- China

- /

- Electronic Equipment and Components

- /

- SZSE:000925

Not Many Are Piling Into UniTTEC Co.,Ltd (SZSE:000925) Just Yet

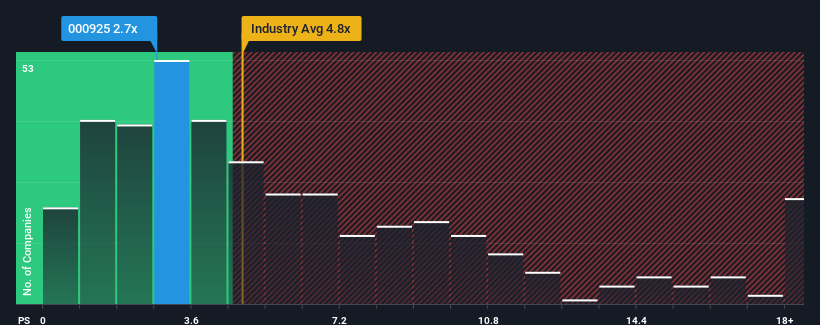

With a price-to-sales (or "P/S") ratio of 2.7x UniTTEC Co.,Ltd (SZSE:000925) may be sending bullish signals at the moment, given that almost half of all the Electronic companies in China have P/S ratios greater than 4.8x and even P/S higher than 9x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for UniTTECLtd

How Has UniTTECLtd Performed Recently?

UniTTECLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on UniTTECLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as UniTTECLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 9.0% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 29% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 37% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this information, we find it odd that UniTTECLtd is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does UniTTECLtd's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at UniTTECLtd's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - UniTTECLtd has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000925

UniTTECLtd

Provides integrated solutions in the areas of rail transit, digitalization, semiconductors, and environmental protection in China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026