- China

- /

- Tech Hardware

- /

- SZSE:002017

Discovering Undiscovered Gems in Global Markets July 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising consumer inflation in the U.S. and mixed performances across key indices, small-cap stocks have shown resilience with the Russell 2000 posting gains amid broader market fluctuations. In this dynamic environment, identifying promising opportunities requires a keen focus on companies that demonstrate strong fundamentals and adaptability to economic shifts, making them potential undiscovered gems in the investment arena.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ohashi Technica | NA | 5.69% | -10.83% | ★★★★★★ |

| Imuraya Group | 4.07% | 4.41% | 30.80% | ★★★★★★ |

| Shenzhen TVT Digital Technology | 2.02% | 10.54% | 29.43% | ★★★★★★ |

| Shenzhen Tongye TechnologyLtd | 8.22% | 15.89% | -9.68% | ★★★★★★ |

| Otec | 7.14% | 4.39% | 6.95% | ★★★★★☆ |

| AJIS | 0.68% | 3.20% | -12.98% | ★★★★★☆ |

| Kondotec | 13.45% | 7.00% | 9.12% | ★★★★★☆ |

| Hyakugo Bank | 161.58% | 6.23% | 7.74% | ★★★★★☆ |

| AlpenLtd | 10.82% | 3.61% | -3.40% | ★★★★★☆ |

| DYPNFLtd | 37.74% | 7.21% | -14.42% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Eastcompeace TechnologyLtd (SZSE:002017)

Simply Wall St Value Rating: ★★★★★★

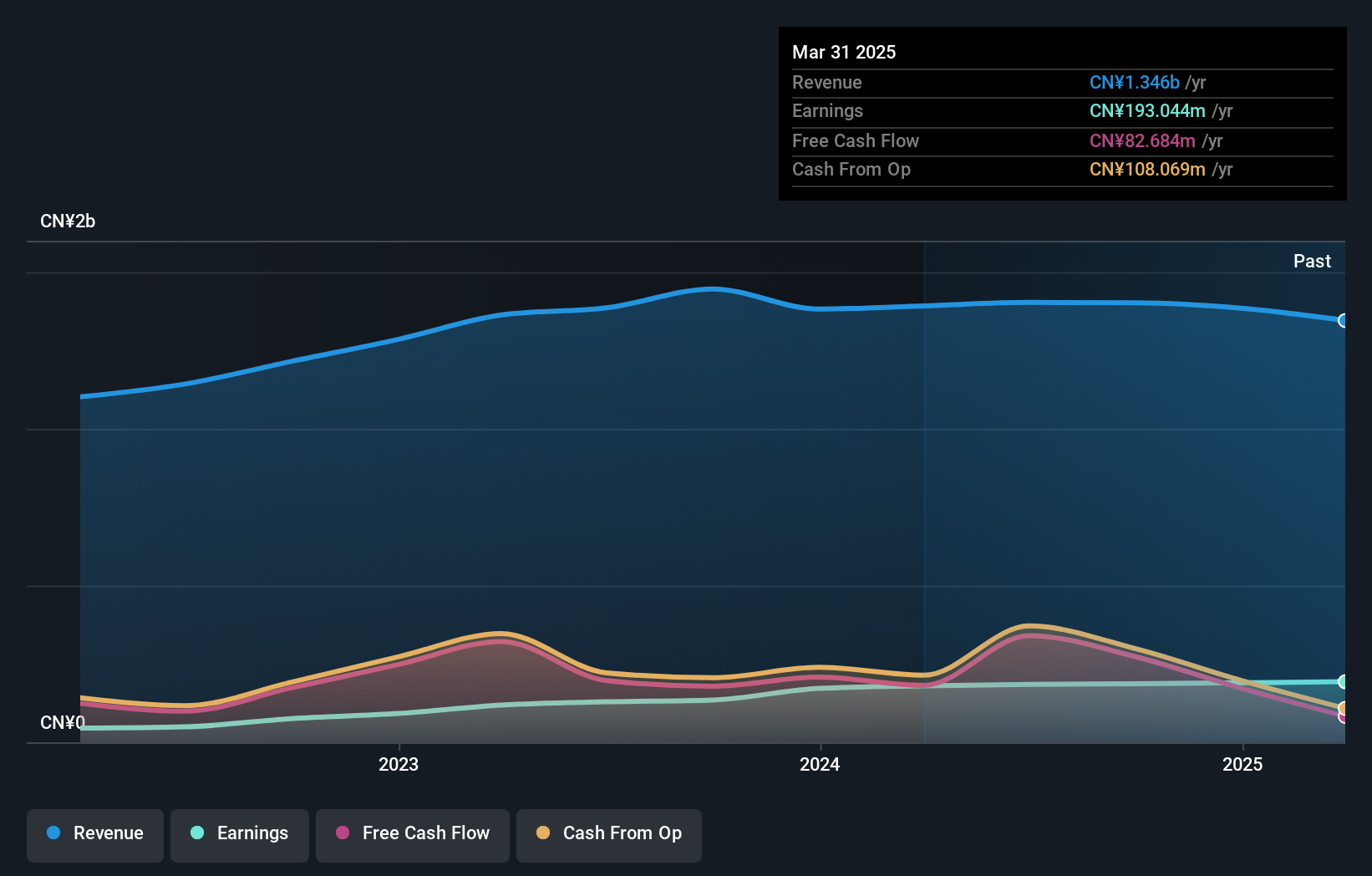

Overview: Eastcompeace Technology Co. Ltd offers smart card and system solutions both in China and internationally, with a market capitalization of CN¥10.73 billion.

Operations: Eastcompeace Technology Co. Ltd generates revenue primarily through its smart card and system solutions. The company's net profit margin is 4.5%, indicating the proportion of revenue that translates into profit after expenses are deducted.

Eastcompeace Technology, a nimble player in the tech sector, showcases a debt-free status which is impressive given its previous debt-to-equity ratio of 1.4 five years ago. The company's earnings grew by 7.3% over the past year, outpacing the tech industry's growth rate of 6.5%. With a price-to-earnings ratio at 55.6x, it seems undervalued compared to its peers averaging 82.9x in the industry. Recent financials highlight a net income increase to CNY 189 million from CNY 172 million last year, alongside consistent dividend payouts approved for shareholders this May at CNY 1.64 per ten shares.

- Click here to discover the nuances of Eastcompeace TechnologyLtd with our detailed analytical health report.

Understand Eastcompeace TechnologyLtd's track record by examining our Past report.

Jiangxi Xinyu Guoke Technology (SZSE:300722)

Simply Wall St Value Rating: ★★★★★★

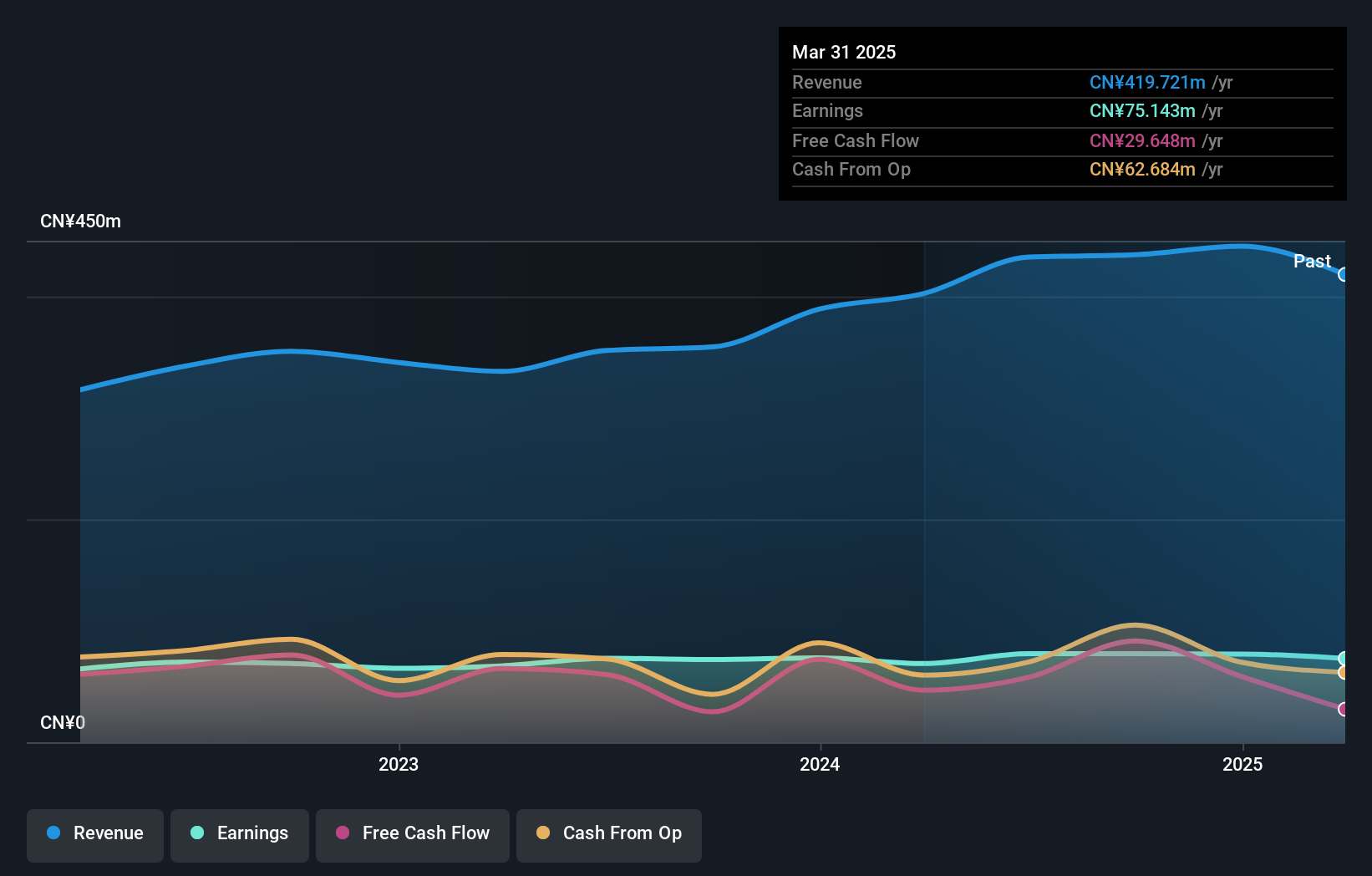

Overview: Jiangxi Xinyu Guoke Technology Co., Ltd specializes in the manufacturing and sale of military products, with a market capitalization of CN¥9.47 billion.

Operations: The company generates revenue primarily through the manufacturing and sale of military products. It has a market capitalization of CN¥9.47 billion, indicating its significant presence in the industry.

Jiangxi Xinyu Guoke Technology, a nimble player in its field, has shown resilience with a 6.3% earnings growth over the past year, outpacing the Aerospace & Defense industry's -12.4%. Despite this growth, recent financials indicate challenges as first-quarter revenue dropped to CNY 53.57 million from CNY 78.93 million last year and net income fell to CNY 4.08 million from CNY 8.12 million previously. The company remains debt-free and boasts high-quality earnings but faces volatility in share price recently noted over three months, reflecting potential investor uncertainty amidst these mixed signals.

EZconn (TWSE:6442)

Simply Wall St Value Rating: ★★★★★☆

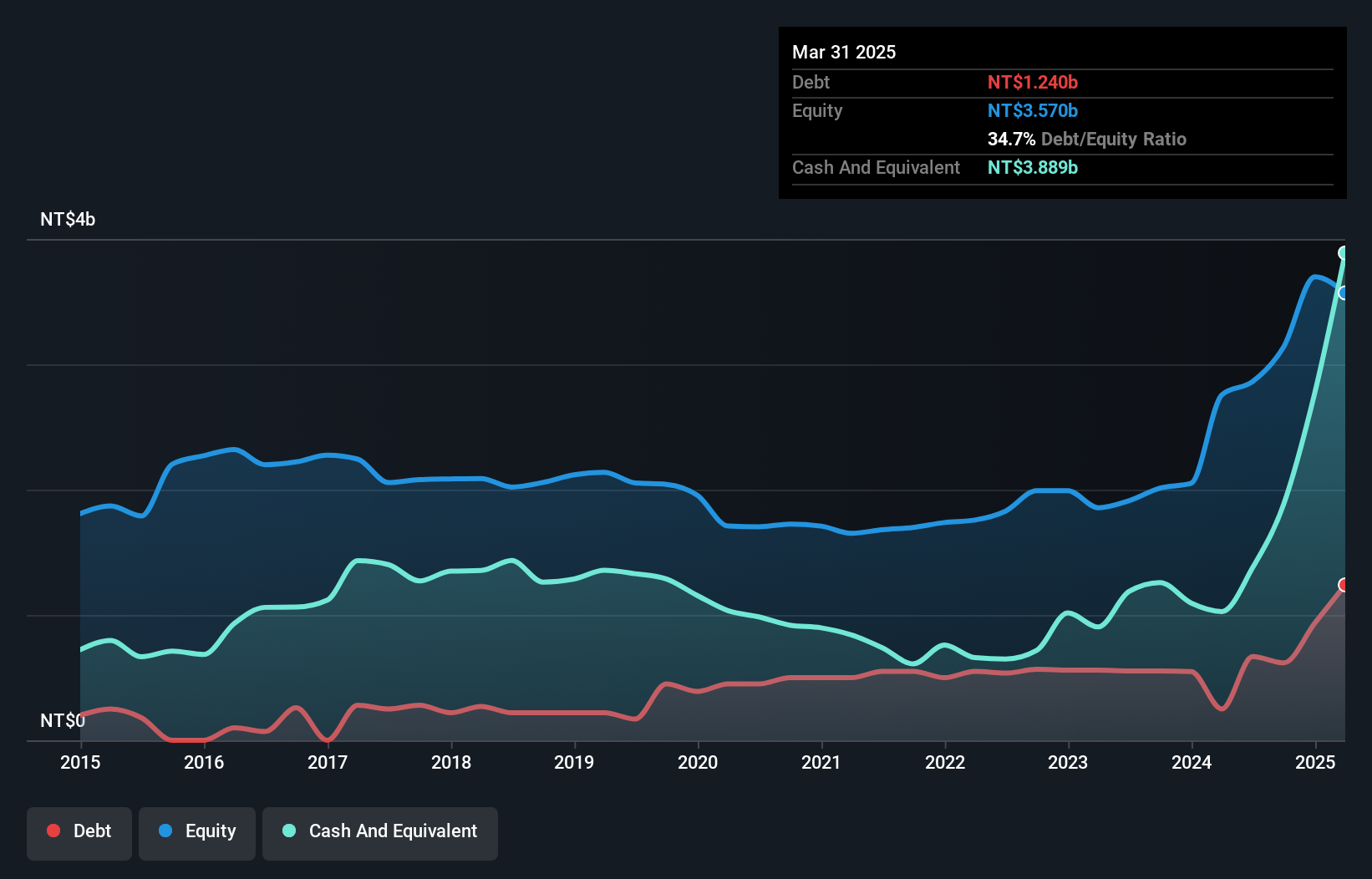

Overview: EZconn Corporation, along with its subsidiaries, is involved in the manufacturing and sale of precision metal components and optical fiber components for various electronic products across Taiwan, Asia, the United States, and Europe, with a market cap of NT$37.43 billion.

Operations: EZconn Corporation generates revenue primarily from its optical fiber components segment, contributing NT$7.06 billion, and high frequency connectors, adding NT$624.31 million. The company's market capitalization stands at NT$37.43 billion.

EZconn's impressive earnings growth of 344.7% over the past year outpaced the communications sector's -1.2%, highlighting its robust performance in a challenging industry landscape. While its debt to equity ratio increased from 26.3% to 34.7% over five years, it remains manageable with more cash than total debt, ensuring financial stability. Trading at a significant discount of 80.1% below estimated fair value suggests potential undervaluation, appealing for investors eyeing value opportunities. Recent share repurchase activity saw the company buy back 200,000 shares for TWD 66.48 million, signaling confidence in future prospects despite recent stock volatility.

- Unlock comprehensive insights into our analysis of EZconn stock in this health report.

Gain insights into EZconn's historical performance by reviewing our past performance report.

Summing It All Up

- Reveal the 3167 hidden gems among our Global Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastcompeace TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002017

Eastcompeace TechnologyLtd

Provides smart card and system solutions in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives