- China

- /

- Communications

- /

- SZSE:002792

Exploring High Growth Tech Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week marked by moderate gains in major stock indexes, the technology-heavy Nasdaq Composite led the charge, reflecting a strong performance from large-cap growth stocks before experiencing some pullback. As consumer confidence wanes and economic indicators present mixed signals, identifying high-growth tech stocks that can withstand market fluctuations becomes crucial for enhancing your portfolio.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1262 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Chengdu Zhimingda Electronics (SHSE:688636)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Zhimingda Electronics Co., Ltd. focuses on the research, development, production, and sale of military embedded computer module products in China and has a market capitalization of CN¥3.16 billion.

Operations: Zhimingda Electronics generates revenue primarily from its Aerospace & Defense segment, amounting to CN¥472.61 million. The company specializes in military embedded computer module products within China.

Chengdu Zhimingda Electronics, despite recent setbacks including a significant revenue drop to CNY 208.66 million from CNY 399.05 million and a shift from net income to a net loss of CNY 9.16 million, is positioned for robust future growth with expected revenue and earnings increases of 31.2% and 64.7% annually. This outlook is bolstered by the company’s strategic focus on R&D, evidenced by substantial investments that align with its ambitious growth projections in the competitive tech sector. The firm's ability to navigate past volatility while planning significant advancements highlights its potential resilience and adaptability in an evolving industry landscape.

Tongyu Communication (SZSE:002792)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tongyu Communication Inc. is engaged in the global research, development, manufacturing, sales, and servicing of mobile communication antennas, RF devices, and optical modules with a market cap of CN¥7.76 billion.

Operations: Tongyu Communication focuses on the global production and distribution of mobile communication antennas, RF devices, and optical modules.

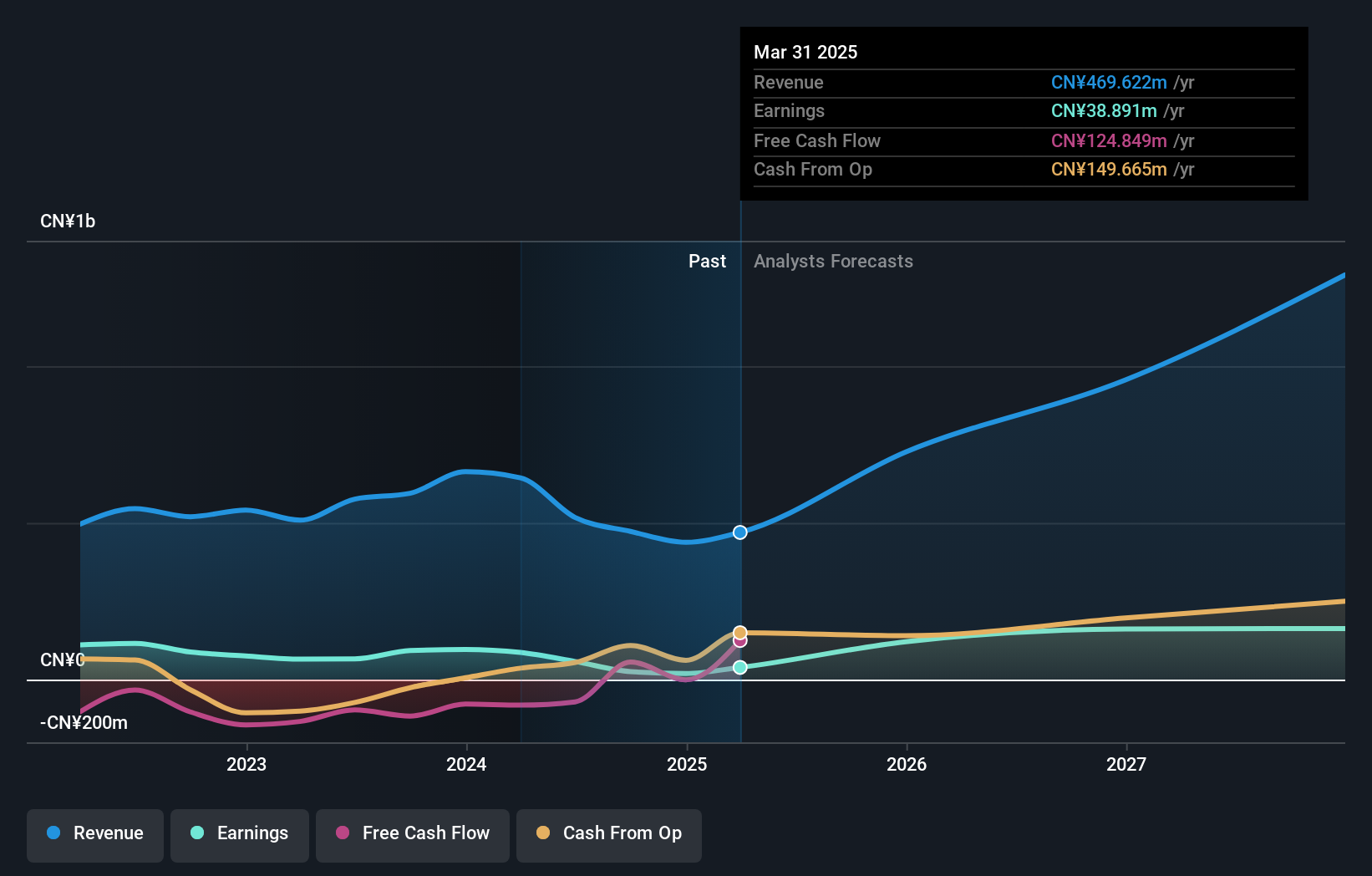

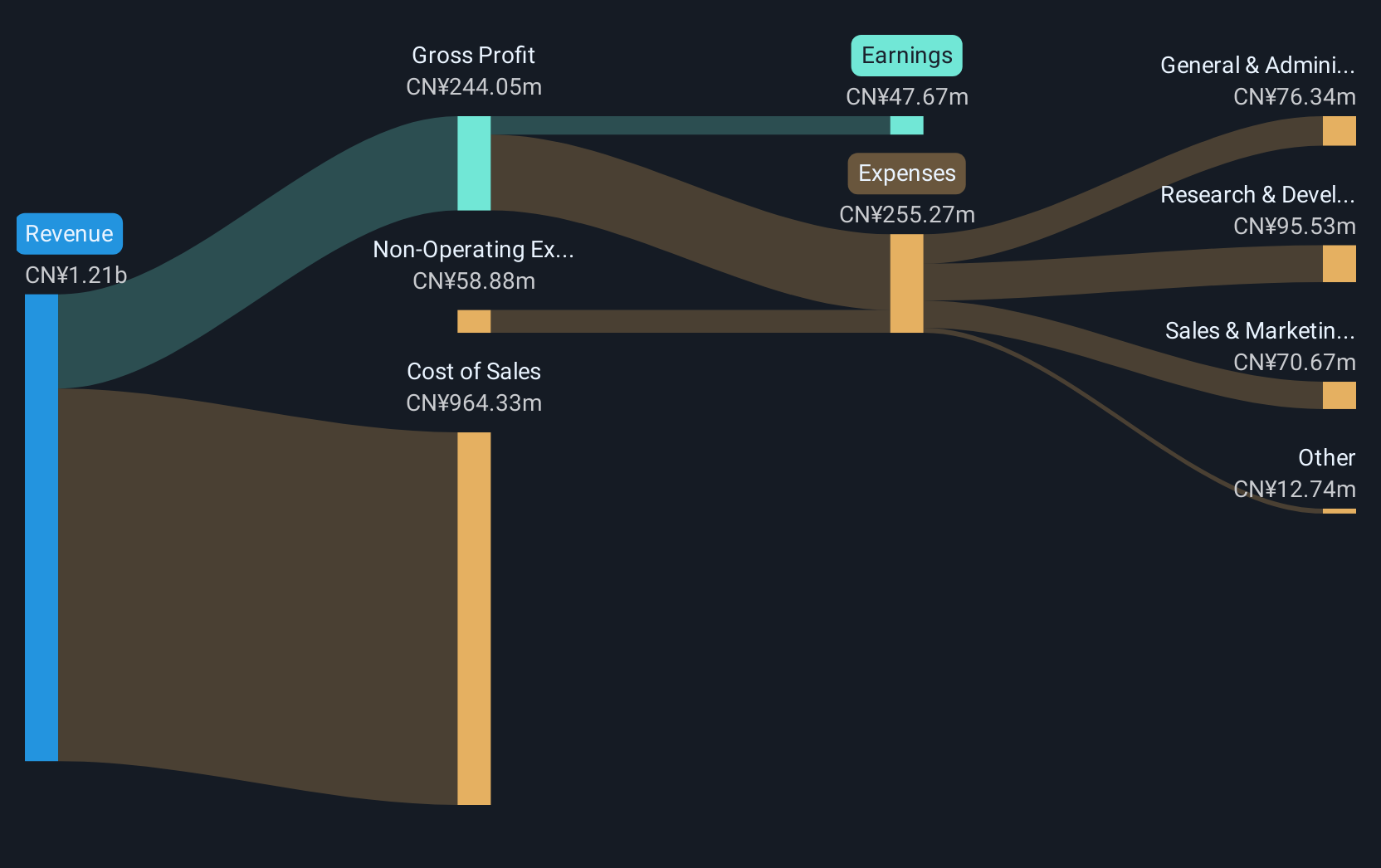

Tongyu Communication, amidst a slight revenue dip to CNY 843.08 million from CNY 858.47 million, still outpaces the industry with its earnings growth of 21.1% over the past year, surpassing the Communications sector's decline by a significant margin. This growth trajectory is expected to surge with an annual earnings increase forecasted at 50.1%. Despite these financial fluctuations, Tongyu's commitment to innovation is evident in their recent strategic decision during a special shareholders meeting to change their audit firm, signaling a proactive approach towards transparency and governance enhancement as they navigate forward in the competitive tech landscape. Their robust focus on R&D aligns with ambitious future projections; however, it's crucial to note that Tongyu has not maintained free cash flow positivity which could impact their operational flexibility. The company’s ability to adapt and evolve in response to industry demands while managing financial intricacies highlights both its potential and areas requiring careful monitoring moving ahead into 2025.

- Click here to discover the nuances of Tongyu Communication with our detailed analytical health report.

Gain insights into Tongyu Communication's past trends and performance with our Past report.

Hunan Sundy Science and Technology (SZSE:300515)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Sundy Science and Technology Co., Ltd provides coal analysis solutions both domestically in the People’s Republic of China and internationally, with a market cap of CN¥2.39 billion.

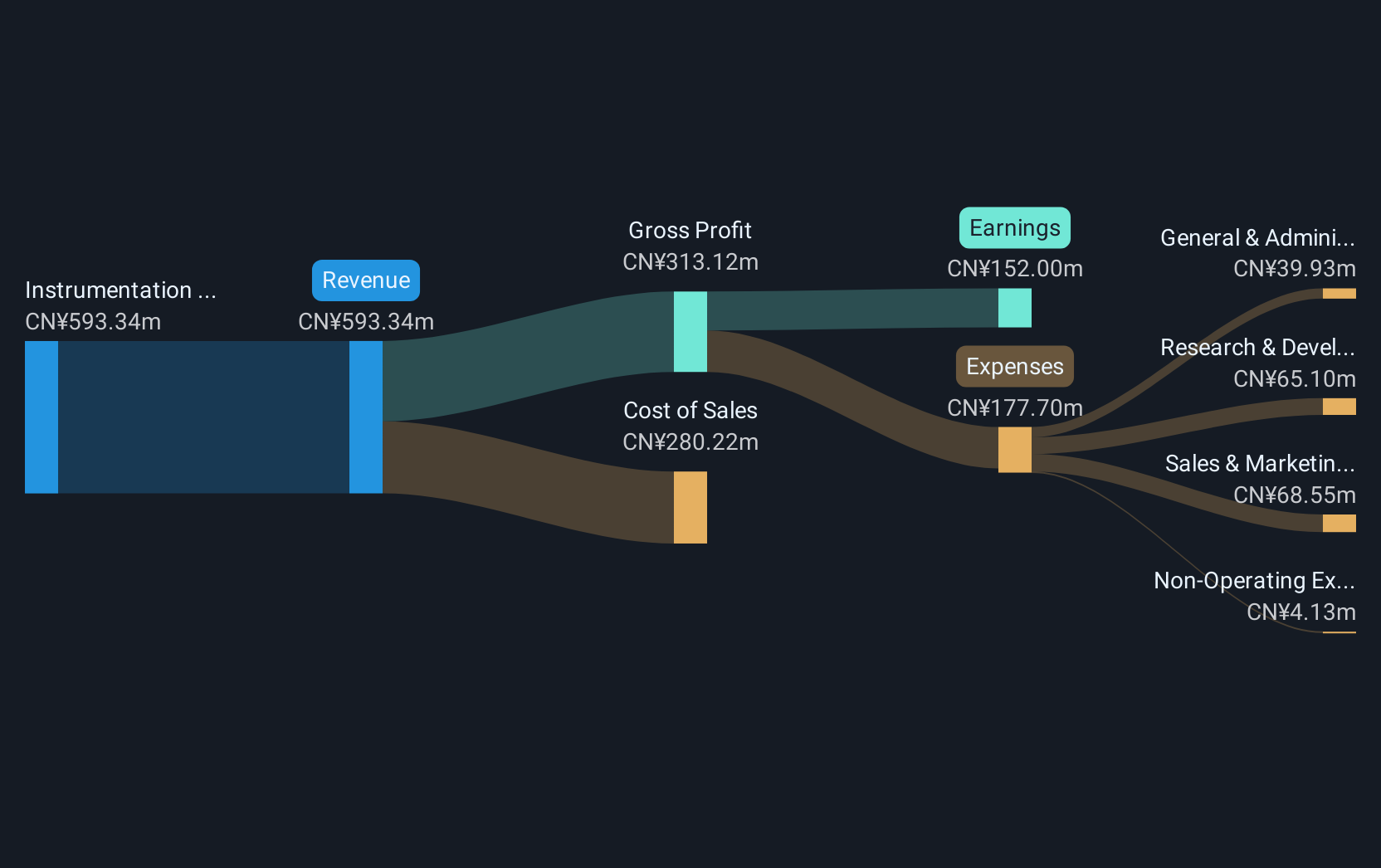

Operations: Sundy Science and Technology generates revenue primarily from its instrumentation industry segment, which contributes CN¥483.69 million. The company's operations are focused on supplying coal analysis solutions both within China and internationally.

Hunan Sundy Science and Technology has demonstrated robust financial performance with a notable increase in net income to CNY 78.05 million from CNY 52.69 million year-over-year, underpinned by a solid sales growth from CNY 319.51 million to CNY 338.66 million. This upward trajectory is mirrored in the projected annual revenue and earnings growth rates of 28% and 34.2%, respectively, outpacing broader market expectations. Recent governance enhancements, including board changes and amendments to company bylaws, underscore a strategic pivot towards strengthening corporate oversight and operational adaptability amidst evolving industry dynamics.

Summing It All Up

- Delve into our full catalog of 1262 High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tongyu Communication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002792

Tongyu Communication

Researches and develops, manufactures, sells, and services mobile communication antennas, radio frequency (RF) devices, optical modules, and other products worldwide.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives