- China

- /

- Electronic Equipment and Components

- /

- SHSE:688502

High Growth Tech Stocks in Asia for March 2025

Reviewed by Simply Wall St

As global markets face a mix of challenges, including U.S. policy risks and tariff concerns impacting tech stocks, Asian markets continue to present unique opportunities for high-growth technology investments despite broader economic uncertainties. In such an environment, identifying promising tech stocks often involves looking for companies with strong innovation capabilities and resilience to geopolitical shifts, which can help them navigate current market complexities effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 35.12% | 34.05% | ★★★★★★ |

| Zhongji Innolight | 29.20% | 29.62% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Fositek | 40.35% | 52.92% | ★★★★★★ |

| Arizon RFID Technology (Cayman) | 27.55% | 28.53% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

We'll examine a selection from our screener results.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. focuses on the research, development, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China with a market cap of CN¥27.70 billion.

Operations: Raytron Technology Co., Ltd. specializes in developing and producing uncooled infrared imaging and MEMS sensor technology. The company's revenue model is centered around the sales of these advanced technologies within China, contributing significantly to its financial performance.

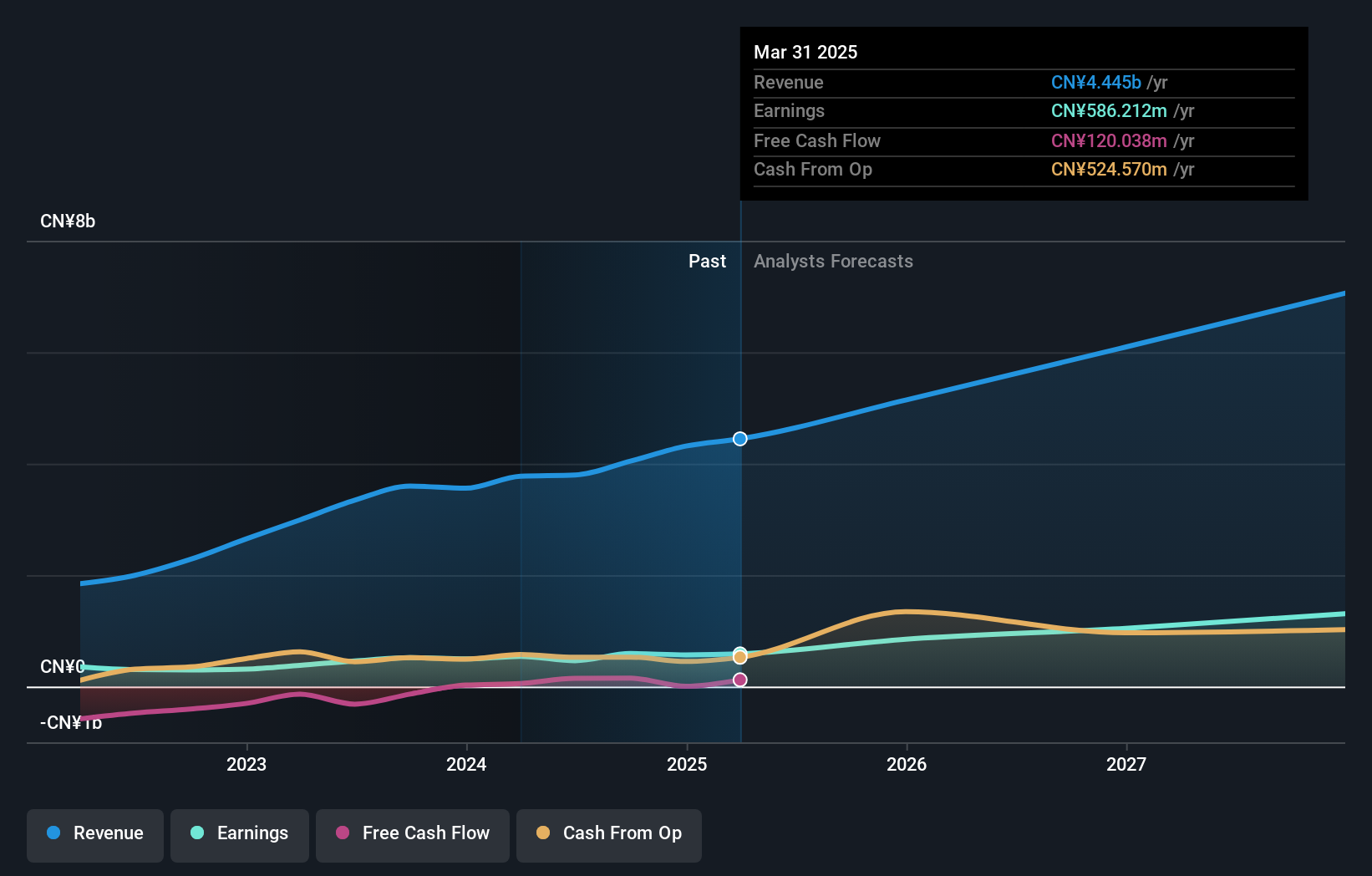

Raytron Technology Ltd. has demonstrated robust financial performance, with a 23.1% increase in earnings over the past year, significantly outpacing the electronic industry's average of 2.6%. This growth is underpinned by a revenue surge to CNY 4.32 billion, up from CNY 3.56 billion last year, reflecting an annual growth rate of 17.3%. Notably, the company's commitment to innovation is evident from its R&D spending trends; however, specific figures on R&D expenditures were not provided in your data set. Moreover, Raytron has actively engaged in shareholder value enhancement through strategic share buybacks totaling CNY 65 million for approximately 2.11 million shares over recent months. Looking ahead, Raytron’s earnings are expected to climb by an impressive annual rate of 29.2%, surpassing broader market projections and indicating potential for sustained competitive advantage within Asia's high-tech sector despite a forecasted lower Return on Equity (15.5%) compared to some industry benchmarks over the next three years.

MLOptic (SHSE:688502)

Simply Wall St Growth Rating: ★★★★★☆

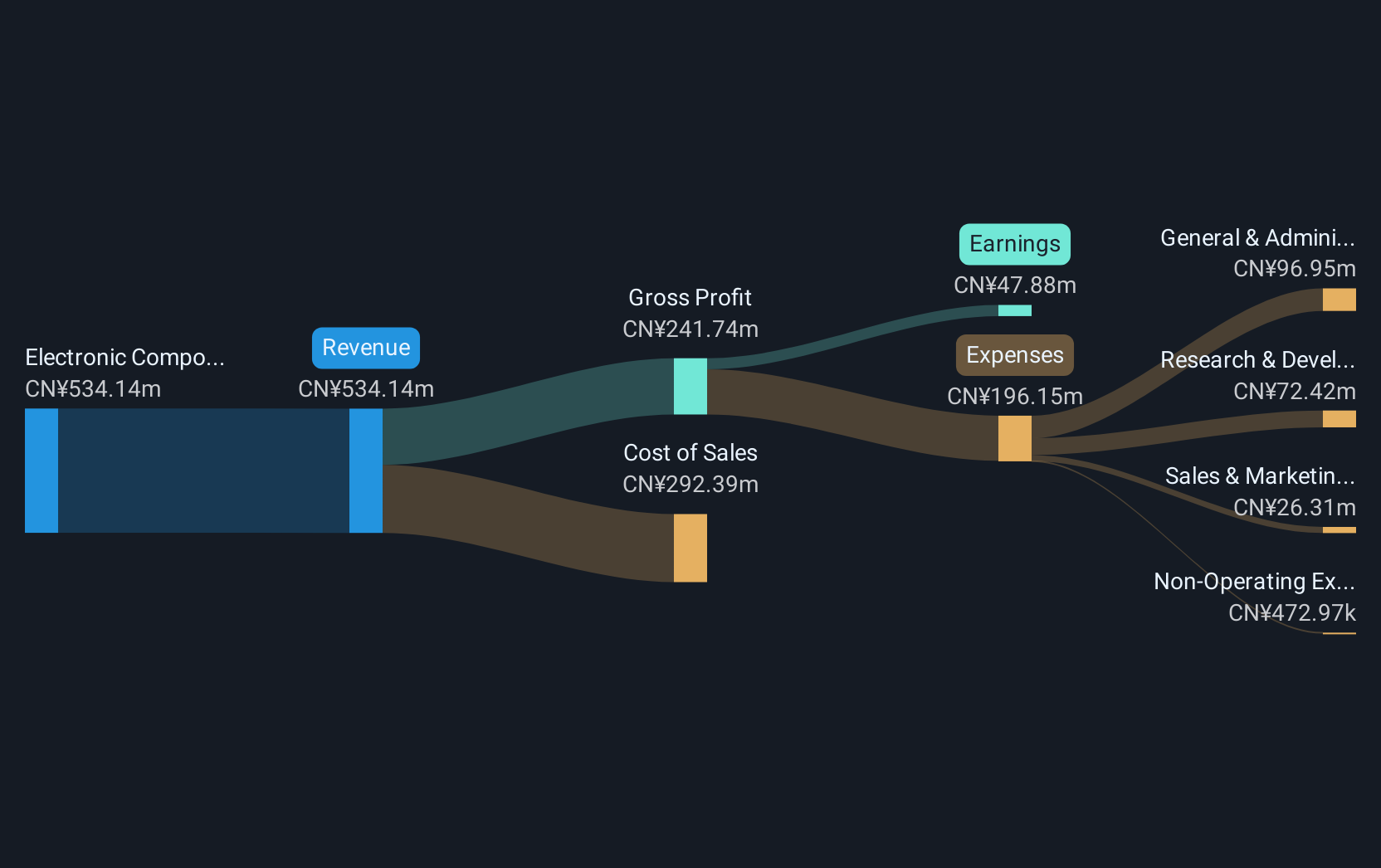

Overview: MLOptic Corp. operates as a precision optical solutions company in China and internationally, with a market capitalization of CN¥15.53 billion.

Operations: MLOptic Corp. specializes in precision optical solutions, catering to both domestic and international markets. The company generates revenue through the sale of advanced optical components and systems, focusing on sectors such as telecommunications, healthcare, and consumer electronics. Its cost structure includes significant investments in research and development to drive innovation within these industries.

MLOptic Corp. has demonstrated a notable trajectory in Asia's tech landscape, with its annual revenue growth at 20.9%, outpacing the CN market average of 13.3%. This growth is complemented by an impressive forecast in earnings increase at 35.8% annually, significantly above the market forecast of 25.4%. Despite a slight dip in net income from CNY 46.72 million to CNY 42.19 million last year, the firm continues to invest heavily in innovation, evidenced by R&D expenses aligning closely with its revenue surge; specific figures were not disclosed but are integral to its strategy. The recent shareholder meeting and consistent financial performance underscore MLOptic's potential amidst volatile markets, setting a robust foundation for future technological advancements and market competitiveness.

- Dive into the specifics of MLOptic here with our thorough health report.

Explore historical data to track MLOptic's performance over time in our Past section.

Digiwin (SZSE:300378)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digiwin Co., Ltd. specializes in providing industry-specific software solutions both in Mainland China and internationally, with a market cap of approximately CN¥12.03 billion.

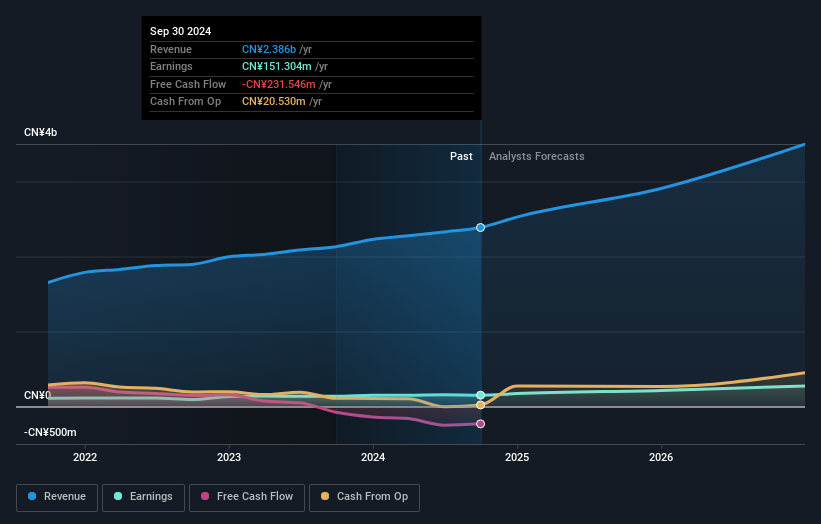

Operations: Digiwin Co., Ltd. generates revenue primarily through its software services segment, which accounted for approximately CN¥2.39 billion.

Digiwin, amidst a volatile Asian tech sector, showcases robust growth with a 16.8% annual increase in revenue and an even more impressive 25.9% rise in earnings per year. This performance is bolstered by strategic R&D investments, which have grown to represent a significant portion of its revenue, indicating a strong commitment to innovation and market competitiveness. Despite challenges like highly volatile share prices over the past three months and lower-than-benchmark forecasts for return on equity at 9.8%, Digiwin continues to outpace industry averages with its earnings growth surpassing the software industry's decline of -12.3%. These factors position Digiwin as a resilient player in high-growth tech sectors, poised for future advancements despite current market uncertainties.

- Get an in-depth perspective on Digiwin's performance by reading our health report here.

Gain insights into Digiwin's past trends and performance with our Past report.

Turning Ideas Into Actions

- Delve into our full catalog of 520 Asian High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688502

MLOptic

Operates as a precision optical solutions company in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives