- China

- /

- Electronic Equipment and Components

- /

- SHSE:688661

Revenues Tell The Story For Suzhou UIGreen Micro&Nano Technologies Co.,Ltd (SHSE:688661) As Its Stock Soars 26%

Suzhou UIGreen Micro&Nano Technologies Co.,Ltd (SHSE:688661) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

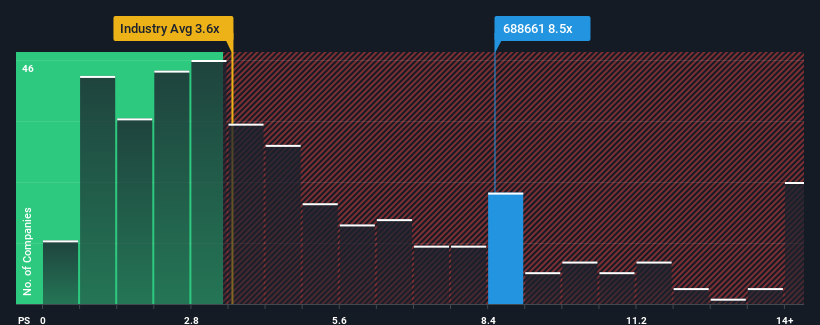

Since its price has surged higher, you could be forgiven for thinking Suzhou UIGreen Micro&Nano TechnologiesLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8.5x, considering almost half the companies in China's Electronic industry have P/S ratios below 3.6x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Suzhou UIGreen Micro&Nano TechnologiesLtd

What Does Suzhou UIGreen Micro&Nano TechnologiesLtd's Recent Performance Look Like?

Recent times have been advantageous for Suzhou UIGreen Micro&Nano TechnologiesLtd as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Suzhou UIGreen Micro&Nano TechnologiesLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Suzhou UIGreen Micro&Nano TechnologiesLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 91% last year. The latest three year period has also seen a 28% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 101% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this information, we can see why Suzhou UIGreen Micro&Nano TechnologiesLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Suzhou UIGreen Micro&Nano TechnologiesLtd's P/S

Shares in Suzhou UIGreen Micro&Nano TechnologiesLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Suzhou UIGreen Micro&Nano TechnologiesLtd shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Suzhou UIGreen Micro&Nano TechnologiesLtd that you need to take into consideration.

If these risks are making you reconsider your opinion on Suzhou UIGreen Micro&Nano TechnologiesLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688661

Suzhou UIGreen Micro&Nano TechnologiesLtd

Engages in the research and development, production, and sale of micro-electromechanical (MEMS) fine components and semiconductor test probe products in China and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.