the broader Metals and Mining industry. The company reported net income of CNY 206.49 million for the nine months ended September 2024, up from CNY 82.29 million a year earlier, reflecting strong financial performance with basic earnings per share rising to CNY 0.1863 from CNY 0.0736 last year. Notably, Innuovo repurchased over four million shares in recent months for about CNY 22.82 million as part of its ongoing buyback program aimed at enhancing shareholder value.

- Click to explore a detailed breakdown of our findings in Innuovo Technology's health report.

Examine Innuovo Technology's past performance report to understand how it has performed in the past.

CASTECH (SZSE:002222)

Simply Wall St Value Rating: ★★★★★☆

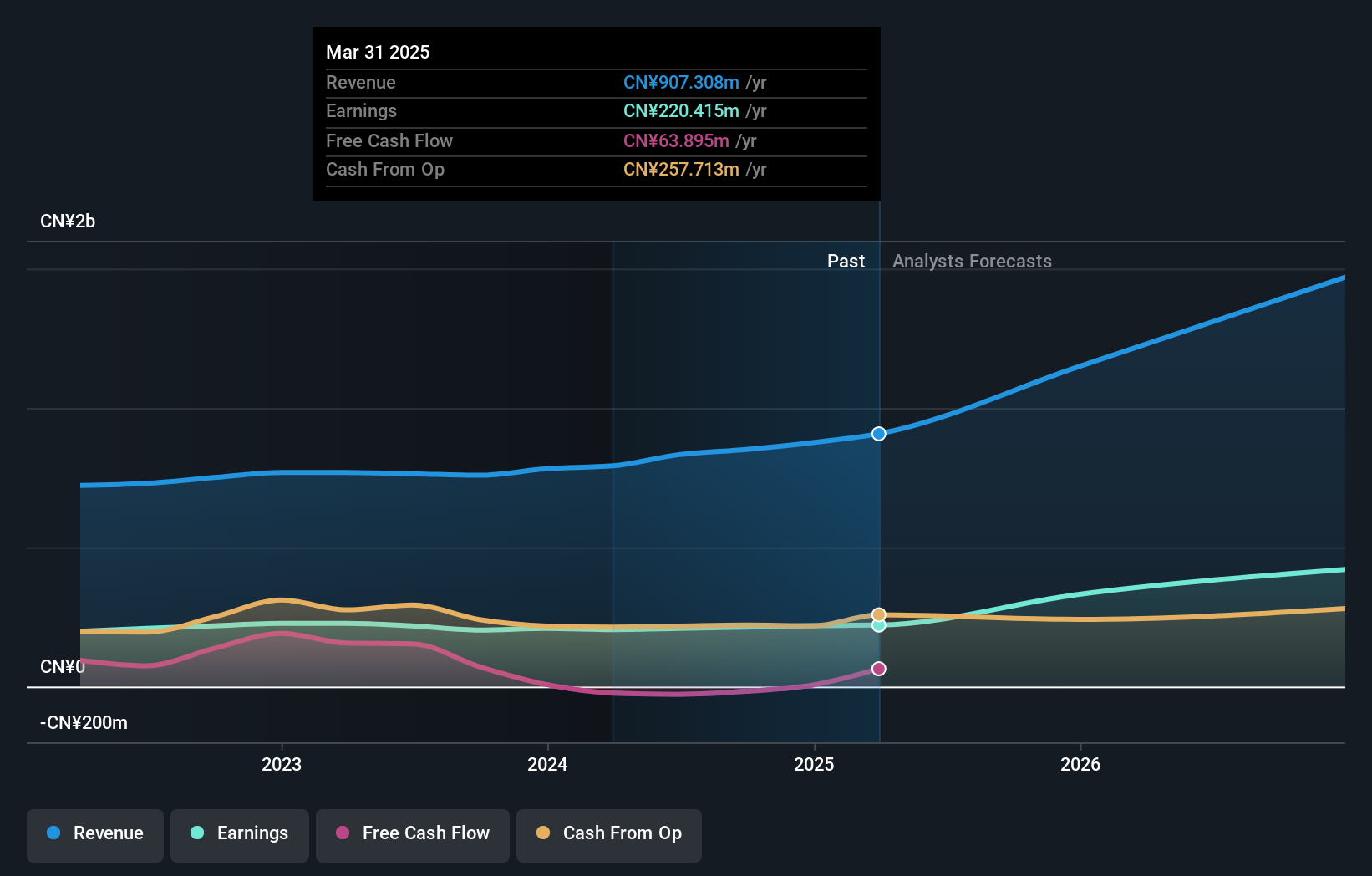

Overview: CASTECH Inc. focuses on the research, development, production, and sale of crystal components, precision optical components, and laser devices primarily in China with a market cap of CN¥13.28 billion.

Operations: CASTECH generates revenue through the sale of crystal components, precision optical components, and laser devices. The company's gross profit margin shows notable variability across reporting periods.

CASTECH, a smaller player in the electronics industry, has shown promising growth with earnings rising by 5.1% over the past year, surpassing the industry's 0.5%. The company's debt to equity ratio increased slightly from 0% to 0.6% over five years, yet it still earns more interest than it pays, indicating healthy financial management. Recently reported sales for nine months reached CNY 665 million compared to CNY 596 million last year, with net income at CNY 168 million up from CNY 164 million. Basic earnings per share improved marginally to CNY 0.3572 from CNY 0.348 previously.

- Dive into the specifics of CASTECH here with our thorough health report.

Explore historical data to track CASTECH's performance over time in our Past section.

Make It Happen

- Click through to start exploring the rest of the 4740 Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000795

Innuovo Technology

Engages in the research and development, production, and sale of rare earth permanent magnet materials in China and internationally.

Solid track record with excellent balance sheet.