As global markets experience mixed performances, with the S&P 500 and Nasdaq reaching new records while small-cap indices like the Russell 2000 show positive momentum, investors are keenly observing how these trends influence high-growth tech sectors in Asia. In this dynamic environment, a good stock is often characterized by its ability to leverage favorable economic conditions and technological advancements to drive sustainable growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.23% | 29.66% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Fositek | 30.05% | 37.09% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

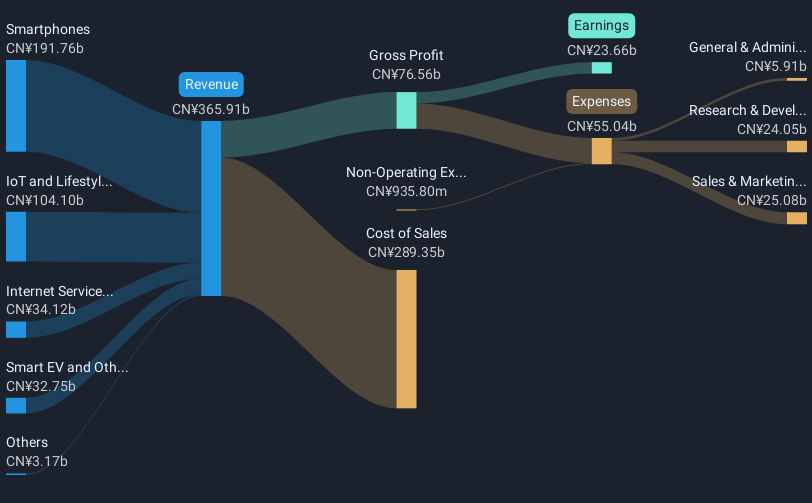

Overview: Xiaomi Corporation is an investment holding company that develops and sells smartphones both in Mainland China and internationally, with a market capitalization of HK$1.50 trillion.

Operations: Xiaomi Corporation generates revenue primarily from the sale of smartphones, contributing CN¥195.89 billion, and IoT and lifestyle products at CN¥116.07 billion. Internet services add another CN¥35.14 billion to its revenue streams, while smart EV and new initiatives account for CN¥51.31 billion.

Xiaomi's strategic maneuvers, including the launch of its YU7 electric SUV and partnerships with tech innovators like Moloco and Liftoff, underscore its adaptability in the high-growth tech sector. The company reported a significant increase in Q1 sales to CNY 111.29 billion from CNY 75.51 billion year-over-year, with net income more than doubling to CNY 10.92 billion. These moves not only expand Xiaomi's technological ecosystem but also enhance its global market presence, indicating robust revenue growth (17% annually) and earnings acceleration (21.1% annually). This positions Xiaomi favorably within Asia's competitive tech landscape, suggesting a sustained upward trajectory driven by innovation and strategic partnerships.

- Navigate through the intricacies of Xiaomi with our comprehensive health report here.

Examine Xiaomi's past performance report to understand how it has performed in the past.

LUSTER LightTech (SHSE:688400)

Simply Wall St Growth Rating: ★★★★☆☆

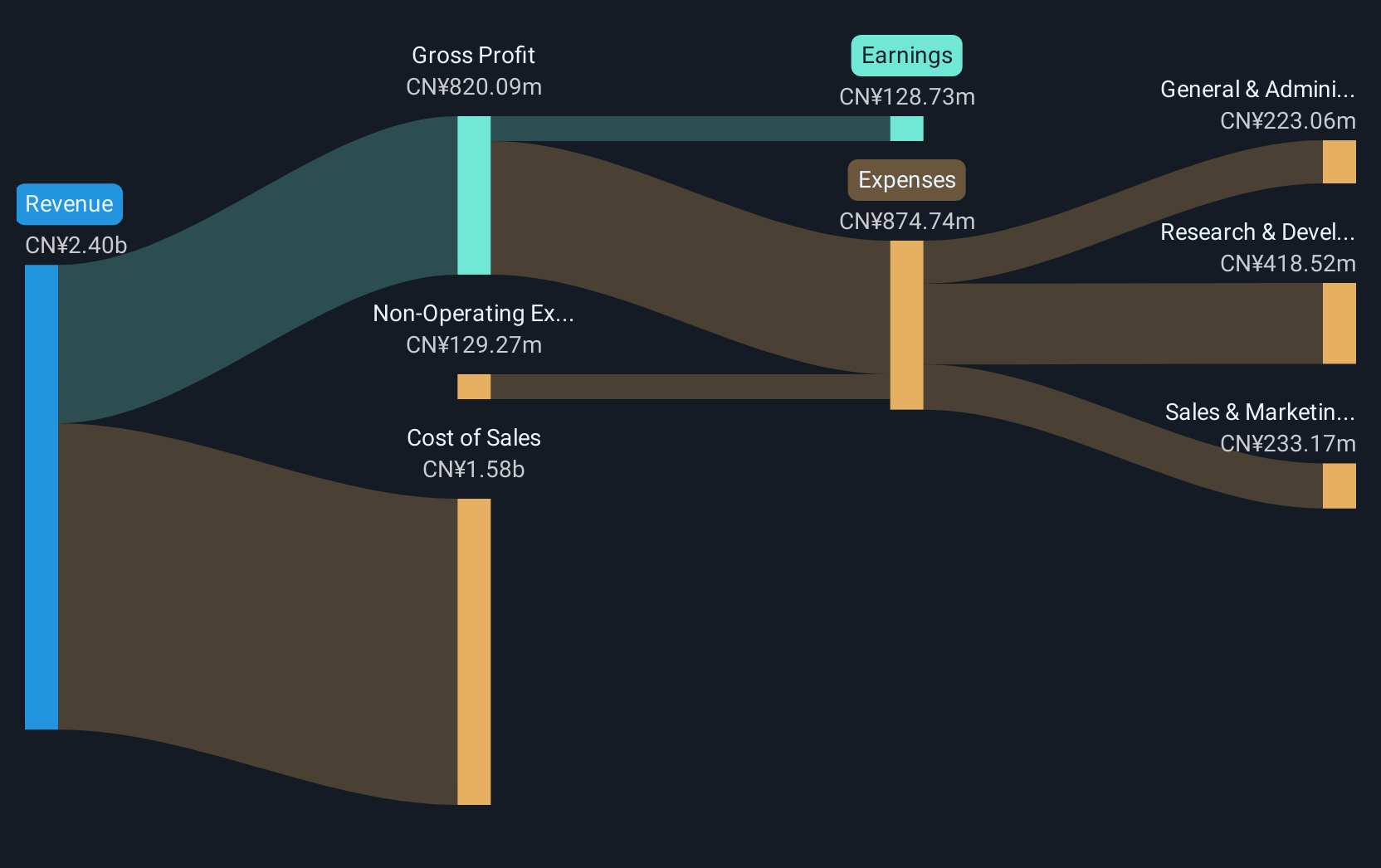

Overview: LUSTER LightTech Co., LTD. focuses on the research and development of configurable visual systems, intelligent visual equipment, and core visual devices in China, with a market capitalization of approximately CN¥13.97 billion.

Operations: LUSTER LightTech Co., LTD. generates revenue through its development of advanced visual systems and equipment in China. The company operates within the technology sector, focusing on innovation in visual technologies to drive its business model.

LUSTER LightTech's recent performance underscores its resilience in the tech sector, with a notable rebound in its financials. In Q1 2025, the company reported a significant uptick in sales to CNY 614.46 million from CNY 443.43 million year-over-year and shifted from a net loss of CNY 6.68 million to a net income of CNY 14.99 million. This turnaround is reflective of effective strategic adjustments and operational improvements, positioning LUSTER for potential sustained growth amid competitive market dynamics in Asia, particularly as it continues to innovate and expand its technological offerings.

- Unlock comprehensive insights into our analysis of LUSTER LightTech stock in this health report.

Assess LUSTER LightTech's past performance with our detailed historical performance reports.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

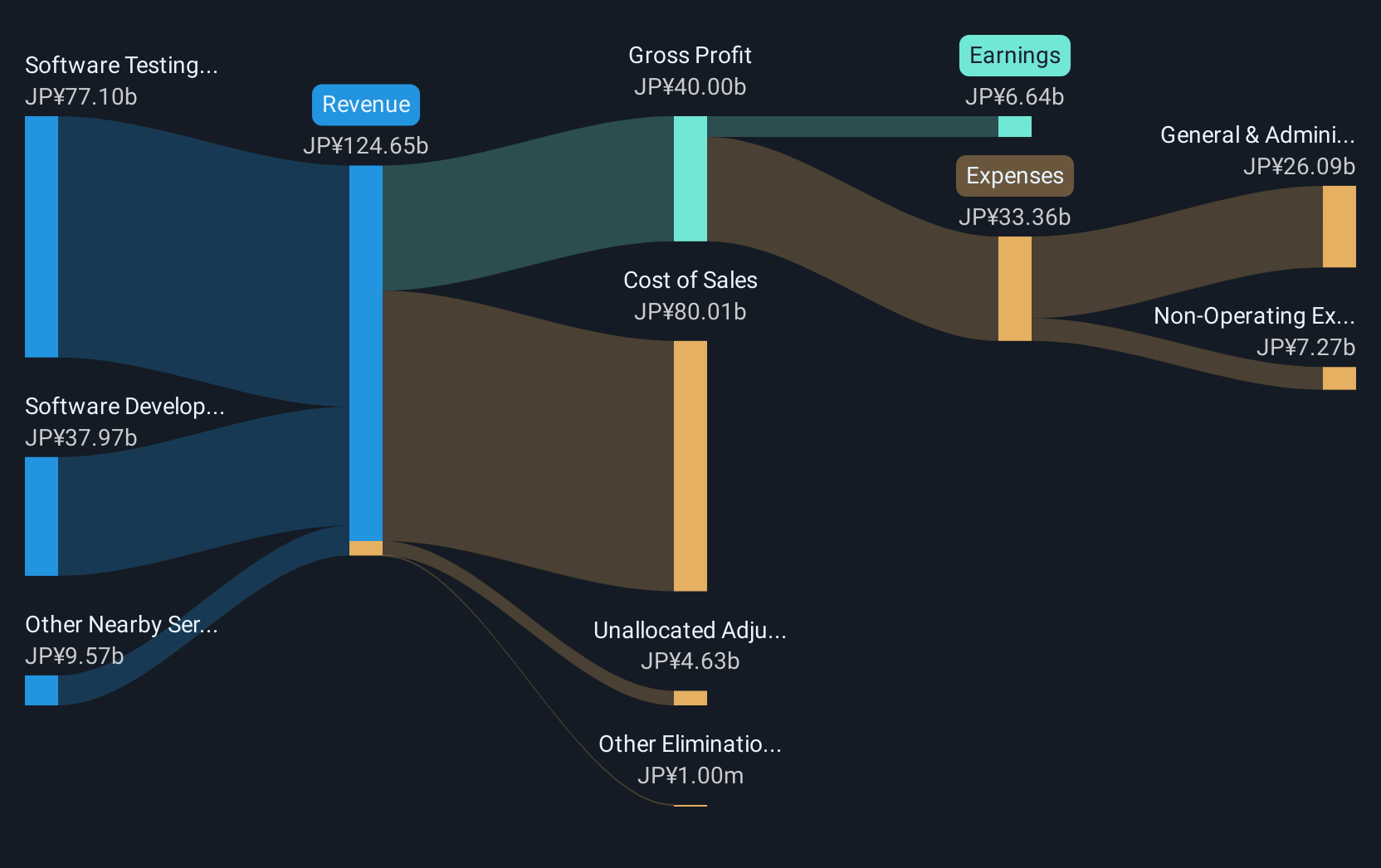

Overview: SHIFT Inc. is a Japanese company specializing in software quality assurance and testing solutions, with a market capitalization of approximately ¥424.81 billion.

Operations: SHIFT Inc. generates revenue primarily from software testing-related services, accounting for ¥80.79 billion, and software development-related services, contributing ¥39.11 billion.

SHIFT's recent strategic adjustments have propelled its financial metrics forward, with a projected annual revenue growth of 18.8% and earnings expected to surge by 33.1% annually. This growth trajectory is complemented by a robust R&D commitment, evident from the increased expenditure which now stands at JPY 5 billion, up from JPY 3.2 billion last year, underscoring its focus on innovation in software development and AI technologies. The company's revised financial forecast anticipates net sales reaching JPY 130 billion with an operating profit of JPY 15 billion for the fiscal year ending August 2025, reflecting positive adjustments post recent board meetings and corporate guidance revisions. These figures highlight SHIFT’s potential to continue expanding its market presence in Asia’s competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of SHIFT.

Review our historical performance report to gain insights into SHIFT's's past performance.

Make It Happen

- Explore the 479 names from our Asian High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3697

SHIFT

Provides software quality assurance and testing solutions in Japan.

Outstanding track record with high growth potential.

Market Insights

Community Narratives