- China

- /

- Communications

- /

- SZSE:300559

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets face renewed trade policy uncertainties and fluctuating economic indicators, the Asian technology sector continues to capture investor interest with its potential for high growth. In such a dynamic environment, identifying strong tech stocks often involves assessing their ability to innovate and adapt amidst shifting market sentiments and geopolitical developments.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.05% | 23.29% | ★★★★★★ |

| Ugreen Group | 20.48% | 26.28% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Shengyi Electronics (SHSE:688183)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shengyi Electronics Co., Ltd. is involved in the research, development, production, and sales of various printed circuit boards in China with a market cap of CN¥42.96 billion.

Operations: Shengyi Electronics focuses on the production and sales of printed circuit boards, leveraging its research and development capabilities to serve the Chinese market. The company's operations are supported by a market capitalization of CN¥42.96 billion, indicating its significant presence in the industry.

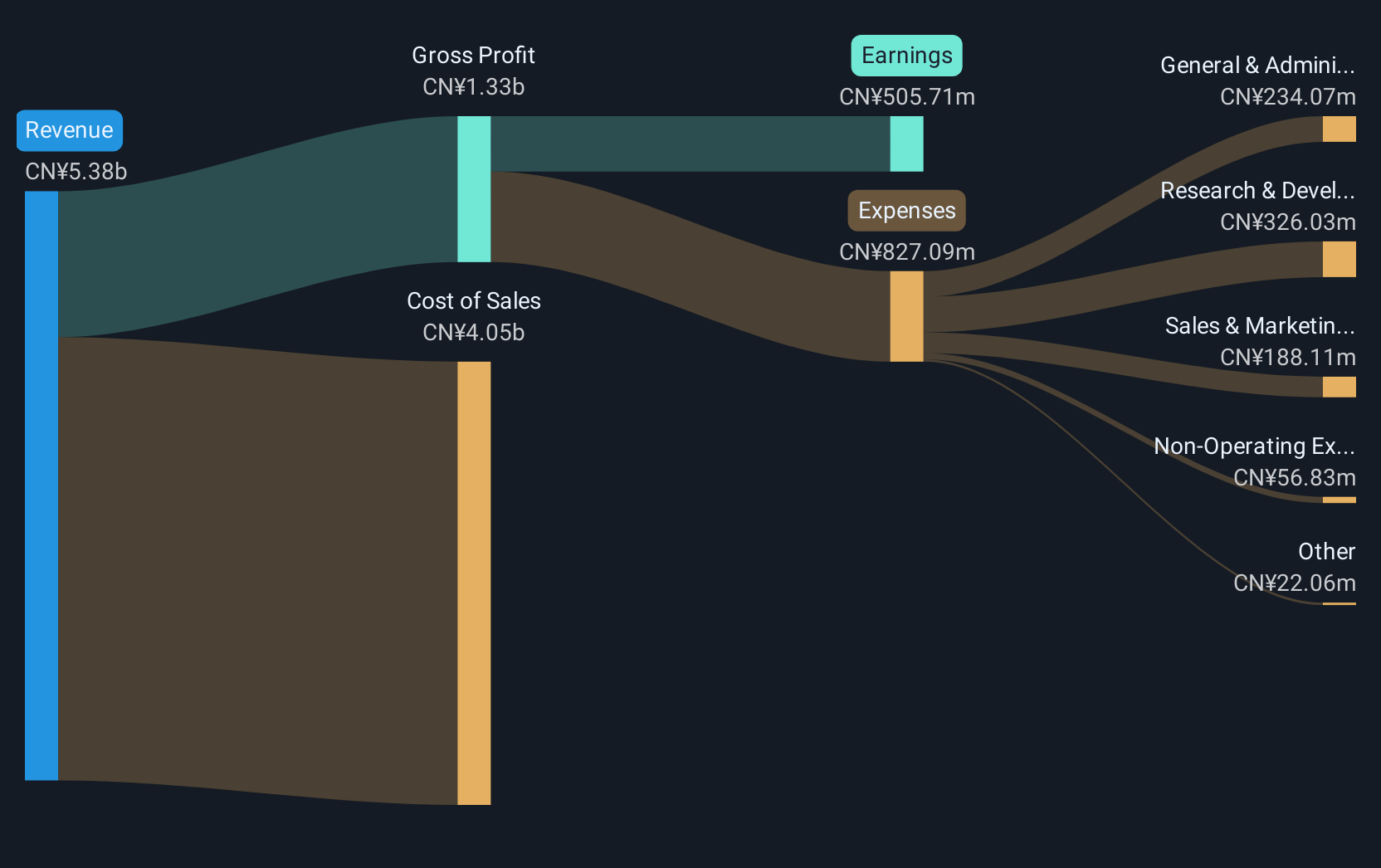

Shengyi Electronics has demonstrated robust growth dynamics, with an annual revenue increase of 26.2% and earnings growth at a striking 37.4%. These figures not only outpace the broader Chinese market averages of 12.6% and 23.6%, respectively but also underscore the company's competitive edge in the electronics sector. Moreover, its commitment to innovation is evident from its significant R&D investments, which have fueled advancements and possibly contributed to its extraordinary earnings surge of over 9156% last year. While dealing with a highly volatile share price recently, Shengyi continues to focus on strategic initiatives like share repurchases aimed at enhancing shareholder value, as evidenced by their recent buyback announcement for up to CNY 100 million worth of shares. This strategy reflects confidence in their operational stability and future growth prospects in high-tech sectors across Asia.

- Click to explore a detailed breakdown of our findings in Shengyi Electronics' health report.

Gain insights into Shengyi Electronics' past trends and performance with our Past report.

Chengdu Zhimingda Electronics (SHSE:688636)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Zhimingda Electronics Co., Ltd. specializes in providing customized embedded modules and solutions in China, with a market cap of CN¥5.99 billion.

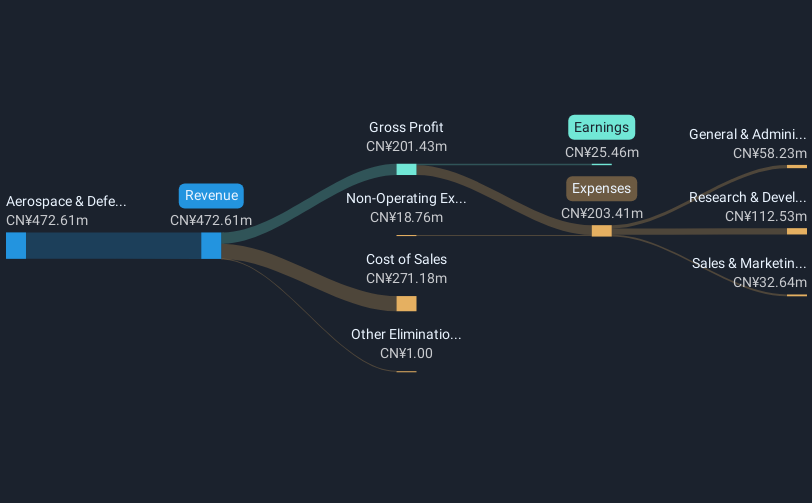

Operations: Zhimingda Electronics focuses on the aerospace and defense sector, generating revenue of CN¥573.21 million from this segment.

Chengdu Zhimingda Electronics has recently showcased a remarkable financial performance, with sales soaring to CNY 293.97 million from CNY 158.53 million in the previous year, and net income escalating to CNY 38.3 million from just CNY 1.7 million, reflecting an annual revenue growth of 31.6% and earnings growth of 43.4%. This surge is supported by strategic moves including a significant private placement aimed at raising CNY 213.4 million, indicating robust confidence in its expansion plans within the tech sector. Additionally, their aggressive R&D investments are set to bolster future technological advancements and market competitiveness in Asia's high-growth tech landscape.

Chengdu Jiafaantai Education TechnologyLtd (SZSE:300559)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chengdu Jiafaantai Education Technology Co., Ltd. operates in the education technology sector and has a market cap of CN¥5.09 billion.

Operations: Chengdu Jiafaantai Education Technology Co., Ltd. generates its revenue primarily from its Information Services - Computer Applications segment, which contributed CN¥370.90 million.

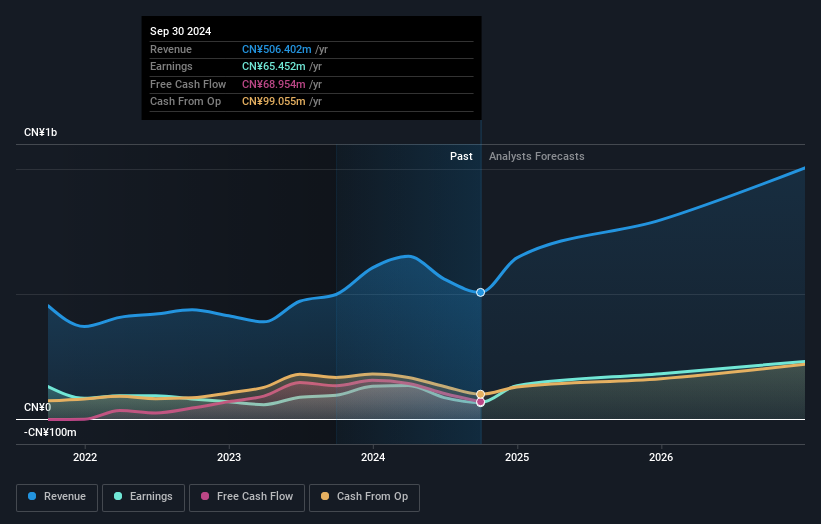

Chengdu Jiafaantai Education Technology Ltd. is navigating the competitive tech landscape with a strategic focus on R&D, dedicating significant resources to innovation. Despite a challenging year with earnings growth contracting by 85.2%, the company's revenue is projected to outpace the Chinese market average, growing at an annual rate of 14.2%. Recent developments saw a planned acquisition by Qianyi Private Equity fall through, yet the firm remains resilient, having confirmed a substantial dividend payout in May 2025, signaling confidence in its financial health and commitment to shareholder value.

Seize The Opportunity

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 163 more companies for you to explore.Click here to unveil our expertly curated list of 166 Asian High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300559

Chengdu Jiafaantai Education TechnologyLtd

Chengdu Jiafaantai Education Technology Co.,Ltd.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives