- China

- /

- Construction

- /

- SZSE:002586

Promising Penny Stocks To Consider In October 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, investors are seeking opportunities that balance risk with potential reward. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.71 | MYR122.98M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.43 | CN¥2.15B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.765 | £473.73M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.125 | £806.26M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.36 | THB1.88B | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.12 | £426.67M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Guangdong Shunna Electric (SZSE:000533)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Shunna Electric Co., Ltd. is a company that supplies power transmission and distribution equipment in China, with a market cap of CN¥2.74 billion.

Operations: Guangdong Shunna Electric Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥2.74B

Guangdong Shunna Electric demonstrates a solid financial position with short-term assets of CN¥2.2 billion exceeding both its short and long-term liabilities, indicating strong liquidity. The company's earnings have grown significantly by 43.9% over the past year, surpassing industry averages, while maintaining stable weekly volatility at 6%. Despite a low return on equity of 11.9%, its debt is well-managed with interest payments covered 33.3 times by EBIT and a net debt to equity ratio of just 4.7%. Recent earnings reports show consistent revenue growth, with sales reaching CN¥1,697.27 million for the first nine months of 2024.

- Take a closer look at Guangdong Shunna Electric's potential here in our financial health report.

- Evaluate Guangdong Shunna Electric's historical performance by accessing our past performance report.

Anhui Sinonet & Xinlong Science & Technology (SZSE:002298)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Anhui Sinonet & Xinlong Science & Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥3.57 billion.

Operations: The company's revenue from China is CN¥2.07 billion.

Market Cap: CN¥3.57B

Anhui Sinonet & Xinlong Science & Technology Co., Ltd. faces challenges with declining revenues, reporting CN¥1.35 billion for the first nine months of 2024, down from CN¥1.51 billion the previous year, alongside a net loss increase to CN¥375.95 million. Despite being unprofitable, the company has a robust cash runway exceeding three years due to positive free cash flow growth of 22.7% annually and short-term assets of CN¥3.9 billion covering liabilities effectively. However, management and board experience is limited with average tenures below three years, raising concerns about leadership stability amid financial pressures.

- Dive into the specifics of Anhui Sinonet & Xinlong Science & Technology here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Anhui Sinonet & Xinlong Science & Technology's track record.

Zhejiang Reclaim Construction Group (SZSE:002586)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Reclaim Construction Group Co., Ltd. operates in the construction industry, focusing on infrastructure projects, with a market cap of CN¥2.05 billion.

Operations: The company generates revenue primarily from Building Construction (CN¥2.01 billion) and Design and Technical Services (CN¥173.97 million).

Market Cap: CN¥2.05B

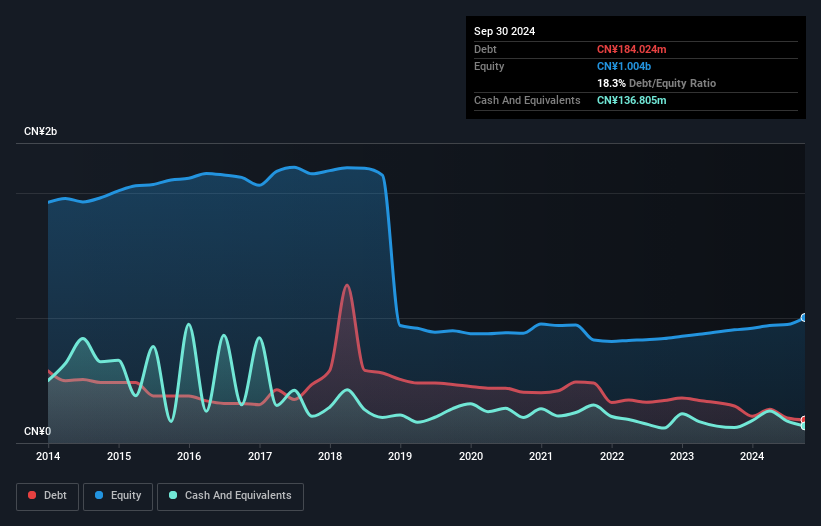

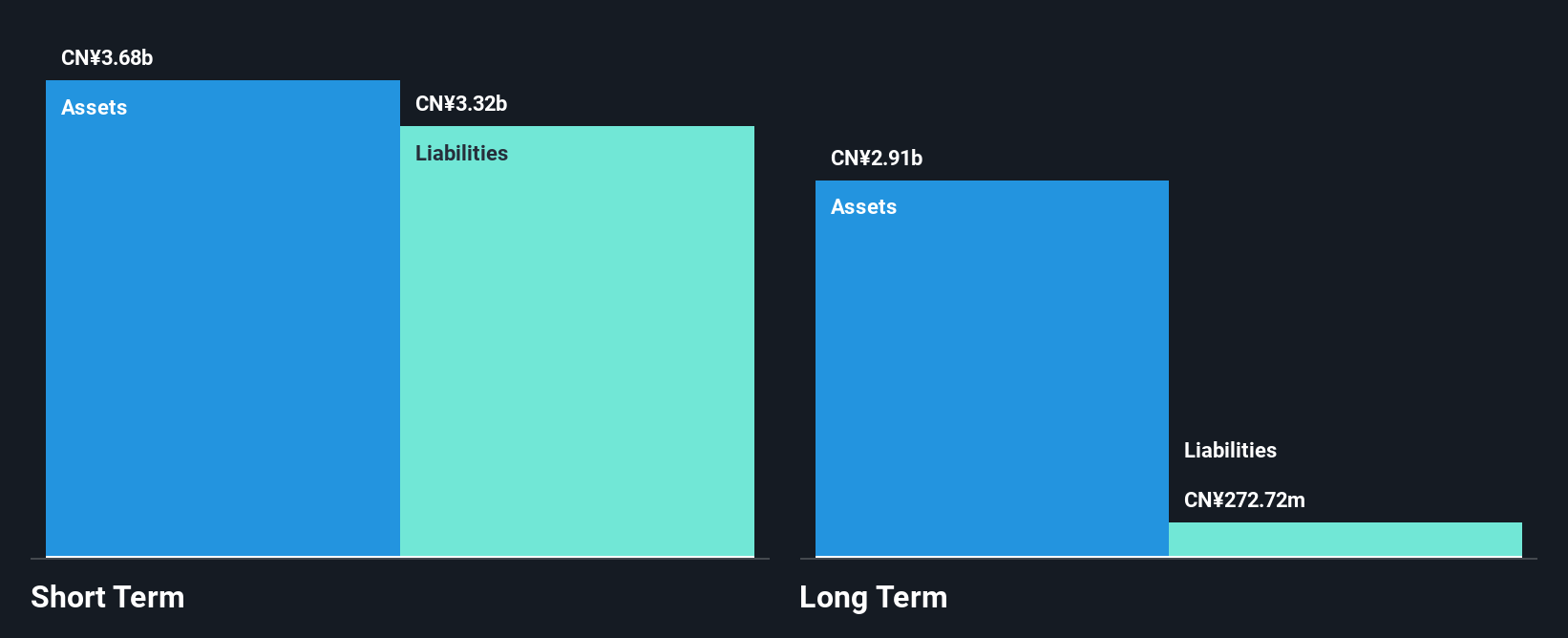

Zhejiang Reclaim Construction Group Co., Ltd. has reported sales of CN¥1.36 billion for the first nine months of 2024, showing growth from CN¥1.26 billion in the previous year, although it remains unprofitable with a net loss of CN¥83.05 million. The company benefits from strong short-term assets totaling CN¥3.7 billion, which surpass its long-term liabilities but fall short against short-term liabilities of CN¥3.9 billion, indicating liquidity challenges. Despite a satisfactory net debt to equity ratio and reduced losses over five years, the board's limited experience could impact strategic decision-making as it navigates financial hurdles.

- Get an in-depth perspective on Zhejiang Reclaim Construction Group's performance by reading our balance sheet health report here.

- Learn about Zhejiang Reclaim Construction Group's historical performance here.

Summing It All Up

- Navigate through the entire inventory of 5,815 Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Reclaim Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002586

Zhejiang Reclaim Construction Group

Zhejiang Reclaim Construction Group Co., Ltd.

Excellent balance sheet and slightly overvalued.