- China

- /

- Electronic Equipment and Components

- /

- SZSE:000045

Shenzhen Textile (Holdings)'s (SZSE:000045) Upcoming Dividend Will Be Larger Than Last Year's

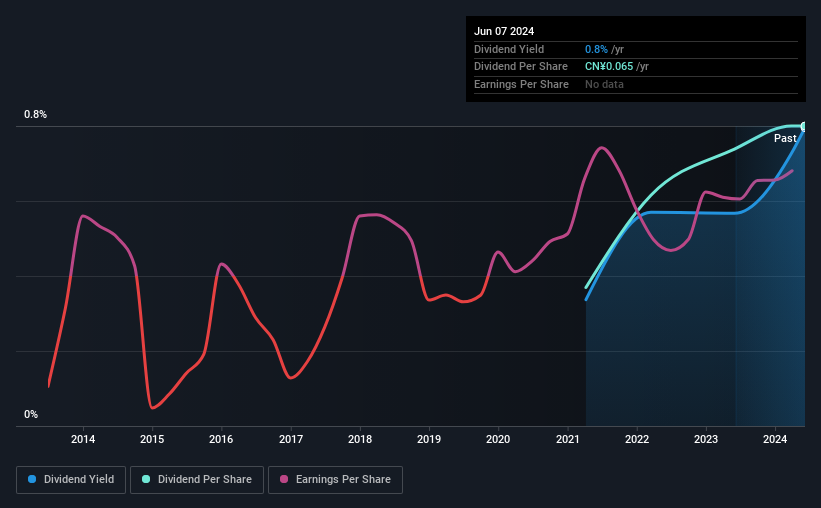

Shenzhen Textile (Holdings) Co., Ltd. (SZSE:000045) has announced that it will be increasing its periodic dividend on the 13th of June to CN¥0.065, which will be 8.3% higher than last year's comparable payment amount of CN¥0.06. Despite this raise, the dividend yield of 0.8% is only a modest boost to shareholder returns.

View our latest analysis for Shenzhen Textile (Holdings)

Shenzhen Textile (Holdings)'s Earnings Easily Cover The Distributions

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. However, Shenzhen Textile (Holdings)'s earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS could expand by 37.6% if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio will be 34%, which is in the range that makes us comfortable with the sustainability of the dividend.

Shenzhen Textile (Holdings) Is Still Building Its Track Record

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. The annual payment during the last 3 years was CN¥0.03 in 2021, and the most recent fiscal year payment was CN¥0.065. This implies that the company grew its distributions at a yearly rate of about 29% over that duration. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Shenzhen Textile (Holdings) has impressed us by growing EPS at 38% per year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

We Really Like Shenzhen Textile (Holdings)'s Dividend

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for Shenzhen Textile (Holdings) that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000045

Shenzhen Textile (Holdings)

Engages in the research and development, production, sale, and marketing of polarizers in China and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.