- China

- /

- Electronic Equipment and Components

- /

- SHSE:688519

Asian Growth Stocks With High Insider Ownership And 29% ROE

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and inflation concerns, Asia remains a focal point for investors seeking growth opportunities. In this context, growth companies with high insider ownership can offer unique insights into potential value creation, particularly when they demonstrate strong financial metrics such as a 29% return on equity (ROE).

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.5% | 23.4% |

| Schooinc (TSE:264A) | 30.6% | 68.9% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| NEXTIN (KOSDAQ:A348210) | 12.4% | 33.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.2% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

We're going to check out a few of the best picks from our screener tool.

Beauty Farm Medical and Health Industry (SEHK:2373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beauty Farm Medical and Health Industry Inc. (SEHK:2373) operates in the medical and health industry with a market capitalization of approximately HK$5.77 billion.

Operations: The company's revenue segments include Aesthetic Medical Services at CN¥927.92 million, Subhealth Medical Services at CN¥200.98 million, Beauty and Wellness Services from Direct Stores at CN¥1.31 billion, and Beauty and Wellness Services from Franchisee and Others at CN¥137.56 million.

Insider Ownership: 33.9%

Return On Equity Forecast: 30% (2027 estimate)

Beauty Farm Medical and Health Industry shows potential as a growth company with high insider ownership in Asia. Despite slower than desired revenue growth at 11.6% annually, it surpasses the Hong Kong market average of 8.2%. Earnings are forecast to grow at 18.3% per year, outpacing the market's 10.4%. Recent strategic moves include seeking M&A opportunities to enhance profit margins and synergies, while board changes aim to improve corporate governance and meet gender diversity requirements.

- Click here and access our complete growth analysis report to understand the dynamics of Beauty Farm Medical and Health Industry.

- Our valuation report unveils the possibility Beauty Farm Medical and Health Industry's shares may be trading at a premium.

Nanya New Material TechnologyLtd (SHSE:688519)

Simply Wall St Growth Rating: ★★★★★★

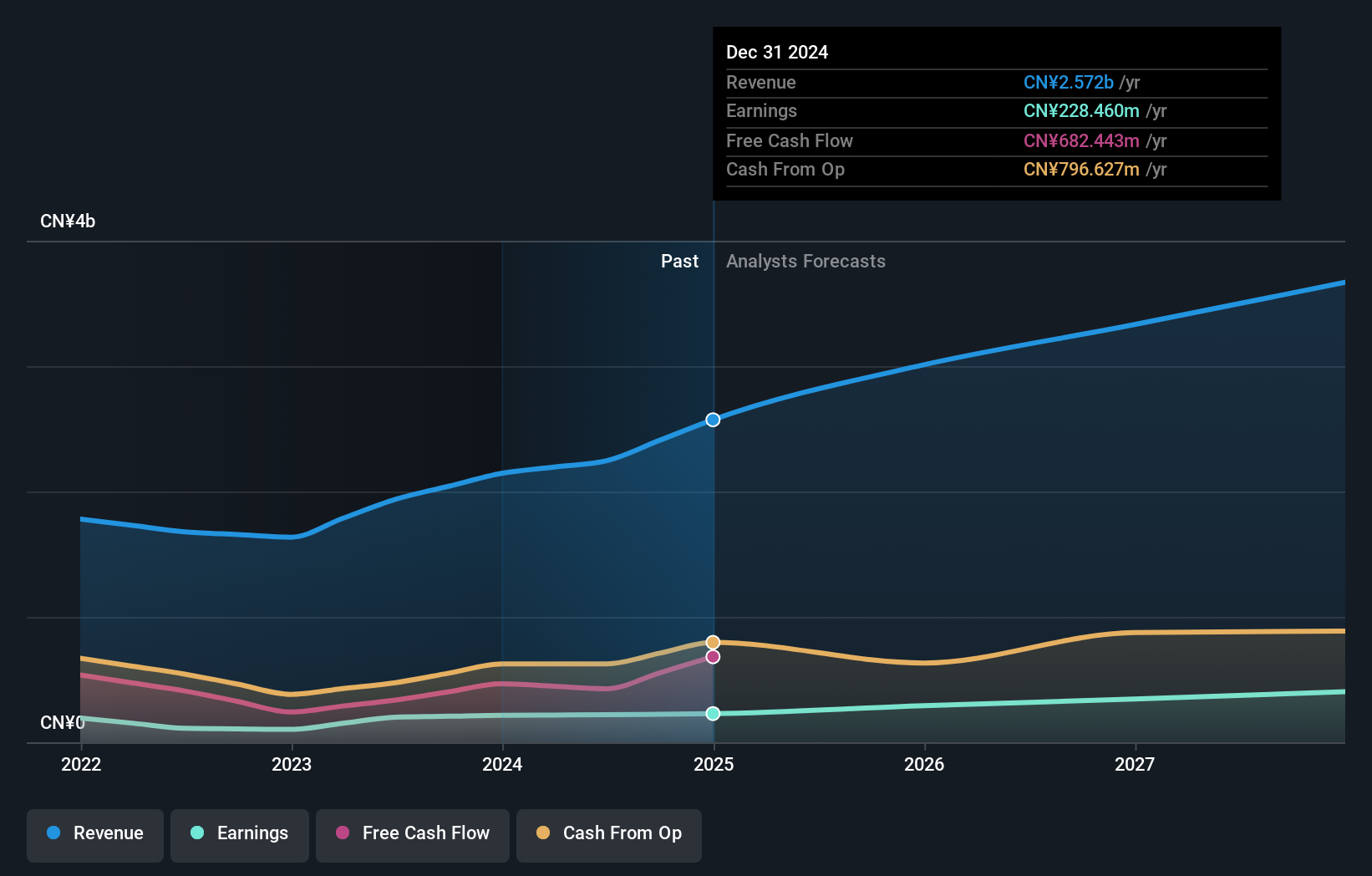

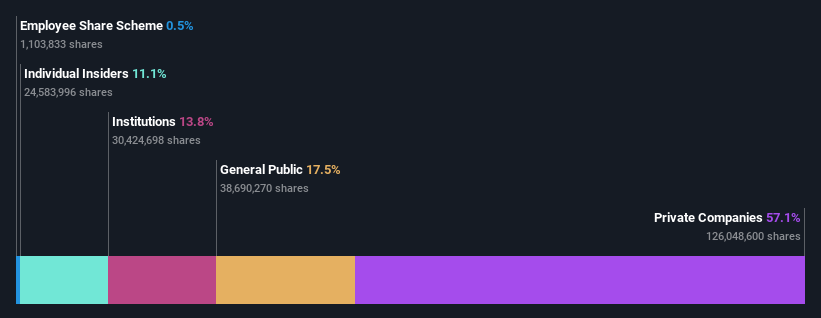

Overview: Nanya New Material Technology Co., Ltd specializes in the manufacturing, design, development, and sale of composite materials with a market cap of CN¥8.91 billion.

Operations: Nanya New Material Technology Co., Ltd generates revenue through its core activities of manufacturing, designing, developing, and selling composite materials.

Insider Ownership: 11%

Return On Equity Forecast: 20% (2028 estimate)

Nanya New Material Technology Ltd demonstrates strong growth potential with its earnings forecasted to increase significantly at 63.3% annually, outpacing the Chinese market's 23.4%. Despite a volatile share price recently, the company became profitable this year and reported Q1 revenue of CNY 952.45 million, up from CNY 656.69 million last year. With no substantial insider trading activity in recent months, Nanya's revenue is expected to grow faster than the market average at 22.7% annually.

- Take a closer look at Nanya New Material TechnologyLtd's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Nanya New Material TechnologyLtd's share price might be too optimistic.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★★

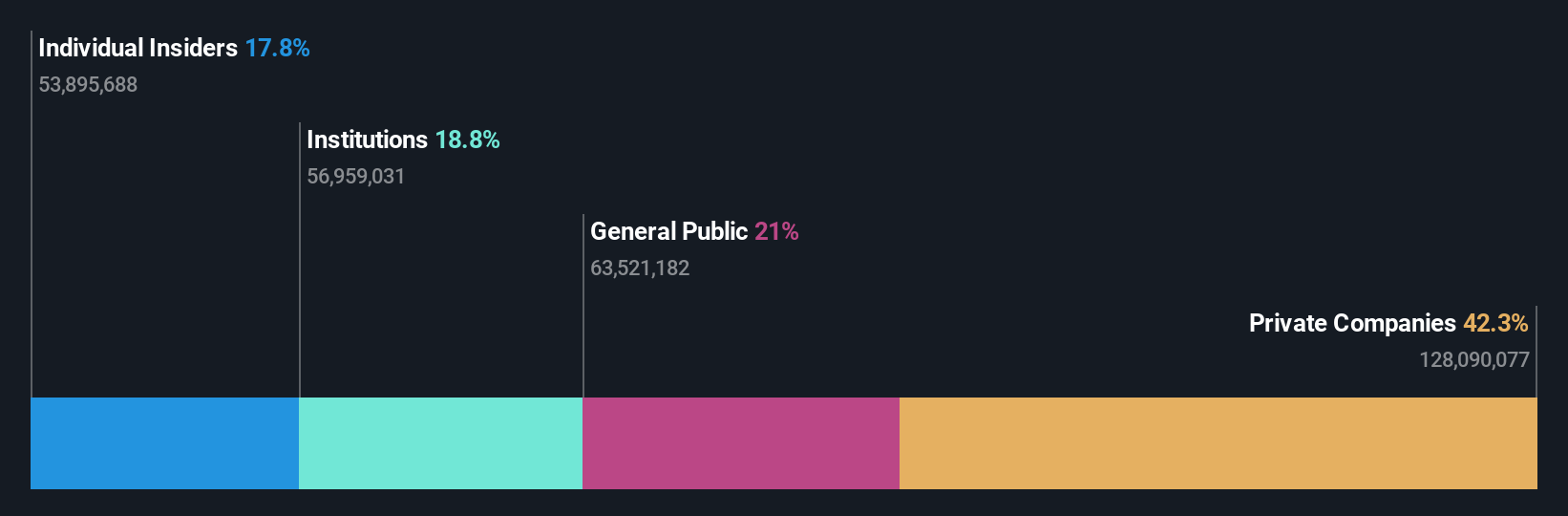

Overview: Naruida Technology Co., Ltd. specializes in the manufacturing and sale of polarized multifunctional active phased array radars in China, with a market cap of CN¥15.38 billion.

Operations: The company's revenue primarily comes from its Scientific & Technical Instruments segment, amounting to CN¥371.98 million.

Insider Ownership: 12.7%

Return On Equity Forecast: 20% (2028 estimate)

Naruida Technology shows promising growth prospects with its earnings expected to grow significantly at 54.4% annually, surpassing the Chinese market's 23.4%. Revenue is forecasted to increase by 47.7% per year, well above the market average of 12.4%. Recent financial results highlight robust performance, with Q1 revenue reaching CNY 58.19 million and net income rising to CNY 21.67 million from CNY 4.23 million last year, amidst no major insider trading activity recently.

- Click here to discover the nuances of Naruida Technology with our detailed analytical future growth report.

- According our valuation report, there's an indication that Naruida Technology's share price might be on the expensive side.

Next Steps

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 617 companies by clicking here.

- Curious About Other Options? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nanya New Material TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688519

Nanya New Material TechnologyLtd

Manufactures, designs, develops, and sells composite materials.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives