- China

- /

- Electronic Equipment and Components

- /

- SZSE:000823

Undiscovered Gems In Global Featuring 3 Promising Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

In recent weeks, global markets have experienced notable gains, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 outperforming their larger counterparts amid strong U.S. job growth and resilient economic indicators. As investors navigate these dynamic conditions, identifying stocks with robust fundamentals becomes crucial, especially in the small-cap sector where opportunities for growth often lie beneath the surface.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 10.29% | 36.24% | 62.32% | ★★★★★☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Guangdong Ellington Electronics TechnologyLtd (SHSE:603328)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Ellington Electronics Technology Co., Ltd specializes in the research, development, manufacturing, and sale of high-precision, high-density double-layer and multi-layer printed circuit boards in China with a market cap of CN¥10.44 billion.

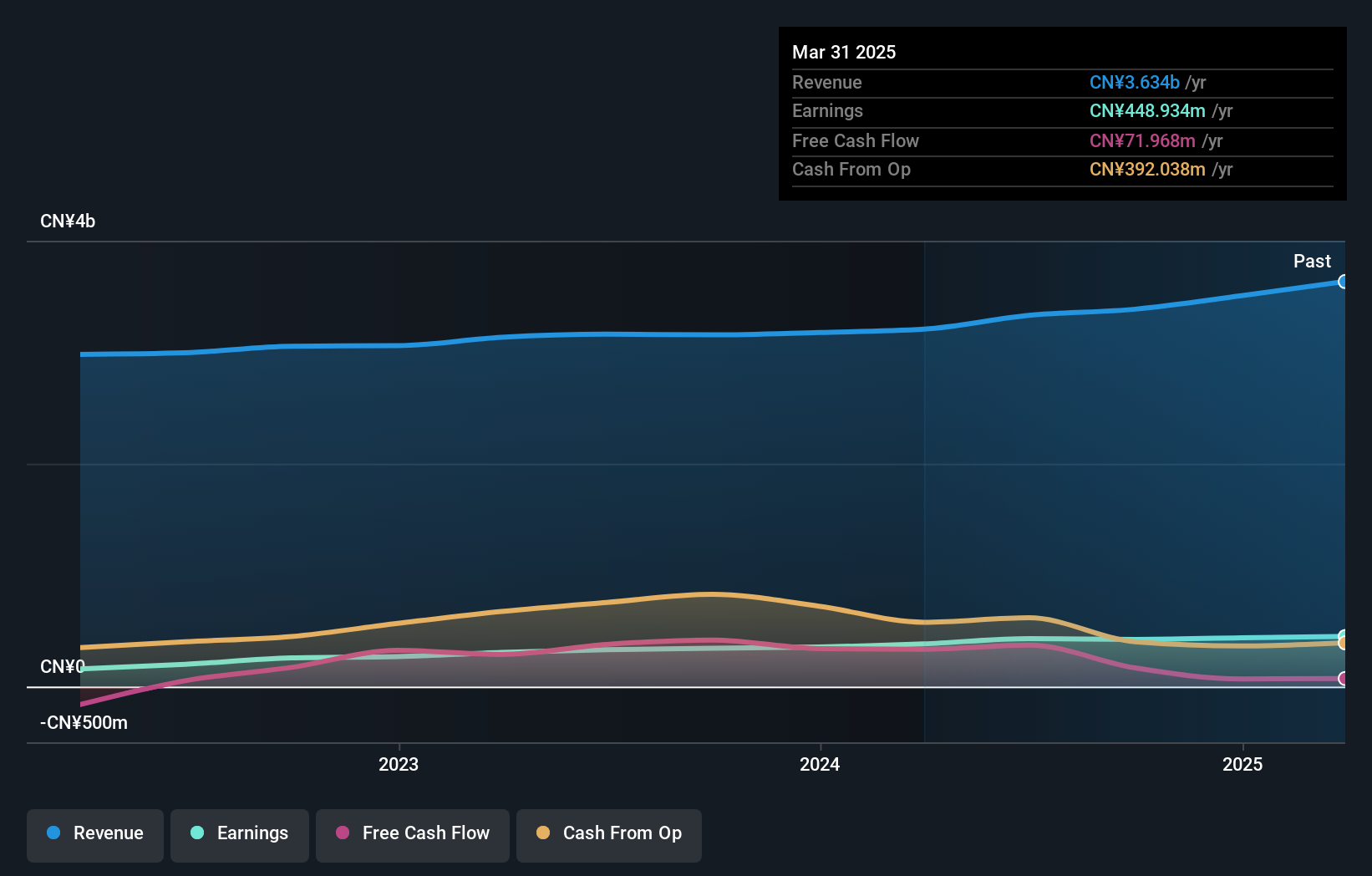

Operations: Ellington's primary revenue stream is from its printed circuit board industry, generating CN¥3.63 billion. The company's financial performance can be analyzed through its gross profit margin, which reflects the efficiency of production and pricing strategies within this segment.

Ellington Electronics, a smaller player in the electronics sector, showcases promising growth with earnings rising by 17.2% over the past year, outpacing industry norms. Its recent quarter saw sales jump to CNY 946 million from CNY 819 million previously, while net income increased to CNY 116 million from CNY 105 million. Despite a rise in its debt-to-equity ratio to 13.3% over five years, it remains manageable due to having more cash than total debt and maintaining positive free cash flow. The price-to-earnings ratio of 23.5x suggests good value compared to the broader market's higher average of 40.1x.

Guangdong Goworld (SZSE:000823)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Goworld Co., Ltd. operates in China, offering electronic components and ultrasonic electronic instruments, with a market cap of CN¥7.02 billion.

Operations: The company generates revenue through its electronic components and ultrasonic electronic instruments segments. It has a market capitalization of CN¥7.02 billion.

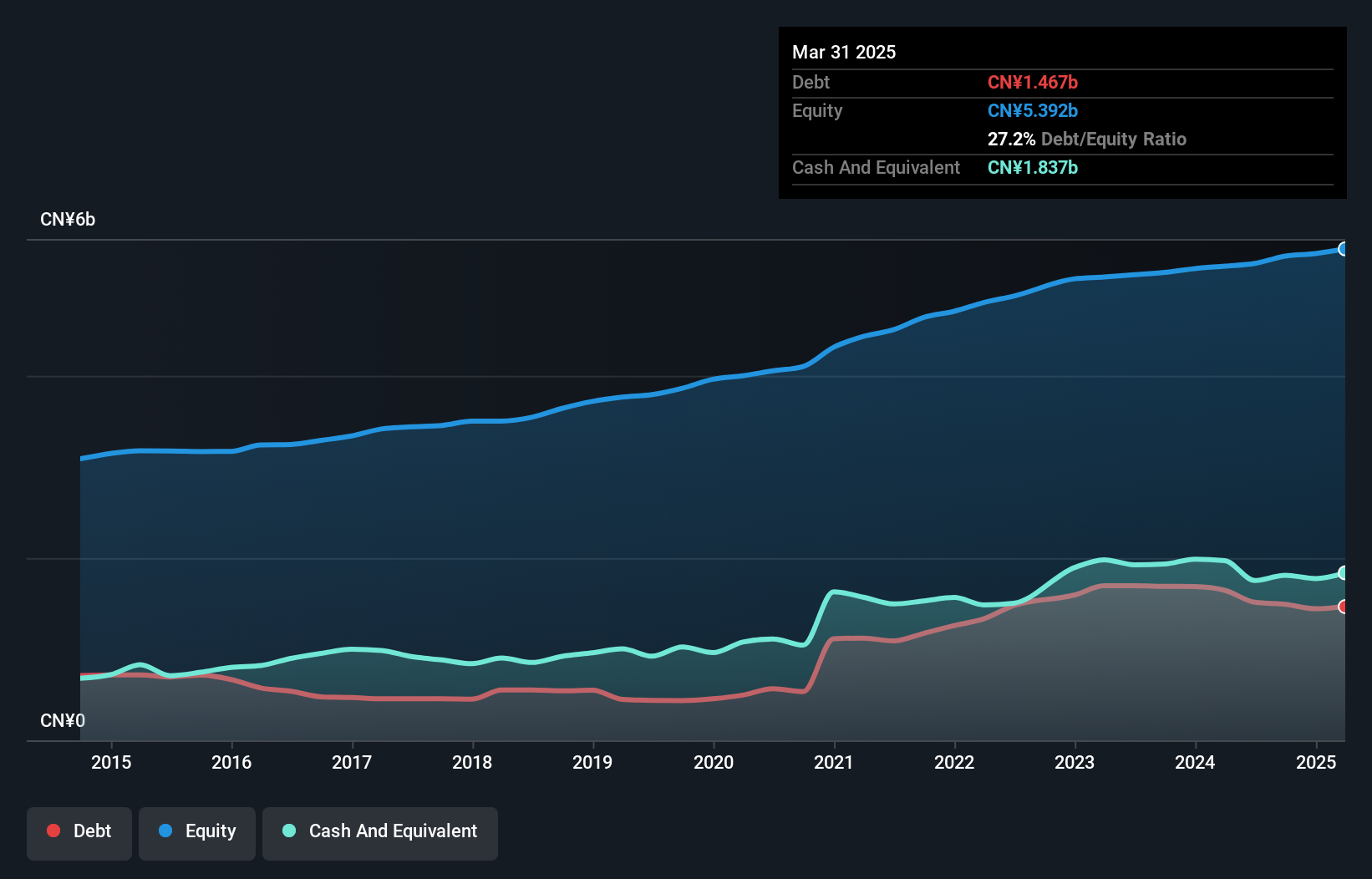

Guangdong Goworld, a dynamic player in the electronics sector, has demonstrated robust financial health with its interest payments well covered by EBIT at 9.9 times. Over the past year, earnings surged by 21%, surpassing the industry's growth of 2.9%. Despite a challenging five-year period with a yearly earnings drop of 9.6%, recent performance shows promise as Q1 sales increased to CNY 1,466 million from CNY 1,266 million last year and net income rose to CNY 41.77 million from CNY 17.24 million. The company declared a dividend of CNY 2 per ten shares for fiscal year-end April 2025, reflecting confidence in future prospects despite its increased debt-to-equity ratio over five years from 12.4% to 27.2%.

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. is a company engaged in the electronic technology industry with a market capitalization of CN¥9.08 billion.

Operations: The company's revenue streams are primarily derived from its operations in the electronic technology sector. It has a market capitalization of CN¥9.08 billion, reflecting its scale within the industry.

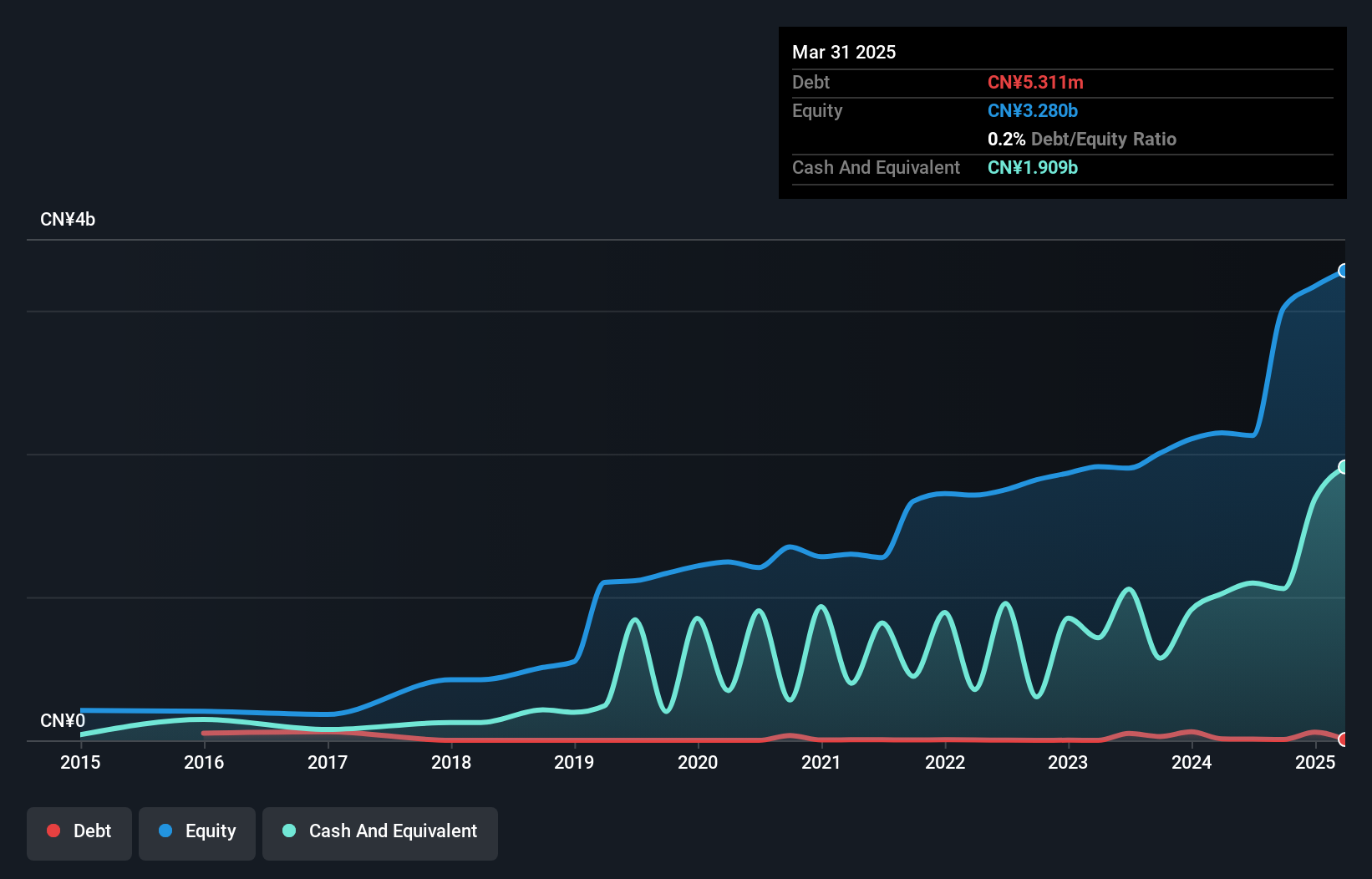

Suzhou Hengmingda Electronic Technology, a smaller player in the electronics sector, has demonstrated robust growth with earnings surging by 59.5% over the past year, significantly outpacing the industry average of 2.9%. The company boasts high-quality earnings and maintains a favorable debt position with more cash than its total debt. Recently, it completed a share buyback of 5.52 million shares for CNY 159.99 million, enhancing shareholder value. Its price-to-earnings ratio stands at an attractive 18.3x compared to the CN market's 40.1x, suggesting potential undervaluation in this competitive landscape.

Next Steps

- Investigate our full lineup of 3164 Global Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000823

Guangdong Goworld

Provides electronic components and ultrasonic electronic instruments in China.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives