- China

- /

- Electronic Equipment and Components

- /

- SZSE:002179

September 2024's Chinese Exchange Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

In September 2024, Chinese equities showed resilience amid a holiday-shortened week, buoyed by the Fed's decision to cut interest rates despite a series of underwhelming economic data. The Shanghai Composite Index and the blue-chip CSI 300 both posted gains, reflecting cautious optimism in the market. When identifying undervalued stocks, it is essential to consider companies with strong fundamentals that may be temporarily overlooked by investors due to broader economic concerns. In this context, we will discuss three Chinese exchange stocks estimated to be trading below their fair value.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| KPC PharmaceuticalsInc (SHSE:600422) | CN¥12.75 | CN¥25.33 | 49.7% |

| Zhongji Innolight (SZSE:300308) | CN¥122.16 | CN¥230.77 | 47.1% |

| NBTM New Materials Group (SHSE:600114) | CN¥14.15 | CN¥26.78 | 47.2% |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥146.48 | CN¥273.24 | 46.4% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.86 | CN¥33.11 | 49.1% |

| Jiangsu Hongdou IndustrialLTD (SHSE:600400) | CN¥2.13 | CN¥4.09 | 47.9% |

| Jiugui Liquor (SZSE:000799) | CN¥39.60 | CN¥73.92 | 46.4% |

| Songcheng Performance DevelopmentLtd (SZSE:300144) | CN¥7.50 | CN¥13.98 | 46.4% |

| Cybrid Technologies (SHSE:603212) | CN¥10.10 | CN¥19.02 | 46.9% |

| Hiconics Eco-energy Technology (SZSE:300048) | CN¥4.47 | CN¥8.68 | 48.5% |

Let's uncover some gems from our specialized screener.

Hangzhou EZVIZ Network (SHSE:688475)

Overview: Hangzhou EZVIZ Network Co., Ltd. manufactures and sells smart home products both in China and internationally, with a market cap of CN¥20.74 billion.

Operations: The company's revenue segments include Smart Home (CN¥639.44 million), Smart Home Camera (CN¥2.92 billion), IoT Cloud Platform (CN¥970.40 million), Accessories Products (CN¥361.32 million), and Other Smart Home Products (CN¥174.73 million).

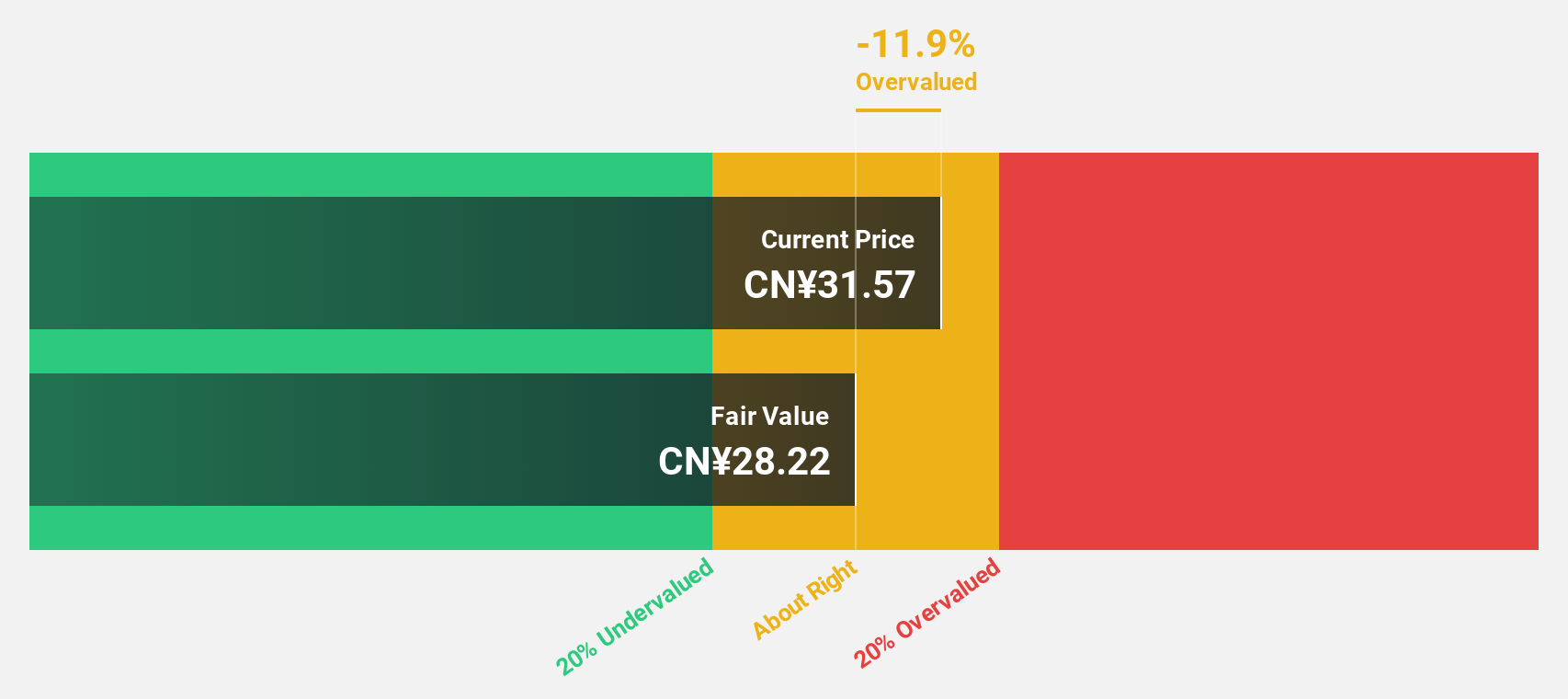

Estimated Discount To Fair Value: 12.1%

Hangzhou EZVIZ Network, recently added to the S&P Global BMI Index, reported half-year sales of CNY 2.58 billion and net income of CNY 281.66 million. Trading at CN¥26.34, it is approximately 12% below its fair value estimate of CN¥29.95. Despite a low future return on equity forecast (14.9%), earnings are expected to grow significantly at 23.2% annually, outpacing the Chinese market's growth rate and indicating potential undervaluation based on cash flows.

- Our expertly prepared growth report on Hangzhou EZVIZ Network implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Hangzhou EZVIZ Network with our comprehensive financial health report here.

AVIC Jonhon Optronic TechnologyLtd (SZSE:002179)

Overview: AVIC Jonhon Optronic Technology Co., Ltd. focuses on the research and development of optical, electrical, and fluid connection technologies and equipment in China, with a market cap of CN¥80.87 billion.

Operations: AVIC Jonhon Optronic Technology Co., Ltd. generates revenue through its research and development of optical, electrical, and fluid connection technologies and equipment in China.

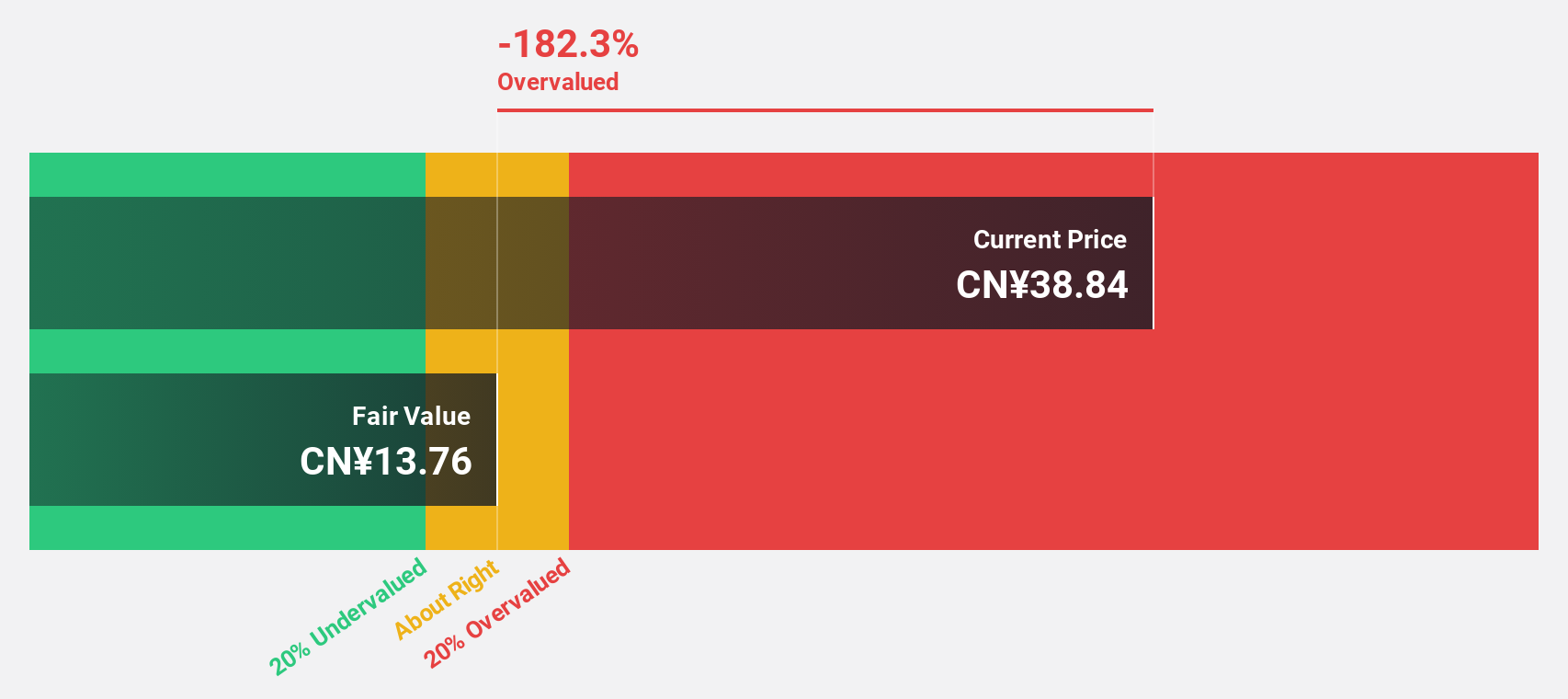

Estimated Discount To Fair Value: 17.4%

AVIC Jonhon Optronic Technology reported half-year sales of CNY 9.20 billion and net income of CNY 1.67 billion, both down from the previous year. Trading at CN¥38.16, it is approximately 17% below its fair value estimate of CN¥46.18. Despite unstable dividends and a forecasted low return on equity (17.9%), earnings are expected to grow significantly at 22.45% annually, suggesting potential undervaluation based on cash flows amidst strong revenue growth projections (20.5%).

- According our earnings growth report, there's an indication that AVIC Jonhon Optronic TechnologyLtd might be ready to expand.

- Unlock comprehensive insights into our analysis of AVIC Jonhon Optronic TechnologyLtd stock in this financial health report.

Lingyi iTech (Guangdong) (SZSE:002600)

Overview: Lingyi iTech (Guangdong) Company provides smart manufacturing services and solutions, with a market cap of CN¥45.43 billion.

Operations: The company's revenue segments are Material Business (CN¥762.25 million), Automotive Products (CN¥2.00 billion), Charger and Boutique Assembly (CN¥6.44 billion), and Precision Functional Parts, Structural Parts, and Modules (CN¥27.50 billion).

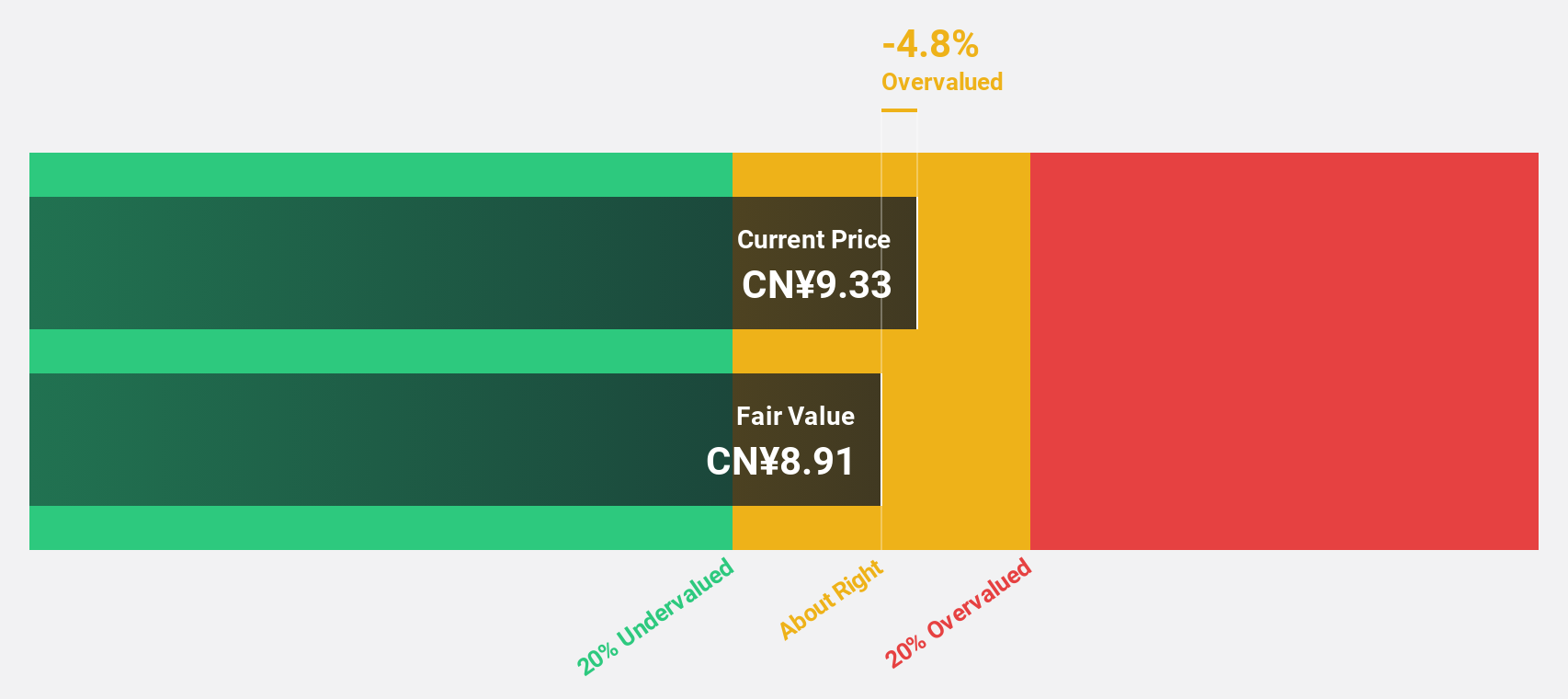

Estimated Discount To Fair Value: 20.7%

Lingyi iTech (Guangdong) is trading at CN¥6.51, significantly below its estimated fair value of CN¥8.21. Despite recent revenue growth to CN¥19.12 billion for the first half of 2024, net income has declined to CN¥692.31 million from the previous year’s CNY 1,248.1 million, reflecting lower profit margins (3.9%). Earnings are forecasted to grow 27.6% annually over the next three years, outpacing market expectations and indicating potential undervaluation based on cash flows amidst recent buybacks and shareholder meetings focused on governance improvements.

- The growth report we've compiled suggests that Lingyi iTech (Guangdong)'s future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Lingyi iTech (Guangdong).

Summing It All Up

- Embark on your investment journey to our 111 Undervalued Chinese Stocks Based On Cash Flows selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002179

Jonhon Optronic Technology

Engages in the research and development of optical, electrical, and fluid connection technologies and equipment in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives