- China

- /

- Electronic Equipment and Components

- /

- SZSE:300476

Exploring Delton Technology Guangzhou And 2 High Growth Tech Stocks Globally

Reviewed by Simply Wall St

Amid ongoing trade policy uncertainty and inflation concerns, global markets have experienced notable volatility, with major indices like the S&P 500 and Russell 2000 posting significant declines. In this environment, identifying high-growth tech stocks such as Delton Technology Guangzhou requires a focus on companies with robust innovation capabilities and strong adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Delton Technology (Guangzhou) (SZSE:001389)

Simply Wall St Growth Rating: ★★★★★★

Overview: Delton Technology (Guangzhou) Inc. engages in the research, development, production, and sale of printed circuit boards both domestically and internationally, with a market capitalization of CN¥25.08 billion.

Operations: The company focuses on the research, development, production, and sale of printed circuit boards (PCBs) for both domestic and international markets. It operates with a market capitalization of CN¥25.08 billion.

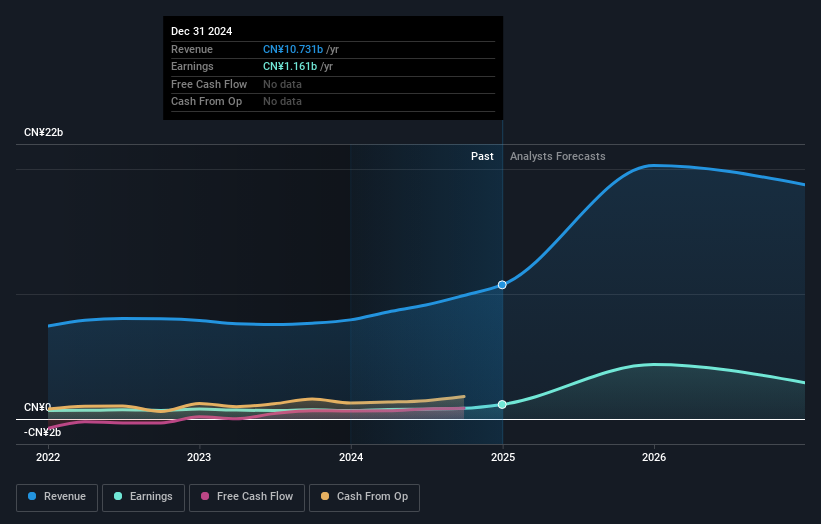

Delton Technology (Guangzhou) has demonstrated robust financial dynamics, with revenue growth projected at 20.2% annually, outpacing the Chinese market's average of 13.3%. This growth is complemented by an anticipated earnings increase of 29.5% per year, significantly above the market norm of 25.4%, underscoring the company's operational efficiency and market adaptability. Recently added to both the Shenzhen Stock Exchange Component Index and A Share Index, Delton's strategic positioning benefits from high non-cash earnings, indicating strong underlying profitability that could appeal to investors looking for companies with solid future prospects in high-tech sectors.

Victory Giant Technology (HuiZhou)Co.Ltd (SZSE:300476)

Simply Wall St Growth Rating: ★★★★★★

Overview: Victory Giant Technology (HuiZhou) Co., Ltd. is a company involved in the production of printed circuit boards, with a market capitalization of CN¥59.61 billion.

Operations: Victory Giant Technology (HuiZhou) Co., Ltd. focuses on the production of printed circuit boards, leveraging its expertise in this sector to generate significant revenue. The company's operations are underpinned by a robust market presence, as evidenced by its substantial market capitalization of CN¥59.61 billion.

Victory Giant Technology (HuiZhou)Co.Ltd has showcased a significant growth trajectory with its revenue and earnings expanding at 24.2% and 31.1% per year respectively, outstripping the broader Chinese market averages of 13.3% and 25.4%. This performance is bolstered by substantial R&D investments, which have increased to CNY 1.5 billion in the latest fiscal year, representing about 14% of total revenue—a clear indicator of the firm's commitment to innovation and technological advancement. The company's recent strategic share repurchases, totaling CNY 70 million for approximately 0.19% of outstanding shares, reflect a proactive approach in enhancing shareholder value amidst this high growth phase.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ANYCOLOR Inc. is an entertainment company with operations in Japan and internationally, and it has a market cap of ¥178.70 billion.

Operations: ANYCOLOR Inc. generates revenue primarily through its entertainment operations in Japan and international markets. The company focuses on creating engaging content and experiences, leveraging its creative assets to drive growth in the entertainment sector.

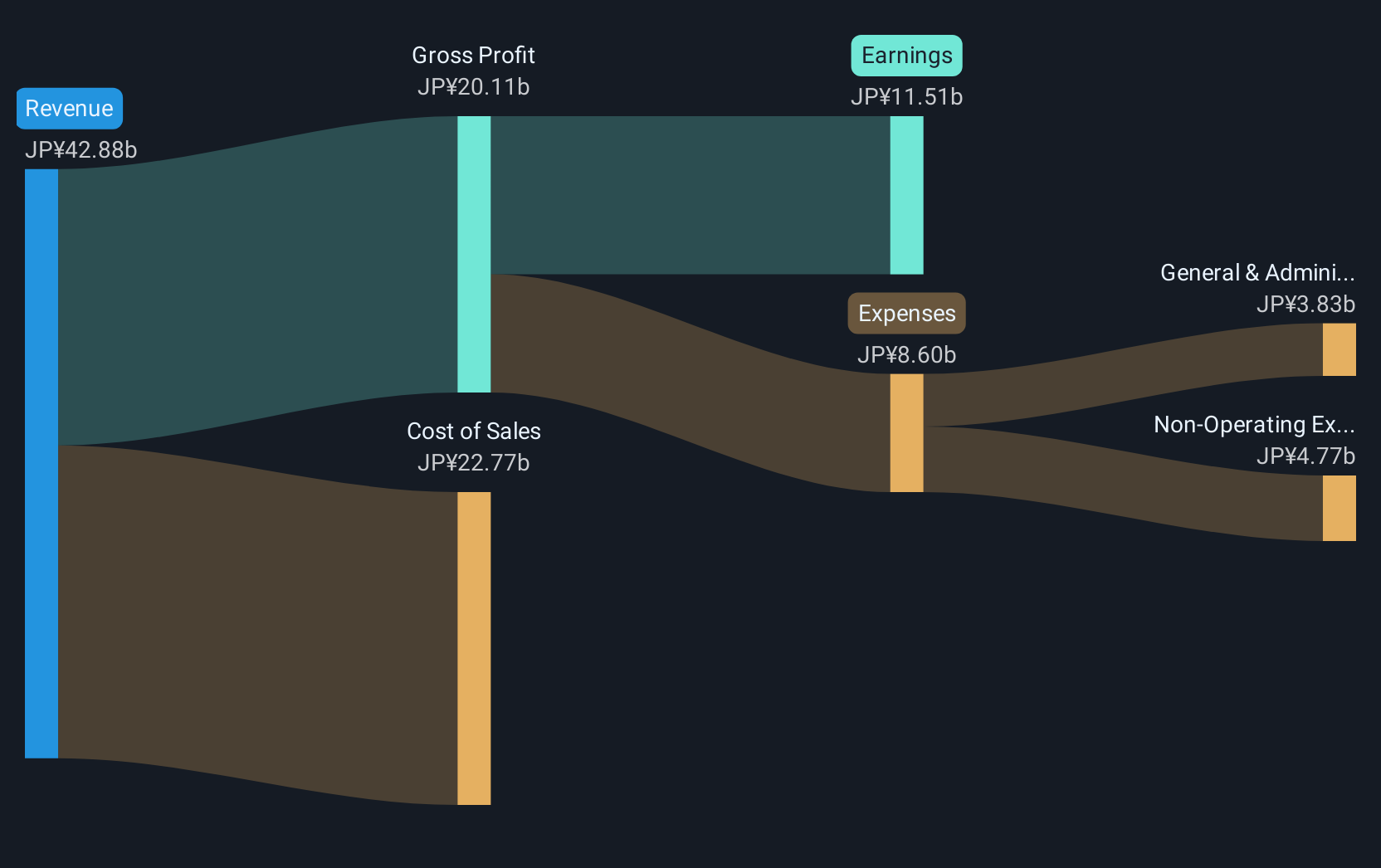

ANYCOLOR Inc. has demonstrated robust growth, with earnings surging by 29.8% over the past year, outpacing the entertainment industry's average of 8.5%. This performance is underpinned by a commitment to innovation, as evidenced by substantial R&D investments that align with revenue growth expectations of 13.6% per year, faster than Japan's market average of 4.2%. Despite a highly volatile share price in recent months, the company’s strategic focus on expanding its technological capabilities and enhancing shareholder value through proactive share repurchases positions it well within the competitive tech landscape.

- Delve into the full analysis health report here for a deeper understanding of ANYCOLOR.

Assess ANYCOLOR's past performance with our detailed historical performance reports.

Seize The Opportunity

- Investigate our full lineup of 791 Global High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300476

Victory Giant Technology (HuiZhou)Co.Ltd

Victory Giant Technology (HuiZhou)Co.,Ltd.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives