3 Asian Stocks Estimated To Be Trading At Up To 47.8% Below Intrinsic Value

Reviewed by Simply Wall St

Amidst a backdrop of global trade tensions and evolving economic policies, Asian markets have been navigating a complex landscape. Despite these challenges, opportunities arise for investors seeking value in stocks that may be trading below their intrinsic worth. In this context, identifying undervalued stocks can be particularly appealing as they offer potential for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pansoft (SZSE:300996) | CN¥20.65 | CN¥39.72 | 48% |

| Micronics Japan (TSE:6871) | ¥3115.00 | ¥5989.21 | 48% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | CN¥15.78 | CN¥30.57 | 48.4% |

| Lingbao Gold Group (SEHK:3330) | HK$9.05 | HK$18.08 | 49.9% |

| Taiyo Yuden (TSE:6976) | ¥2135.50 | ¥4111.30 | 48.1% |

| Renesas Electronics (TSE:6723) | ¥1715.50 | ¥3417.17 | 49.8% |

| Rakus (TSE:3923) | ¥2221.50 | ¥4339.94 | 48.8% |

| Suzhou Dongshan Precision Manufacturing (SZSE:002384) | CN¥26.71 | CN¥51.43 | 48.1% |

| giftee (TSE:4449) | ¥1598.00 | ¥3071.15 | 48% |

| Yuhan (KOSE:A000100) | ₩109700.00 | ₩219128.89 | 49.9% |

Let's review some notable picks from our screened stocks.

Zhaojin Mining Industry (SEHK:1818)

Overview: Zhaojin Mining Industry Company Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and other metallic products both within China and internationally, with a market cap of approximately HK$68.23 billion.

Operations: The company generates revenue from the exploration, mining, processing, smelting, and sale of gold and other metallic products in China and internationally.

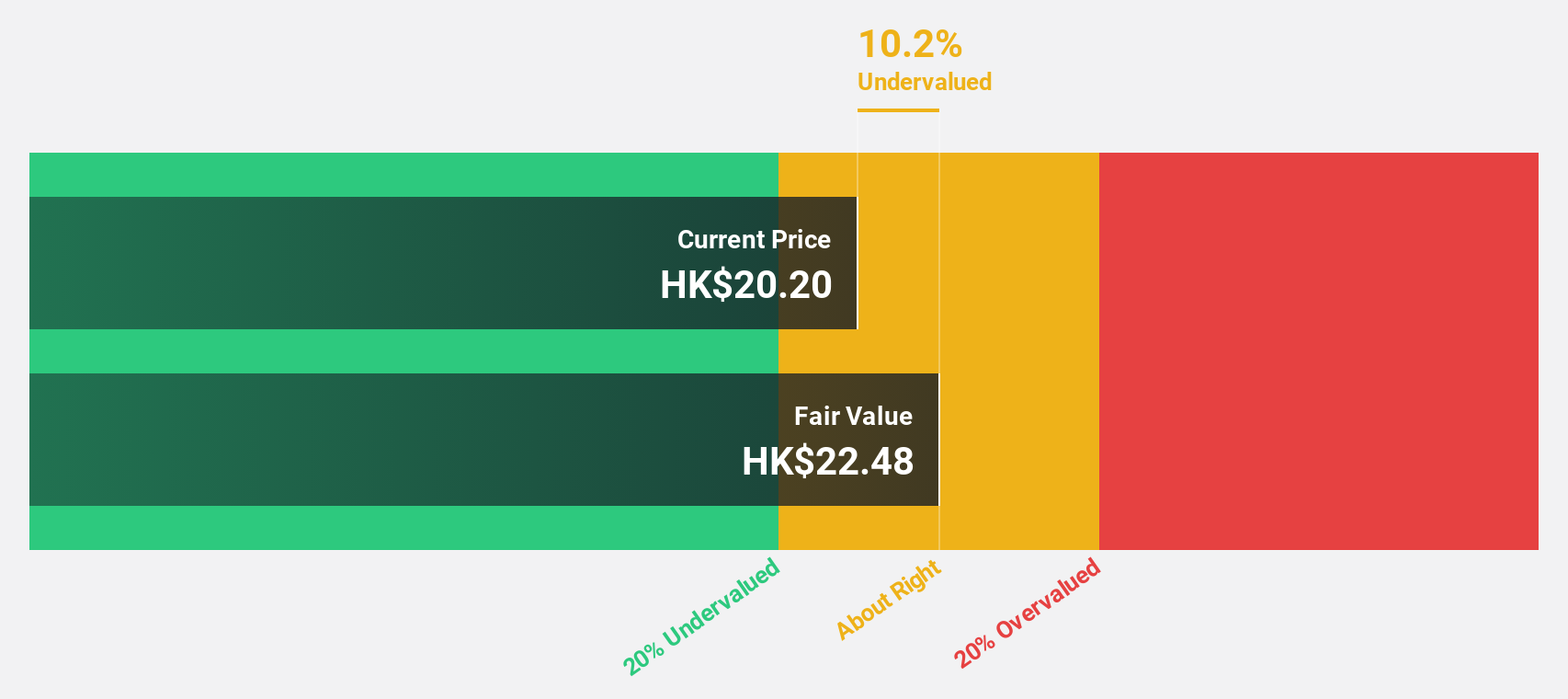

Estimated Discount To Fair Value: 10.2%

Zhaojin Mining Industry's recent earnings report highlights a robust increase in sales and net income, with sales reaching CNY 3.04 billion and net income at CNY 659.18 million for Q1 2025. The company is trading slightly below its estimated fair value of HK$21.44 at HK$19.26, suggesting potential undervaluation based on cash flows. However, debt coverage by operating cash flow remains a concern despite strong profit growth forecasts exceeding market averages.

- The analysis detailed in our Zhaojin Mining Industry growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Zhaojin Mining Industry stock in this financial health report.

AVIC Heavy Machinery (SHSE:600765)

Overview: AVIC Heavy Machinery Co., Ltd. operates in forging, casting, and hydraulic environmental sectors in China with a market cap of CN¥25.24 billion.

Operations: The company's revenue primarily comes from its operations in forging, casting, and hydraulic environmental sectors within China.

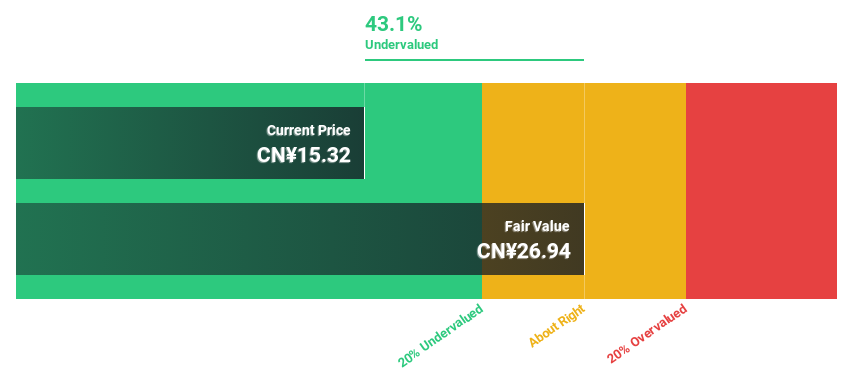

Estimated Discount To Fair Value: 38.7%

AVIC Heavy Machinery is trading significantly below its estimated fair value of CN¥26.11, despite earnings growth forecasts of 48.5% annually, surpassing the market average. However, recent financials show a decline in Q1 2025 revenue to CN¥2.31 billion from CN¥2.92 billion year-on-year and net income falling to CN¥197.81 million from CN¥324.12 million, indicating challenges in profit margins and sustainability concerns for its dividend coverage by cash flows amidst these earnings pressures.

- In light of our recent growth report, it seems possible that AVIC Heavy Machinery's financial performance will exceed current levels.

- Take a closer look at AVIC Heavy Machinery's balance sheet health here in our report.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. operates in the high-tech sector with a focus on advanced material manufacturing, and it has a market cap of CN¥13.29 billion.

Operations: Beijing Zhong Ke San Huan High-Tech Co., Ltd. generates its revenue primarily from advanced material manufacturing within the high-tech sector.

Estimated Discount To Fair Value: 47.8%

Beijing Zhong Ke San Huan High-Tech is trading at CN¥11.04, significantly below its estimated fair value of CN¥21.13, suggesting undervaluation based on cash flows. Despite a decline in Q1 2025 revenue to CN¥1.46 billion from CN¥1.65 billion year-on-year, the company turned a net income of CN¥13.49 million compared to a loss previously, showing potential for recovery in profitability with earnings growth forecasted at 43.9% annually over the next three years.

- Our growth report here indicates Beijing Zhong Ke San Huan High-Tech may be poised for an improving outlook.

- Click here to discover the nuances of Beijing Zhong Ke San Huan High-Tech with our detailed financial health report.

Turning Ideas Into Actions

- Access the full spectrum of 259 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AVIC Heavy Machinery, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600765

AVIC Heavy Machinery

Engages in forging, casting, hydraulic environmental and other business in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives