- China

- /

- Tech Hardware

- /

- SZSE:000066

Investors Still Aren't Entirely Convinced By China Greatwall Technology Group Co., Ltd.'s (SZSE:000066) Revenues Despite 30% Price Jump

China Greatwall Technology Group Co., Ltd. (SZSE:000066) shares have had a really impressive month, gaining 30% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 65%.

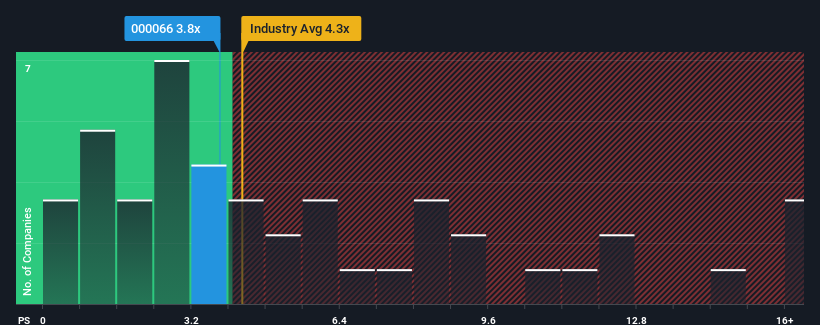

Although its price has surged higher, you could still be forgiven for feeling indifferent about China Greatwall Technology Group's P/S ratio of 3.8x, since the median price-to-sales (or "P/S") ratio for the Tech industry in China is also close to 4.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for China Greatwall Technology Group

What Does China Greatwall Technology Group's P/S Mean For Shareholders?

China Greatwall Technology Group could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think China Greatwall Technology Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For China Greatwall Technology Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like China Greatwall Technology Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 21% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 25% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 19% growth forecast for the broader industry.

In light of this, it's curious that China Greatwall Technology Group's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now China Greatwall Technology Group's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at China Greatwall Technology Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for China Greatwall Technology Group that you need to be mindful of.

If these risks are making you reconsider your opinion on China Greatwall Technology Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000066

China Greatwall Technology Group

China Greatwall Technology Group Co., Ltd.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives