- China

- /

- Tech Hardware

- /

- SZSE:000066

Despite currently being unprofitable, China Greatwall Technology Group (SZSE:000066) has delivered a 51% return to shareholders over 1 year

The China Greatwall Technology Group Co., Ltd. (SZSE:000066) share price has had a bad week, falling 14%. But that doesn't change the reality that over twelve months the stock has done really well. Looking at the full year, the company has easily bested an index fund by gaining 51%.

While the stock has fallen 14% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for China Greatwall Technology Group

China Greatwall Technology Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

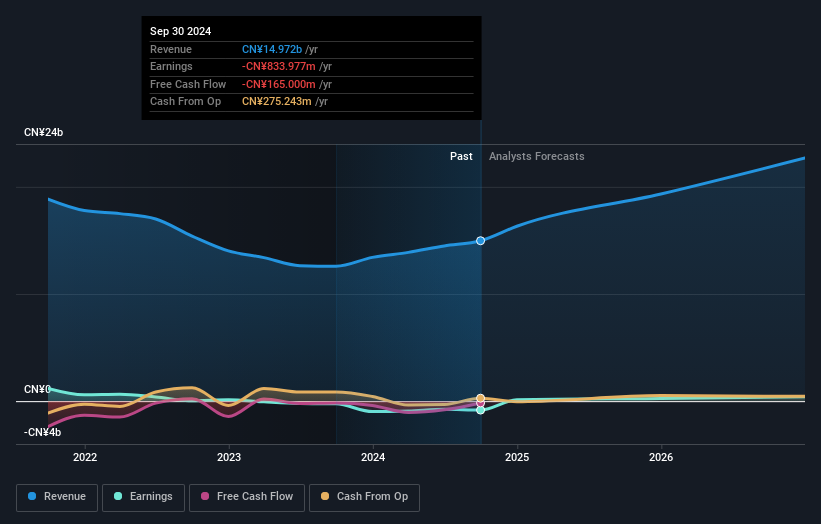

Over the last twelve months, China Greatwall Technology Group's revenue grew by 19%. We respect that sort of growth, no doubt. While the share price performed well, gaining 51% over twelve months, you could argue the revenue growth warranted it. If revenue stays on trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on China Greatwall Technology Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that China Greatwall Technology Group shareholders have received a total shareholder return of 51% over one year. That's better than the annualised return of 1.8% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand China Greatwall Technology Group better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for China Greatwall Technology Group (of which 1 is concerning!) you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000066

China Greatwall Technology Group

China Greatwall Technology Group Co., Ltd.

Reasonable growth potential with mediocre balance sheet.