- China

- /

- Electrical

- /

- SHSE:688408

Spotlighting Ningbo Jifeng Auto Parts And 2 Other High-Insider Growth Stocks

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, investors are keenly observing how these factors influence stock performance across various sectors. In this environment, growth companies with high insider ownership can present intriguing opportunities due to their potential for alignment between management and shareholder interests. Identifying such stocks involves assessing not only their growth prospects but also the strategic involvement of insiders who may have a vested interest in steering the company towards long-term success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.5% | 24.6% |

Let's explore several standout options from the results in the screener.

Ningbo Jifeng Auto Parts (SHSE:603997)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Jifeng Auto Parts Co., Ltd. manufactures automotive interior parts in China and has a market cap of CN¥15.56 billion.

Operations: The company generates revenue primarily from the production and sale of automotive interior components within China.

Insider Ownership: 25.7%

Revenue Growth Forecast: 17.5% p.a.

Ningbo Jifeng Auto Parts is forecast to grow its revenue by 17.5% annually, outpacing the broader Chinese market. Despite a recent net loss of CNY 531.94 million for the first nine months of 2024, insider ownership remains significant with recent acquisitions by Yu Wanli and Wang Jimin totaling over 16%. The stock trades at a substantial discount to its estimated fair value, though past shareholder dilution may be a concern for potential investors.

- Delve into the full analysis future growth report here for a deeper understanding of Ningbo Jifeng Auto Parts.

- In light of our recent valuation report, it seems possible that Ningbo Jifeng Auto Parts is trading behind its estimated value.

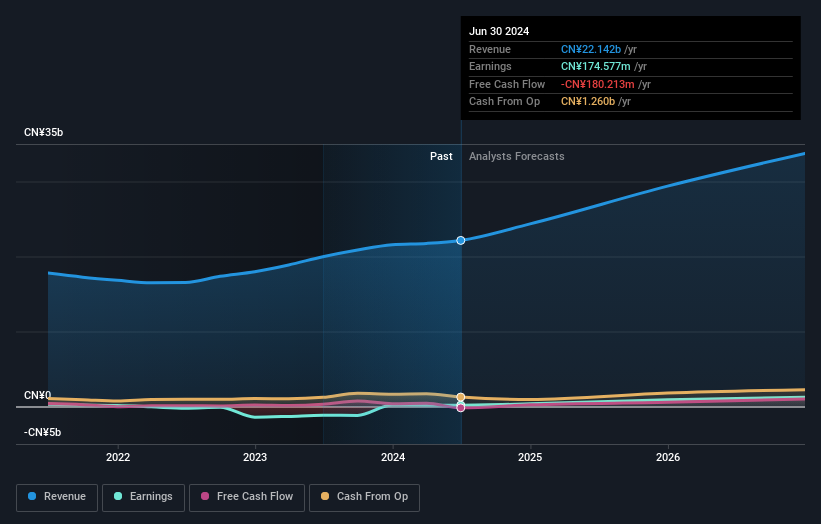

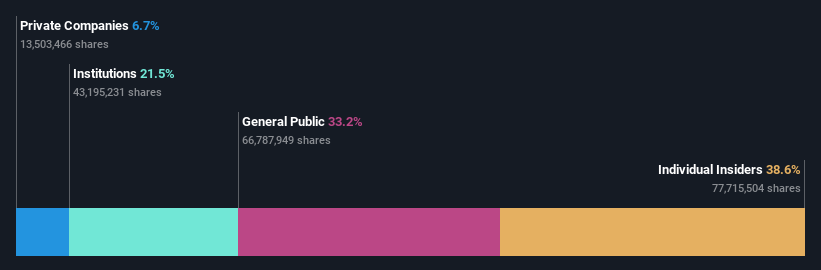

Arctech Solar Holding (SHSE:688408)

Simply Wall St Growth Rating: ★★★★★★

Overview: Arctech Solar Holding Co., Ltd. manufactures and supplies solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects worldwide, with a market cap of approximately CN¥17.23 billion.

Operations: The company's revenue segments include solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for large-scale and commercial solar installations globally.

Insider Ownership: 37.8%

Revenue Growth Forecast: 21.5% p.a.

Arctech Solar Holding's revenue and earnings are forecast to grow significantly, with expected annual increases of 21.5% and 25.3%, respectively, outpacing the broader Chinese market. Recent earnings show a substantial rise in net income to CNY 427.28 million for the first nine months of 2024, reflecting strong operational performance. The stock offers good value with a P/E ratio of 27.9x against the market's 34x, though its dividend coverage is weak due to limited free cash flow support.

- Get an in-depth perspective on Arctech Solar Holding's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Arctech Solar Holding shares in the market.

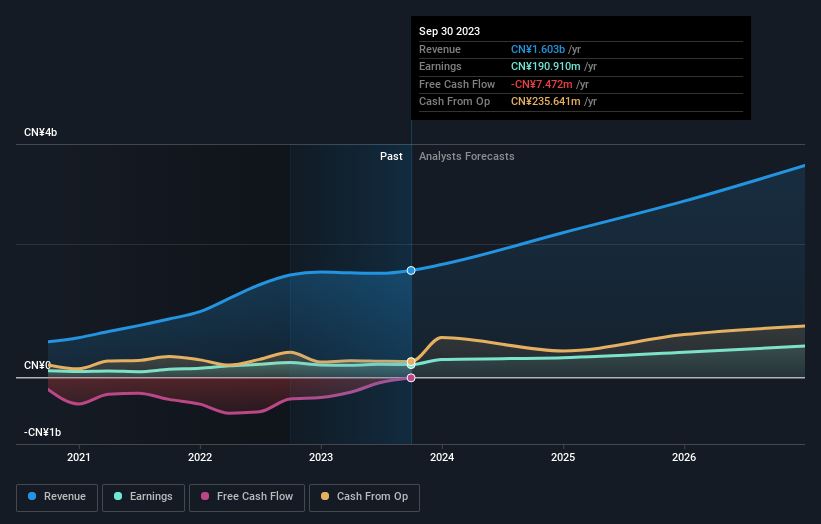

Jiangsu Nata Opto-electronic Material (SZSE:300346)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Nata Opto-electronic Material Co., Ltd. operates in the optoelectronic materials industry and has a market cap of CN¥21.67 billion.

Operations: The company generates revenue primarily from its Semiconductor Materials segment, which amounts to CN¥1.60 billion.

Insider Ownership: 19.1%

Revenue Growth Forecast: 21.4% p.a.

Jiangsu Nata Opto-electronic Material's revenue is forecast to grow at 21.4% annually, surpassing the Chinese market's 13.9% growth rate, though its earnings growth of 24.55% slightly lags behind the market's 25%. Recent earnings show a rise in net income to CNY 265.61 million for the first nine months of 2024, indicating solid performance despite high share price volatility and low expected return on equity (14.3%) in three years.

- Click to explore a detailed breakdown of our findings in Jiangsu Nata Opto-electronic Material's earnings growth report.

- Our valuation report here indicates Jiangsu Nata Opto-electronic Material may be overvalued.

Make It Happen

- Click here to access our complete index of 1523 Fast Growing Companies With High Insider Ownership.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688408

Arctech Solar Holding

Manufactures and supplies solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects worldwide.

Exceptional growth potential with proven track record.