- China

- /

- Electronic Equipment and Components

- /

- SHSE:688616

Hangzhou Xili Intelligent Technology Co.,Ltd (SHSE:688616) Surges 32% Yet Its Low P/E Is No Reason For Excitement

Despite an already strong run, Hangzhou Xili Intelligent Technology Co.,Ltd (SHSE:688616) shares have been powering on, with a gain of 32% in the last thirty days. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

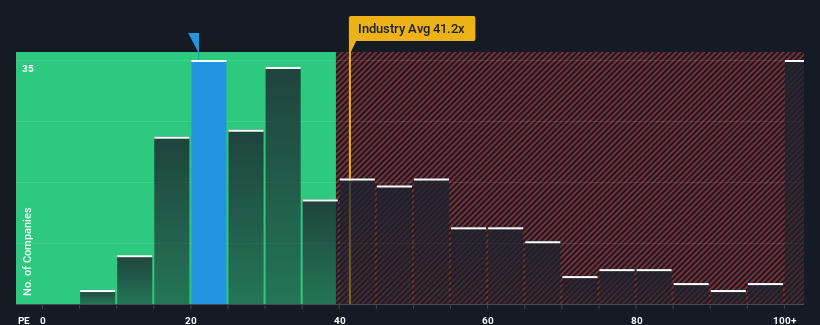

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 33x, you may still consider Hangzhou Xili Intelligent TechnologyLtd as an attractive investment with its 20.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Hangzhou Xili Intelligent TechnologyLtd has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Hangzhou Xili Intelligent TechnologyLtd

What Are Growth Metrics Telling Us About The Low P/E?

Hangzhou Xili Intelligent TechnologyLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 30%. Still, incredibly EPS has fallen 19% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 38% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Hangzhou Xili Intelligent TechnologyLtd is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Hangzhou Xili Intelligent TechnologyLtd's P/E?

Hangzhou Xili Intelligent TechnologyLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Hangzhou Xili Intelligent TechnologyLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Hangzhou Xili Intelligent TechnologyLtd is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Hangzhou Xili Intelligent TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Xili Intelligent TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688616

Hangzhou Xili Intelligent TechnologyLtd

Hangzhou Xili Intelligent Technology Co.,Ltd.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026