As global markets continue to navigate a complex landscape, Asia's tech sector stands out with its potential for high growth, driven by evolving consumer demands and technological advancements. In this environment, identifying strong stocks involves looking at companies that are not only innovating but also effectively navigating geopolitical tensions and economic shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.40% | 25.85% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Marketingforce Management (SEHK:2556)

Simply Wall St Growth Rating: ★★★★☆☆

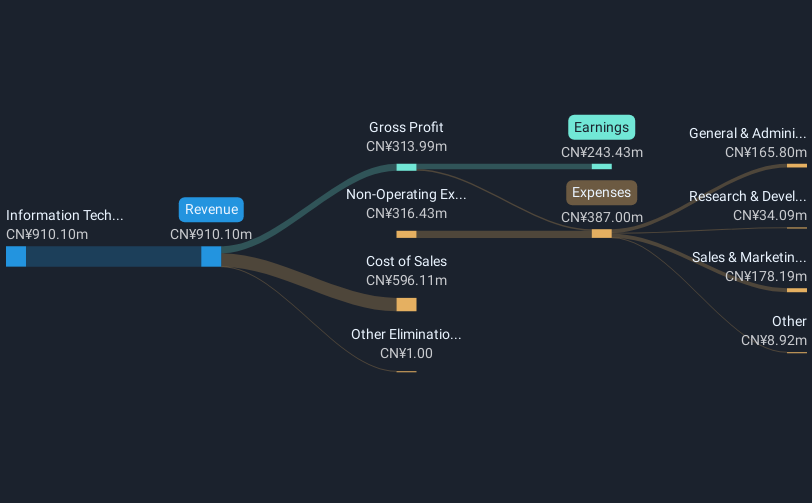

Overview: Marketingforce Management Ltd offers software as a service (SaaS) solutions in China and has a market capitalization of HK$11.30 billion.

Operations: The company generates revenue through two primary segments: AI + SaaS Business, contributing CN¥842.16 million, and Precision Marketing Service, adding CN¥716.43 million.

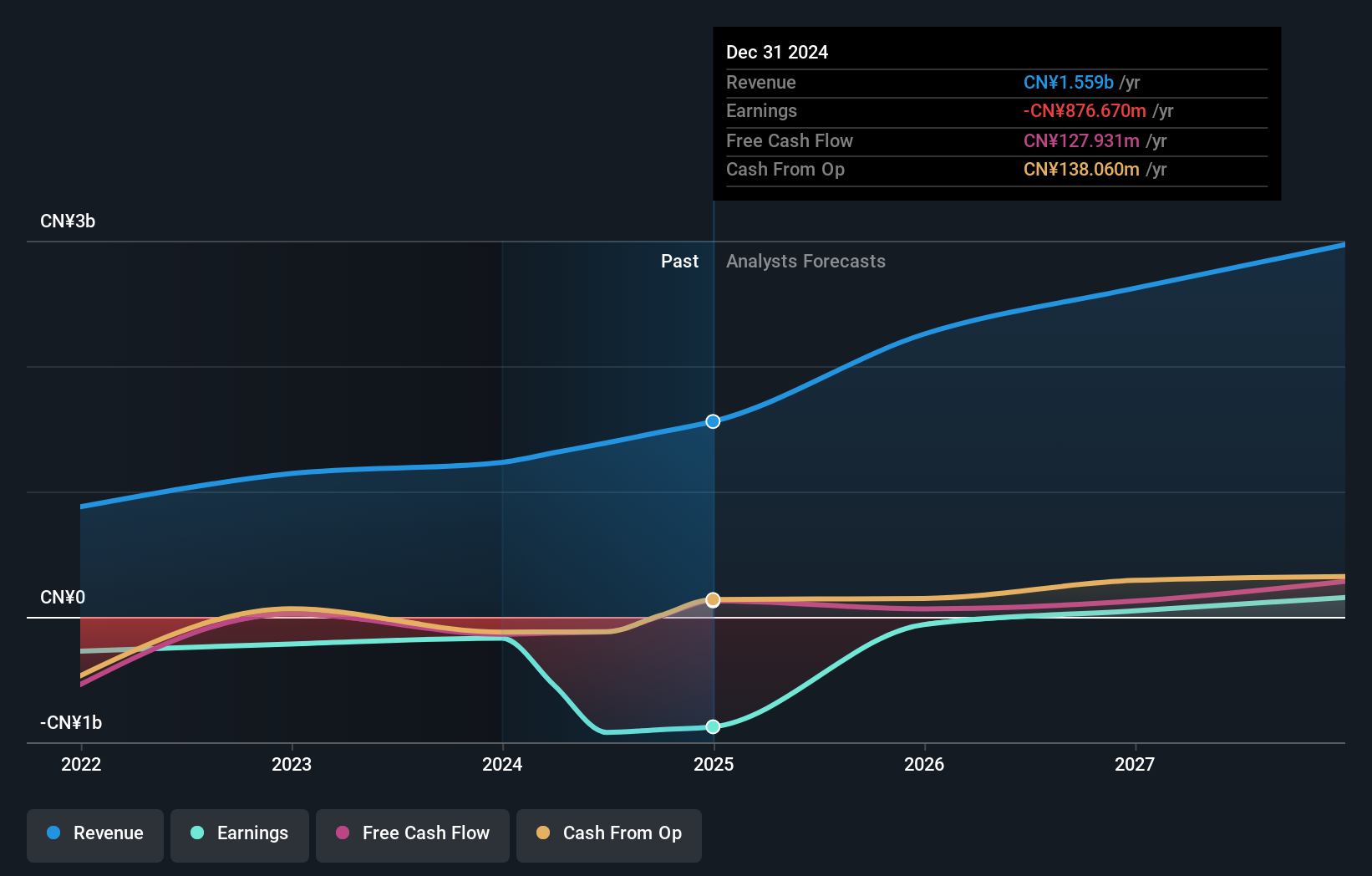

Marketingforce Management, despite its recent unprofitability, is showing promising signs of growth with a revenue increase of 26.5% over the past year and an anticipated earnings surge of 112.3% annually. This growth trajectory is well above the Hong Kong market average of 8.1%, positioning it favorably in a competitive landscape. The company's commitment to innovation is evident from its strategic AI collaborations aimed at transforming industries like liquor through advanced AI applications, as seen in their recent partnership with China Qidian Guofeng Holdings Limited. These initiatives not only enhance Marketingforce's service offerings but also solidify its role in driving sectoral advancements with artificial intelligence, potentially setting the stage for future profitability and industry leadership.

Nanya New Material TechnologyLtd (SHSE:688519)

Simply Wall St Growth Rating: ★★★★★★

Overview: Nanya New Material Technology Co., Ltd specializes in the manufacturing, design, development, and sale of composite materials with a market capitalization of CN¥9.02 billion.

Operations: Nanya New Material Technology Co., Ltd focuses on producing and marketing composite materials. The company generates revenue through its diverse range of products, with a significant emphasis on innovation and development in the composite sector.

Nanya New Material TechnologyLtd has demonstrated robust growth dynamics, with its revenue soaring by 45% to CNY 952.45 million in Q1 2025 from the previous year. This surge is underscored by a significant improvement in net income, which more than doubled to CNY 21.12 million. The company's aggressive investment in R&D, constituting a substantial portion of its revenue, underscores its commitment to innovation and positions it well within the competitive tech landscape of Asia. Moreover, the strategic focus on expanding product lines and enhancing material technologies could catalyze future growth prospects in burgeoning sectors like electronics and renewable energy materials.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Doushen (Beijing) Education & Technology INC. operates in the education and technology sector with a market capitalization of approximately CN¥15.54 billion.

Operations: Doushen (Beijing) Education & Technology focuses on the education and technology sectors, leveraging its expertise to generate revenue. The company has a market capitalization of approximately CN¥15.54 billion, indicating its significant presence in these industries.

Doushen (Beijing) Education & Technology has demonstrated a remarkable growth trajectory, with its annual revenue and earnings growth rates at 46.7% and 41.5% respectively, significantly outpacing the Chinese market averages of 12.4% for revenue and 23.4% for earnings. This performance is supported by a robust increase in net income from CNY 31.6 million to CNY 137.13 million in one year, reflecting strong operational efficiency and market demand for its educational technology solutions. The company's commitment to innovation is evident from its R&D investments, which are crucial in maintaining competitive advantage in the fast-evolving tech education sector.

- Click to explore a detailed breakdown of our findings in Doushen (Beijing) Education & Technology's health report.

Understand Doushen (Beijing) Education & Technology's track record by examining our Past report.

Summing It All Up

- Navigate through the entire inventory of 490 Asian High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2556

Marketingforce Management

Provides software as a service (SaaS) solution in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives