- China

- /

- Electronic Equipment and Components

- /

- SZSE:000970

Exploring High Growth Tech Stocks This February 2025

Reviewed by Simply Wall St

Amidst geopolitical tensions and consumer spending concerns, U.S. markets have experienced volatility, with major indexes like the S&P 500 initially reaching record highs before closing the week lower due to tariff fears and economic uncertainty. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability in response to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.86% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1192 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

OPT Machine Vision Tech (SHSE:688686)

Simply Wall St Growth Rating: ★★★★★☆

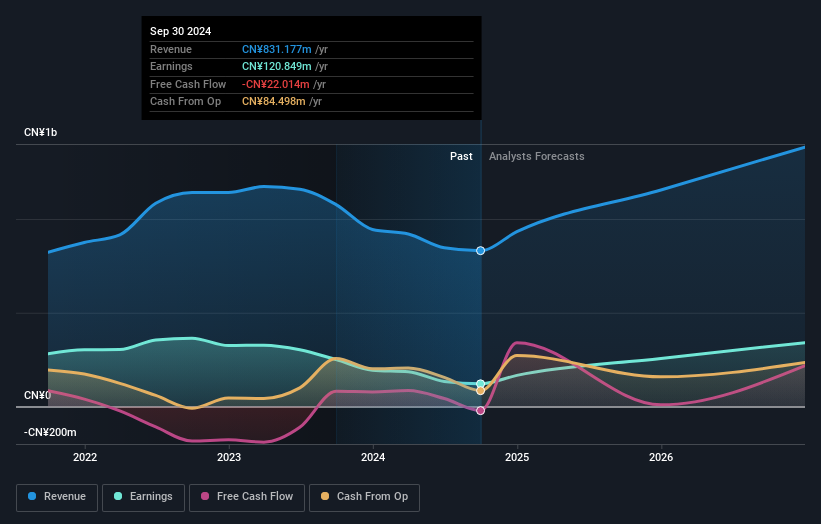

Overview: OPT Machine Vision Tech Co., Ltd. develops and supplies components and software for factory automation worldwide, with a market cap of CN¥12.14 billion.

Operations: The company generates revenue primarily from its Photographic Equipment & Supplies segment, with sales amounting to CN¥831.18 million.

Despite a challenging year with a 51.6% drop in earnings, OPT Machine Vision Tech is poised for significant recovery, projecting an annual earnings growth of 42.9%. This outpaces the broader Chinese market's forecast of 25.3%, underscoring the company's potential resilience and adaptability in the tech sector. Additionally, its commitment to innovation is evident from recent activities, including a share buyback program where it repurchased shares worth CNY 4.91 million, enhancing shareholder value. However, investors should note the volatility in its share price and a decrease in profit margins from 23.2% to 14.5%, which could suggest underlying challenges despite optimistic growth projections.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Simply Wall St Growth Rating: ★★★★☆☆

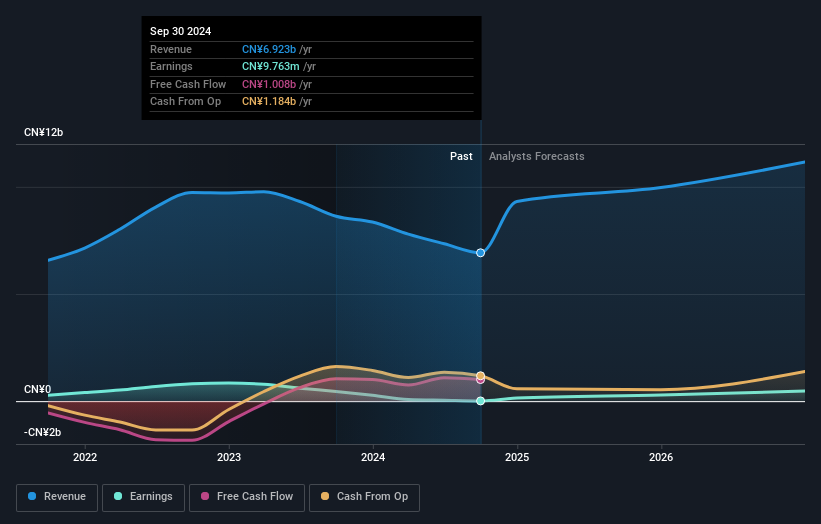

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. specializes in the production and development of high-performance magnetic materials, with a market cap of CN¥14.31 billion.

Operations: The company focuses on producing high-performance magnetic materials, generating revenue primarily from this segment. Its market cap stands at CN¥14.31 billion, reflecting its significant presence in the industry.

Beijing Zhong Ke San Huan High-Tech has demonstrated a robust trajectory with an expected annual profit growth of 82.8%, significantly outpacing the broader Chinese market's forecast of 25.3%. This growth is supported by strategic initiatives like the recent shareholders meeting focused on enhancing working capital through surplus funds from a rights issue, which could bolster future operations. Despite facing challenges with a past earnings decline of 97.9% and low current profit margins at 0.1%, the company's revenue growth projection stands at 16.4% annually, indicating potential resilience and adaptability in its sector. These elements combined suggest that while there are hurdles, Beijing Zhong Ke San Huan High-Tech is positioning itself for meaningful progress in the tech landscape.

SDIC Intelligence Xiamen Information (SZSE:300188)

Simply Wall St Growth Rating: ★★★★☆☆

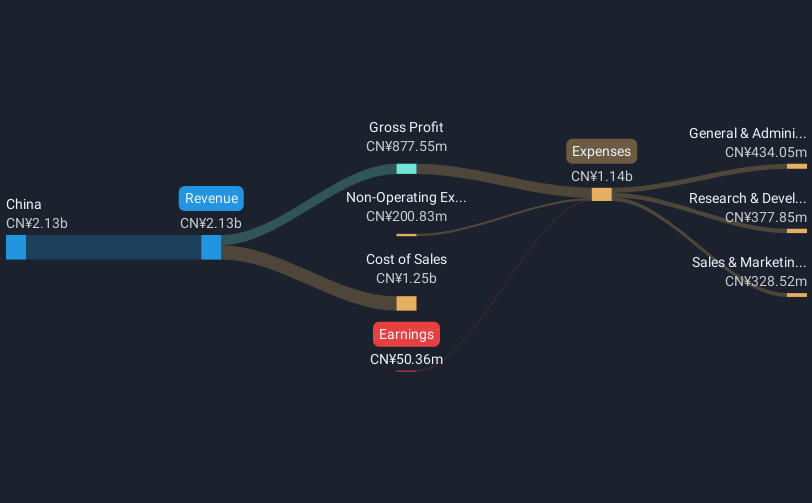

Overview: SDIC Intelligence Xiamen Information Co., Ltd. operates within the technology sector and has a market capitalization of CN¥14.06 billion.

Operations: SDIC Intelligence Xiamen Information focuses on technology-driven solutions, with a market capitalization of CN¥14.06 billion.

SDIC Intelligence Xiamen Information, amid a tech landscape where innovation is paramount, has shown promising growth dynamics. With an annual revenue increase of 15.8%, the company outpaces the average market growth rate in China. Its commitment to innovation is underscored by significant R&D investments, totaling 12% of its revenue last year. This strategic focus on development not only fuels its software solutions but also positions it advantageously within AI advancements, a sector witnessing exponential demand and application diversity. Despite challenges like a competitive market and initial unprofitability, SDIC's robust investment in technology and potential for scalability suggest it could play a pivotal role in shaping future tech trends.

- Dive into the specifics of SDIC Intelligence Xiamen Information here with our thorough health report.

Understand SDIC Intelligence Xiamen Information's track record by examining our Past report.

Seize The Opportunity

- Navigate through the entire inventory of 1192 High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Zhong Ke San Huan High-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000970

Beijing Zhong Ke San Huan High-Tech

Beijing Zhong Ke San Huan High-Tech Co., Ltd.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives