- China

- /

- Electronic Equipment and Components

- /

- SZSE:002222

High Growth Tech Stocks To Watch This December 2024

Reviewed by Simply Wall St

As the year draws to a close, global markets have experienced a mix of gains and setbacks, with U.S. consumer confidence dipping in December and major stock indexes showing moderate progress despite some mid-week declines. In this fluctuating environment, identifying high growth tech stocks involves looking for companies that can capitalize on technological advancements and maintain resilience amid economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

CASTECH (SZSE:002222)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CASTECH Inc. focuses on the research, development, production, and sale of crystal components, precision optical components, and laser devices primarily in China with a market cap of CN¥15.93 billion.

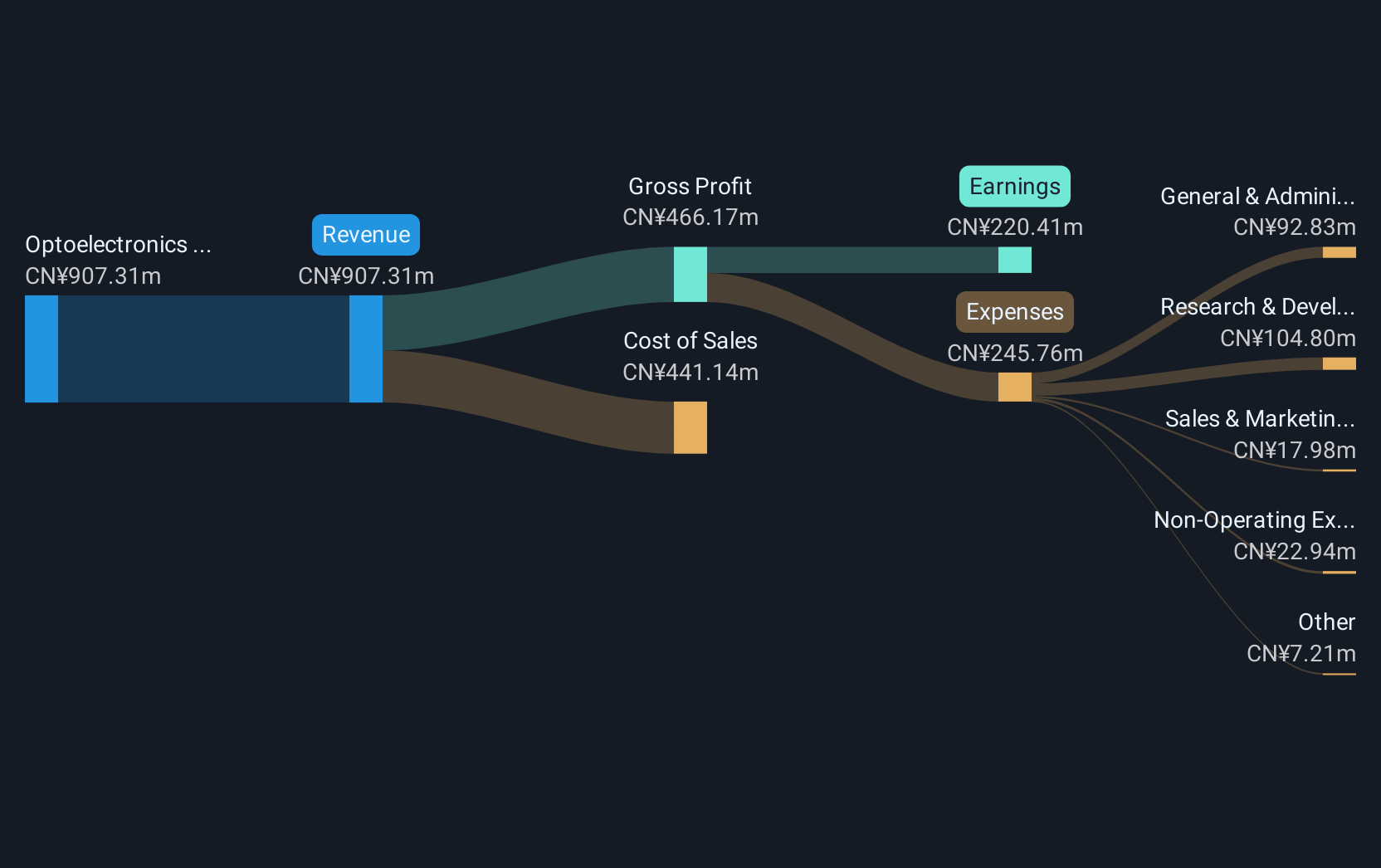

Operations: The company generates revenue primarily from the optoelectronics industry, amounting to CN¥850.99 million.

CASTECH Inc. has demonstrated a robust trajectory in its financial performance, with a notable increase in sales to CNY 665.11 million from CNY 595.75 million year-over-year and an uptick in net income to CNY 168 million from CNY 163.64 million. This growth is underpinned by significant R&D investment, aligning with the industry's shift towards advanced technologies that ensure sustainable revenue streams through innovation. Moreover, the company's recent declaration of a cash dividend reflects its commitment to shareholder returns amidst this growth phase, signaling confidence in its financial health and future prospects.

Shenzhen Sunway Communication (SZSE:300136)

Simply Wall St Growth Rating: ★★★★☆☆

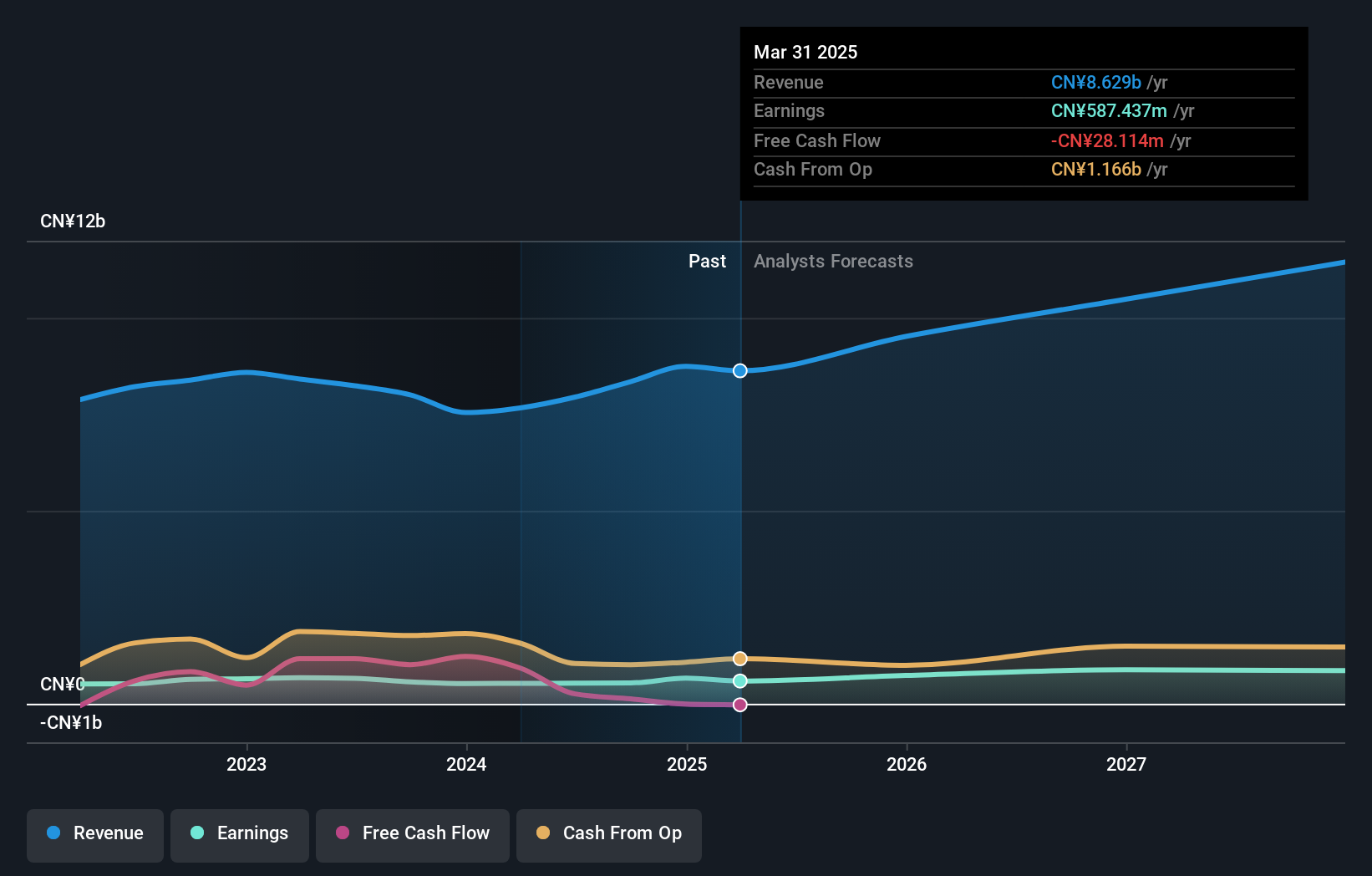

Overview: Shenzhen Sunway Communication Co., Ltd. focuses on the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions both in China and internationally with a market cap of CN¥25.19 billion.

Operations: Sunway Communication generates revenue primarily from its electronic components segment, amounting to CN¥8.35 billion. The company operates in both domestic and international markets, offering a range of products including antennas and wireless charging modules.

Shenzhen Sunway Communication has marked a significant uptick in its financial metrics, with revenue climbing to CNY 6.39 billion, up from CNY 5.59 billion the previous year, and net income rising to CNY 533.24 million from CNY 517.32 million. This growth is supported by a robust R&D focus, where the company invests significantly in innovation—key in sustaining competitive advantage in the tech sector. Moreover, their recent activities including presenting at Electronica Europe and completing a share repurchase of 1.56% for CNY 268.02 million underscore their proactive market engagement and shareholder value enhancement strategies amidst growing earnings forecasts of 31.9% annually.

TRS Information Technology (SZSE:300229)

Simply Wall St Growth Rating: ★★★★☆☆

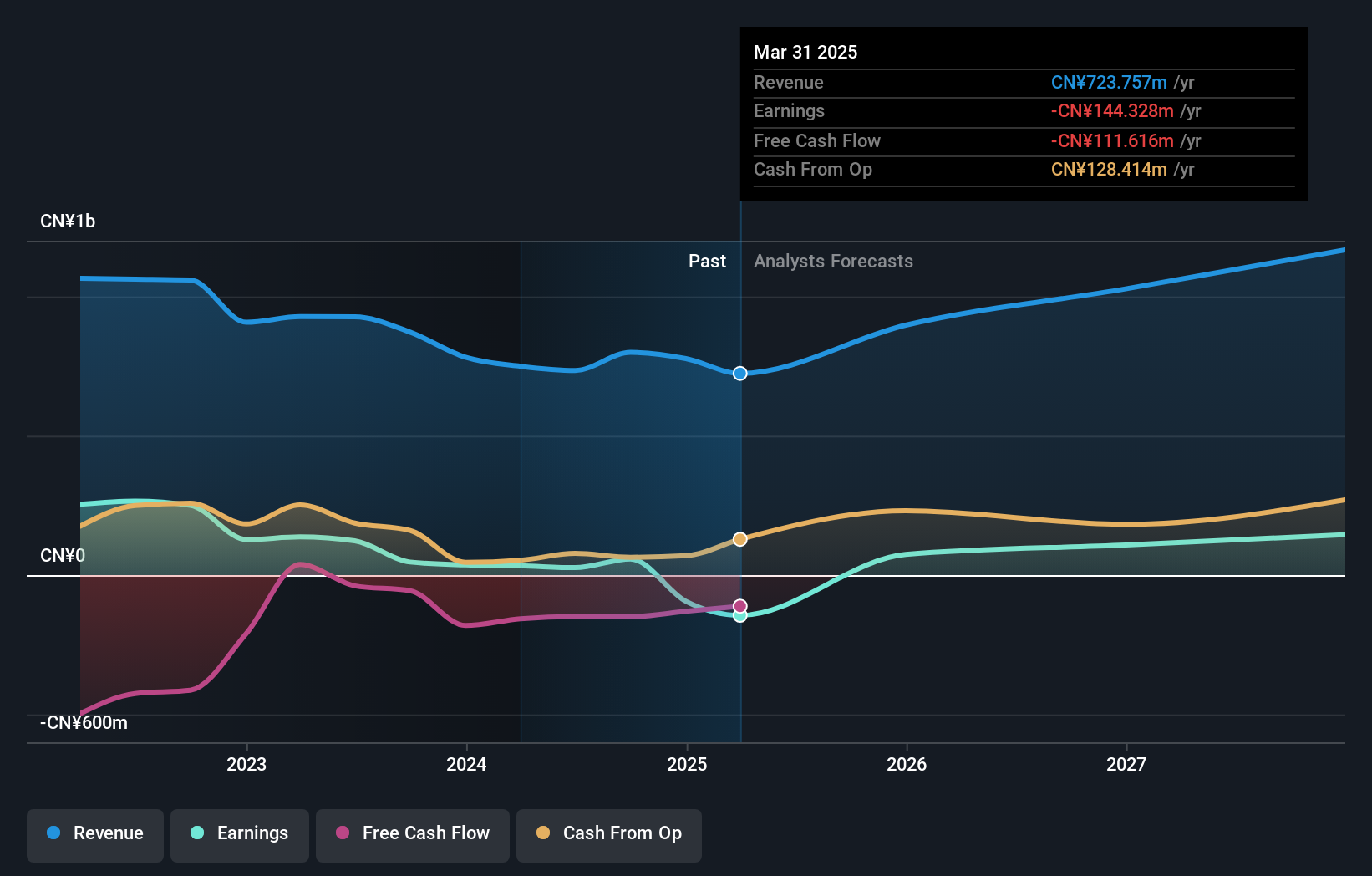

Overview: TRS Information Technology Co., Ltd. offers software, artificial intelligence, big data, and data security products and services in China with a market capitalization of CN¥17.87 billion.

Operations: TRS Information Technology Co., Ltd. generates revenue through its offerings in software, artificial intelligence, big data, and data security sectors within China. The company's financial performance is highlighted by its market capitalization of CN¥17.87 billion.

TRS Information Technology has demonstrated robust financial growth, with a notable increase in revenue from CNY 601.38 million to CNY 619.14 million year-over-year and a surge in net income from CNY 22.86 million to CNY 44.44 million, reflecting an earnings growth of approximately 94%. This performance is underpinned by significant R&D investments, aligning with industry trends towards enhanced digital solutions and innovation-driven market positioning. Recently, the company also engaged in strategic activities including a substantial private placement raising nearly CNY 890.37 million, aimed at fueling further technological advancements and market expansion initiatives.

Taking Advantage

- Unlock our comprehensive list of 1270 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002222

CASTECH

Engages in the research and development, production, and sale of crystal components, precision optical components, and laser devices primarily in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives