- China

- /

- Electronic Equipment and Components

- /

- SHSE:688551

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets respond to the Federal Reserve's recent interest rate cut, small-cap stocks have shown a notable rally, reflecting broader market optimism and trade developments between major economies like the U.S. and China. In this context, exploring high-growth tech stocks in Asia becomes particularly compelling, as these companies often thrive on innovation and adaptability—key traits that can help navigate fluctuating economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| PharmaEssentia | 31.53% | 65.34% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.79% | 30.71% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Selvas AI (KOSDAQ:A108860)

Simply Wall St Growth Rating: ★★★★☆☆

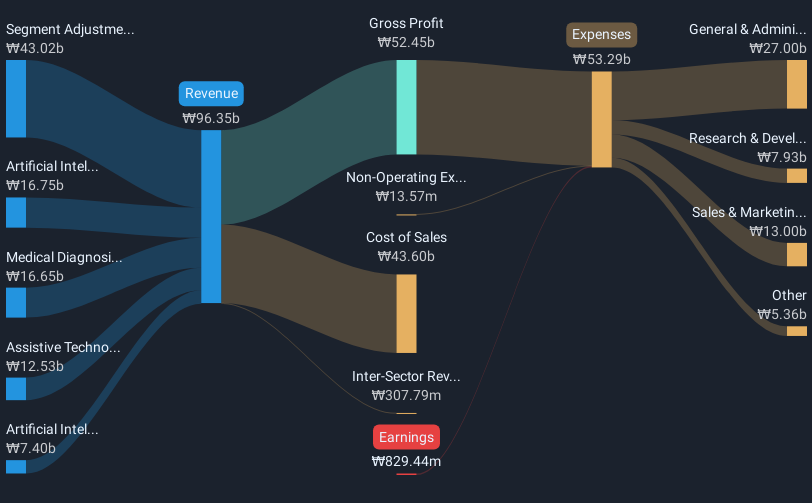

Overview: Selvas AI Inc. is a South Korean company specializing in artificial intelligence, with a market capitalization of ₩382.72 billion.

Operations: Selvas AI Inc. focuses on artificial intelligence, generating revenue primarily from medical device manufacturing and sales (₩58.21 billion) and assistive technology equipment (₩14.85 billion). The company also earns from its artificial intelligence application solutions (₩17.35 billion) and medical diagnosis devices (₩19.35 billion).

Selvas AI, a burgeoning name in Asia's tech landscape, is poised for significant transformation. Currently unprofitable, the firm is expected to shift gears with an anticipated profit surge of 89.86% annually over the next three years. This outpaces the broader market's growth predictions substantially. Moreover, Selvas AI's commitment to innovation is evident from its R&D investments which underscore its strategic focus despite a revenue growth forecast (12.3% annually) that trails the high industry standard of 20%. However, it surpasses Korea's average growth rate (7.2%), highlighting its competitive edge in a challenging market environment. With these dynamics at play, Selvas AI could be steering towards becoming a pivotal player in shaping tech advancements regionally.

- Dive into the specifics of Selvas AI here with our thorough health report.

Explore historical data to track Selvas AI's performance over time in our Past section.

Nanya New Material TechnologyLtd (SHSE:688519)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanya New Material Technology Co., Ltd specializes in the manufacturing, design, development, and sale of composite materials, with a market capitalization of CN¥17.27 billion.

Operations: Nanya New Material Technology Co., Ltd focuses on producing and marketing composite materials. The company operates with a market capitalization of CN¥17.27 billion, emphasizing innovation in material design and development to cater to various industrial applications.

Nanya New Material TechnologyLtd is making significant strides in Asia's high-growth tech sector, with a notable 24.4% annual revenue increase and an impressive 67% surge in earnings per year. This performance outpaces the broader Chinese market's growth rates of 14.1% for revenue and 26.7% for earnings, positioning the company as a strong contender in its field. Recent events such as their H1 2025 earnings call highlight robust sales growth from CNY 1,583 million to CNY 2,263 million year-over-year and an increase in net income from CNY 55 million to CNY 87 million. These financial achievements are supported by strategic R&D investments that not only reflect Nanya's commitment to innovation but also enhance its competitive edge in the rapidly evolving tech landscape of Asia.

Hefei Kewell Power SystemLtd (SHSE:688551)

Simply Wall St Growth Rating: ★★★★★☆

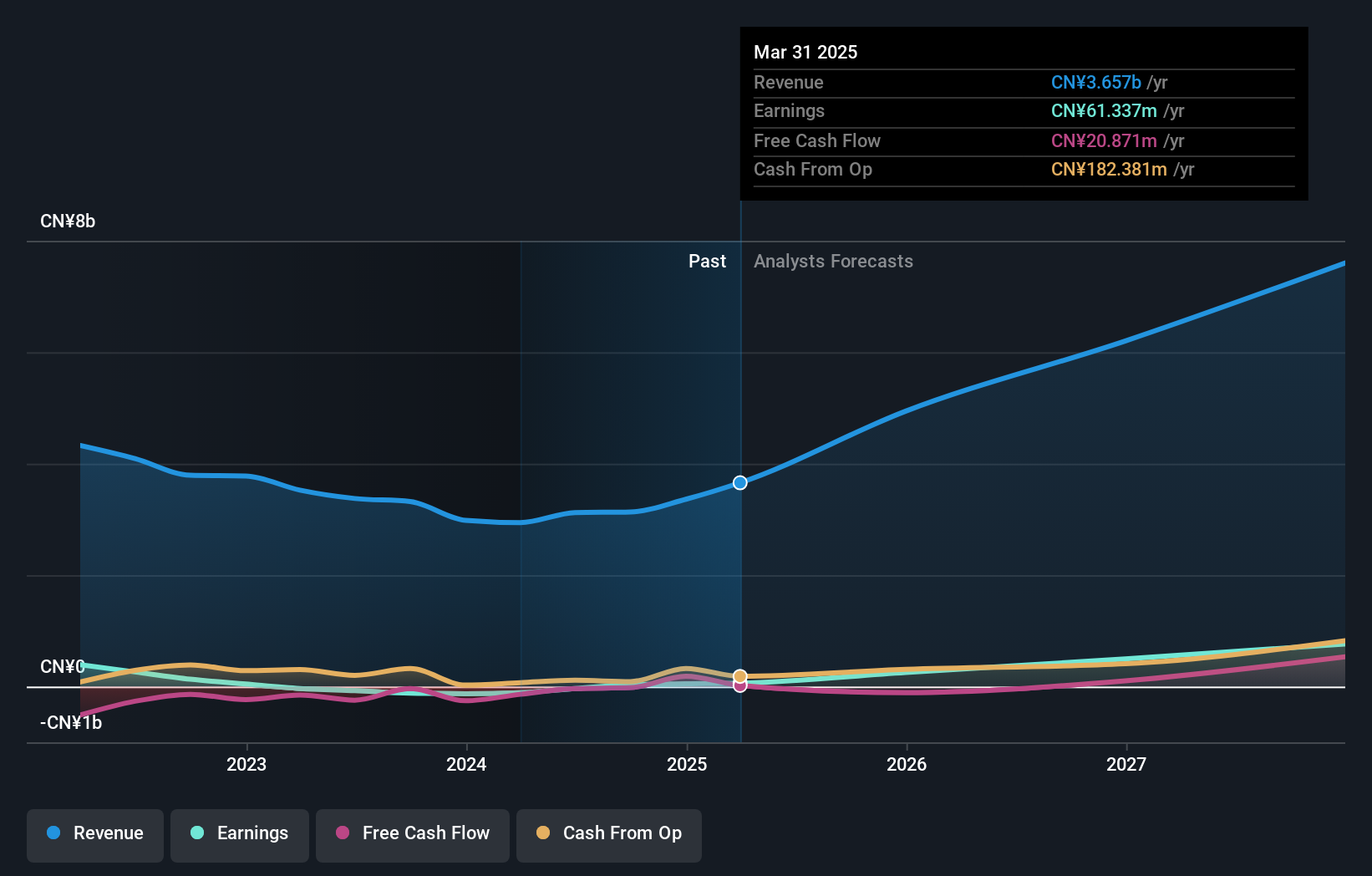

Overview: Hefei Kewell Power System Co., Ltd. specializes in providing testing equipment for test systems and intelligent manufacturing equipment in China, with a market cap of CN¥3.37 billion.

Operations: Kewell Power System generates revenue primarily from the sale of testing equipment and intelligent manufacturing equipment in China. The company focuses on serving industries that require advanced testing solutions, contributing to its financial performance.

Despite a challenging year with a revenue dip from CNY 253.99 million to CNY 224.47 million, Hefei Kewell Power SystemLtd shows resilience in the tech sector, evidenced by an ambitious R&D investment strategy that aligns with its forward-looking vision in Asia's competitive landscape. The company repurchased 841,042 shares for CNY 22.95 million, signaling confidence in its future prospects while maintaining a robust annual earnings growth forecast of 85.8%. This strategic focus on innovation and shareholder value underscores Hefei Kewell's potential to navigate market fluctuations and capitalize on emerging technological trends.

Taking Advantage

- Discover the full array of 186 Asian High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hefei Kewell Power SystemLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688551

Hefei Kewell Power SystemLtd

Provides testing equipment for test systems and intelligent manufacturing equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives