- Hong Kong

- /

- Entertainment

- /

- SEHK:6633

November 2024's Must-Watch Penny Stocks

Reviewed by Simply Wall St

Global markets have experienced a tumultuous week, with major indices such as the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating amid a flurry of earnings reports and economic data. Despite these fluctuations, the allure of penny stocks—often seen as relics from past trading eras—remains strong for investors seeking growth potential at lower price points. These smaller or newer companies can offer substantial opportunities when they are underpinned by solid financials, making them an intriguing area to explore in today's market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £489.64M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.00 | MYR2.07B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.80 | £384.4M | ★★★★☆☆ |

Click here to see the full list of 5,768 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

United Arab Bank P.J.S.C (ADX:UAB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: United Arab Bank P.J.S.C. offers commercial banking products and services to institutional and corporate clients in the United Arab Emirates, with a market capitalization of AED2.33 billion.

Operations: The company's revenue from Retail Banking amounts to AED54.37 million.

Market Cap: AED2.33B

United Arab Bank P.J.S.C. presents a mixed picture for investors interested in penny stocks. The bank has demonstrated strong earnings growth over the past five years, averaging 63.9% annually, although recent growth of 5.7% lags behind its historical performance and industry peers. Its Price-To-Earnings ratio of 9x suggests it may be undervalued compared to the broader AE market average of 13.4x. Despite high-quality earnings and primarily low-risk funding sources, challenges include a high level of non-performing loans at 5.1%. Recent financial results show stable net interest income but a decline in quarterly net income year-over-year.

- Click to explore a detailed breakdown of our findings in United Arab Bank P.J.S.C's financial health report.

- Examine United Arab Bank P.J.S.C's past performance report to understand how it has performed in prior years.

Qingci Games (SEHK:6633)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qingci Games Inc. is an investment holding company that develops, publishes, and operates mobile games across multiple regions including China, Japan, the United States, and more, with a market cap of approximately HK$1.70 billion.

Operations: The company's revenue segment primarily consists of Computer Graphics, generating CN¥914.42 million.

Market Cap: HK$1.7B

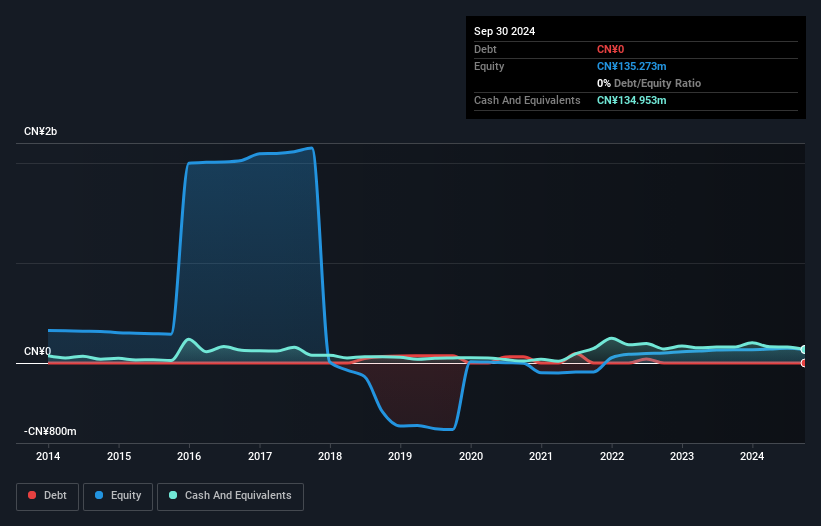

Qingci Games Inc. offers an intriguing prospect for penny stock investors, with a market cap of approximately HK$1.70 billion and recent half-year sales of CN¥342.62 million, showing slight growth from last year. Despite being unprofitable, the company has more cash than debt and a sufficient cash runway for over three years if free cash flow continues to decline at historical rates. The management team and board are experienced, with average tenures of 4.6 and 3.4 years respectively. While earnings are forecasted to grow substantially by 168% annually, past profit growth remains elusive as losses have increased slightly over five years.

- Unlock comprehensive insights into our analysis of Qingci Games stock in this financial health report.

- Gain insights into Qingci Games' future direction by reviewing our growth report.

Zhongtian Service (SZSE:002188)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhongtian Service Co., Ltd. offers property management and related services in China, with a market cap of CN¥1.46 billion.

Operations: No specific revenue segments are reported for Zhongtian Service Co., Ltd.

Market Cap: CN¥1.46B

Zhongtian Service Co., Ltd. presents a mixed picture for penny stock investors, with a market cap of CN¥1.46 billion and recent sales of CN¥264.37 million for the first nine months of 2024, reflecting modest growth from the previous year. Despite having no debt and an experienced management team with an average tenure of 4.1 years, profitability has been challenged by significant one-off losses affecting earnings quality and a sharp decline in net income to CN¥3.03 million from CN¥19.58 million last year. The company’s short-term assets comfortably cover both short-term and long-term liabilities, providing some financial stability amidst volatile profit margins.

- Dive into the specifics of Zhongtian Service here with our thorough balance sheet health report.

- Learn about Zhongtian Service's historical performance here.

Taking Advantage

- Explore the 5,768 names from our Penny Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingci Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6633

Qingci Games

An investment holding company, develops, publishes, and operates mobile games in the People’s Republic of China, Japan, the United States, Canada, Australia, New Zealand, Hong Kong, Macau, Taiwan, and internationally.

Flawless balance sheet with high growth potential.