Stock Analysis

High Growth Tech Stocks To Explore This October 2024

Reviewed by Simply Wall St

As global markets navigate rising U.S. Treasury yields and a tepid economic growth outlook, the tech-heavy Nasdaq Composite Index has shown resilience, slightly gaining amidst broader market declines. In such an environment, identifying high-growth tech stocks can be crucial for investors looking to leverage innovation-driven performance while considering current macroeconomic factors that favor growth over value.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

CASTECH (SZSE:002222)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CASTECH Inc. focuses on the research, development, production, and sale of crystal components, precision optical components, and laser devices primarily in China with a market capitalization of CN¥13.28 billion.

Operations: CASTECH Inc. generates revenue through the sale of crystal components, precision optical components, and laser devices in China. The company's market presence is supported by its focus on research and development within these specialized sectors.

CASTECH, navigating through a competitive tech landscape, has demonstrated resilience with a 11.6% increase in sales to CNY 665.11 million and a subtle rise in net income to CNY 168 million over the first nine months of 2024. This growth trajectory is underscored by its R&D commitment, aligning with an industry trend where robust investment in innovation often predicates sustained revenue growth—CASTECH's R&D expenses are strategically positioned to harness this potential. Moreover, the company's earnings are projected to surge by an impressive 29.5% annually, outpacing the broader Chinese market's expectation of 25%. This financial vigor is complemented by revenue forecasts that anticipate a yearly increase of 25.1%, significantly above the market norm of 13.9%, positioning CASTECH well within an industry ripe for technological advancements and increased demand for high-tech solutions.

- Delve into the full analysis health report here for a deeper understanding of CASTECH.

Understand CASTECH's track record by examining our Past report.

iFLYTEKLTD (SZSE:002230)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iFLYTEK CO., LTD. is a company that provides artificial intelligence (AI) technology services in China, with a market capitalization of CN¥104.45 billion.

Operations: iFLYTEK CO., LTD. focuses on AI technology services in China, leveraging its expertise to generate revenue through various applications and solutions within the AI sector.

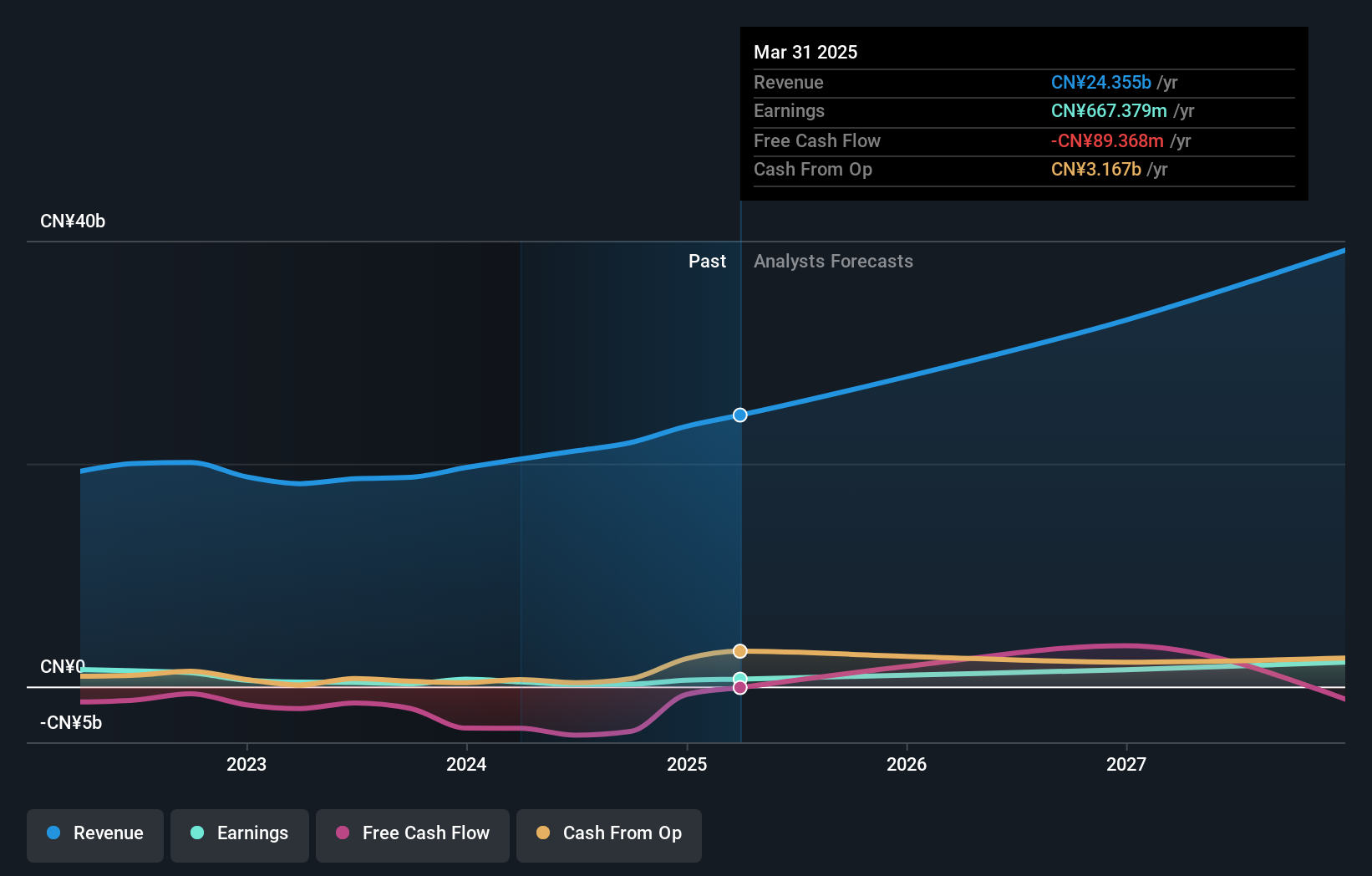

iFLYTEK CO.,LTD, amidst a challenging backdrop, has shown a notable revenue uptick of 15.3% year-over-year, reaching CNY 14.85 billion for the first nine months of 2024. This growth is juxtaposed against a net loss of CNY 343.7 million for the same period, reflecting the high costs and investments tied to its aggressive R&D strategy which accounts for a significant portion of its expenses. The firm's commitment to innovation is evident as it channels substantial resources into R&D, aligning with an industry-wide emphasis on technological advancement and competitiveness in AI and software sectors. Despite current financial strains, such strategic focus on research could poise iFLYTEK for pivotal breakthroughs or market gains as it navigates through evolving tech landscapes.

- Click here to discover the nuances of iFLYTEKLTD with our detailed analytical health report.

Explore historical data to track iFLYTEKLTD's performance over time in our Past section.

TRS Information Technology (SZSE:300229)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TRS Information Technology Co., Ltd. is a Chinese company specializing in software, artificial intelligence, big data, and data security products and services, with a market capitalization of CN¥14.63 billion.

Operations: TRS Information Technology focuses on delivering a range of software and AI-driven solutions, along with big data and data security services within China. The company's revenue model is built around these core technological offerings, contributing to its significant market presence.

TRS Information Technology has demonstrated a robust financial performance with a 40.2% forecasted annual earnings growth, significantly outpacing the broader Chinese market's 25%. This surge is supported by an aggressive investment in R&D, which is evident from its recent revenue growth of 17.4% year-over-year—marking it as a standout in technological innovation within the sector. The company's strategic focus on expanding its tech capabilities through substantial R&D expenses underscores its commitment to securing a competitive edge in the rapidly evolving software industry. Moreover, TRS's recent private placement raising CNY 890.37 million highlights investor confidence and provides capital to fuel further innovations and market expansion, positioning it well for future technological advancements and industry leadership.

Taking Advantage

- Reveal the 1279 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iFLYTEKLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002230

iFLYTEKLTD

Engages artificial intelligence (AI) technologies services in China.