- China

- /

- Electronic Equipment and Components

- /

- SZSE:000050

Why Investors Shouldn't Be Surprised By Tianma Microelectronics Co., Ltd.'s (SZSE:000050) Low P/S

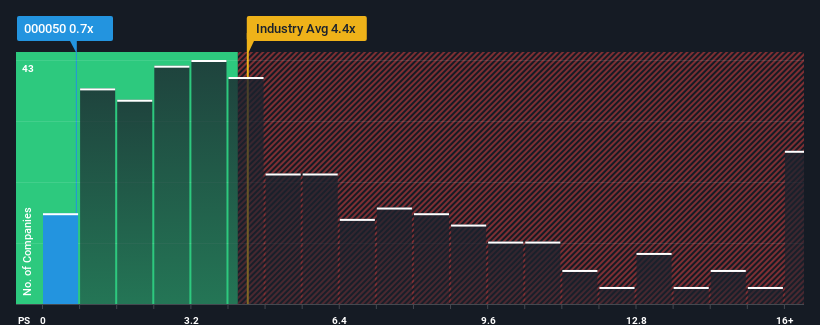

With a price-to-sales (or "P/S") ratio of 0.7x Tianma Microelectronics Co., Ltd. (SZSE:000050) may be sending very bullish signals at the moment, given that almost half of all the Electronic companies in China have P/S ratios greater than 4.4x and even P/S higher than 9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Tianma Microelectronics

How Tianma Microelectronics Has Been Performing

While the industry has experienced revenue growth lately, Tianma Microelectronics' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tianma Microelectronics.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Tianma Microelectronics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.1%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 14% as estimated by the three analysts watching the company. With the industry predicted to deliver 26% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Tianma Microelectronics is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Tianma Microelectronics' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Tianma Microelectronics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Tianma Microelectronics, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tianma Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000050

Tianma Microelectronics

Designs, manufactures, and supplies display solutions and related support services worldwide.

Undervalued with moderate growth potential.

Market Insights

Community Narratives