- China

- /

- Electronic Equipment and Components

- /

- SZSE:002139

3 Asian Growth Companies With Insider Ownership Expecting Up To 34% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate the complexities of interest rate expectations and AI-driven optimism, Asian economies are capturing attention with their unique growth narratives. In this environment, companies with high insider ownership can be particularly intriguing as they often reflect strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Tongguan Gold Group (SEHK:340) | 30.1% | 29.5% |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 84.7% |

| Sineng ElectricLtd (SZSE:300827) | 36.2% | 27.6% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

| AprilBioLtd (KOSDAQ:A397030) | 31.1% | 87.1% |

Let's dive into some prime choices out of the screener.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company involved in the research, development, manufacture, and commercialization of antibody drugs globally, with a market cap of HK$120.67 billion.

Operations: The company generates revenue of CN¥2.51 billion from its activities in the research, development, production, and sale of biopharmaceutical products.

Insider Ownership: 18.1%

Revenue Growth Forecast: 34.4% p.a.

Akeso's growth trajectory is underscored by its high insider ownership and robust R&D pipeline, focusing on innovative cancer therapies. The company forecasts revenue growth of 34.4% annually, outpacing the Hong Kong market. Recent advancements include the global Phase II trial of cadonilimab for hepatocellular carcinoma and promising data from lung cancer studies. Despite a net loss in H1 2025, Akeso's strategic focus on bispecific antibodies like ivonescimab positions it well in addressing unmet medical needs globally.

- Click here and access our complete growth analysis report to understand the dynamics of Akeso.

- According our valuation report, there's an indication that Akeso's share price might be on the expensive side.

Shenzhen Topband (SZSE:002139)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Topband Co., Ltd. is involved in the research, development, production, and sale of intelligent control system solutions both in China and internationally, with a market cap of CN¥19.98 billion.

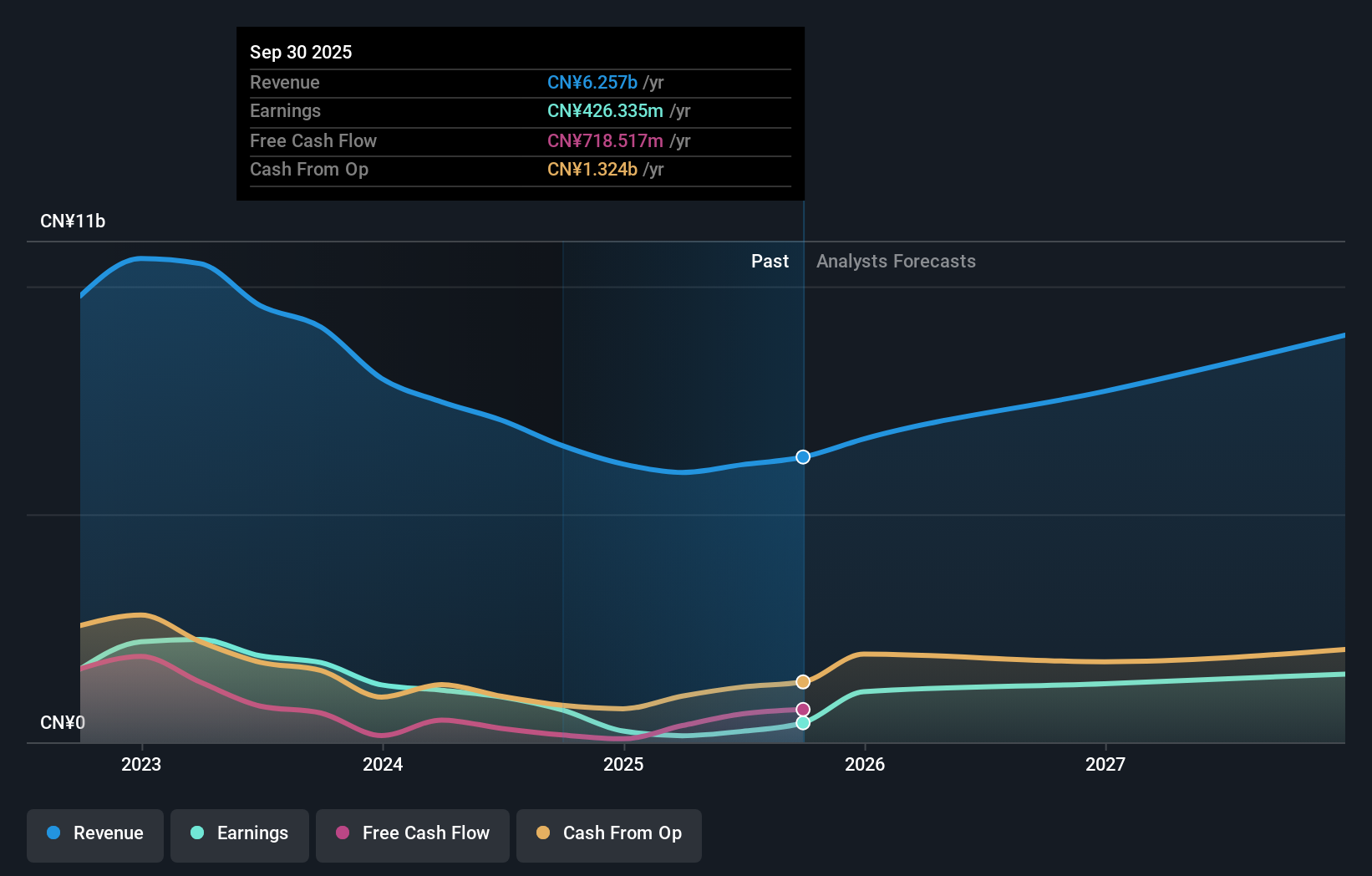

Operations: The company generates revenue of CN¥10.99 billion from its Intelligent Control Electronics Industry segment.

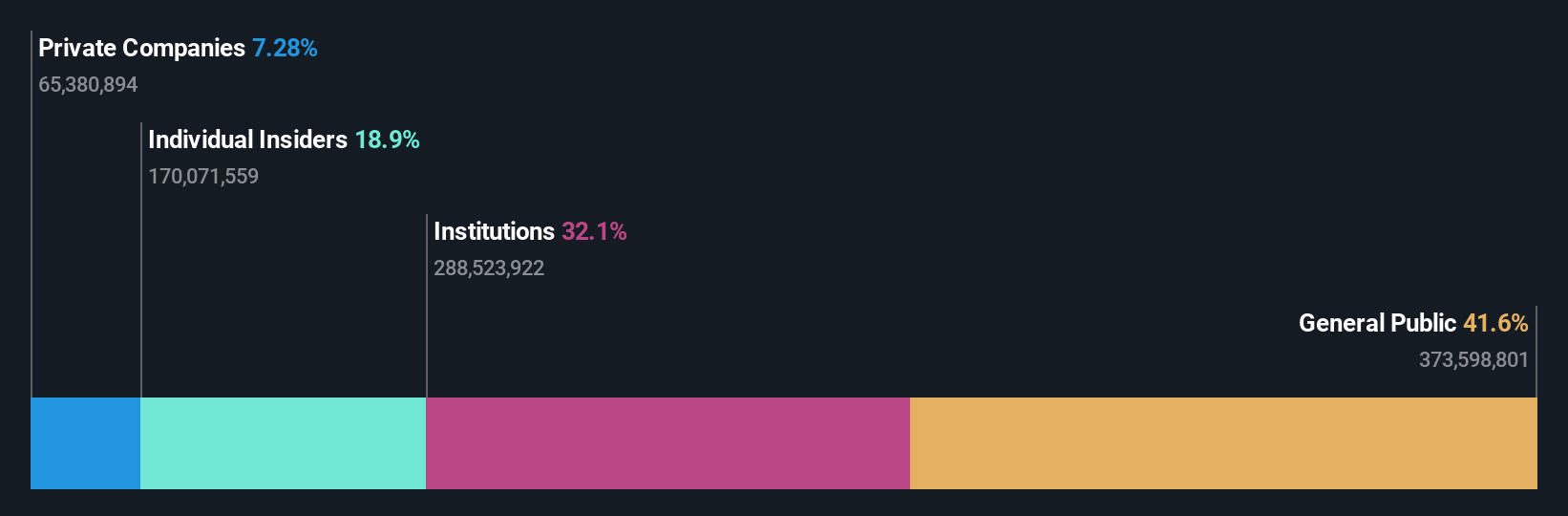

Insider Ownership: 23.8%

Revenue Growth Forecast: 15.6% p.a.

Shenzhen Topband's growth is marked by strategic global expansion and high insider ownership. The company forecasts revenue growth of 15.6% annually, slightly above the Chinese market average. Its earnings are expected to grow significantly at 27% per year, despite a recent dip in net income for H1 2025. The Mexico facility enhances its global manufacturing efficiency with advanced production lines and certifications, supporting its smart controller segment across diverse applications while maintaining competitive value with a P/E ratio of 32.6x.

- Click to explore a detailed breakdown of our findings in Shenzhen Topband's earnings growth report.

- Our comprehensive valuation report raises the possibility that Shenzhen Topband is priced lower than what may be justified by its financials.

Lepu Medical Technology (Beijing) (SZSE:300003)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lepu Medical Technology (Beijing) Co., Ltd. operates in the medical device and pharmaceutical sectors, with a market cap of CN¥34.90 billion.

Operations: Lepu Medical Technology (Beijing) Co., Ltd. generates revenue from its operations in the medical device and pharmaceutical sectors.

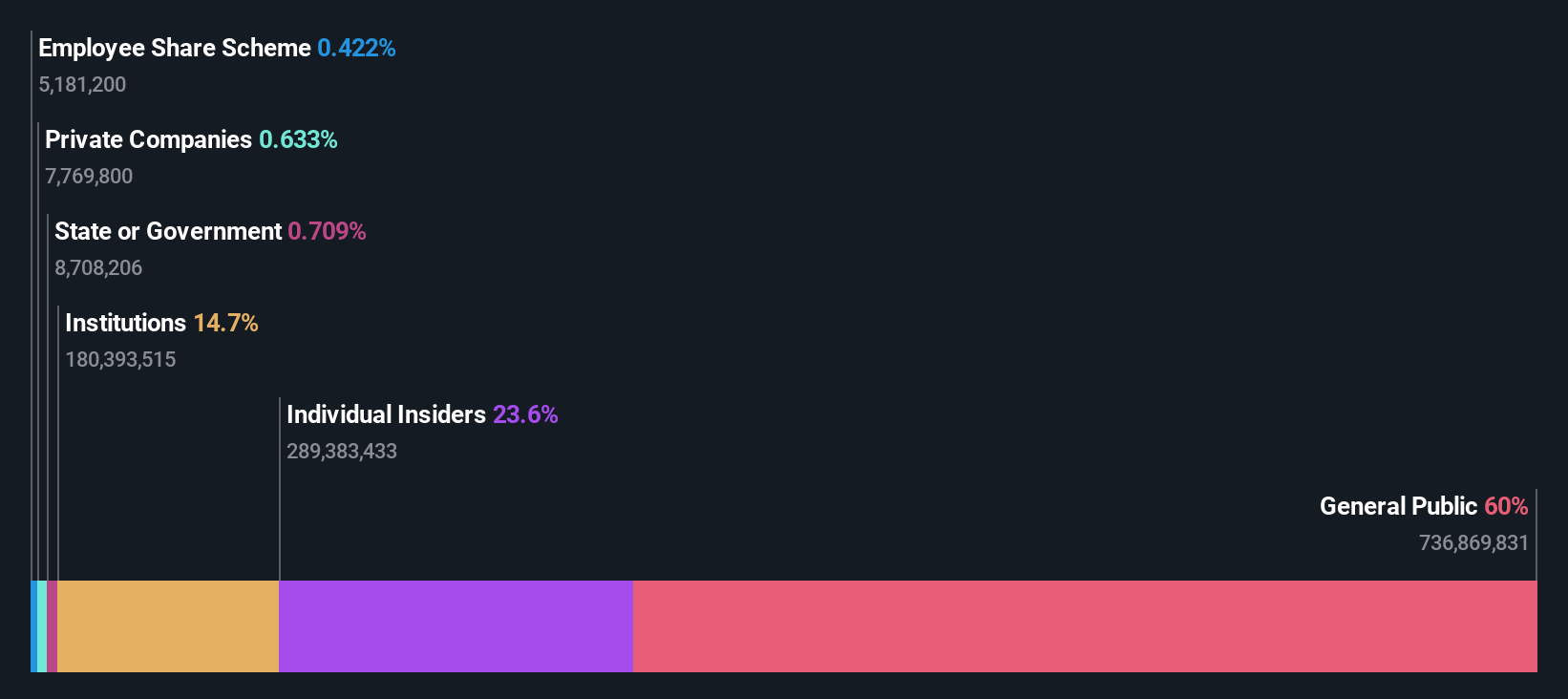

Insider Ownership: 13.1%

Revenue Growth Forecast: 14.1% p.a.

Lepu Medical Technology (Beijing) demonstrates growth potential with forecasted earnings growth of 40% annually, outpacing the Chinese market. Despite a recent decline in profit margins to 4% and high share price volatility, its revenue is expected to grow at 14.1%, slightly above the market average. The company recently approved amendments to its articles of association and an interim cash dividend of CNY 1.63 per 10 shares for 2025, reflecting active shareholder engagement.

- Unlock comprehensive insights into our analysis of Lepu Medical Technology (Beijing) stock in this growth report.

- The valuation report we've compiled suggests that Lepu Medical Technology (Beijing)'s current price could be inflated.

Summing It All Up

- Explore the 618 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Interested In Other Possibilities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002139

Shenzhen Topband

Engages in the research and development, production, and sale of intelligent control system solutions in China and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives