- China

- /

- Tech Hardware

- /

- SHSE:688636

Market Participants Recognise Chengdu Zhimingda Electronics Co., Ltd.'s (SHSE:688636) Earnings Pushing Shares 28% Higher

Chengdu Zhimingda Electronics Co., Ltd. (SHSE:688636) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

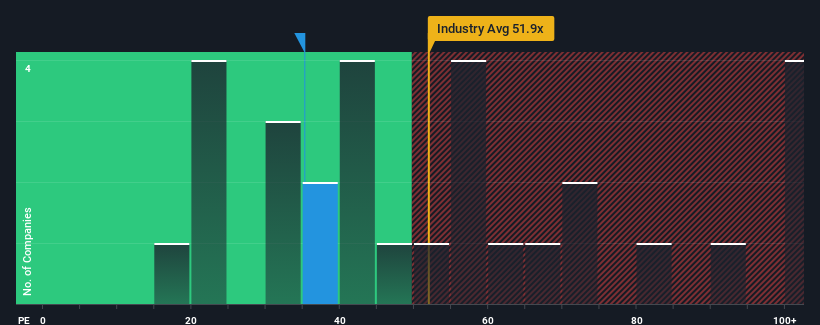

After such a large jump in price, Chengdu Zhimingda Electronics may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 35.2x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Chengdu Zhimingda Electronics has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Chengdu Zhimingda Electronics

Is There Enough Growth For Chengdu Zhimingda Electronics?

The only time you'd be truly comfortable seeing a P/E as high as Chengdu Zhimingda Electronics' is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 27%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 16% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 61% over the next year. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Chengdu Zhimingda Electronics' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The large bounce in Chengdu Zhimingda Electronics' shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Chengdu Zhimingda Electronics' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Chengdu Zhimingda Electronics with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Chengdu Zhimingda Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688636

Chengdu Zhimingda Electronics

Provides customized embedded modules and solutions in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026