- China

- /

- Communications

- /

- SHSE:688592

Statutory Earnings May Not Be The Best Way To Understand ComNav Technology's (SHSE:688592) True Position

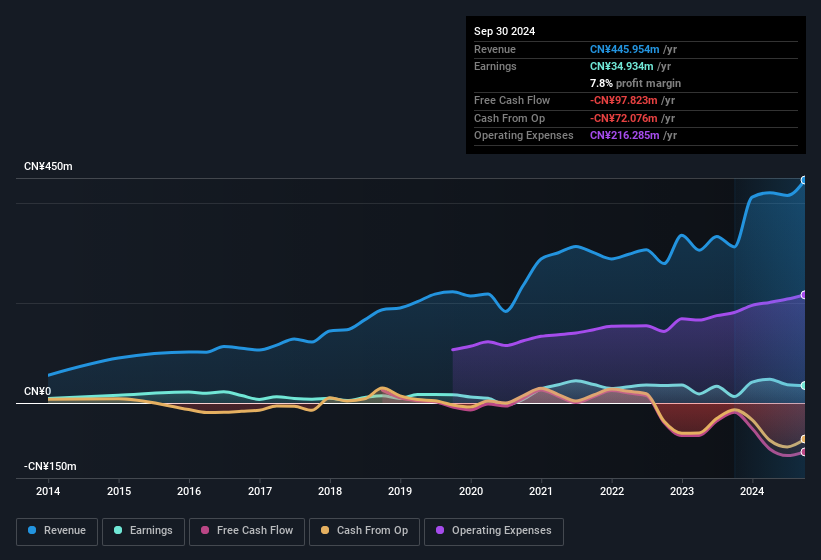

Even though ComNav Technology Ltd. (SHSE:688592) posted strong earnings recently, the stock hasn't reacted in a large way. We decided to have a deeper look, and we believe that investors might be worried about several concerning factors that we found.

See our latest analysis for ComNav Technology

Zooming In On ComNav Technology's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

For the year to September 2024, ComNav Technology had an accrual ratio of 0.38. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. In the last twelve months it actually had negative free cash flow, with an outflow of CN¥98m despite its profit of CN¥34.9m, mentioned above. We also note that ComNav Technology's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of CN¥98m. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of ComNav Technology.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that ComNav Technology's profit was boosted by unusual items worth CN¥21m in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. ComNav Technology had a rather significant contribution from unusual items relative to its profit to September 2024. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On ComNav Technology's Profit Performance

ComNav Technology had a weak accrual ratio, but its profit did receive a boost from unusual items. Considering all this we'd argue ComNav Technology's profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To that end, you should learn about the 2 warning signs we've spotted with ComNav Technology (including 1 which is potentially serious).

Our examination of ComNav Technology has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688592

ComNav Technology

Develops, manufactures, and sells global navigation satellite system (GNSS) original equipment manufacturer boards, receivers, and solutions for high precision positioning applications worldwide.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion