- China

- /

- Electronic Equipment and Components

- /

- SZSE:002179

High Growth Tech And 2 Other High Potential Stocks To Watch

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's first rate cut in over four years, U.S. stocks have surged to new highs, with small-cap indexes showing notable performance despite remaining below their historical peaks. Amid this optimistic backdrop, identifying high-growth tech stocks and other high-potential investments becomes crucial for capitalizing on market momentum and economic resilience.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 1299 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

AVIC Jonhon Optronic TechnologyLtd (SZSE:002179)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AVIC Jonhon Optronic Technology Co., Ltd. engages in the research and development of optical, electrical, and fluid connection technologies and equipment in China, with a market cap of approximately CN¥80.08 billion.

Operations: AVIC Jonhon Optronic Technology Co., Ltd. focuses on developing and producing optical, electrical, and fluid connection technologies and equipment. The company generates revenue primarily from the sale of these advanced technological products in China.

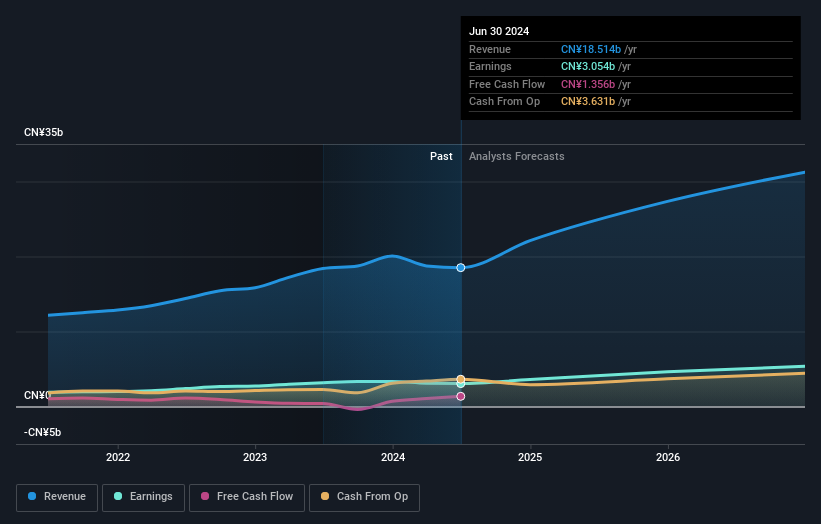

AVIC Jonhon Optronic TechnologyLtd, amidst a challenging backdrop with a recent dip in sales to CNY 9.2 billion and net income falling to CNY 1.67 billion, is navigating through its financial contours with strategic agility. Despite these hurdles, the company's commitment to innovation is evident from its robust R&D expenditure, aligning with an anticipated revenue growth of 20.5% per year, surpassing the Chinese market's average of 13%. This focus on research has poised AVIC Jonhon not just for recovery but also for capturing emerging opportunities in optronic technologies. Looking ahead, the company's earnings are expected to climb by 22.45% annually, a reflection of its potential resilience and adaptability in a competitive sector. The recent shareholders meeting underscores a proactive governance approach which might further stabilize operations and steer towards sustained growth. With significant investments in R&D and an optimistic growth trajectory despite current financial pressures, AVIC Jonhon appears geared towards leveraging its technological prowess for future gains.

Beijing Enlight Media (SZSE:300251)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Enlight Media Co., Ltd. is involved in the investment, production, and distribution of film and television projects in China, with a market cap of CN¥20.54 billion.

Operations: Beijing Enlight Media Co., Ltd. focuses on the investment, production, and distribution of film and television projects in China. The company's market cap stands at CN¥20.54 billion.

Beijing Enlight Media has demonstrated notable financial agility, with its revenue more than doubling to CNY 1.33 billion from the previous year, and net income surging to CNY 472.77 million. This growth is underpinned by a strategic emphasis on R&D, which aligns with the company's revenue increase of 14.6% per year—outpacing the Chinese market average of 13%. Moreover, earnings are projected to expand by an impressive 25% annually, reflecting robust future prospects despite current market challenges. The recent appointment of new directors and amendments to corporate bylaws suggest proactive governance that could further enhance operational efficiency and market responsiveness.

- Unlock comprehensive insights into our analysis of Beijing Enlight Media stock in this health report.

Gain insights into Beijing Enlight Media's past trends and performance with our Past report.

Shenzhen Longsys Electronics (SZSE:301308)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Longsys Electronics Co., Ltd. specializes in the research, development, manufacture, and sale of memory storage products globally, with a market cap of CN¥26.87 billion.

Operations: Longsys focuses on the global market for memory storage products, engaging in comprehensive activities from research and development to manufacturing and sales. The company operates with a market cap of CN¥26.87 billion.

Shenzhen Longsys Electronics has recently pivoted from a net loss to a robust profit, with earnings surging to CNY 593.78 million from a previous loss, reflecting a dynamic turnaround in its financial health. This resurgence is underscored by an impressive sales jump to CNY 9.04 billion, up from CNY 3.71 billion year-over-year. The firm's commitment to innovation is evident in its R&D spending trends which align closely with its revenue growth of 16.2% annually, outstripping the broader Chinese market's growth rate of 13%. Looking ahead, Longsys is poised for continued expansion with projected annual earnings growth of 23.6%, signaling strong future prospects amid recent strategic amendments and dividend affirmations that enhance shareholder value.

Next Steps

- Delve into our full catalog of 1299 High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002179

Jonhon Optronic Technology

Engages in the research and development of optical, electrical, and fluid connection technologies and equipment in China.

Flawless balance sheet, undervalued and pays a dividend.