- China

- /

- Electronic Equipment and Components

- /

- SHSE:688627

3 Asian Stocks With High Insider Ownership And Up To 52% Growth

Reviewed by Simply Wall St

As Asian markets continue to navigate a landscape marked by economic fluctuations and policy shifts, investors are increasingly focused on identifying companies with strong growth potential and solid insider ownership. In this context, stocks that combine robust insider confidence with promising growth prospects can offer intriguing opportunities for those looking to capitalize on the region's evolving economic environment.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36.1% | 26.6% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Putailai New Energy TechnologyLtd (SHSE:603659)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Putailai New Energy Technology Co., Ltd. develops and sells materials for lithium-ion batteries and automation equipment in China, with a market capitalization of CN¥57.81 billion.

Operations: Shanghai Putailai New Energy Technology Co., Ltd. generates revenue primarily from its lithium-ion battery materials and automation equipment segments in China.

Insider Ownership: 37%

Earnings Growth Forecast: 34.3% p.a.

Shanghai Putailai New Energy Technology Ltd. demonstrates significant growth potential with an expected annual profit increase of over 34%, surpassing the Chinese market average. Its revenue is projected to grow faster than the market, though not exceeding 20% annually. Recent earnings reports show strong performance with net income rising to CNY 1.70 billion for the first nine months of 2025, up from CNY 1.24 billion year-on-year, despite a volatile share price and low forecasted return on equity.

- Click here and access our complete growth analysis report to understand the dynamics of Shanghai Putailai New Energy TechnologyLtd.

- Our comprehensive valuation report raises the possibility that Shanghai Putailai New Energy TechnologyLtd is priced lower than what may be justified by its financials.

Shenzhen SEICHI Technologies (SHSE:688627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen SEICHI Technologies Co., Ltd. focuses on the R&D, production, and sale of new display device testing equipment in China and has a market cap of CN¥17.61 billion.

Operations: Shenzhen SEICHI Technologies Co., Ltd. derives its revenue from the research, development, production, and sale of advanced display device testing equipment in China.

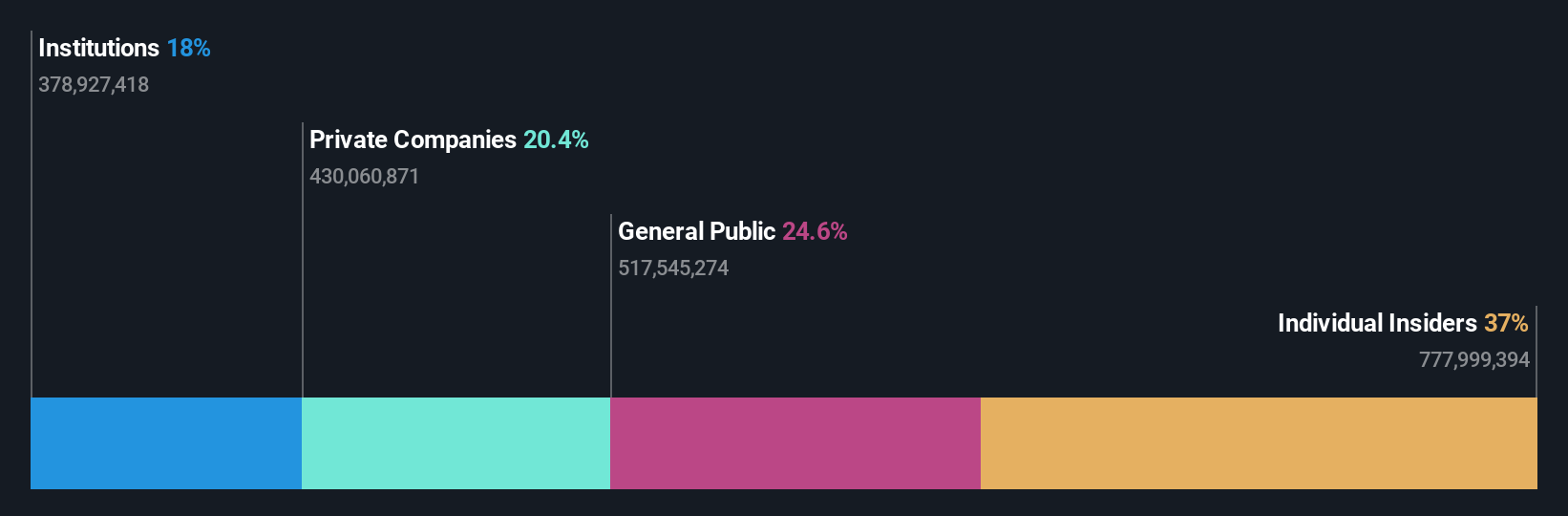

Insider Ownership: 18.9%

Earnings Growth Forecast: 52.9% p.a.

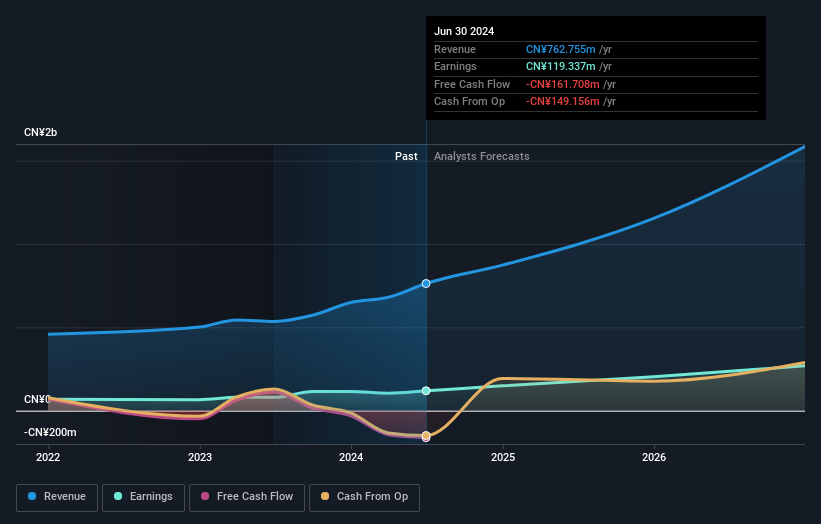

Shenzhen SEICHI Technologies is set for robust growth, with revenue anticipated to increase by 32% annually, outpacing the Chinese market. Earnings are projected to rise significantly at 52.9% per year. Despite recent volatility and a decline in profit margins from 15.6% to 8.2%, the company has actively engaged in share buybacks worth CNY 40.17 million, signaling confidence in its future prospects amidst lower forecasted return on equity of 15%.

- Navigate through the intricacies of Shenzhen SEICHI Technologies with our comprehensive analyst estimates report here.

- The analysis detailed in our Shenzhen SEICHI Technologies valuation report hints at an inflated share price compared to its estimated value.

Dazhong Mining (SZSE:001203)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dazhong Mining Co., Ltd. is involved in the mining and processing of iron ore, with a market capitalization of CN¥22.21 billion.

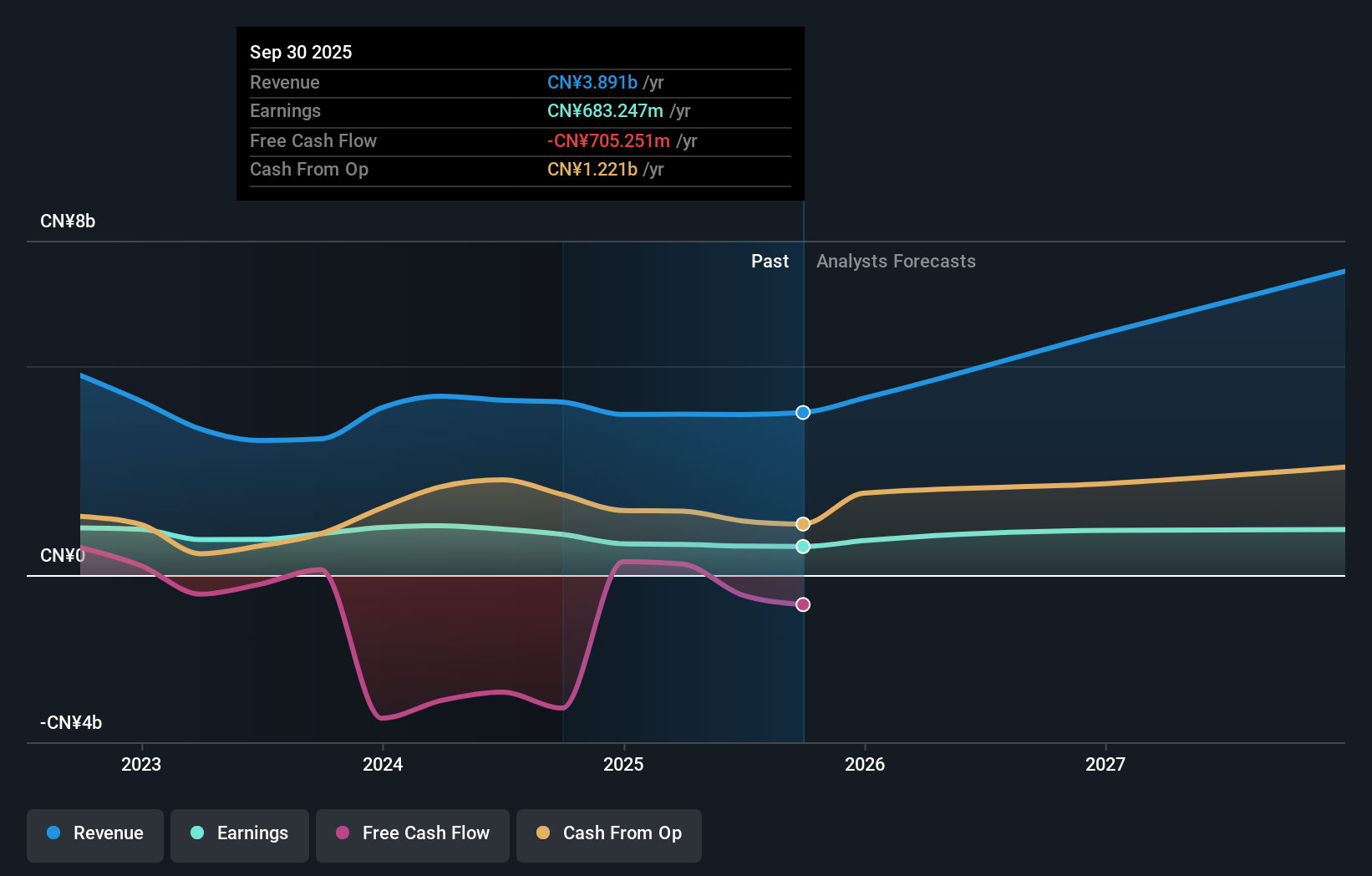

Operations: The company's revenue is primarily derived from its Mining and Smelting Industry segment, which generated CN¥3.89 billion.

Insider Ownership: 27.6%

Earnings Growth Forecast: 20.6% p.a.

Dazhong Mining demonstrates potential for growth, with revenue expected to grow at 28.5% annually, surpassing the Chinese market average. Despite a recent decline in net income from CNY 661.89 million to CNY 593.88 million, the company has completed a share buyback of over CNY 202 million, indicating confidence in its future trajectory. However, earnings growth is forecasted to be slower than the market average and debt coverage by operating cash flow remains a concern.

- Delve into the full analysis future growth report here for a deeper understanding of Dazhong Mining.

- Our valuation report unveils the possibility Dazhong Mining's shares may be trading at a premium.

Turning Ideas Into Actions

- Reveal the 620 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688627

Shenzhen SEICHI Technologies

Engages in the research and development, production, and sale of new display device testing equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion