- China

- /

- Electronic Equipment and Components

- /

- SHSE:688400

LUSTER LightTech Co., LTD. (SHSE:688400) Stock Rockets 32% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, LUSTER LightTech Co., LTD. (SHSE:688400) shares have been powering on, with a gain of 32% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.9% in the last twelve months.

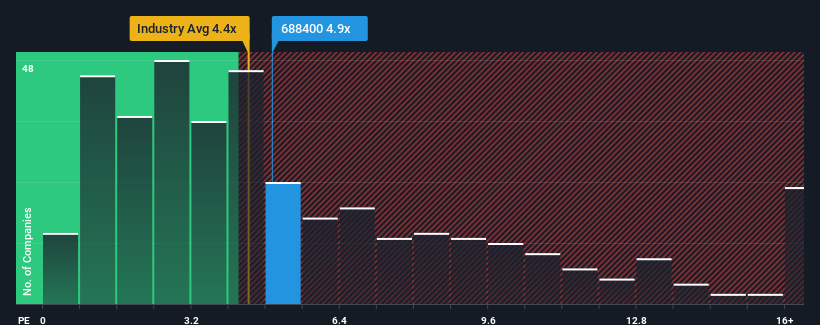

In spite of the firm bounce in price, there still wouldn't be many who think LUSTER LightTech's price-to-sales (or "P/S") ratio of 4.9x is worth a mention when the median P/S in China's Electronic industry is similar at about 4.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for LUSTER LightTech

What Does LUSTER LightTech's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, LUSTER LightTech's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on LUSTER LightTech will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For LUSTER LightTech?

The only time you'd be comfortable seeing a P/S like LUSTER LightTech's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. As a result, revenue from three years ago have also fallen 5.6% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 23% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 27%, which is noticeably more attractive.

With this in mind, we find it intriguing that LUSTER LightTech's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Its shares have lifted substantially and now LUSTER LightTech's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of LUSTER LightTech's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for LUSTER LightTech that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688400

LUSTER LightTech

Researches, develops, and sales of configurable visual systems, intelligent visual equipment, and optical communication products in China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion