- China

- /

- Electronic Equipment and Components

- /

- SZSE:002036

Why Investors Shouldn't Be Surprised By LianChuang Electronic Technology Co.,Ltd's (SZSE:002036) Low P/S

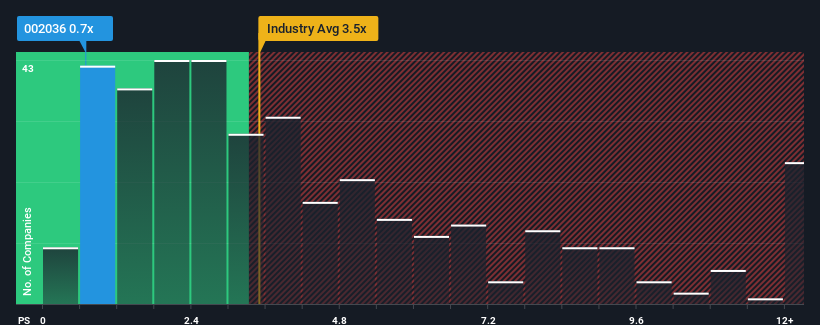

You may think that with a price-to-sales (or "P/S") ratio of 0.7x LianChuang Electronic Technology Co.,Ltd (SZSE:002036) is definitely a stock worth checking out, seeing as almost half of all the Electronic companies in China have P/S ratios greater than 3.5x and even P/S above 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for LianChuang Electronic TechnologyLtd

What Does LianChuang Electronic TechnologyLtd's Recent Performance Look Like?

LianChuang Electronic TechnologyLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on LianChuang Electronic TechnologyLtd will help you uncover what's on the horizon.How Is LianChuang Electronic TechnologyLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as LianChuang Electronic TechnologyLtd's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.9%. Regardless, revenue has managed to lift by a handy 17% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 18% over the next year. Meanwhile, the rest of the industry is forecast to expand by 25%, which is noticeably more attractive.

With this in consideration, its clear as to why LianChuang Electronic TechnologyLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of LianChuang Electronic TechnologyLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with LianChuang Electronic TechnologyLtd, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on LianChuang Electronic TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002036

LianChuang Electronic TechnologyLtd

Engages in the research and development, production, and sale of optics and optoelectronics in China and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives