- China

- /

- Electronic Equipment and Components

- /

- SZSE:002222

Exploring 3 High Growth Tech Stocks in the Global Market

Reviewed by Simply Wall St

In a week marked by solid corporate earnings and record highs for the S&P 500 and Nasdaq Composite, global markets have shown resilience despite inflationary pressures and geopolitical uncertainties. As investors navigate these dynamic conditions, identifying high-growth tech stocks that align with favorable economic indicators can be key to capitalizing on potential opportunities in this evolving landscape.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Pharma Mar | 26.67% | 43.29% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

MLOptic (SHSE:688502)

Simply Wall St Growth Rating: ★★★★★☆

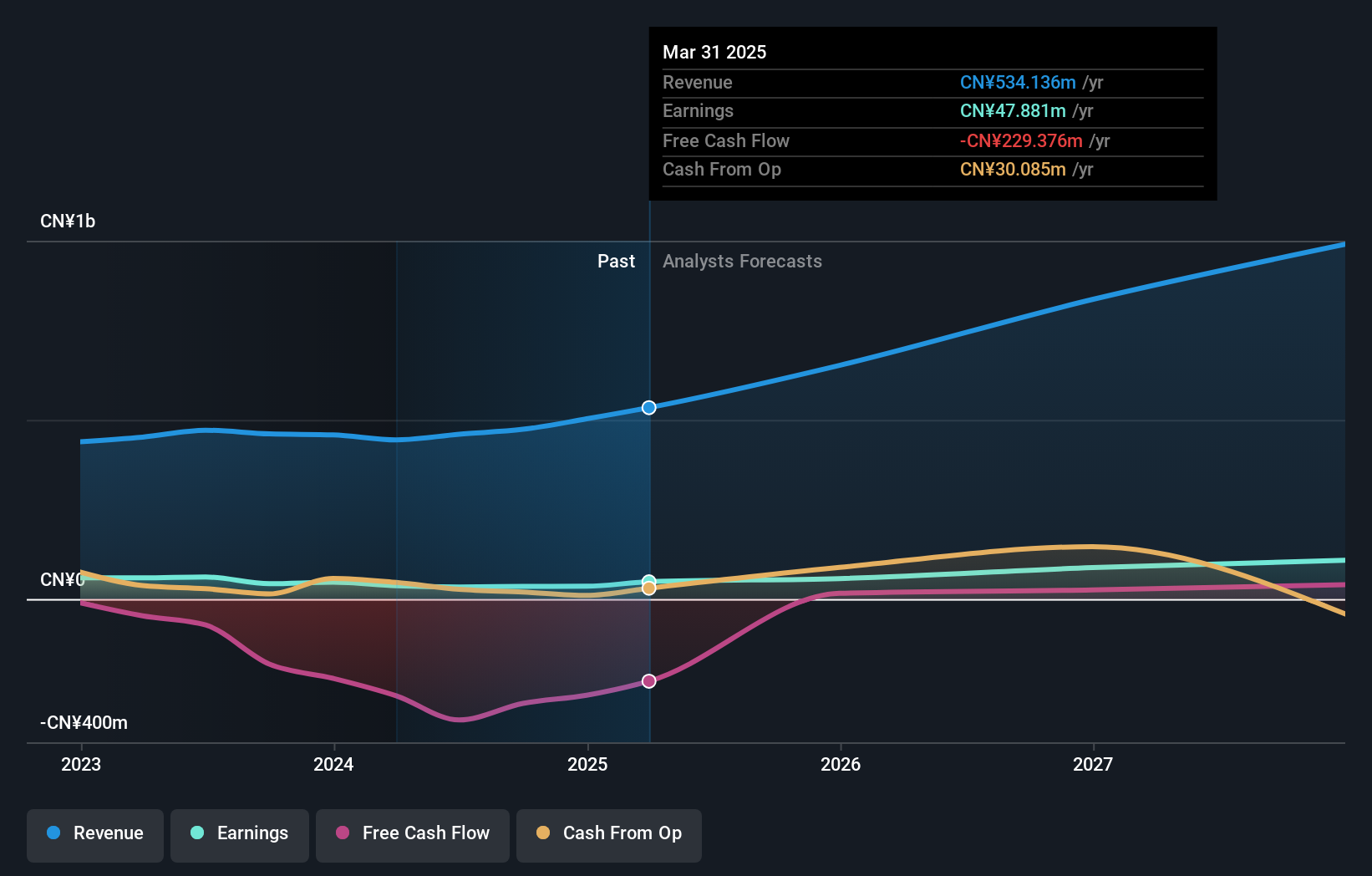

Overview: MLOptic Corp. is a precision optical solutions company that operates both in China and internationally, with a market capitalization of CN¥15.55 billion.

Operations: MLOptic Corp.'s primary revenue stream is from its Electronic Components & Parts segment, generating CN¥534.14 million.

MLOptic has demonstrated robust financial performance, with a notable increase in Q1 2025 earnings, where net income surged to CNY 16.64 million from CNY 4.28 million year-over-year. This growth is underpinned by a significant annual revenue increase of 22.4%, outpacing the broader Chinese market's growth rate of 12.4%. Despite not engaging in share repurchases this quarter, the company's strategic focus on innovation is evident from its R&D investments, aligning with its revenue growth trajectory and enhancing its competitive edge in the tech sector. The firm’s ability to maintain high-quality earnings and a forecasted annual profit growth of 30.1% positions it well for sustained advancement within the high-growth tech landscape.

- Click to explore a detailed breakdown of our findings in MLOptic's health report.

Examine MLOptic's past performance report to understand how it has performed in the past.

CASTECH (SZSE:002222)

Simply Wall St Growth Rating: ★★★★★☆

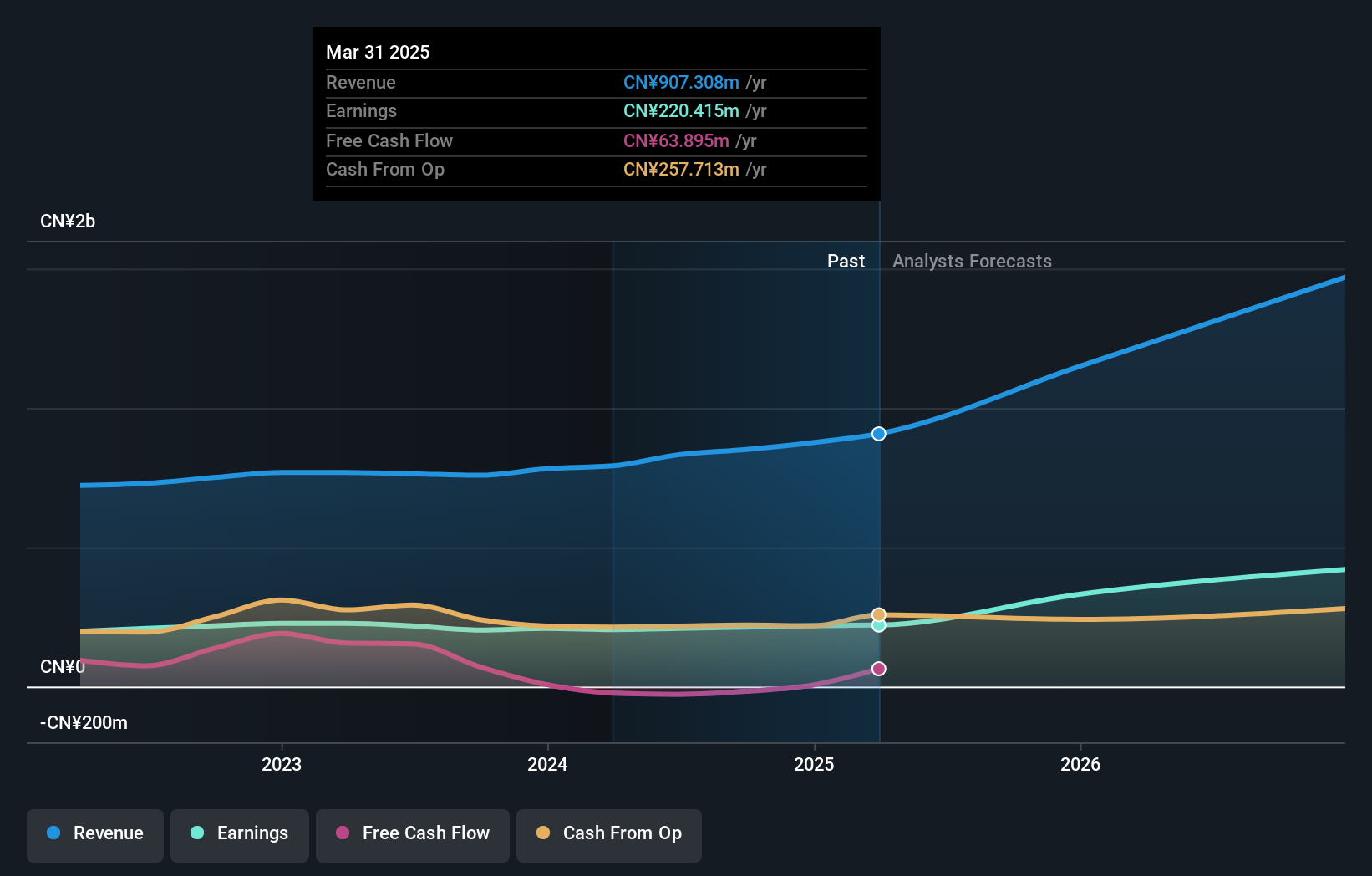

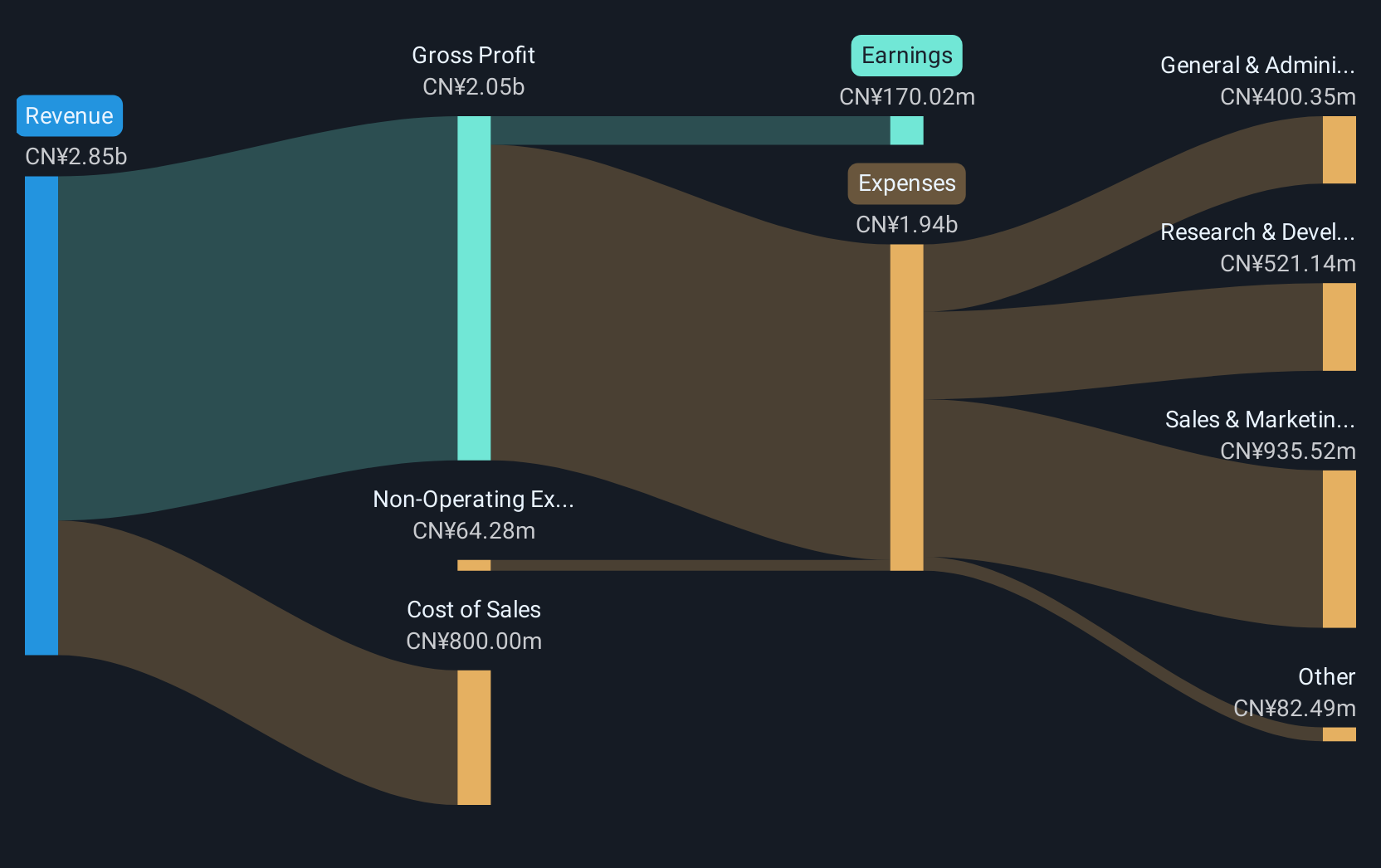

Overview: CASTECH Inc. focuses on the R&D, production, and sale of crystal components, precision optical components, and laser devices primarily in China with a market capitalization of CN¥16.21 billion.

Operations: The company derives its revenue primarily from the optoelectronics industry, generating CN¥907.31 million.

CASTECH has recently been added to key indices on the Shenzhen Stock Exchange, signaling increased market recognition. This aligns with its robust financial performance, where annual revenue growth stands at 27.3%, significantly outpacing the broader Chinese market's growth rate of 12.4%. Notably, earnings have surged by 34.8% annually, reflecting strong operational efficiency and market demand. The company's commitment to innovation is evident in its R&D investments which are crucial for sustaining this momentum in a competitive tech landscape.

- Navigate through the intricacies of CASTECH with our comprehensive health report here.

Gain insights into CASTECH's historical performance by reviewing our past performance report.

Shenzhen Kangtai Biological Products (SZSE:300601)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Kangtai Biological Products Co., Ltd. focuses on the research, development, production, and distribution of vaccines and biological products with a market cap of CN¥18.17 billion.

Operations: Kangtai Biological Products generates revenue primarily through the sale of vaccines and biological products. The company operates with a market capitalization of CN¥18.17 billion.

Shenzhen Kangtai Biological Products, despite a challenging year with earnings growth contracting by 76.1%, still forecasts a notable rebound with an expected annual profit growth of 38.6%. This contrasts sharply with its industry's average decline of 17.7%. The company's R&D investments remain pivotal, aligning with its strategic focus on innovation to drive future performance. Additionally, recent shareholder endorsements via dividend affirmations reflect confidence in its financial health and commitment to returning value to investors.

Next Steps

- Dive into all 741 of the Global High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002222

CASTECH

Engages in the research and development, production, and sale of crystal components, precision optical components, and laser devices primarily in China.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives